In case you want to fill out Form 470 2844, there's no need to install any sort of applications - simply give a try to our online PDF editor. The tool is constantly upgraded by us, acquiring new functions and growing to be more convenient. To get started on your journey, consider these simple steps:

Step 1: Click on the "Get Form" button in the top section of this page to open our PDF editor.

Step 2: After you start the editor, you'll notice the document made ready to be filled in. Besides filling out various blanks, you could also perform some other things with the form, specifically putting on custom textual content, editing the original text, inserting illustrations or photos, putting your signature on the form, and more.

It is straightforward to finish the pdf using out practical guide! Here's what you want to do:

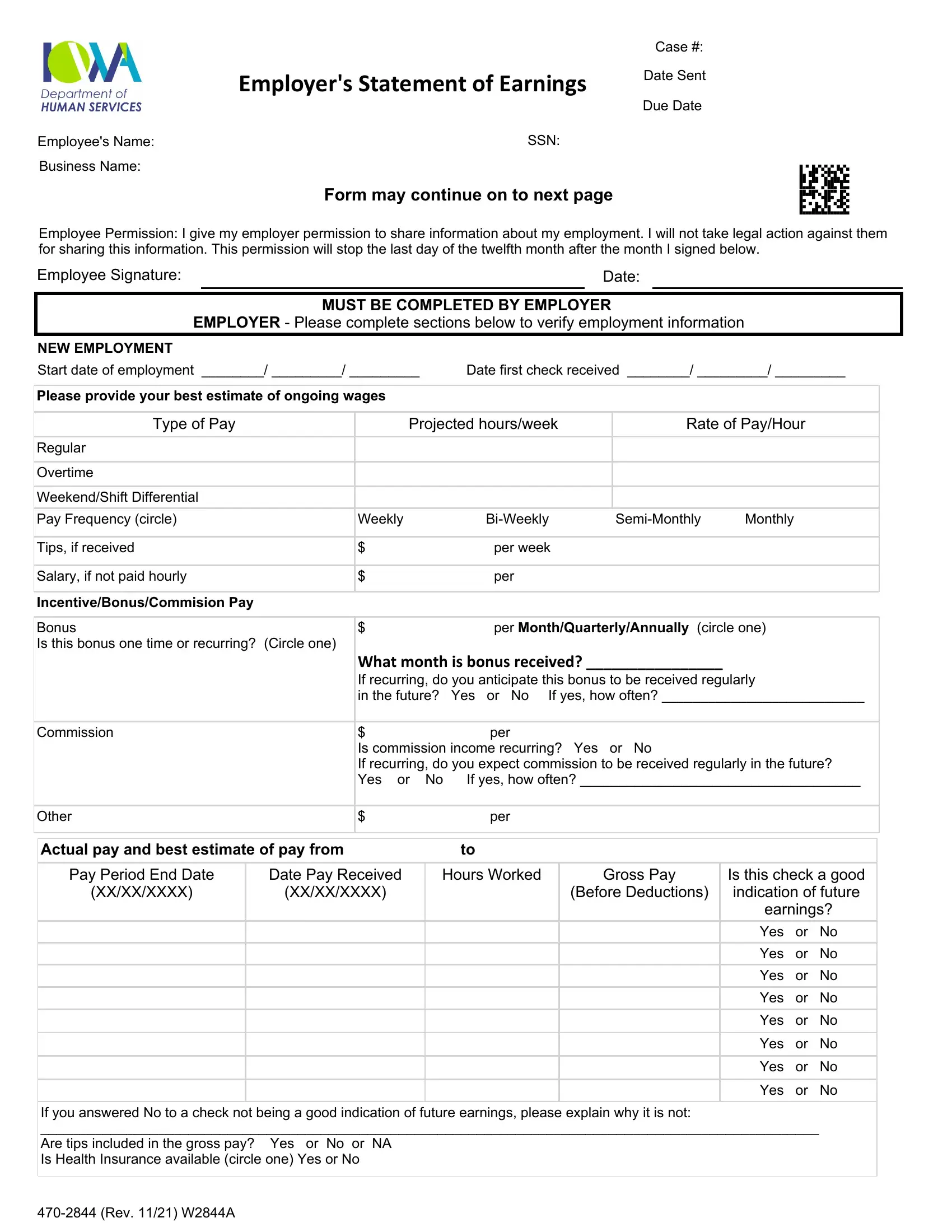

1. Start completing your Form 470 2844 with a number of essential blank fields. Consider all of the required information and be sure there is nothing left out!

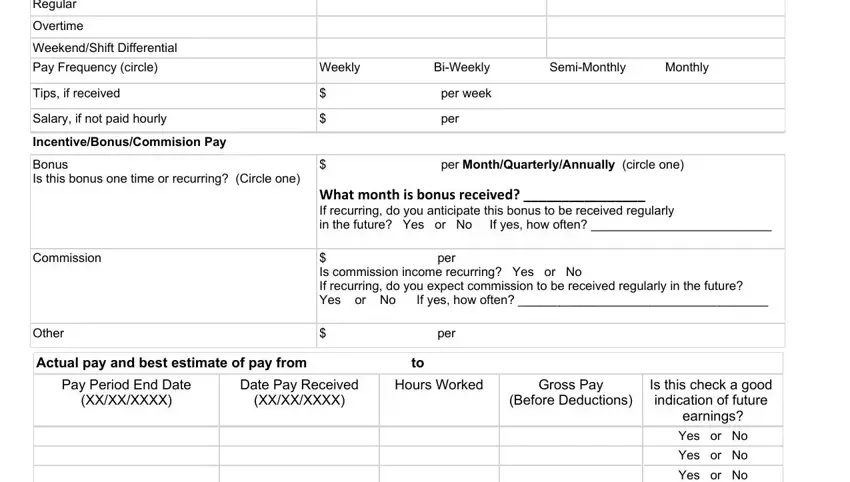

2. Once your current task is complete, take the next step – fill out all of these fields - Regular Overtime WeekendShift, Weekly, Tips if received Salary if not, SemiMonthly, Monthly, BiWeekly, per week per, per MonthQuarterlyAnnually circle, Commission, Other, Actual pay and best estimate of, What month is bonus received If, per Is commission income, per, and Pay Period End Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really mindful when filling out SemiMonthly and Other, because this is where a lot of people make errors.

