Working with PDF forms online is actually a piece of cake with our PDF tool. Anyone can fill out irs 3922 here within minutes. To make our editor better and more convenient to work with, we constantly come up with new features, with our users' suggestions in mind. With just a few basic steps, you may begin your PDF journey:

Step 1: Press the "Get Form" button above on this webpage to get into our PDF editor.

Step 2: As soon as you access the file editor, there'll be the document ready to be completed. Aside from filling in various blank fields, you might also do other sorts of actions with the form, namely putting on your own textual content, editing the original text, inserting images, affixing your signature to the form, and a lot more.

This form needs some specific details; in order to guarantee consistency, take the time to consider the following recommendations:

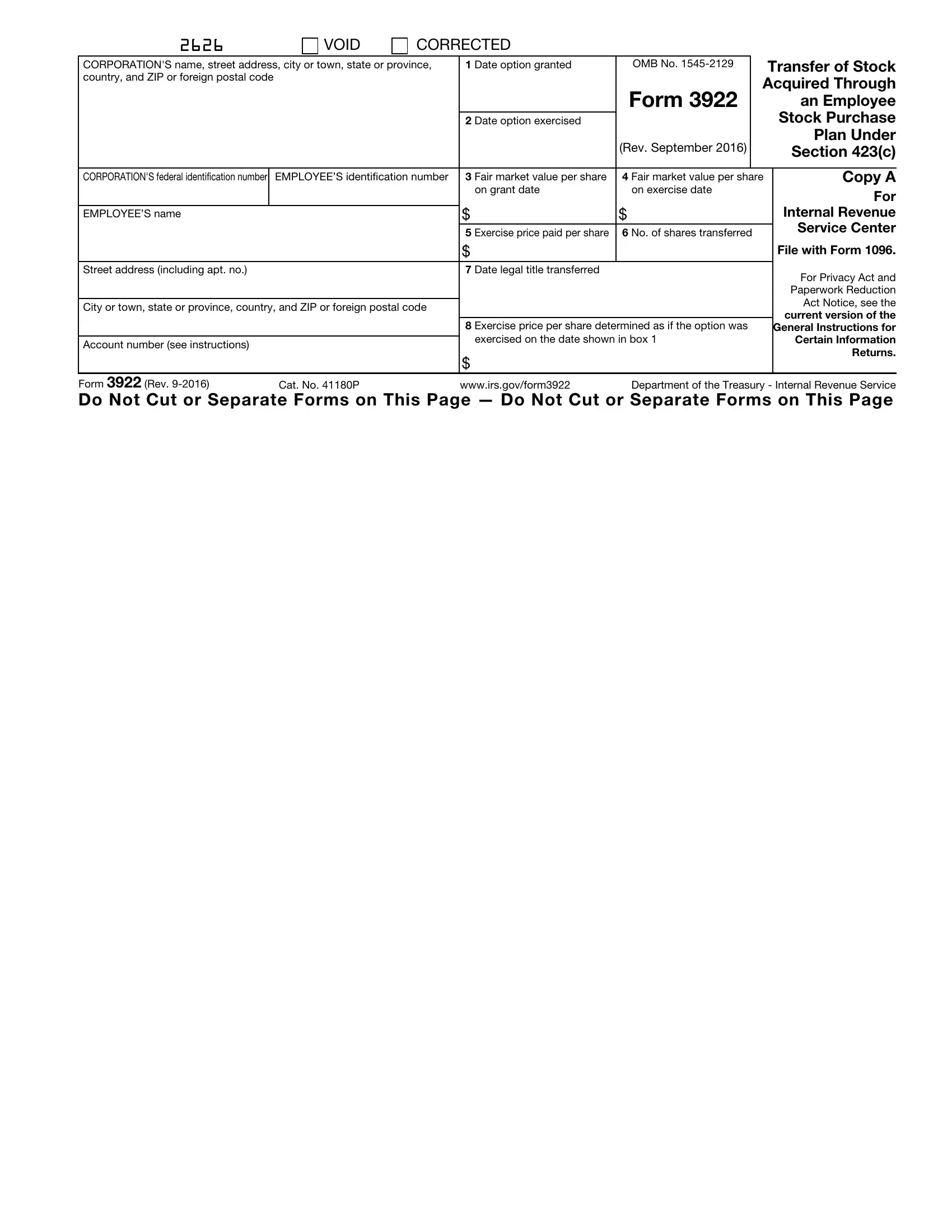

1. It is important to fill out the irs 3922 correctly, thus be mindful when filling out the parts containing these specific blank fields:

