General Instructions

Section references are to the Internal Revenue Code.

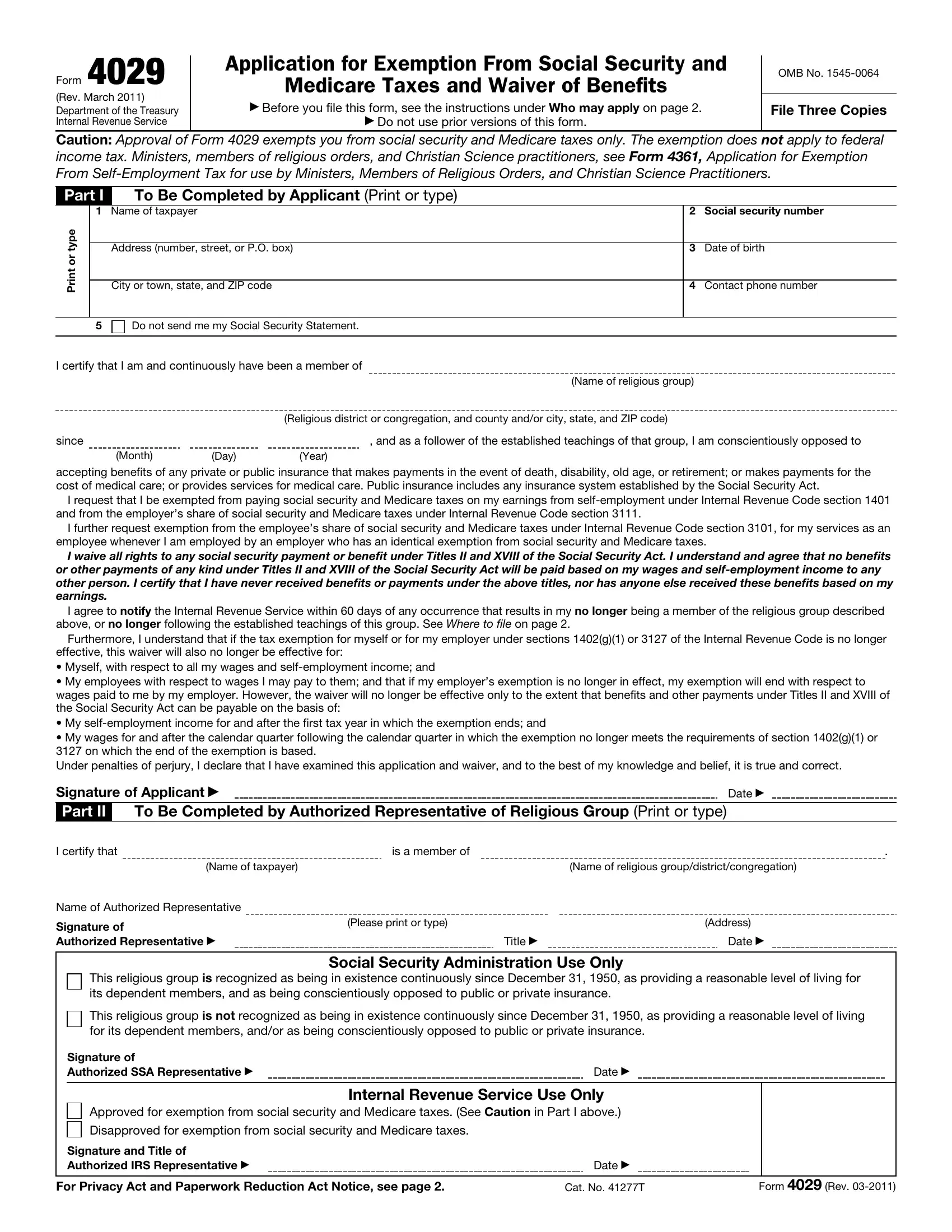

Purpose of form. Form 4029 is used by members of recognized religious groups to apply for exemption from social security and Medicare taxes. The exemption is for individuals and partnerships (when all the partners have approved certification).

Note. The election to waive social security benefits, including Medicare benefits, applies to all wages and self-employment income earned before and during the effective period of this exemption and is irrevocable for that period.

Who may apply. You may apply for this exemption if you are a member of, and follow the teachings of, a recognized religious group (as defined below). If you already have approval for exemption from self-employment taxes, you are considered to have met the requirements for exemption from social security and Medicare taxes on wages and do not need to file this form.

You are not eligible for this exemption if you received social security benefits or payments, or if anyone else received these benefits or payments based on your wages or self-employment income. However, you can file Form 4029 and be considered for approval if you paid back any benefits you received.

Recognized religious group. A recognized religious group must meet all the following requirements:

•It is conscientiously opposed to accepting benefits of any private or public insurance that makes payments in the event of death, disability, old age, or retirement; makes payments for the cost of medical care; or provides services for medical care (including social security and Medicare benefits).

•It has provided a reasonable level of living for its dependent members.

•It has existed continuously since December 31, 1950.