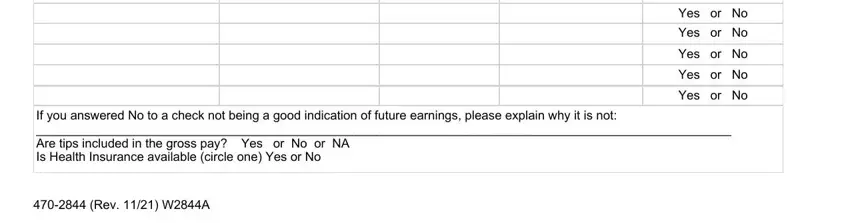

3. Within this step, examine earnings Yes or No Yes or No Yes, If you answered No to a check not, and Rev WA. Each one of these should be completed with greatest accuracy.

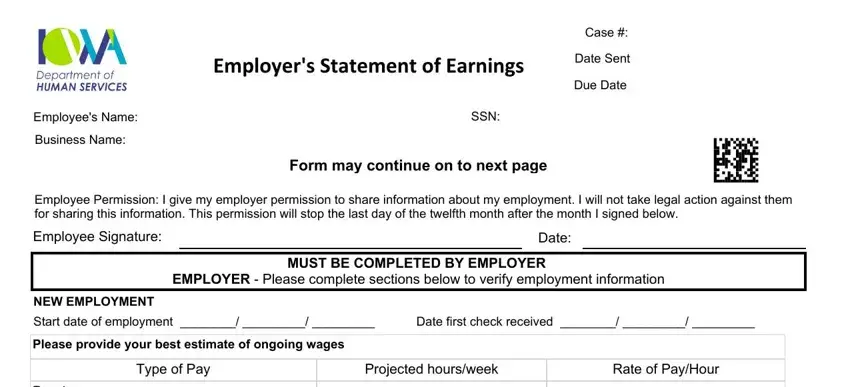

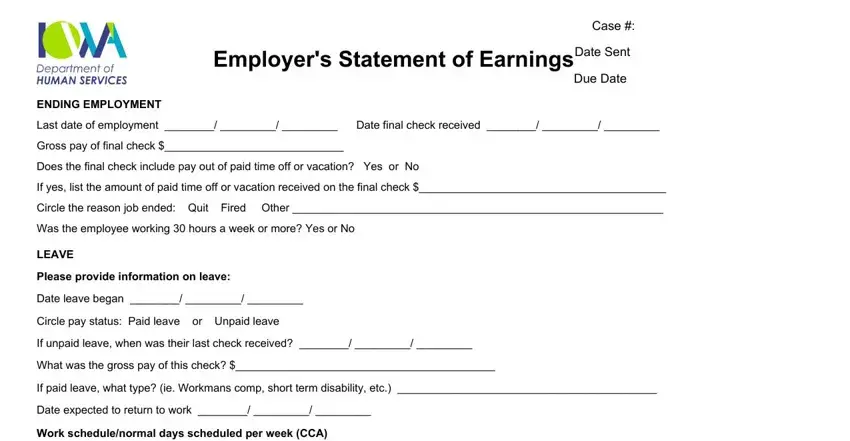

4. This next section requires some additional information. Ensure you complete all the necessary fields - Employers Statement of Earnings, Case, Date Sent, Due Date, ENDING EMPLOYMENT Last date of, and LEAVE Please provide information - to proceed further in your process!

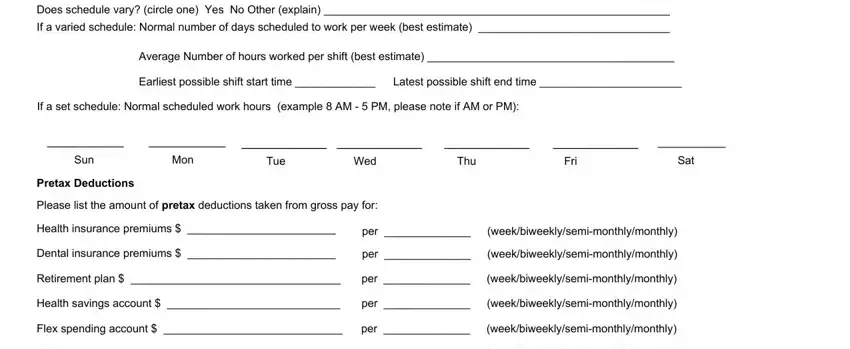

5. As a final point, this last part is precisely what you need to wrap up prior to closing the document. The fields at issue include the next: LEAVE Please provide information, Average Number of hours worked per, Earliest possible shift start time, Latest possible shift end time, If a set schedule Normal scheduled, Sun, Mon, Tue, Wed, Thu, Fri, Sat, Pretax Deductions Please list the, Dental insurance premiums, and per per.

Step 3: Right after you've reviewed the details in the fields, click "Done" to conclude your document generation. Right after getting a7-day free trial account here, it will be possible to download Form 470 2844 or email it without delay. The PDF will also be available via your personal account with your each edit. FormsPal offers protected document tools devoid of personal data record-keeping or distributing. Feel safe knowing that your data is safe here!