In the complex landscape of tax compliance and administration, the Form 4810 emerges as a crucial tool for entities and individuals seeking a swift assessment of potential additional taxes owed. Officially titled "Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)," this form serves a critical role in streamlining the tax review process for a variety of tax types, including income, employment, gift, and excise taxes. It is meticulously designed to facilitate the prompt assessment request directly to the Internal Revenue Service (IRS), ensuring that the applicant's documentation is correctly aligned with IRS requirements. This includes providing exhaustive details such as the taxpayer's name, the kind of tax, the tax periods in question, and the specific returns for which the prompt assessment is requested. Additionally, the form mandates the inclusion of supporting documents, such as copies of the tax returns in question and, where applicable, letters of administration or letters testamentary. Offering a structured pathway for individuals, estates, and corporations — especially those undergoing dissolution — to expedite the assessment process, Form 4810 must be filed subsequent to the return it concerns, directly with the IRS Service Center where the original returns were filed. Through this process, it aims to not just fulfill compliance requirements but also to potentially aid in the swifter resolution of financial or legal matters that hinge on tax liabilities. The intent behind this form, embedded within the broader framework of U.S. tax law, underscores the ongoing efforts by the IRS to accommodate taxpayer needs for efficiency and clarity in tax administration.

| Question | Answer |

|---|---|

| Form Name | 4810 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | IR-6526, nontax, OMB, testamentary |

Form 4810 |

Request for Prompt Assessment Under |

OMB No. |

|

(Rev. February 2009) |

Internal Revenue Code Section 6501(d) |

|

|

Department of the Treasury |

▶ See instructions on back. |

For IRS Use Only |

|

Internal Revenue Service |

|||

|

|||

Requester’s name |

|

Kind of tax |

|

|

|

Income |

|

|

|

Gift |

|

Title |

|

Employment |

|

|

|

Excise |

|

|

|

|

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City, town, or post office, state, and ZIP code

Daytime phone number

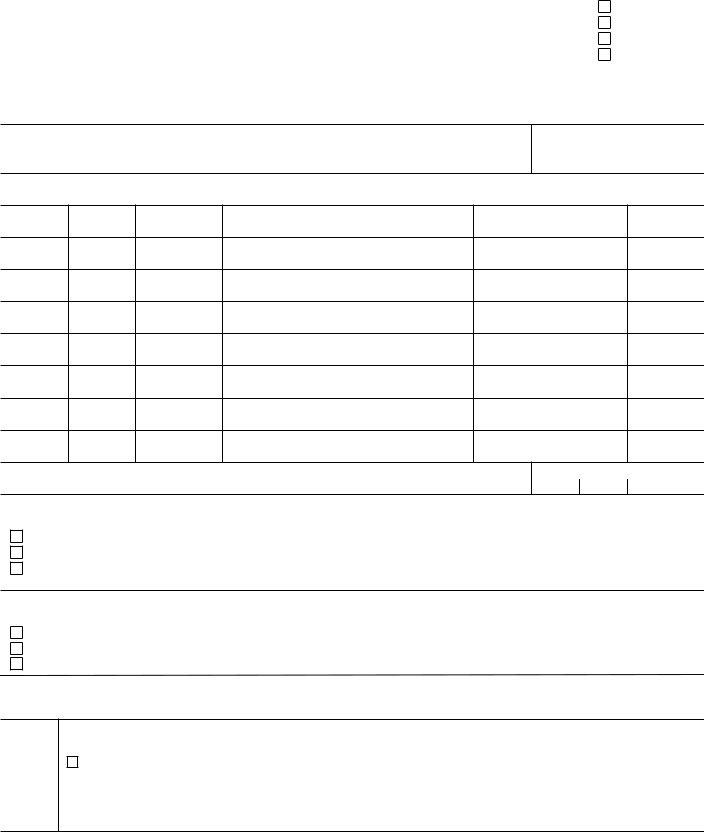

Tax Returns for Which Prompt Assessment of Any Additional Tax is Requested

Form

Number

Tax Period

Ended

SSN/EIN on

Return

Name and Address Shown on Return

Service Center Where Filed

Date Filed

If applicable, provide the name of decedent’s spouse (surviving or deceased)

Spouse’s social security number

If corporate income tax returns are included, check the applicable box below:

Dissolution has been completed.

Dissolution has begun and will be completed either before or after the

Dissolution has not begun but will begin before the

Attached are copies of:

The returns listed above.

Letters of administration or letters testamentary.

Other (describe):

I request a prompt assessment of any additional tax for the kind of tax and periods shown above, as provided by Internal Revenue Code section 6501(d).

Sign Here

Under penalties of perjury, I declare that I have examined this request, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

I certify that I have never been assessed any penalties for civil fraud for any federal or state tax matter nor have I been charged with, indicted for, or convicted of fraud. If you cannot certify this statement, attach a detailed statement explaining the circumstances under which you were assessed a penalty, charged with, indicted for, or convicted of fraud.

▶ |

|

|

▶ |

|

Signature of requester |

Date |

Identifying number |

For Privacy Act and Paperwork Reduction Act Notice, see back of form. |

Cat. No. 42022S |

Form 4810 (Rev. |

Form 4810 (Rev. |

Page 2 |

|

|

General Instructions

Section references are to the Internal Revenue Code.

Purpose of Form

Use Form 4810 to request prompt assessment of tax. Attach to your request the documentation requested on Form 4810. If you prefer to use your own format, your request must list the same information as requested on this form and include the applicable attachments. Specifically, you must verify your authority to act for the taxpayers (for example, letters testamentary or letters of administration) and provide copies of the authorizing document. Also, your request must clearly show:

●It is a request for prompt assessment under section 6501(d);

●The kind of tax and the tax periods involved;

●The name and social security number (SSN) or employer identification number (EIN) shown on the return (copies of the returns may be attached to help identify the return; write at the top of the return copy: “COPY - DO NOT PROCESS AS ORIGINAL”); and

●The date and location of the IRS office where the returns were filed.

When To File

Do not file Form 4810 requesting prompt assessment until after you file the tax returns listed on the front of this form. You must submit a separate request for prompt assessment for any tax returns filed after this Form 4810.

Where To File

Send your request to the Internal Revenue Service Center where you filed the returns for which you are requesting prompt assessment.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We collect this information under the authority under Internal Revenue Code section 6501(d). We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax. You are

not required to request prompt assessment; however, if you do so you are required to provide the information requested on this form. Failure to provide the information may delay or prevent processing your request. Section 6109 requires you to provide the requested taxpayer identification numbers.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential as required by section 6103. However, section 6103 allows or requires the Internal Revenue Service to disclose or give such information shown on your Form 4810 to the Department of Justice to enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file this form and related schedules will vary depending on individual circumstances. The estimated average times are:

Recordkeeping |

5 |

hrs., |

30 |

min. |

Learning about the law or the form |

0 |

hrs., 18 |

min. |

|

Preparing the form |

0 |

hrs., 24 |

min. |

|

Copying, assembling, and |

|

|

|

|

sending the form to the IRS |

0 |

hrs., |

0 |

min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this request simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW,