If you are a U.S. citizen or resident and own foreign financial assets, you may be required to file Form 4891 with your federal income tax return. Form 4891 is used to report information about your foreign financial assets, including their value and type. Knowing which assets are considered "foreign" and understanding the associated reporting requirements can help you avoid penalties and interest charges. This blog post will provide an overview of Form 4891 and explain when it is necessary to file this form.

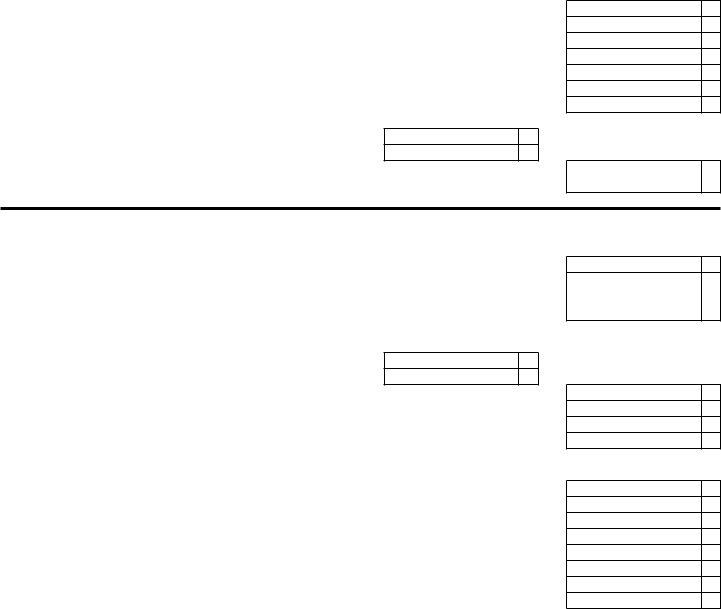

| Question | Answer |

|---|---|

| Form Name | Form 4891 |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | michigan form 4891 instructions, faa piv card application, mi 4891 instructions 2020, form 4891 form |

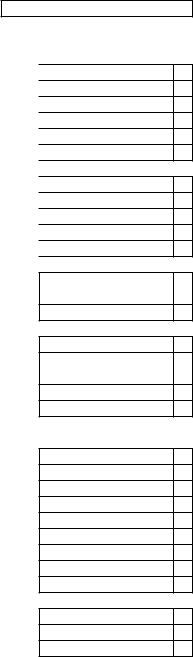

Michigan Department of Treasury |

|

|

|

|

|

|

This form cannot be used |

|||||

4891 (Rev. |

|

|

|

|

|

|

as an amended return; use |

|||||

2020 MICHIGAN Corporate Income Tax Annual Return |

|

|

|

the CIT Amended Return |

||||||||

|

|

|

(Form 4892). |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

Issued under authority of Public Act 38 of 2011. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

1. |

Return is for calendar year 2020 or for tax year beginning: |

|

|

|

and ending: |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Taxpayer Name (print or type) |

|

|

3. Federal Employer Identification Number (FEIN) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Street Address |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP/Postal Code |

|

|

Country Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

||

5. NAICS (North American Industry Classification System) Code |

6. If a Final Return, Enter Effective |

End Date |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

8. |

|

Check if a special sourcing formula |

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

Check if Filing Michigan Unitary Business Group Return. |

7b. Affiliated Group Election year |

|

|

for transportation services is used in |

|||||

|

|

|

|

|

|

|

|

the sourcing of Sales to Michigan. |

||||

7a. |

|

|

(Include Form 4896, if applicable, and Form 4897.) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Important: If the tax liability on line 41 is less than or equal to $100, or the gross receipts on line 11 are less than $350,000, you are not required to file this return or pay the tax. Short period filers, see instructions.

9. Apportionment Calculation — If any amount in line 9a through 9e is zero, enter zero. All lines must be completed. |

||||

|

a. |

Michigan sales of the corporation/Unitary Business Group (UBG) (if no Michigan sales, enter zero) |

...... 9a. |

|

|

b. |

Proportionate Michigan sales from unitary |

9b. |

|

|

c. |

Michigan sales. Add lines 9a and 9b |

9c. |

|

|

d. |

Total sales of the corporation/UBG |

9d. |

|

|

e. |

Proportionate total sales from unitary FTEs (include Form 4900) |

9e. |

|

|

f. |

Total sales. Add lines 9d and 9e |

9f. |

|

|

g. |

Apportionment percentage. Divide 9c by 9f |

9g. |

|

10. |

a. |

Gross receipts from corporate activities (see instructions) |

10a. |

00 |

10. |

b. |

Apportioned gross receipts from FTEs |

10b. |

00 |

11.REQUIRED: Total gross receipts for filing threshold purposes. Multiply line 10a by line 9g, and add

line 10b |

11. |

00

00

00

00

00

00

%

00

PART 1: CORPORATE INCOME TAX

Unitary Business Groups: Amounts reported for all members on Form 4897 must be summed and carried to the corresponding line on Form 4891.

