By using the online PDF editor by FormsPal, it is easy to fill out or alter IRAs here. To keep our tool on the leading edge of efficiency, we aim to put into practice user-oriented capabilities and improvements on a regular basis. We are at all times pleased to receive suggestions - assist us with reshaping how you work with PDF forms. With just several simple steps, you may begin your PDF editing:

Step 1: Click on the "Get Form" button in the top section of this page to access our PDF editor.

Step 2: Once you open the online editor, you will notice the form all set to be completed. Besides filling in different blanks, it's also possible to do various other actions with the file, such as adding your own words, editing the initial textual content, adding graphics, placing your signature to the document, and more.

With regards to the fields of this particular document, here is what you should do:

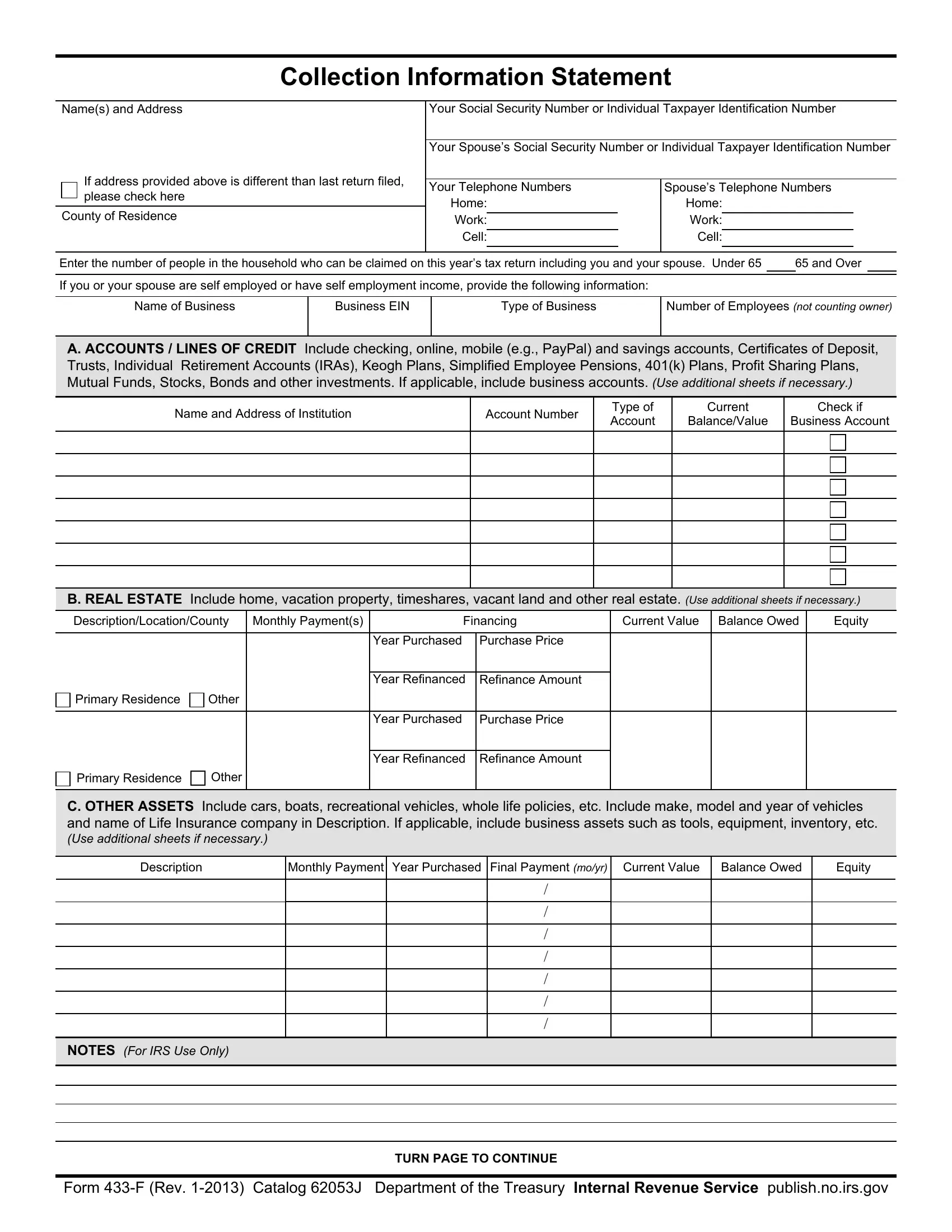

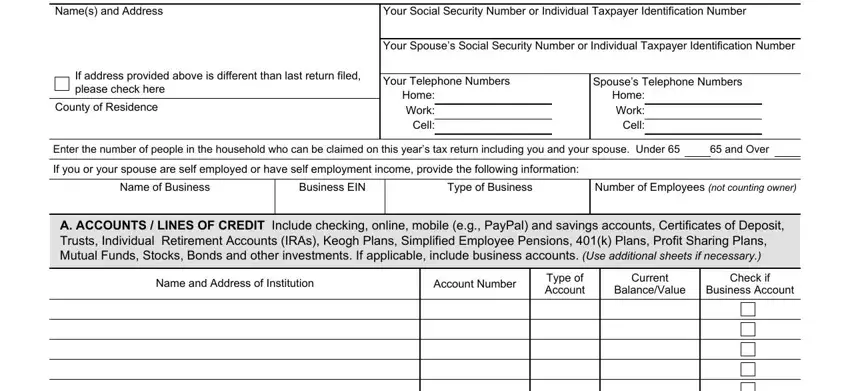

1. Complete the IRAs with a group of major blanks. Consider all of the required information and make certain there is nothing left out!

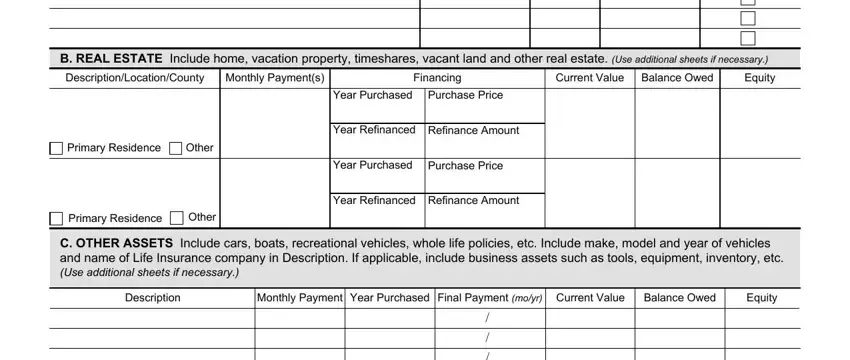

2. Right after completing this section, head on to the subsequent stage and fill out the necessary particulars in all these blank fields - B REAL ESTATE Include home, DescriptionLocationCounty, Monthly Payments, Financing, Current Value Balance Owed, Equity, Primary Residence, Other, Primary Residence, Other, Year Purchased Purchase Price, Year Refinanced Refinance Amount, Year Purchased Purchase Price, Year Refinanced Refinance Amount, and C OTHER ASSETS Include cars boats.

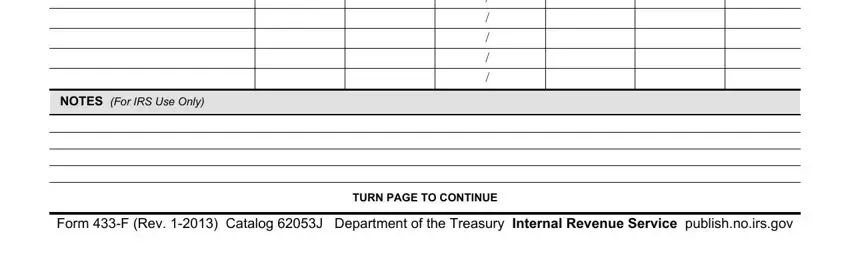

3. This next step focuses on NOTES For IRS Use Only, Form F Rev Catalog J Department, and TURN PAGE TO CONTINUE - complete all of these blank fields.

