Nebraska Department of Revenue

Form No. 96-296-2009 Rev. 1-2014 Supersedes 96-296-2009 Rev. 1-2013

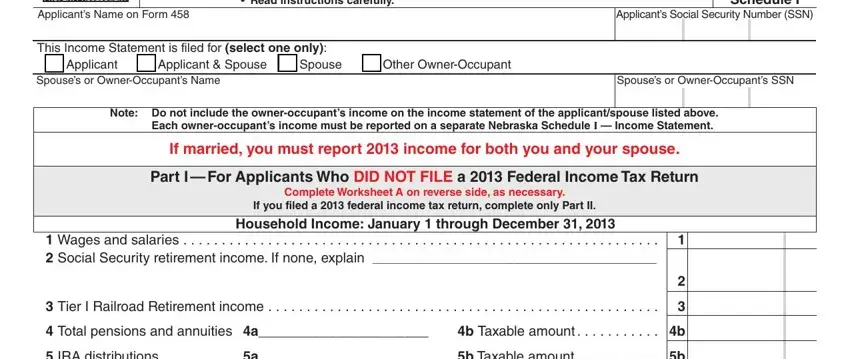

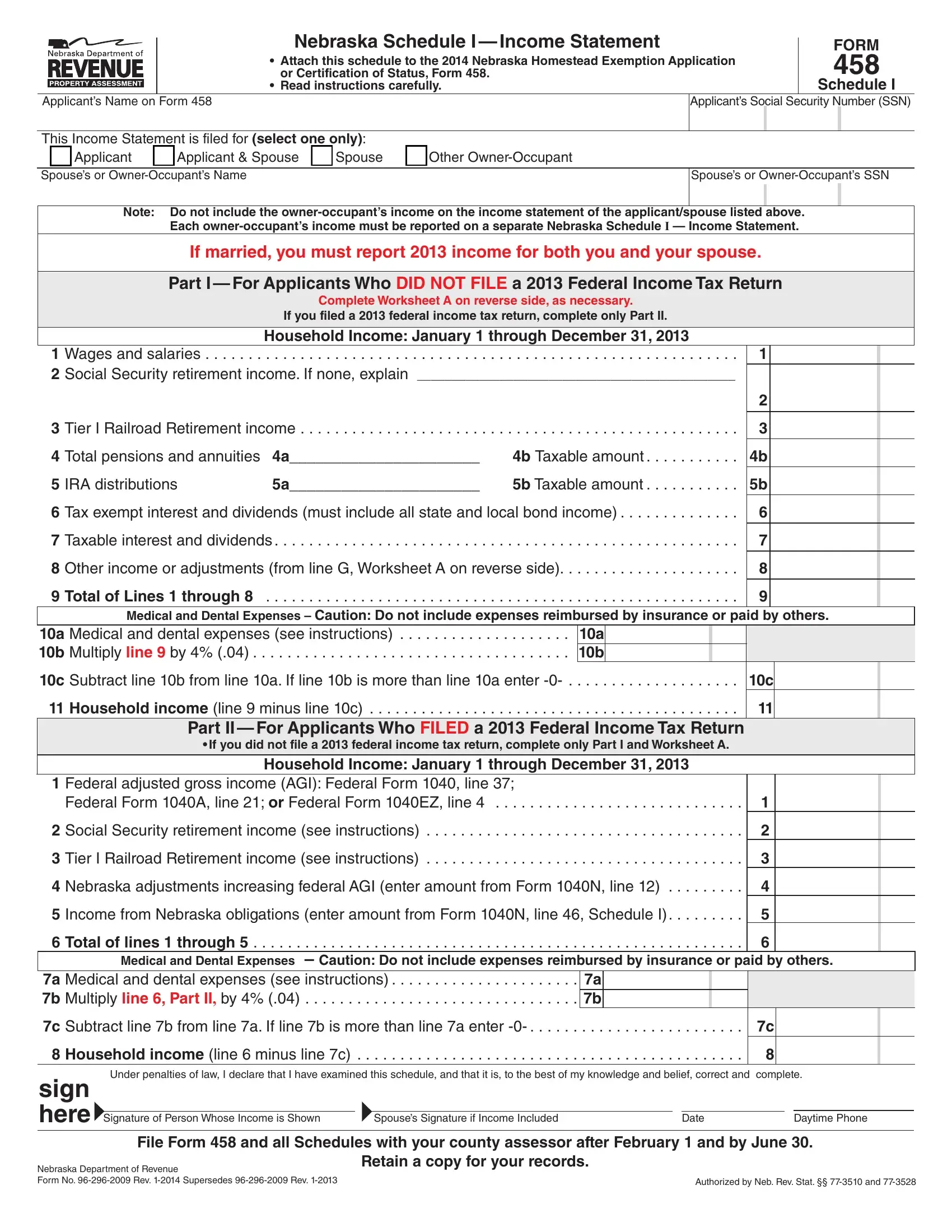

Nebraska Schedule I — Income Statement

• Attach this schedule to the 2014 Nebraska Homestead Exemption Application

or Certification of Status, Form 458. • Read instructions carefully.