12. Federal taxable income. (Amount includes agricultural activities. See instructions.) |

12. |

00 |

13.Domestic production activities deduction based on IRC § 199 reported on federal Form 8903, to the extent

deducted from federal taxable income |

13. |

00 |

14. Miscellaneous (see instructions) |

14. |

00 |

15.Adjustments due to decoupling of Michigan depreciation from IRC § 168(k). If adjustment is negative, enter as negative:

a. |

Net bonus depreciation adjustment |

15a. |

00 |

b. |

Gain/loss adjustment on sale of eligible depreciable asset(s) |

15b. |

00 |

|

c. Add lines 15a and 15b. If negative, enter as negative |

15c. |

16. |

Add lines 12, 13, 14 and 15c. If negative, enter as negative |

16. |

17. |

For a UBG, total group eliminations from business income (see instructions). All other filers, enter zero |

17. |

18. |

Business Income. Subtract line 17 from line 16. (UBGs, see instructions.) If negative, enter as negative... |

18. |

Additions to Business Income

19. |

Interest income and dividends derived from obligations or securities of states other than Michigan |

19. |

20. |

Taxes on or measured by net income including tax imposed under CIT |

20. |

21. |

Any carryback or carryover of a federal net operating loss (enter as a positive number) |

21. |

22. |

Royalty, interest, and other expenses paid to a related person that is not a UBG member of this taxpayer .... |

22. |

23. |

Expenses from the production of oil and gas, and/or minerals (see instructions) |

23. |

24. |

Miscellaneous (see instructions) |

24. |

25. |

Total Additions to Income. Add lines 19 through 24 |

25. |

26. |

Corporate Income Tax Base After Additions. Add lines 18 and 25. If negative, enter as negative |

26. |

+ 0000 2020 12 01 27 3

00

00

00

00

00

00

00

00

00

00

00

00

Continue and sign on Page 2

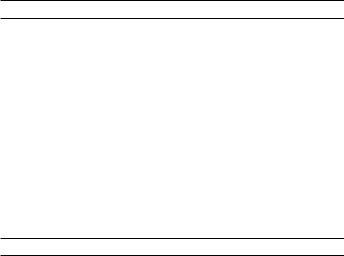

2020 Form 4891, Page 2 of 2 |

Taxpayer FEIN |

|

|

PART 1: CORPORATE INCOME TAX (Continued) |

|

Subtractions from Business Income |

|

27. |

.........................Income from |

27. |

|

|

28. |

Dividends and royalties received from persons other than U.S. persons and foreign operating entities |

28. |

|

|

29. |

Interest income derived from United States obligations |

29. |

|

|

30. |

Income from the production of oil and gas, and/or minerals (see instructions) |

30. |

|

|

31. |

Miscellaneous (see instructions) |

31. |

|

|

32. |

Total Subtractions from Income. Add lines 27 through 31 |

32. |

|

|

33. |

Corporate Income Tax Base. Subtract line 32 from line 26. If negative, enter as negative |

33. |

|

|

|

||||

34. |

Apportioned Corporate Income Tax Base. Multiply line 33 by percentage on line 9g |

34. |

|

|

35. |

Apportioned Income from |

35. |

|

|

36. |

Total apportioned Corporate Income Tax Base. Add line 34 and line 35 |

36. |

|

|

37a. |

Available CIT business loss carryforward (see instructions). Enter as positive |

37a. |

|

|

|

|

|

|

|

37b. |

|

Check if any loss on line 37a was acquired in this filing period in an IRC 381(a)(1) or (2) transaction (see instructions) |

||

38.Subtract line 37a from line 36. If negative, enter here as negative. A negative number here is the available

|

business loss carryforward to the next filing period (see instructions) |

38. |

39. |

Corporate Income Tax Before Credit. Multiply line 38 by 6% (0.06). If less than zero, enter zero |

39. |

PART 2: TOTAL CORPORATE INCOME TAX |

|

|

40. |

Small Business Alternative Credit (SBAC) from Form 4893, line 14 or line 18, whichever applies |

40. |

41.Tax Liability after SBAC. Subtract line 40 from line 39. If less than or equal to $100, enter zero.

|

If apportioned or allocated gross receipts are less than $350,000, enter zero (see instructions) |

41. |

42. |

Total Recapture of Certain Business Tax Credits from Form 4902 |

42. |

43. |

Total Tax Liability. Add lines 41 and 42 |

43. |

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

PART 3: PAYMENTS AND TAX DUE

UBGs include on lines 44 through 46 payments from all members as reported on Form 4897.

44. |

Overpayment credited from prior period return (MBT or CIT) |

44. |

45. |

Estimated tax payments |

45. |

46. |

Tax paid with request for extension |

46. |

47. |

Payment total. Add lines 44 through 46 |

47. |

48. |

TAX DUE. Subtract line 47 from line 43. If less than zero, leave blank |

48. |

49. |

Underpaid estimate penalty and interest from Form 4899, line 38 |

49. |

50. |

Annual Return Penalty (see instructions) |

50. |

51. |

Annual Return Interest (see instructions) |

51. |

52. |

PAYMENT DUE. If line 48 is blank, go to line 53. Otherwise, add lines 48 through 51 |

52. |

00

00

00

00

00

00

00

00

00

PART 4: REFUND OR CREDIT FORWARD

53. |

Overpayment. Subtract lines 43, 49, 50 and 51 from line 47. If less than zero, leave blank (see instructions) .. |

53. |

54. |

CREDIT FORWARD. Amount on line 53 to be credited forward and used as an estimate for next CIT tax year... |

54. |

55. |

REFUND. Subtract line 54 from line 53 |

55. |

00

00

00

Taxpayer Certification. I declare under penalty of perjury that the information in this |

Preparer Certification. I declare under penalty of perjury that this |

||||

return and attachments is true and complete to the best of my knowledge. |

return is based on all information of which I have any knowledge. |

||||

|

|

|

|

|

|

|

|

|

|

|

Preparer’s PTIN, FEIN or SSN |

|

|

By checking this box, I authorize Treasury to discuss my return with my preparer. |

|

||

|

|

|

|||

|

|

|

|

|

|

Authorized Signature for Tax Matters |

|

|

Preparer’s Business Name (print or type) |

||

|

|

|

|

|

|

Authorized Signer’s Name (print or type) |

|

Date |

Preparer’s Business Address and Telephone Number (print or type) |

||

|

|

|

|

|

|

Title |

Telephone Number |

|

|||

|

|

|

|

|

|

Return is due April 30 or on or before the last day of the 4th month after the close of the tax year.

