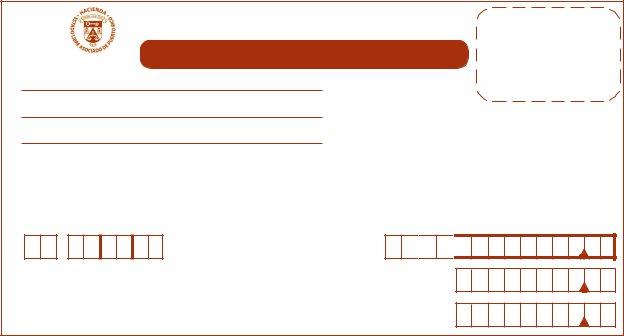

Navigating the complexities of tax obligations demands a keen understanding of various forms and their purposes, among which the 480 E 1 form plays a pivotal role for individuals and entities in Puerto Rico. This vital document, officially titled under the Commonwealth of Puerto Rico as the "COMPROBANTE DE PAGO DE CONTRIBUCION ESTIMADA" or Estimated Tax Payment Voucher, serves as a cornerstone in the process of fulfilling estimated tax payments. It is meticulously designed to accommodate both individuals and corporations or partnerships, ensuring that all parties can efficiently report and remit their estimated taxes due to the Department of Hacienda - the territory's tax authority. Essential information such as the taxpayer's name, address, social security or employer identification number, and specific payment details including the payment date, tax year, and the total amount paid, are systematically captured within the form. Additionally, the form provides a detailed mechanism for taxpayers to segregate their payments into categories like regular estimated tax and any excess over the alternative minimum or alternate basic tax, underscoring the territory's effort to streamline tax administrative processes. Understanding the nuances of Form 480 E 1 is not only critical for compliance but also for optimizing tax strategy within Puerto Rico's unique fiscal landscape.

| Question | Answer |

|---|---|

| Form Name | Form 480 E 1 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | formulario 480, forma 480, 480 e, form 480 puerto rico |

Estado Libre Asociado de Puerto Rico - Commonwealth of Puerto Rico |

SELLO DE PAGO |

|

Rev.10.13 |

Departamento de Hacienda - Department of the Treasury |

Payment Stamp |

|

COMPROBANTE DE PAGO DE CONTRIBUCION ESTIMADA

Estimated Tax Payment Voucher

NOMBRE - Name

DIRECCION - Address

|

|

|

|

|

|

|

|

CODIGO |

1- INDIVIDUO - Individual |

||

|

|

|

|

|

|

|

|

Code |

2- CORPORACION O SOCIEDAD |

||

|

|

|

|

|

CODIGO POSTAL - Zip Code |

|

|

||||

|

|

|

|

|

|

|

|

|

Corporation or Partnership |

||

|

|

|

|

|

|

|

|

|

|

||

|

|

FECHA DE PAGO |

NUMERO DE SEGURO SOCIAL O |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

|

|

Payment Date |

IDENTIFICACION PATRONAL |

|

|

AÑO |

|

|

|||

COLECTURIA |

AÑO |

MES |

DIA |

Social Security or Employer |

|

|

|

IMPORTE TOTAL PAGADO |

|||

CODIGO CONTRIBUTIVO |

|||||||||||

Identification Number |

|||||||||||

CollectionsOffice |

Year |

Month |

Day |

Code |

Tax Year |

|

Total Amount Paid |

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

0 |

|

|

|

2 |

0 0

DESGLOSE EL IMPORTE TOTAL PAGADO ENTRE: (A) CONTRIBUCION ESTIMADA REGULAR

Break Down the Total Amount Paid Between: |

Regular Estimated Tax |

|

(B) EXCESO DE CONTRIBUCION ALTERNATIVA MINIMA O |

|

CONTRIBUCION BASICA ALTERNA SOBRE |

|

CONTRIBUCION REGULAR - Excess of Alternative |

|

Minimum Tax or Alternate Basic Tax over Regular Tax |