Applicant’s Name on Form 458

Applicant’s Social Security Number (SSN)

This Income Statement is filed for (select one only):

Applicant |

|

Applicant & Spouse |

|

Spouse |

|

Other Owner-Occupant |

Spouse’s or Owner-Occupant’s Name

Spouse’s or Owner-Occupant’s SSN

Note: Do not include the owner-occupant’s income on the income statement of the applicant/spouse listed above. Each owner-occupant’s income must be reported on a separate Nebraska Schedule I — Income Statement.

If married, you must report 2013 income for both you and your spouse.

Part I — For Applicants Who DID NOT FILE a 2013 Federal Income Tax Return

Complete Worksheet A on reverse side, as necessary.

If you filed a 2013 federal income tax return, complete only Part II.

Household Income: January 1 through December 31, 2013

1 |

.Wages and salaries |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

|

|

2 |

Social Security retirement income. If none, explain ______________________________________________ |

|

|

|

|

________________________________________________________________________________________________ |

2 |

|

|

3 |

Tier I Railroad Retirement income |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

3 |

|

|

4 |

Total pensions and annuities |

4a______________________ |

4b Taxable amount |

4b |

|

|

5 |

IRA distributions |

5a______________________ |

5b Taxable amount |

5b |

|

|

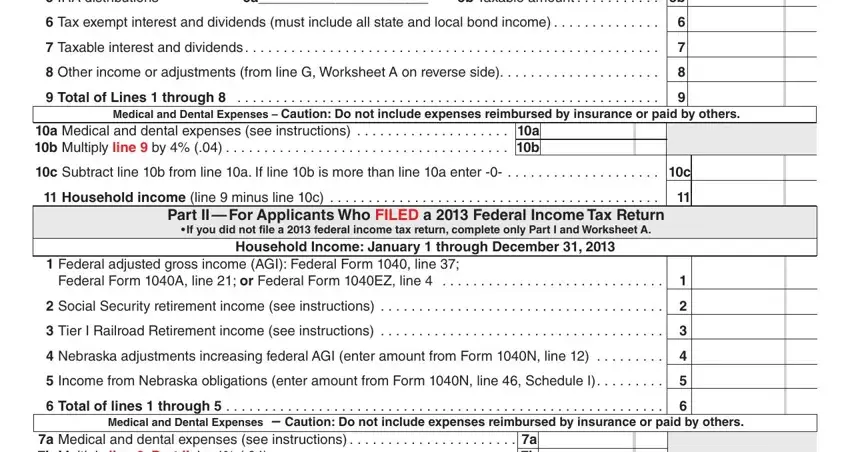

6 |

Tax exempt interest and dividends (must include all state and local bond income) |

6 |

|

|

7 |

Taxable interest and dividends |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

7 |

|

|

8 |

Other income or adjustments (from line G, Worksheet A on reverse side) |

8 |

|

|

9 |

Total of Lines 1 through 8 . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

9 |

|

|

Medical and Dental Expenses – Caution: Do not include expenses reimbursed by insurance or paid by others.

10a |

Medical and dental expenses (see instructions) |

10a |

10b |

Multiply line 9 by 4% (.04) |

10b |

10c |

Subtract line 10b from line 10a. If line 10b is more than line 10a enter -0- . |

. . . . . . . . . . . . . . . . . . . 10c |

11 |

Household income (line 9 minus line 10c) |

. . . . . . . . . . . . . . . . . . . 11 |

|

Part II — For Applicants Who FILED a 2013 Federal Income Tax Return |

|

• If you did not file a 2013 federal income tax return, complete only Part I and Worksheet A. |

|

Household Income: January 1 through December 31, 2013 |

1 Federal adjusted gross income (AGI): Federal Form 1040, line 37;

Federal Form 1040A, line 21; or Federal Form 1040EZ, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Social Security retirement income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Tier I Railroad Retirement income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Nebraska adjustments increasing federal AGI (enter amount from Form 1040N, line 12) . . . . . . . . .