WITHOUT PAYMENT. Mail return to: |

WITH PAYMENT. Pay amount on line 52. Mail check and return to: Michigan Department of Treasury, |

Michigan Department of Treasury, |

PO Box 30804, Lansing MI 48909. Make check payable to “State of Michigan.” Print taxpayer’s FEIN, the tax |

PO Box 30803, Lansing MI 48909 |

year, and “CIT” on the front of the check. Do not staple the check to the return. |

+ 0000 2020 12 02 27 1

Instructions for Form 4891

Corporate Income Tax Annual Return

Purpose

To calculate the Corporate Income Tax (CIT) for standard taxpayers. Insurance companies should file the Insurance

Company Annual Return for Michigan Corporate Income and Retaliatory Taxes (Form 4905) and Financial Institutions

should file the CIT Annual Return for Financial Institutions

(Form 4908).

A standard taxpayer is an entity that is a C Corporation, an entity that has elected to be taxed federally as a C Corporation for the tax year, or a Unitary Business Group (UBG) that includes members that are C Corporations or entities that have elected to be taxed federally as a C Corporation for the tax year.

Instructions for UBGs

NOTE: UBGs must complete a copy of the Michigan

Corporate Income Tax Data on Unitary Business Group Members (Form 4897) for each member of the UBG before completing Form 4891. Amounts reported for all members on Form 4897 must be summed and carried to the corresponding line on Form 4891.

Under the CIT, corporation means an entity that is a C

Corporation or has elected to file federally as a C Corporation for the tax year. A taxpayer is a corporation, an insurance company, a financial institution, or a UBG that is liable for tax, interest, or penalty.

A UBG is a group of United States persons that are corporations, insurance companies, or financial institutions, other than a foreign operating entity, that satisfies the following criteria:

•Control Test: One of the persons owns or controls, directly or indirectly, more than 50 percent of the ownership interest with voting rights (or rights comparable to voting rights) of the other members; AND

•Relationship Test: The UBG has operations which result in a flow of value between the members in the UBG or has operations that are integrated with, are dependent upon, or contribute to each other. Flow of value is determined by reviewing the totality of facts and circumstances of business activities and operations.

United States person is defined in the Internal Revenue Code (IRC) § 7701(a)(30).

A foreign operating entity means a United States corporation that would otherwise be a part of a UBG that is taxable in Michigan; has substantial operations outside the United States, the District of Columbia, any territory or possession of the United States except for the commonwealth of Puerto Rico, or a political subdivision of the foregoing; and at least 80 percent of its income is active foreign business income as defined in IRC § 871(l)(1)(B)(ii).

A UBG may alternatively be determined by making an

Affiliated Group Election.

In Michigan, a UBG with members that are corporations must file Form 4891. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a

Tax Year of a UBG: A taxpayer that is a UBG must file a combined return using the tax year of the DM. The combined return of the UBG must include each tax year of each member whose tax year ends with or within the tax year of the DM. For example, Taxpayer ABC is a UBG comprised of three standard members: Member A, the DM with a calendar tax year, and Members B and C with fiscal years ending March 31 and September 30, respectively. Taxpayer ABC’s tax year is that of its DM. For this group in 2013, that annual return will include Member A’s calendar year ending December 31, 2013, the tax year of Member B ending March 31, 2013, and the tax year of Member C ending September 30, 2013.

The gross receipts of a UBG is the sum of the gross receipts of each member included in the UBG, other than a person subject to the tax as an insurance company or financial institution, less any gross receipts arising from transactions between members included in the UBG. Gross receipts of each member should reflect the accounting method that member used to compute its federal taxable income.

The business income of a UBG is the sum of the business income of each member included in the UBG, other than a person subject to the tax as an insurance company or financial institution, less any items of income and related deductions arising from transactions (including dividends) between members included in the UBG. Business income of each member should reflect the accounting method that member used to compute its federal taxable income.

In general, components used to determine tax liability relate to the group as a single taxpayer, not to the individual members that comprise the group. Exceptions to this general rule are noted in instructions to the applicable forms. The group of members on the combined return is treated as the taxpayer (a distinct entity) for purposes of the Income Tax Act.

Additional information can be found at www.michigan.gov/ taxes. Select “Business Taxes” from the items near the top of the page, and click on “Corporate Income Tax.” Also review Revenue Administrative Bulletin (RAB)

Business Group Control Test And Relationship Tests. Click on “Reports and Legal” from the items near the top of the page, then click on “Revenue Administrative Bulletins.”

Also see “Notice to Taxpayers Regarding Labelle Management Inc v Department of Treasury.” This notice is found under

15

“News and Information” at www.michigan.gov/taxes.

Taxpayer Certification

A return filed by a UBG must be signed by an individual authorized to sign on behalf of the DM. Provide a telephone number for that individual at the DM’s office. Treasury will only discuss the return with the authorized signer.