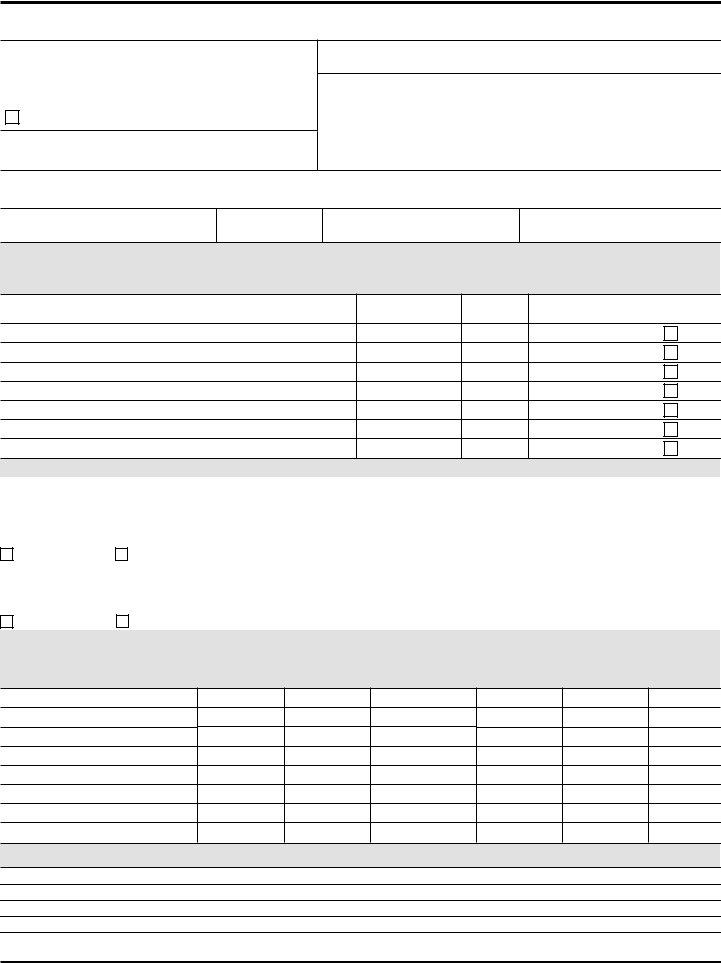

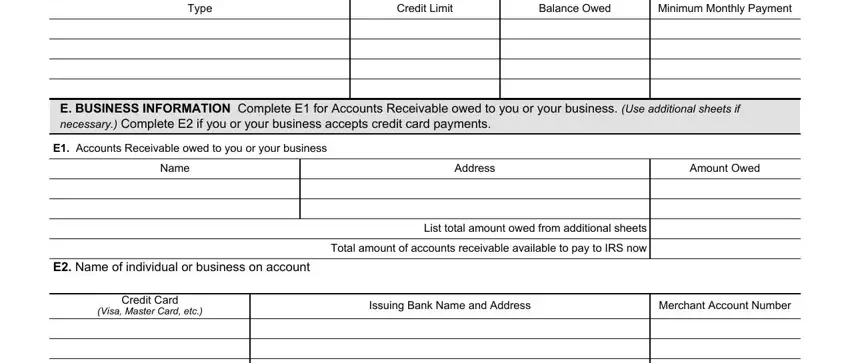

4. The following paragraph will require your details in the following places: Type, Credit Limit, Balance Owed, Minimum Monthly Payment, E BUSINESS INFORMATION Complete E, E Accounts Receivable owed to you, Name, Address, Amount Owed, E Name of individual or business, List total amount owed from, Total amount of accounts, Credit Card, Visa Master Card etc, and Issuing Bank Name and Address. Be sure to type in all of the needed info to move onward.