5 Income from Nebraska obligations (enter amount from Form 1040N, line 46, Schedule I). . . . . . . . .

6 Total of lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Medical and Dental Expenses – Caution: Do not include expenses reimbursed by insurance or paid by others.

7a |

Medical and dental expenses (see instructions) |

7a |

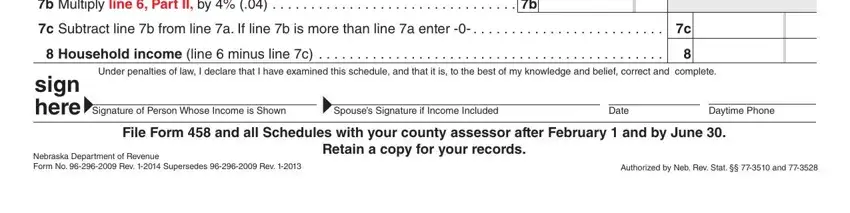

7b |

Multiply line 6, Part II, by 4% (.04) |

7b |

7c |

Subtract line 7b from line 7a. If line 7b is more than line 7a enter -0- |

. . . . . . . . . . . . . . . . . . . 7c |

8 |

Household income (line 6 minus line 7c) |

. . . . . . . . . . . . . . . . . . . 8 |

Under penalties of law, I declare that I have examined this schedule, and that it is, to the best of my knowledge and belief, correct and complete.

( )

Signature of Person Whose Income is Shown |

Spouse’s Signature if Income Included |

Date |

Daytime Phone |

File Form 458 and all Schedules with your county assessor after February 1 and by June 30.

Retain a copy for your records.

Authorized by Neb. Rev. Stat. §§ 77-3510 and 77-3528

|

|

|

|

|

|

|

|

|

|

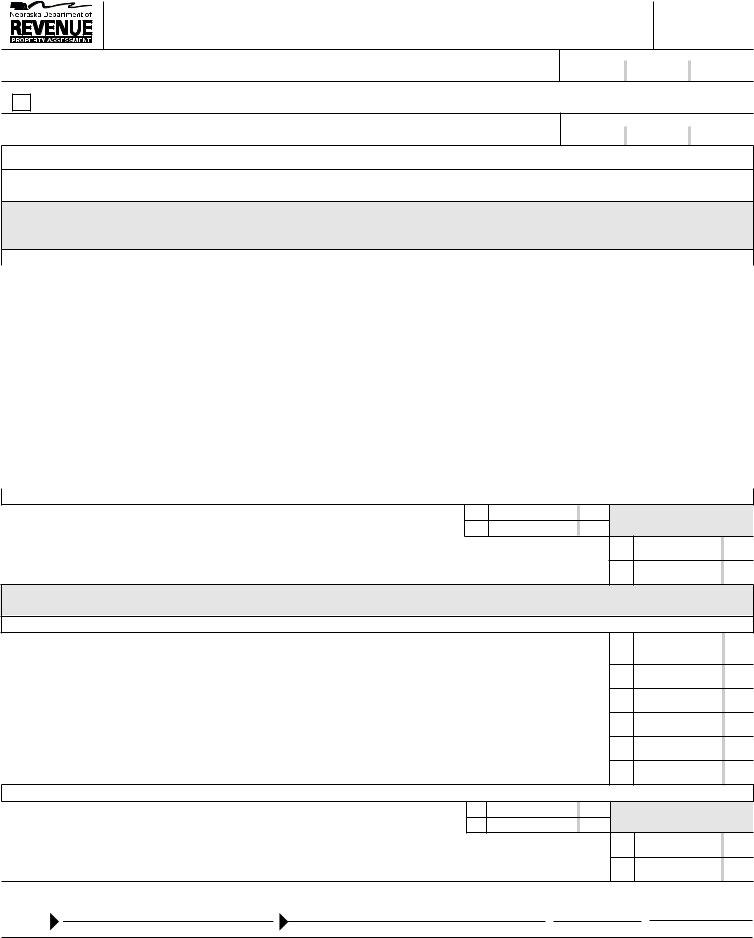

Worksheet A — Part I |

FORM 458 |

|

|

|

|

|

|

|

|

|

|

Schedule I |

|

|

|

|

|

|

|

|

|

|

Line 8, Other Income or Adjustments |

|

|

|

|

|

|

|

|

|

|

|

Worksheet A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.........................................................A Net business income including rental, or farm income, or (loss) |