The Affiliated Group Election

The affiliated group election allows a group of persons that satisfy the definition of “affiliated group,” (see below) to elect to be treated as a UBG under the CIT even if those persons do not satisfy the relationship test of MCL 206.611(6). The relationship test is discussed in the Instructions for UBGs on this form and online at www.michigan.gov/taxes.

The term “affiliated group” means that term as defined in section 1504 of the IRC except that 1) the term includes all United States persons that are corporations, insurance companies, or financial institutions, other than a foreign operating entity, and 2) the entities listed in (1) are commonly owned, directly or indirectly, by any member of such affiliated group and other members of which more than 50 percent of the ownership interests with voting rights or ownership interests that confer comparable rights to voting rights of the member is directly or indirectly owned by a common owner or owners.

A taxpayer makes the election by affirmatively indicating so on the annual return (see line 7b). The affiliated group members are treated as members of a UBG for all purposes. However, the affiliated group election does not affect the determination of the

General Instructions

Dates must be entered in

For periods less than 12 months, see the “General Information for Standard Taxpayers” section in the Michigan CIT for Standard Taxpayers booklet (Form 4890).

Every standard taxpayer with nexus in Michigan and with apportioned or allocated gross receipts of $350,000 or more and whose CIT tax liability is greater than $100 must file an annual CIT return. (The gross receipts filing threshold does not apply to insurance companies or financial institutions.) Businesses that operate less than 12 months must annualize their gross receipts to determine if a filing requirement exists. For a UBG, the $350,000 filing threshold is calculated after elimination of intercompany transactions. See the instructions for line 11 on calculating gross receipts for filing theshold purposes.

If the taxpayer is operating business for a period less than 12 months, the apportioned or allocated gross receipts for filing purposes must be annualized and then compared to the $350,000 threshold.

UBGs: Complete Form 4897 and, if necessary, Form 4896 before beginning Form 4891. Answer lines 1 through 7 of Form

4891 as they apply to the DM.

Amended Returns: To amend a current or prior year

annual return: complete the CIT Amended Annual Return

(Form 4892) that is applicable for the year that is being amended. Include a copy of an amended federal return or a signed and dated Internal Revenue Service (IRS) audit document, if applicable. Complete and file all schedules, all forms and all attachments filed with the original return, even if not amending information on those schedules. Do not include a copy of the original return with the amended return.

Refund Only: If apportioned or allocated gross receipts are less than $350,000 and there is no recapture of any credits, and the taxpayer is filing Form 4891 to claim a refund of estimates paid, skip lines 12 through 43 and lines 49 through 53.

UBGs: If combined apportioned or allocated gross receipts of all members is less than $350,000 after eliminations and there is no recapture of any credits and the taxpayer is filing Form 4891 solely to claim a refund of estimates paid, the UBG may follow the “Refund Only” instructions for claiming a refund. However, the DM must include a Form 4896, if necessary, and a Form 4897 for each member included in the UBG.

Public Law

UBGs: If all members of the UBG are claiming PL

Lines not listed are explained on the form.

Line 1: If not a

Tax year means the calendar year, or the fiscal year ending during the calendar year, on which the tax base of a taxpayer is computed. If a return is made for a part of a year, tax year means the period for which the return is made. Generally, a taxpayer’s tax year is for the same period as is covered by its federal income tax return.

16

Line 2: Enter the taxpayer’s name. If a UBG, enter the name of the DM.

Line 3: Use the taxpayer’s FEIN. Be sure to use the same account number on all forms. Also, the taxpayer’s FEIN from line 3 must be repeated in the proper location on page 2.

NOTE: Unless already registered, taxpayers must register with the Michigan Department of Treasury before filing a tax return. Taxpayers are encouraged to register online at www.michigan.gov/businesstaxes. Taxpayers that register with Treasury online receive their registration confirmation within seven days.

If the taxpayer does not have an FEIN, the taxpayer must obtain an FEIN before filing the CIT. The Web site www.michigan.gov/businesstaxes provides information on obtaining an FEIN (under “New Business Registration”).

Returns received without a registered account number will not be processed until such time as a number is provided.

UBGs: Enter the FEIN of the DM for this UBG.

Line 4: Enter the complete address, including the

NOTE: Any correspondence regarding the return f iled and/ or refund will be sent to the address provided on this form. The taxpayer’s primary address in Treasury files, identified as the legal address and used for all purposes other than refund and correspondence on a specific CIT return, will not change unless the taxpayer files a Notice of Change or Discontinuance

(Form 163) with Treasury.

UBGs: Enter the address of the DM for this UBG.

FOREIGN FILERS: Complete the address fields as follows: Address: Enter the postal address for this taxpayer.

City: Enter the city name for this taxpayer. DO NOT include the country name in this field.

State: Enter the

ZIP/Postal Code: Enter the ZIP Code or Postal Code.

Country Code: Enter the

Line 5: Enter the entity’s

UBGs: Enter here the NAICS code for the principal activity of the group. If no principal activity is available, enter the NAICS code used when filing the DM’s federal Form 1120, Schedule K.

Line 6: Enter the date, if applicable, on which the taxpayer discontinued its business in Michigan or went out of existence.

NOTE: If the taxpayer is still subject to another tax

administered by Treasury, or continues to exist but has stopped doing business in Michigan, do not use this line. A discontinuance may be processed by updating the account by using the Michigan Treasury Online (MTO) Web site. Visit michigan.gov/mtobusiness for more information.

