Dealing with PDF forms online is definitely very simple using our PDF editor. You can fill in FEIN here effortlessly. Our tool is constantly evolving to grant the very best user experience attainable, and that is due to our dedication to continuous enhancement and listening closely to user opinions. To get the ball rolling, consider these basic steps:

Step 1: Click on the "Get Form" button in the top area of this page to open our PDF editor.

Step 2: The editor provides the opportunity to modify nearly all PDF files in a variety of ways. Enhance it with your own text, adjust what is already in the document, and put in a signature - all when it's needed!

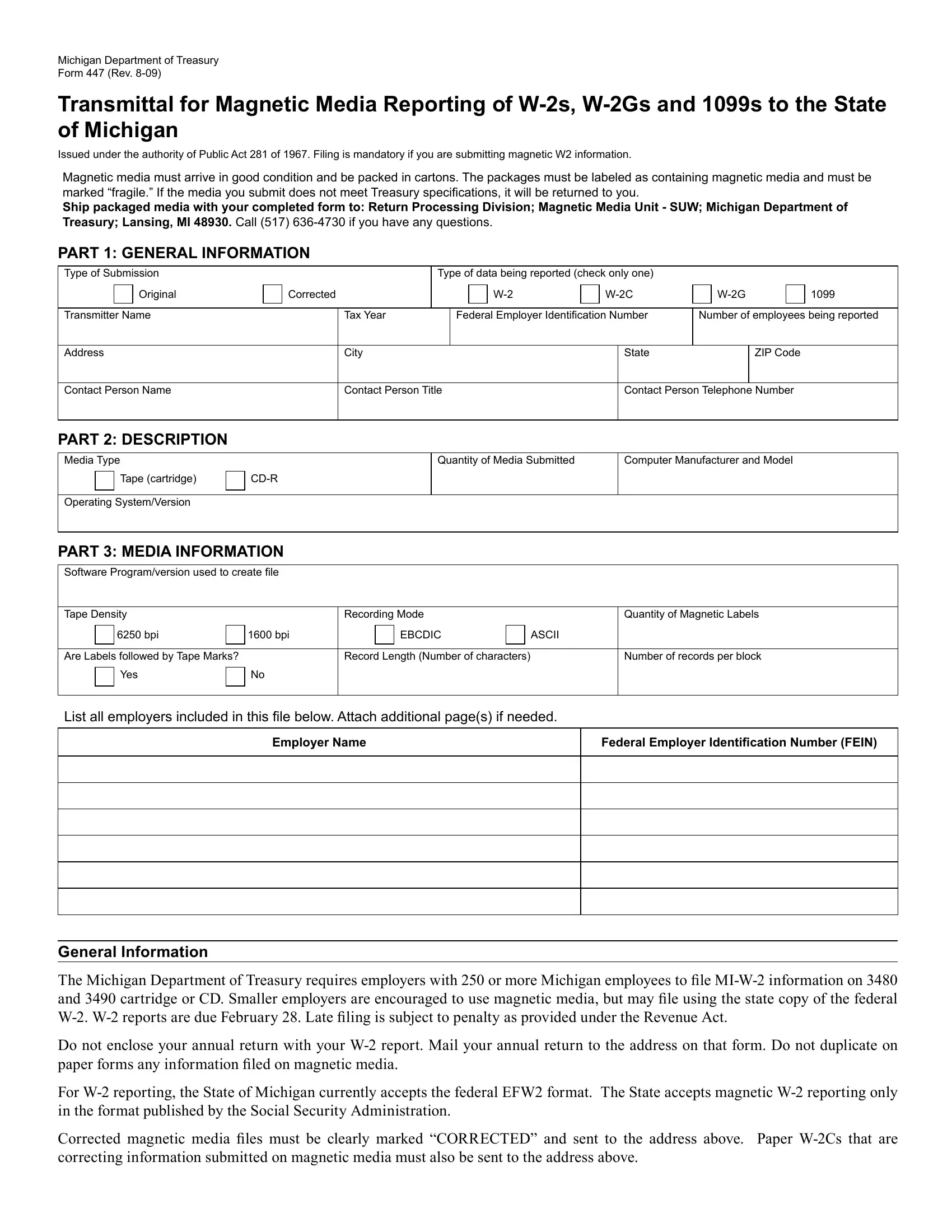

To be able to finalize this PDF document, make certain you provide the required details in each and every blank field:

1. Whenever completing the FEIN, be sure to complete all necessary blank fields in its relevant part. It will help facilitate the process, making it possible for your information to be handled fast and correctly.

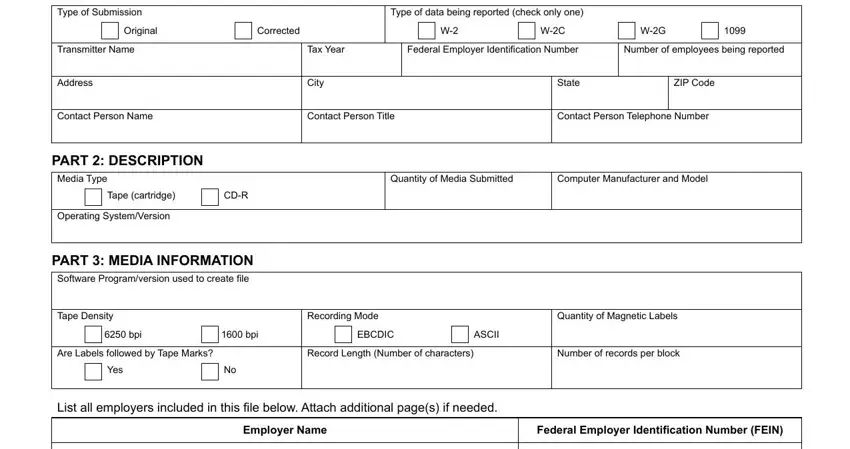

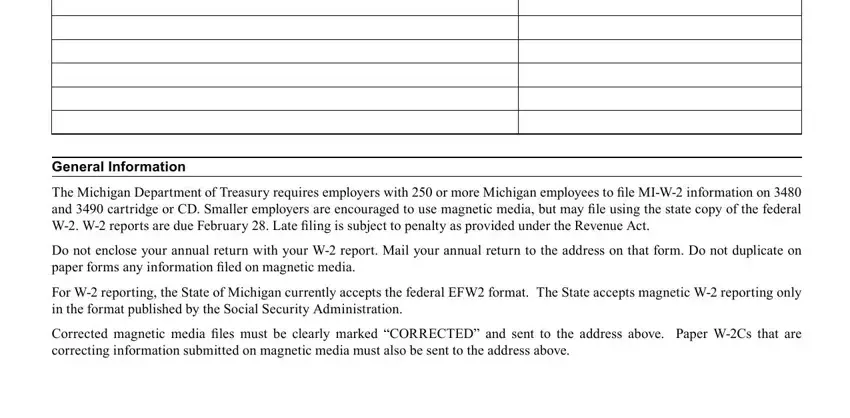

2. Given that this section is done, you should put in the needed details in General Information The Michigan so you can progress to the third stage.

Always be very careful when filling out General Information The Michigan and General Information The Michigan, since this is where most people make some mistakes.

Step 3: Make sure that the information is correct and click on "Done" to proceed further. Right after creating a7-day free trial account at FormsPal, it will be possible to download FEIN or send it through email promptly. The document will also be accessible through your personal account menu with your each and every change. We do not share or sell the details you provide while dealing with documents at FormsPal.