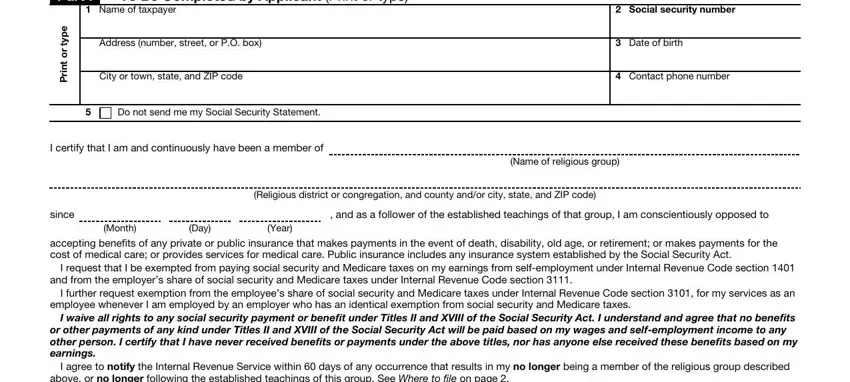

Certification. In order to complete the certification portion under Part I, you need to enter your religious group (on the first line) followed by the religious district or congregation (on the second line). For example, if you enter “Old Order Amish” as your religious group, then you would enter “Conewango Valley North District,” “Conewango Valley West District,” etc., on the second line as the district. However, if you are Anabaptist or Mennonite, enter the name of your religious group as “Unaffiliated Mennonite Churches” or “Eastern Pennsylvania Mennonite Church,” etc., and the congregation as “Antrim Mennonite Church (Anabaptist)” or “Bethel Mennonite Church (Mennonite),” on the second line.

When to file. File Form 4029 when you want to apply for exemption from social security and Medicare taxes. This is a one-time election. Keep your approved copy of Form 4029 for your permanent records.

Where to file. Send the original and two copies of Form 4029 to:

Social Security Administration

Security Records Branch,

Attn: Religious Exemption Unit

P.O. Box 7

Boyers, PA 16020

If you are no longer a member or no longer follow the teachings of the religious group, your exemption is no longer effective. Notify the Internal Revenue Service by sending a letter to:

Department of the Treasury

Internal Revenue Service Center

Philadelphia, PA 19255-0733

Social security number. Enter your social security number on line 2. If you do not have a social security number, file Form SS-5, Application for a Social Security Card, at your local social security office. You can order Form SS-5 by calling 1-800-772-1213 or by visiting the website for Social Security at www.socialsecurity.gov .

Effective period of exemption. An approved exemption granted to employers and employees is effective on the first day of the first quarter after the quarter in which Form 4029 is filed. An approved exemption granted to self-employed individuals is effective when granted and applies for all years for which you satisfy the requirements. The exemption will continue as long as you, or in the case of wage payments, both the employee and employer continue to meet the exemption requirements.

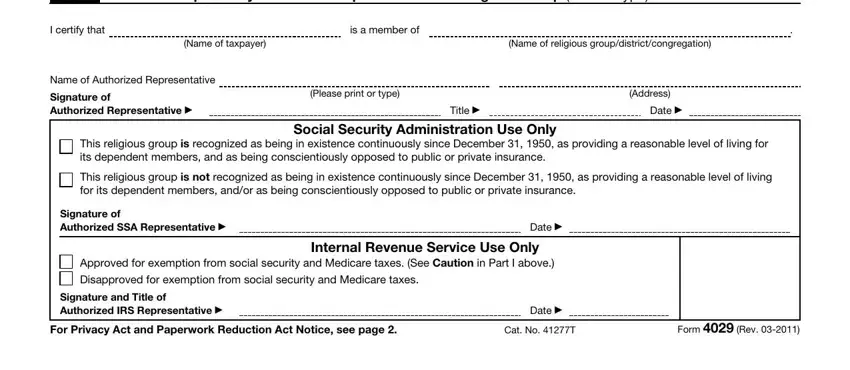

Signature. The completed Form 4029 must be signed and dated by the applicant in Part I and by the authorized representative of the religious group/ district/congregation in Part II.

How to show exemption from self-employment taxes on Form 1040. If the IRS returned your copy of Form 4029 marked “Approved,” write “Form 4029” on the “Self-employment tax” line in the Other Taxes section of Form 1040, page 2.

Instructions to Employers

Employees without Form 4029 approval. If you have employees who do not have an approved Form 4029, you must withhold the employee’s share of social security and Medicare taxes and pay the employer’s share.

Reporting exempt wages. If you are a qualifying employer with one or more qualifying employees, you are not required to report wages that are exempt under section 3127. Do not include these wages for social security and Medicare tax purposes on Form 941, Employer’s QUARTERLY Federal Tax Return, Form 943, Employer’s Annual Tax Return for Agricultural Employees, or on Form 944, Employer’s ANNUAL Federal Tax Return. If you have received an approved Form 4029, check the box on line 4 of Form 941 (line 3 of Form 944) and write “Form 4029” in the empty space below the check box. If you file Form 943 and have received an approved Form 4029, write “Form 4029” to the left of the wage entry spaces for Total wages subject to social security taxes and Total wages subject to Medicare taxes.

Preparation of Form W-2. When you prepare Form W-2 for a qualifying employee, enter “Form 4029” in the box marked “Other.” Do not make any entries in the boxes for Social security wages, Medicare wages and tips, Social security tax withheld, or Medicare tax withheld for these employees.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need this information to ensure that you are complying with these laws and to allow us to figure and to collect the right amount of tax. Applying for an exemption from social security and Medicare taxes is voluntary. Providing the requested information, however, is mandatory if you apply for the exemption. Our legal right to ask for the information requested on this form is Internal Revenue Code sections 6001, 6011, 6012(a) and 6109. Code section 6109 requires that you provide your social security number on what you file. If you fail to provide all or part of the information requested on Form 4029, your application may be denied. If you provide false or fraudulent information, you may be subject to penalties.

Generally, tax returns and return information are confidential, as stated in section 6103. However, section 6103 allows or requires the Internal Revenue Service to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose your tax information to the Department of Justice to enforce the tax laws, both civil and criminal, to cities, states, the District of Columbia, U.S. commonwealths or possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

Please keep this notice with your records. It may help you if we ask for other information. If you have any questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is: Recordkeeping, 6 min.; Learning about the law or the form, 19 min.; Preparing the form, 18 min.; Copying, assembling, and sending the form to the SSA, 16 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send the form to this address. Instead, see Where to file on this page.