UBGs: Leave this line blank. This information will be included, if needed, on Form 4897.

Line 7a: Check this box if filing a UBG return and include a Form 4897 for every member (including the DM) whose activity is included in this UBG return. Also file a Form 4896, if necessary.

NOTE: Every UBG must check this box, regardless of whether it has elected under PA 266 of 2013, as described in the line 7b instructions.

Line 7b: Enter here the end date — in an

Calendar year filers that made this election beginning 2013, and fiscal filers that made this election beginning with the 2013- 14 fiscal year, completed the Michigan Corporate Income Tax

Affiliated Group Election to File as a Unitary Business Group (Form 5114) to make the election. Enter here the end date — in an

Taxpayers that first make this election beginning calendar year 2014 or later do not use Form 5114, which is now discontinued. Instead, make the election on this line of the return filed for the first year of the election, by entering the end date of that filing period in an

Line 8: Check this box if the taxpayer has sales from transportation services. Taxpayers that check this box also must complete lines 9a through 9g. To calculate Michigan Sales from Transportation Services, see the instructions for line 9 and the table in the “Sourcing of Sales to Michigan” section of the general instructions in Form 4890.

UBGs: If at least one member of the UBG has sales from transportation services, check this box.

Line 9: For a

The CIT is based only on business activity apportioned or allocated to Michigan. A taxpayer that is not subject to tax in one other state or foreign country is subject to CIT on its entire corporate income tax base.

If the taxpayer is able to apportion its tax base, then its tax base will be apportioned to Michigan based on sales. Sale or Sales means the amounts received by the taxpayer as consideration from the following:

17

•The transfer of title to, or possession of, property that is stock in trade or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the tax period, or property held by the taxpayer primarily for sale to customers in the ordinary course of its trade or business. For intangible property, the amounts received will be limited to any gain received from the disposition of that property.

•Performance of services which constitute business activities.

•The rental, leasing, licensing, or use of tangible or intangible property, including interest that constitutes business activity.

•Any combination of business activities described above.

•For taxpayers not engaged in any other business activities, sales include interest, dividends, and other income from investment assets and activities and from trading assets and activities.

Complete the Apportionment Calculation using amounts for the taxpayer’s business activity only. Do not include amounts received from an interest in a Partnership, S Corporation, or LLC.

Use the information in the “Sourcing of Sales to Michigan” section of the general instructions in Form 4890.

NOTE: Only transportation services are sourced using revenue miles. To the extent the taxpayer has business activities or revenue streams not from transportation services, those sales should be sourced according to the applicable guidance in the “Sourcing of Sales to Michigan” section of Form 4890.

Line

Line 9a: Enter the Michigan sales that are directly attributable to the taxpayer.

Transportation services that source sales based on revenue miles: Enter on this line the taxpayer’s total sales multiplied by the ratio of Michigan revenue miles over revenue miles everywhere as provided in the “Sourcing of Sales to Michigan” chart for that type of transportation service. Revenue mile means the transportation for consideration of one net ton in weight or one passenger the distance of one mile.

UBGs: Enter on this line the entire amount of Michigan sales of all members in the group after eliminations. For more information see the instructions for Form 4897.

For each member reported on Form 4897, calculate the member’s Michigan sales as follows: from the amount reported on Form 4897, line 13, subtract the amount reported on Form 4897, line 15. Add the calculated Michigan sales amount of all members of the group, and enter the total sum here.

Taxpayers that have a unitary relationship with a Flow- Through Entity (FTE), but are not part of a CIT unitary group of corporations (i.e., line 7a is not checked): Do not include on this line Michigan sales made by the taxpayer to an FTE that is unitary with the taxpayer and is included on FTEs that are Unitary with the Taxpayer (Form 4900). In other words, enter this line net of eliminations with the FTE. For more

information on eliminations, see the instructions to line 17.

An FTE is an entity that, for the applicable tax year, is treated as a subchapter S Corporation under section 1362(a) of the IRC, a general partnership, a trust, a limited partnership, a limited liability partnership, or a limited liability company that is not taxed as a C Corporation for federal income tax purposes.

A taxpayer is unitary with an FTE if the taxpayer:

•Owns or controls, directly or indirectly, more than 50% of the ownership interests with voting rights (or ownership interests that confer comparable rights to voting rights) of the FTE; AND

•The taxpayer and FTE have activities or operations which result in a flow of value between the taxpayer and the FTE, or between the FTE and another FTE unitary with the taxpayer, or has business activities or operations that are integrated with, are dependent upon, or contribute to each other.

The determination of whether a taxpayer is unitary with an FTE is made at the taxpayer level. If the taxpayer at issue is a UBG, the ownership requirement will be made at the UBG level. So, if the combined ownership of the FTE by the UBG is greater than 50%, then the ownership requirement will be satisfied.

NOTE: PA 266 of 2013 authorizes an affiliated group election that applies an alternate test for finding a unitary relationship between corporations. This act DID NOT create a corresponding “affiliated group” test for finding a unitary relationship between a corporation and an FTE. The existence of a unitary relationship between a corporation and an FTE is still based exclusively on the

Line 9b: If the taxpayer is unitary with an FTE or FTEs, enter on this line the total proportionate amount of Michigan sales attributed to these

UBGs: Enter on this line the entire amount of total Michigan sales attributed to all

Line 9d: Enter the total sales that are directly attributable to the taxpayer.

Transportation services that source sales based on revenue miles: Enter on this line the total sales that are directly attributable to the taxpayer.