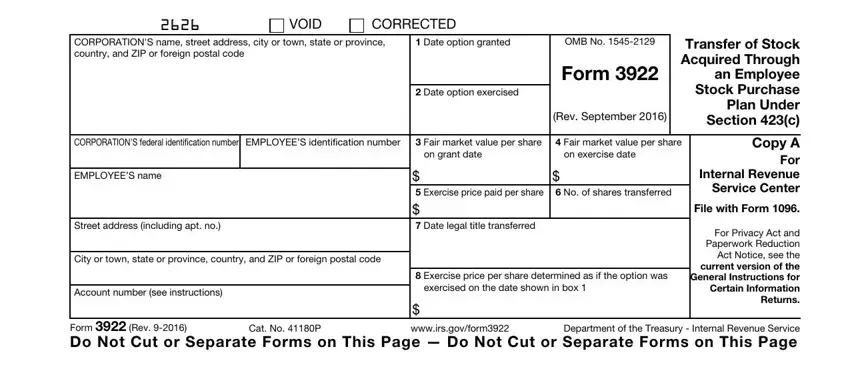

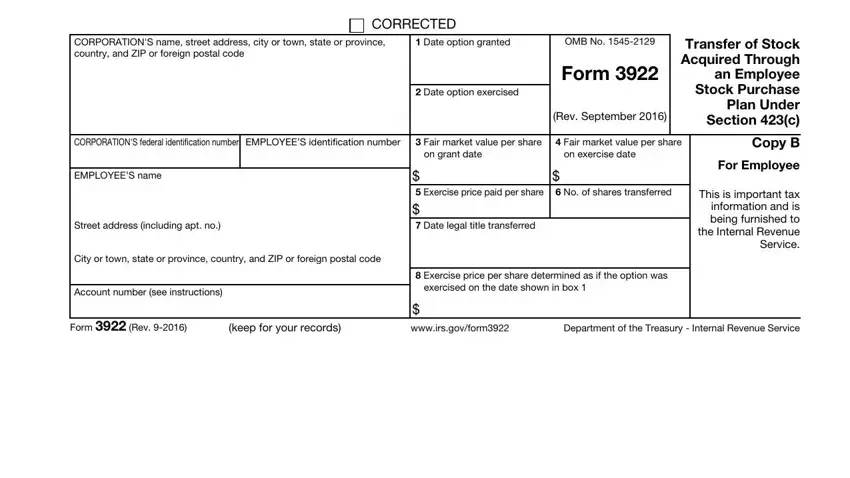

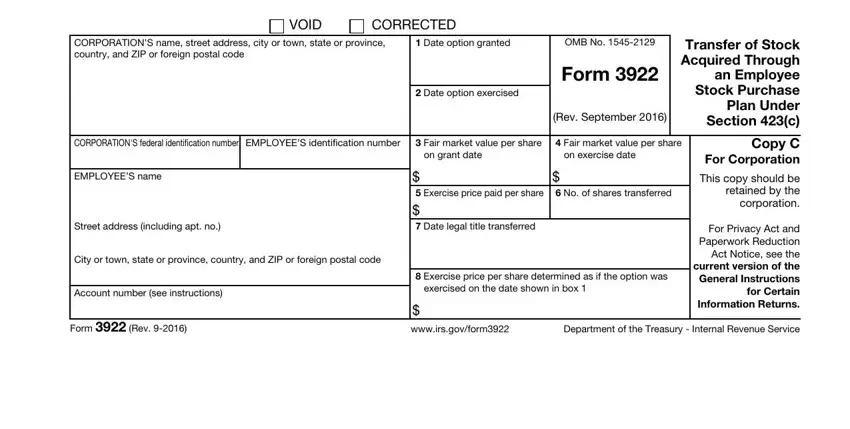

2. When this selection of fields is completed, go on to enter the relevant details in these: CORPORATIONS name street address, CORRECTED, Date option granted, OMB No, Date option exercised, Form, Rev September, Transfer of Stock Acquired Through, CORPORATIONS federal, Fair market value per share, Fair market value per share, EMPLOYEES name, Street address including apt no, City or town state or province, and Account number see instructions.

3. The next step is easy - fill in all the fields in CORPORATIONS name street address, VOID, CORRECTED, Date option granted, OMB No, Date option exercised, Form, Rev September, Transfer of Stock Acquired Through, CORPORATIONS federal, Fair market value per share, Fair market value per share, EMPLOYEES name, Street address including apt no, and City or town state or province to complete the current step.

It is easy to make a mistake while filling out the Rev September, consequently ensure that you take a second look prior to when you finalize the form.

Step 3: Prior to finalizing this file, make sure that blank fields have been filled in properly. The moment you verify that it is correct, click on “Done." Create a free trial option with us and acquire immediate access to irs 3922 - readily available in your personal cabinet. FormsPal is dedicated to the confidentiality of our users; we make sure that all personal information put into our tool continues to be confidential.