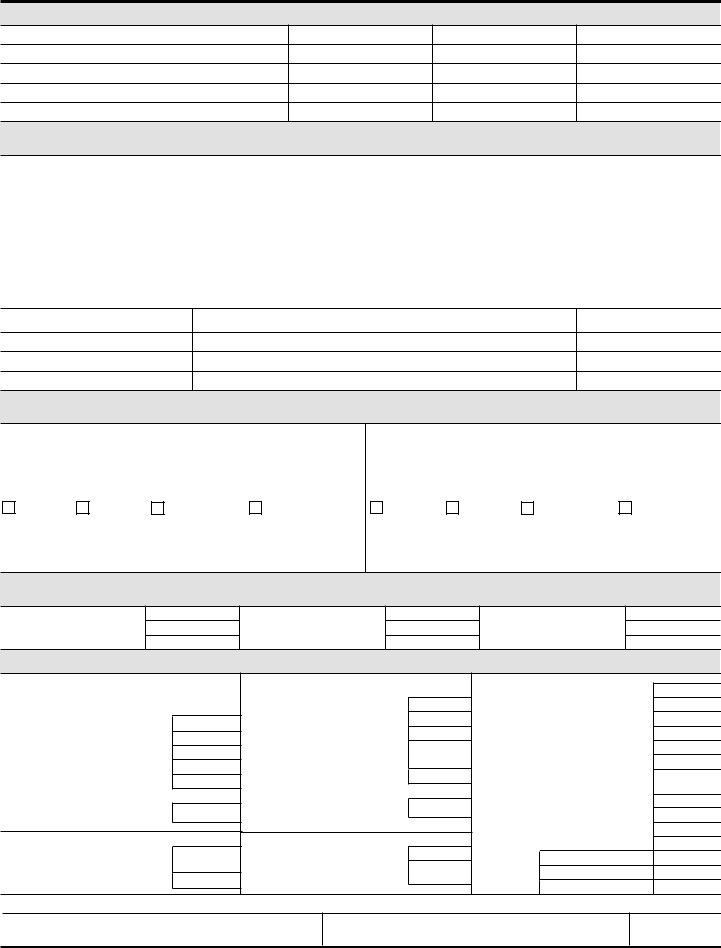

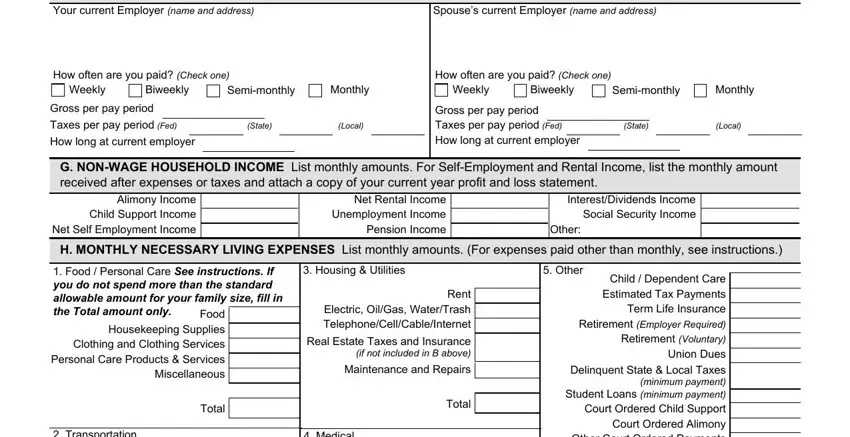

5. This final point to submit this PDF form is essential. Be sure you fill out the required fields, and this includes Your current Employer name and, Spouses current Employer name and, How often are you paid Check one, How often are you paid Check one, Weekly, Biweekly, Semimonthly, Monthly, Weekly, Biweekly, Semimonthly, Monthly, Gross per pay period, Taxes per pay period Fed, and State, before using the form. Neglecting to do this could result in an unfinished and possibly invalid form!

Be very attentive while filling in Biweekly and Taxes per pay period Fed, since this is the part in which many people make errors.

Step 3: Immediately after proofreading the entries, hit "Done" and you're all set! Join FormsPal now and immediately get access to IRAs, ready for downloading. All changes made by you are saved , so that you can change the document at a later time anytime. FormsPal offers protected form tools with no personal information record-keeping or any type of sharing. Be assured that your data is safe with us!