A |

|

B Capital gain or (loss) |

B |

|

C Other gain or (loss) |

C |

|

D Unemployment compensation |

D |

|

E Any other income or (adjustments reducing income.) Explain: |

|

|

E |

|

|

|

|

|

F Penalty on early withdrawal of savings |

F |

|

G Total of lines A through E, minus line F (enter this amount here and on Part I, line 8) |

G |

|

Retain a copy for your records. |

|

|

|

Instructions

Who Must File. Any person applying for a homestead exemption must complete Nebraska Schedule I – Income Statement and attach it to the Nebraska Homestead Exemption Application or Certiication of Status, Form 458. If you iled, or would have iled as married for Nebraska individual income tax purposes for 2013, you must include income for both you and your spouse, even if you iled as “married, iling separately.” Each additional owner who occupied the homestead during any part of 2013 must also report their income on a separate schedule.

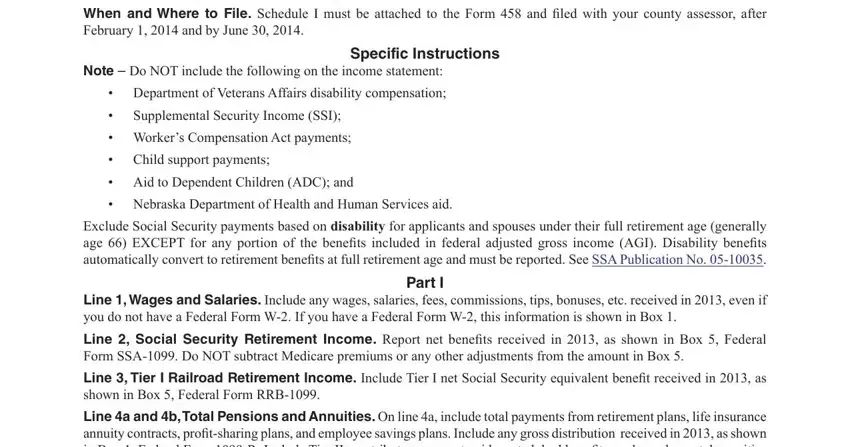

When and Where to File. Schedule I must be attached to the Form 458 and iled with your county assessor, after February 1, 2014 and by June 30, 2014.

Specific Instructions

Note – Do NOT include the following on the income statement:

•Department of Veterans Affairs disability compensation;

•Supplemental Security Income (SSI);

•Worker’s Compensation Act payments;

•Child support payments;

•Aid to Dependent Children (ADC); and

•Nebraska Department of Health and Human Services aid.

Exclude Social Security payments based on disability for applicants and spouses under their full retirement age (generally age 66) EXCEPT for any portion of the beneits included in federal adjusted gross income (AGI). Disability beneits automatically convert to retirement beneits at full retirement age and must be reported. See SSA Publication No. 05-10035.

Part I

Line 1, Wages and Salaries. Include any wages, salaries, fees, commissions, tips, bonuses, etc. received in 2013, even if you do not have a Federal Form W-2. If you have a Federal Form W-2, this information is shown in Box 1.

Line 2, Social Security Retirement Income. Report net beneits received in 2013, as shown in Box 5, Federal Form SSA-1099. Do NOT subtract Medicare premiums or any other adjustments from the amount in Box 5.

Line 3, Tier I Railroad Retirement Income. Include Tier I net Social Security equivalent beneit received in 2013, as shown in Box 5, Federal Form RRB-1099.

Line 4a and 4b,Total Pensions and Annuities. On line 4a, include total payments from retirement plans, life insurance annuity contracts, proit-sharing plans, and employee savings plans. Include any gross distribution received in 2013, as shown in Box 1, Federal Form 1099-R. Include Tier II, contributory amount paid, vested dual beneits, and supplemental annuities as shown in Box 7, Federal Form RRB-1099-R. On line 4b, report the taxable amount from Box 2(a), Form 1099-R. See Federal Form 1099-R and IRS Publication 575.

Line 5a and 5b, IRA Distributions. On line 5a, report the total payments received in 2013 from your IRA as shown in Box 1, Federal Form 1099-R. On line 5b, report the taxable amount from Box 2(a), Form 1099-R. Do not report any amount from a qualiied IRA rollover. See Federal Form 1099-R and IRS Publication 590.