NOTE: Only transportation services are sourced using revenue miles. To the extent the taxpayer has business activities or revenue streams not from transportation services, those sales should be sourced according to the applicable guidance in the “Sourcing of Sales to Michigan” section of Form 4890.

UBGs: Enter on this line the entire amount of total sales of all members in the group after eliminations. For more information see the instructions for Form 4897. For each member reported on Form 4897, calculate the member’s total sales as follows:

18

from the amount reported on Form 4897, line 16, subtract the amount on Form 4897, line 18. Add the calculated total sales amount of all members of the group, and enter the total here.

Taxpayers that have a unitary relationship with an FTE, but are not part of a CIT unitary group of corporations (i.e., line 7a is not checked): Do not include on this line sales made by the taxpayer to an FTE that is unitary with the taxpayer and is included on Form 4900. In other words, enter this line net of eliminations with the FTE. For more information on eliminations, see the instructions to line 17.

Line 9e: If the taxpayer is unitary with an FTE or FTEs, enter on this line the total proportionate amount of total sales attributed to these FTEs in column O on Form 4900. For more information see the instructions for Form 4900. If an amount is entered on this line, then Form 4900 must be completed and included with the filing of this form.

UBGs: Enter on this line the entire amount of total sales attributed to all

Line 10a: Enter the amount of total, unapportioned gross receipts received by the taxpayer. DO NOT include f low- through gross receipts on this line.

Gross receipts means the entire amount received by the taxpayer from any activity, whether in intrastate, interstate, or foreign commerce, carried out for direct or indirect gain, benefit, or advantage to the taxpayer or to others, with certain exceptions. Use the checklist in the instructions to line 10b as a guide to be sure receipts have been totaled correctly. Taxpayers and tax professionals are expected to be familiar with uncommon situations within their experience, which produce gross receipts not identified by the checklist.

UBGs: Enter on this line the entire amount of gross receipts of all members in the group after eliminations. For each member reported on Form 4897, calculate the member’s gross receipts net of eliminations as follows: from the amount reported on Form 4897, line 19a, subtract the amount reported on Form 4897, line 19b. Combine the resulting gross receipts net of eliminations amounts of all members of the group, and enter the total here.

UBG members reporting for a period of less than 12 months must report actual gross receipts on Form 4897 line 19a, and then annualize their gross receipts net of eliminations on a member by member basis. For each member reporting a period of less than 12 months, from the amount reported on Form 4897, line 19a, subtract line 19b, and annualize the result using that member’s number of months reported in the group’s tax year. Once all applicable members’ gross receipts net of elimination are annualized, carry the sum of all members’ gross receipts net of eliminations, annualized as applicable, to Form 4891, line 10a.

Line 10b: Enter the allocated or apportioned imputed gross receipts from all unitary or

EXCEPTION: Do not include imputed gross receipts from any FTE in which the taxpayer is a

Single filers, use the “Worksheet on

UBGs: Add the amount on Form 4897, line 20, reported for all members of the group, and enter the sum here. UBG members reporting a period of less than 12 months with this group return must annualize their apportioned FTE gross receipts on a member by member basis. Use each member’s number of months reported in the group’s tax year. Once all applicable members’ FTE gross receipts are annualized, carry all members’ gross receipts from line 20 of Form 4897 to line 10b.

Gross Receipts Checklist

NOTE: This checklist is not intended to be all encompassing. Receipts include, but are not limited to:

•Receipts (sales price) from the sale of assets used in a business activity.

•Sale of products.

•Services performed.

•Gratuities stipulated on a bill.

•Sales tax collected on the sale of tangible personal property.

•Dividend and interest income.

•Gross commissions earned.

•Rents.

•Royalties.

•Professional services provided.

•Sales of scrap and other similar items.

•Receipts from the production of oil and gas.

•Client reimbursed expenses not obtained in an agency capacity.

Receipts exclude:

•Proceeds from sales by a principal that are collected in an agency capacity solely on behalf of the principal and delivered to the principal.

•Amounts received as an agent solely on behalf of the principal that are expended by the taxpayer under certain circumstances.

•Amounts excluded from gross income of a foreign corporation engaged in the international operation of aircraft under section 883(a) of the IRC.

•Amounts received by an advertising agency used to acquire advertising media time, space, production, or talent on behalf of another person.

•Amounts received by a person that manages real property owned by a client that are deposited into a separate account kept in the name of the client and that are not reimbursed and are not indirect payments for management services provided to that client.

19

•Proceeds from the original issue of stock, equity instruments, or debt instruments.

•Refunds from returned merchandise.

•Cash and

•Trade discounts.

•Federal, State or local tax refunds.

•Security deposits.

•Payment of the principal portion of loans.

•Value of property received in a

•Proceeds from a sale, transaction, exchange, involuntary conversion, or other disposition of tangible, intangible, or real property that is a capital asset as defined in section 1221(a) of the IRC or land that qualifies as property used in the trade or business as defined in section 1231(b) of the IRC, less any gain from the disposition to the extent that gain is included in federal taxable income.

•Proceeds from an insurance policy, settlement of a claim, or judgment in a civil action, less any proceeds that are included in federal taxable income.

•Proceeds from the taxpayer’s transfer of an account receivable, if the sale that generated the account receivable was included in gross receipts for federal income tax purposes. This provision will not apply to a taxpayer that both buys and sells any receivables during the tax year.

