It is possible to complete Form 4305 effectively with our PDFinity® online PDF tool. In order to make our tool better and simpler to work with, we continuously develop new features, with our users' feedback in mind. Here is what you would have to do to get going:

Step 1: Access the PDF doc inside our tool by clicking on the "Get Form Button" in the top area of this webpage.

Step 2: The editor will let you work with PDF forms in various ways. Modify it with your own text, adjust existing content, and add a signature - all within a few clicks!

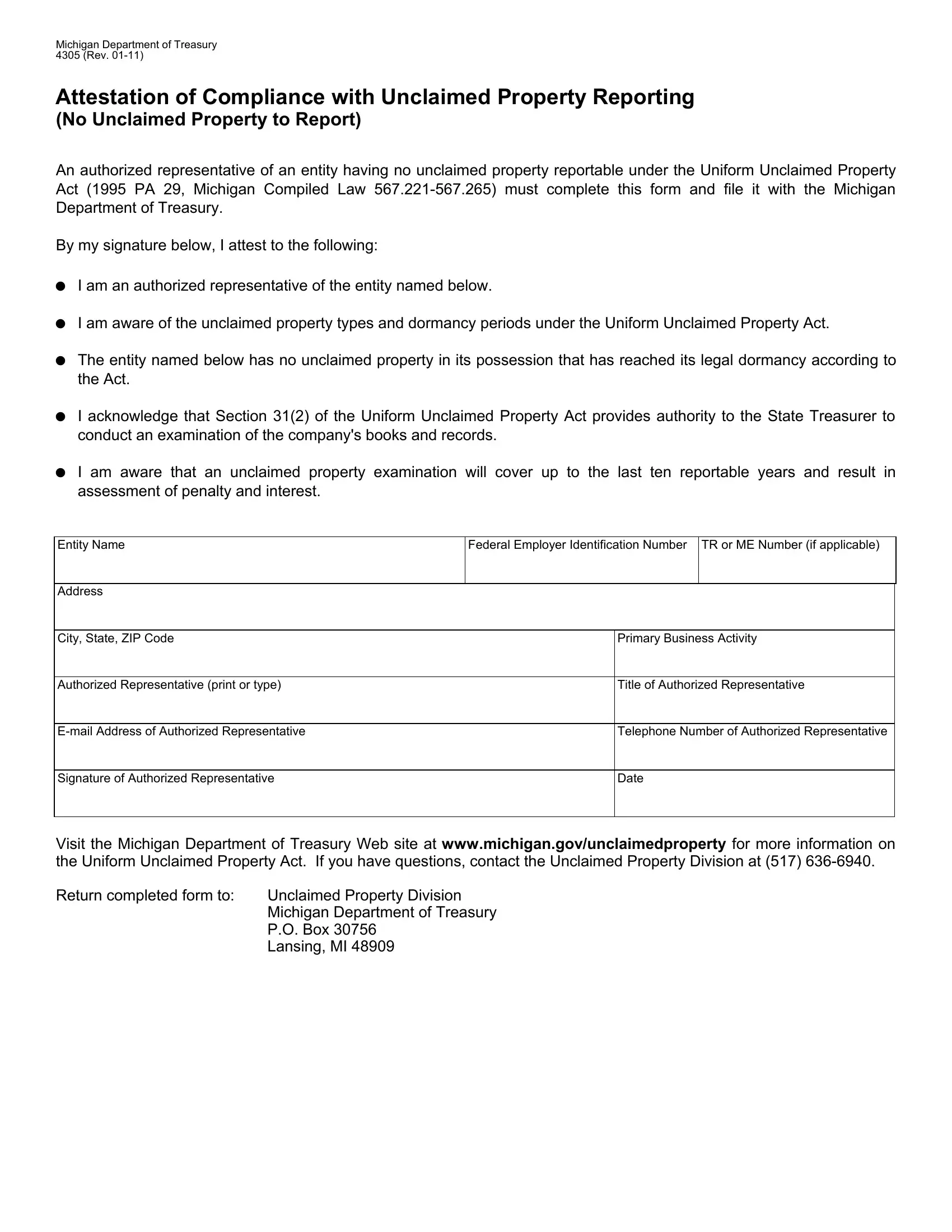

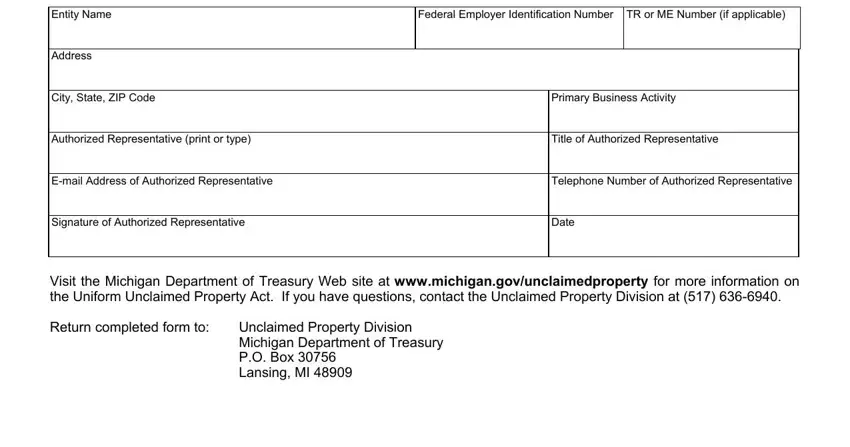

This document will require specific info to be entered, thus make sure to take your time to fill in what's asked:

1. It is important to complete the Form 4305 correctly, therefore pay close attention while filling out the segments containing all of these blanks:

Step 3: Soon after taking another look at your filled out blanks, press "Done" and you are good to go! Right after creating afree trial account here, you will be able to download Form 4305 or email it right away. The PDF document will also be easily accessible through your personal cabinet with all your edits. Here at FormsPal, we aim to be sure that all your details are kept private.