Line 6, Tax Exempt Interest and Dividends. Report the total interest received in 2013 on tax exempt obligations. State and local bond income from both Nebraska and out-of-state obligations must be included. Include any exempt interest from a mutual fund or other regulated investment company. Do not include interest earned on your IRA, or excludable interest on series EE bonds. See Federal Form 8815.

Line 7, Taxable Interest and Dividends. Include your total interest and dividends received in 2013, as shown in:

1.Box 1 and Box 3, Federal Form 1099-INT (Interest Income) or similar statement;

2.Box 1 and Box 2, Federal Form 1099-OID; and

3.Box 1a and Box 2a, Federal Form 1099-DIV.

Interest and dividends from all U.S. government obligations must be included.

Line 8, Other Income or Adjustments. Complete Worksheet A and enter the amount from line G.

Line 9, Total of Lines 1 Through 8. If the amount on line 9 qualiies you for 100% relief (see the Household Income Table in these instructions), it is not necessary to complete line 10. In this case, the line 9 amount may be entered on line 11.

Line 10a-10c, Medical and Dental Expenses. See medical expenses speciic instructions on next page.

Line 11. Household Income. Use this amount to determine your percentage of relief as found in the Household Income

Table in these instructions.

Part II

Line 1, Federal AGI. Include income as reported for federal income tax purposes on line 37, Federal Form 1040; line 21, Federal Form 1040A; or line 4, Federal Form 1040EZ.

Line 2, Social Security Retirement Income. Enter Social Security retirement beneits minus any portion included as taxable in AGI. This is the amount shown in Box 5, Federal Form SSA-1099 (line 20a, Federal Form 1040, or line 14a, Federal Form 1040A), minus any amount reported on line 20b, Federal Form 1040, or line 14b, Federal Form 1040A. Do NOT subtract Medicare premiums or any other adjustments from the amount in Box 5.

Line 3, Tier I Railroad Retirement Income. Include the net Social Security equivalent portion of Tier I beneits minus any portion included as taxable in AGI. This is the amount shown in Box 5, Federal Form RRB-1099 (line 20a, Federal Form 1040, or line 14a, Federal Form 1040A), minus any amount reported on line 20b, Federal Form 1040, or line 14b, Federal Form 1040A.

Line 4, Nebraska Adjustments Increasing federal AGI. Report the total amount of Nebraska adjustments increasing federal AGI as shown on line 12, Nebraska Form 1040N. If there is an amount being deducted as a Nebraska net operating loss carryforward on line 13 of the Form 1040N, subtract the amount on line 13 from the amount on line 12. The difference must be entered on line 4 of this form, unless the total is a negative amount; then please enter -0-.

Line 5, Income From Nebraska Obligations. Include the total amount of interest income from Nebraska obligations as shown on line 46, Schedule I, Nebraska Form 1040N.

Line 6, Total of Lines 1 Through 5. If the amount on line 6 qualiies you for 100% relief (see the Household Income Table in these instructions), it is not necessary to complete line 7. In this case, the line 6 amount may be entered on line 8.

Line 7a-7c, Medical and Dental Expenses. See medical expenses instructions below.

Line 8. Household Income. Use this amount to determine your percentage of relief as found in the Household Income Table.

Medical Expenses Instructions

Part I, Line 10 or Part II, Line 7

“Medical expenses paid” includes all 2013 medical expenses incurred for and paid by the applicant, spouse, or owner-occupant.

In general, medical expenses include any payments you made that would qualify for the income tax medical expenses deduction on Federal Form 1040, Schedule A, line 1; except payments for the treatment of a dependent who is not an owner-occupant of the homestead. Include all amounts that were paid during 2013, regardless of when the care was received. If your insurance company paid the service provider directly for part of your expenses, and you paid only the amount that remained, include ONLY the amount you paid. Do not include amounts paid on your behalf directly to the service provider by any other person or governmental unit. IRS Publication 502 contains more information on medical and dental expenses.

Reimbursements. Do not include any amounts you paid that have been or will be reimbursed by insurance. Doctors, Dentists, Hospitals. Include amounts paid for medical services such as:

1.Payments to doctors, dentists, osteopaths, nurses, chiropractors, and other licensed medical practitioners;

2.Payments to hospitals or licensed nursing care facilities; and

3.Payments for purchases of medical equipment, crutches, hearing aids, eyeglasses, contact lenses, dentures, etc. Do not include funeral, burial, or cremation costs.