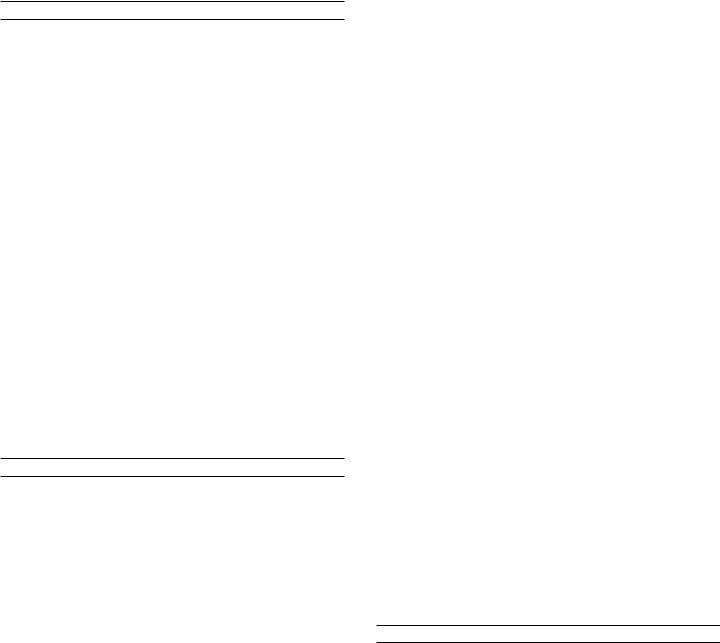

WORKSHEET ON

A taxpayer must complete the following calculation for each

Entity (FTE), whether unitary or not, that does not elect to file an MBT return for this tax year and from which the taxpayer receives distributive share of income. The amount in line 5 of this worksheet for each FTE must be added, and the sum carried to Form 4891, line 10b.

Do not include imputed gross receipts from any FTE in which the

taxpayer is a

1. |

FTE’s gross receipts that fall |

|

|

|

with or within the taxpayer’s tax |

|

|

|

year included in this return |

1. |

00 |

2. |

Percentage of the FTE’s |

|

|

|

income or loss received by the |

|

|

|

taxpayer |

2. |

% |

3.Gross receipts amount before apportionment. Multiply line 1

by line 2 |

3. |

00 |

4.FTE’s apportionment percentage (Michigan sales

divided by total sales)* |

4. |

% |

5.

Multiply line 3 by line 4 |

5. |

00 |

*Line 4: If the FTE is unitary with the taxpayer, use the apportionment percentage from line 9g. Otherwise, use the FTE’s apportionment percentage.

Line 11: Calculate the taxpayer’s total apportioned gross receipts for filing threshold by multiplying Line 10a by the percentage on Line 9g, and adding that amount to Line 10b. Do not leave this field blank.

Gross Receipts Filing Threshold: Taxpayers with allocated or apportioned gross receipts of less than $350,000 do not have to file a CIT return and do not have to pay the tax imposed by the CIT. For periods less than 12 months, this amount must be annualized. To annualize this amount, multiply the taxpayer’s total apportioned or allocated gross receipts by 12 and divide the result by the number of months in the taxpayers’ tax year. Do not enter annualized figures on this line.

UBGs: Calculate the apportioned gross receipts for filing threshold purposes by multiplying the amount on line 10a by the apportionment percentage on line 9g, and adding to that product the amount on line 10b. Because amounts entered on lines 10a and 10b represent the sum of annualized member figures (when applicable), no further annualization is required on line 11.

PART 1: CORPORATE INCOME TAX

Line 12: Federal taxable income, as reported on this line, is defined for CIT purposes to include carryback and carryover of federal net operating losses. Note that these amounts will be added back, for CIT purposes, in the Additions to Business Income section, below.

For a

Agricultural activities: Include income from agricultural activities on line 12. Farm activity by entities subject to the CIT is not exempt.

Exempt income (loss) from certain

UBGs: Add Form 4897, line 21, of all members and enter sum here.

Line 13: Generally, IRC 199 was repealed effective for tax years beginning after December 31, 2017. Therefore, most taxpayers will leave this line blank. However, the federal deduction can still be taken in limited circumstances or it’s possible that a member of a UBG return includes in this return its tax year beginning before January 1, 2018. In any case, to the extent a deduction was taken in this tax year’s federal taxable income, report that deduction here.

UBGs: Add Form 4897, line 22, of all members and enter sum here.

Line 14: There are currently no miscellaneous items to be entered on this line. Leave this line blank.

Line 15: Adjustments are required for all assets placed into

20

service after December 31, 2007, for which bonus depreciation was taken.

UBGs: Add Form 4897, line 24, of all members and enter sum here.

Line 15a: For the computation of business income for CIT, persons who claimed a federal bonus depreciation deduction under IRC § 168(k) on property first placed in service in 2008 or later must calculate the net bonus depreciation adjustment on those assets as follows: net bonus depreciation adjustment in tax year equals the total federal depreciation claimed in tax year less the total amount of depreciation that would be claimed in the federal return in the tax year if the person had elected not to utilize the bonus depreciation allowance under IRC § 168(k). A person may not elect IRC § 179 expensing of an asset for MBT or CIT purposes if it did not elect to use IRC § 179 for that asset federally.