Prescription Medicines. Include payments for prescription medicines and insulin. Prescription medicines are only those drugs and medicines that cannot be purchased without a prescription.

Do not include any medicine that can be purchased over-the-counter without a prescription, whether or not they have been prescribed by a doctor. For example, aspirin, vitamins, and cough drops are not prescription medicines.

Health Insurance Premiums. Include insurance premiums paid for medical insurance for the applicant, spouse, or owner-occupant. Medical insurance includes Medicare Part B, Medicare Supplemental, Part D Medicare prescription drug coverage, or insurance for licensed nursing care. Part B Medicare withheld from Social Security payments should be included as insurance premiums paid.

Do not include: Medicare Part A deductions withheld from wages; self-employed health insurance that reduced total income; the medical payments portion of a car insurance policy; an accident or health insurance policy where the beneits do not speciically cover medical care; life insurance or income protection policies; employer-sponsored health insurance plans; and lexible spending accounts. These are not deductible medical insurance premiums.

Worksheet A — Part I

Note: Retain a copy for your records.

Line A, Net Business Income Including Rental, or Farm Income, or (Loss). Report your 2013 net income. For information on computing the income, refer to the following federal schedules and instructions:

1.For business income, see Schedule C, Federal Form 1040, or Schedule C-EZ, Federal Form 1040;

2.For income from rental real estate, royalties, partnerships, S corporations, trusts, REMICs, etc., see Schedule E, Federal Form 1040; and

3.For farm income, see Schedule F, Federal Form 1040.

Line B, Capital Gains or (Loss). Include all income or loss resulting from the sale of stock, bonds, or real estate from Federal Forms 1099-B, 1099-S, 1099-R, 1099-DIV, or equivalents. See Schedule D, Federal Form 1040.

Line C, Other Gains or (Loss). Report all other gains or losses on tangible or intangible property not included on line A or line B. See Federal Form 4797.

Line D, Unemployment Compensation. Include all unemployment compensation received for 2013 from Box 1, Federal Form 1099-G.

Line E,Any Other Income or (Adjustments Reducing Income). Report all other income (from Federal Form 1099-MISC or other Forms 1099), taxable state income tax refunds reported on Federal Form 1099-G, and all alimony received. Report any adjustments reducing income such as moving expenses, IRA deductions, student loan interest, tuition and fees, self- employment tax and self-employment health insurance, SEP, SIMPLE, and other qualiied retirement plans, and alimony paid. Refer to the instructions for Federal Form 1040. Health expenses and health insurance premiums other than self-employment health insurance should be entered on line 10a.

Subtract the calculated adjustments from the calculated “other income” and enter the net income or loss on line E.

LINE F, Penalty on Early Withdrawal of Savings. Report your total amount of penalties for early withdrawal of savings from Box 2, Federal Form 1099-INT.

FOR MORE INFORMATION, SEE revenue.nebraska.gov/PAD, OR CALL 888-475-5101 OR 402-471-6185.

Household Income Table

|

|

Over Age 65 |

|

|

Percentage |

|

Disabled Veterans & Disabled Individuals |

|

Single |

|

|

Married |

of Relief |

|

|

Single |

|

|

Married |

$ |

0 — $26,900.99 |

$ |

0 |

— $31,600.99 |

100% |

$ |

0 — $30,300.99 |

$ |

0 |

— $34,700.99 |

|

26,901 — |

28,300.99 |

|

31,601 |

— |

33,200.99 |

85% |

30,301 |

— |

31,700.99 |

|

34,701 |

— |

36,300.99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,301 — |

29,700.99 |

|

33,201 |

— |

34,900.99 |

70% |

31,701 |

— |

33,100.99 |

|

36,301 |

— |

38,000.99 |

|

29,701 — |

31,100.99 |

|

34,901 |

— |

36,600.99 |

55% |

33,101 |

— |

34,500.99 |

|

38,001 |

— |

39,700.99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,101 — |

32,500.99 |

|

36,601 |

— |

38,300.99 |

40% |

34,501 |

— |

35,900.99 |

|

39,701 |

— |

41,400.99 |

|

32,501 — |

34,000.99 |

|

38,301 |

— |

40,000.99 |

25% |

35,901 |

— |

37,300.99 |

|

41,401 |

— |

43,100.99 |

|

|

|

|

|

|

|

|

|

|

|

|

34,001 AND OVER |

|

40,001 |

AND OVER |

0% |

37,301 |

AND OVER |

|

43,101 |

AND OVER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|