Line 15b: For the computation of business income for CIT purposes, persons who claimed a federal bonus depreciation deduction under IRC § 168(k) on property first placed in service in 2008 or later and subsequently disposed of that property in the current tax year must calculate the gain/ loss adjustment on the sale of those assets as follows: gain/ loss adjustment in tax year equals the total amount of federal depreciation that would be claimed on the federal return over the years (starting the year the asset was placed in service and ending in the current tax year) if the person had elected not to utilize the bonus depreciation allowance under IRC § 168(k) on the property being disposed LESS the total federal depreciation claimed over the years (starting the year asset was placed in service and ending in the current tax year). A person may not elect IRC § 179 expensing of an asset for MBT or CIT purposes if it did not elect to use IRC § 179 for that asset federally.

Line 15c: UBGs: Add Form 4897, line 24c, of all members and enter sum here.

Line 17: UBGs: Add Form 4897, line 25, of all members and enter sum here.

NOTE: Elimination, where required, applies to transactions between any members of the UBG. For example, if the UBG includes standard taxpayers (not owned by and unitary with a financial institution in the UBG), an insurance company, and two financial institutions, transactions between a standard taxpayer member and an insurance or financial member are eliminated whenever elimination is required, despite the fact that the insurance and financial members are not reported on the combined return filed by standard taxpayer members.

However, there is no elimination with an otherwise related entity if the related entity is excluded from the UBG. For example, consider a group with a U.S. parent, a U.S. subsidiary, and a foreign operating entity subsidiary that would otherwise be a UBG, but the foreign operating entity is excluded from the UBG by definition. The U.S. parent filing a UBG return may not eliminate intercompany transactions between itself and the foreign operating entity.

If a transaction between two members of a UBG is reported on the group’s current return by one member but reported on the preceding or succeeding group return by the other member (due to differing year ends or accounting methods of the

members), the side of that transaction that is included in the group’s current filing period must be eliminated. The other side of the same transaction will be eliminated on the group return for the filing period in which the other member reports the transaction.

Additions to Business Income

Line 19: Enter any interest income and dividends from bonds and similar obligations or securities of states other than Michigan and their political subdivisions in the same amount that was excluded from federal taxable income (as defined for CIT purposes). Reduce this addition by any expenses related to the foregoing income that were disallowed on the federal return by IRC § 265 and § 291.

UBGs: Add Form 4897, line 27 of all members and enter sum here.

Line 20: Enter all taxes on, or measured by, net income including city and state taxes, Foreign Income Tax, and Federal Environmental Tax claimed as a deduction on the taxpayer’s federal return. This would include the tax imposed under the CIT to the extent claimed as a deduction on the taxpayer’s federal return that includes the tax period on this return. This includes, to the extent deducted in arriving at federal taxable income (as defined for CIT purposes), the Business Income Tax portion of the MBT.

UBGs: Add Form 4897, line 28, of all members and enter sum here.

Line 21: Enter any net operating loss carryback or carryover that was deducted in arriving at federal taxable income (as defined for CIT purposes). Enter this amount as a positive number.

UBGs: Add Form 4897, line 29, of all members and enter sum here.

Line 22: Enter, to the extent deducted in arriving at federal taxable income (as defined for CIT purposes), any royalty, interest, or other expense paid to a person related to the taxpayer by ownership or control for the use of an intangible asset if the person is not included in the taxpayer’s UBG. Royalty, interest, or other expense described here is not required to be included if the taxpayer can demonstrate that the transaction has a nontax business purpose other than avoidance of this tax, is conducted with

•Is a pass through of another transaction between a third party and the related person with comparable rates and terms.

•Results in double taxation. For this purpose, double taxation exists if the transaction is subject to tax in another jurisdiction.

•Is unreasonable as determined by the state treasurer.

•The related person (recipient of the transaction) is organized under the laws of a foreign nation which has in force a comprehensive income tax treaty with the United States.

UBGs: Add Form 4897, line 30, of all members and enter sum here.

Line 23: Enter on this line the expenses included on line 12 that resulted from the production of oil and gas if that

21

production of oil and gas is subject to Michigan severance tax on oil or gas in 1929 PA 48. Also enter expenses related to the income derived from a mineral to the extent that income is included on line 30 and that expense was deducted in arriving at federal taxable income.

UBGs: Add the amount on Form 4897, line 31 of all members and enter the sum here.

Line 24: There are currently no miscellaneous items to be entered on this line. Leave this line blank.

Subtractions from Business Income

Subtractions are generally available to the extent included in arriving at federal taxable income (as defined for CIT purposes).

Line 27: Complete all other subtractions from business income, lines 28 through 31, before completing line 27. Enter on this line the sum of all entries in Column C of

To calculate apportionment properly, line 27 removes from the corporate income tax base the taxpayer’s distributive share of income (loss) attributable to a

See the General Information section of the instructions for Form 4898 for an explanation of FTEs with which a taxpayer is not unitary.

UBGs: The amount entered on line 27 must equal the sum of all entries in Column C of all Forms 4898 that were filed by the UBG. The amount also will equal the sum of all group members’ Forms 4897, line 32.

Line 28: Enter, to the extent included in federal taxable income (as defined for CIT purposes), any dividends and royalties received from persons other than United States persons and foreign operating entities, including, but not limited to, amounts determined under IRC § 78 or IRC § 951 to 965.

NOTE: To the extent deducted in arriving at federal taxable income, any deduction under IRC 250(a)(1)(B) should be added back on this line (i.e., netted against subtractions made on this line).

UBGs: Add Form 4897, line 33, of all members and enter sum here.

Line 29: To the extent included in federal taxable income (as defined for CIT purposes), deduct interest income derived from United States obligations.

UBGs: Add Form 4897, line 34, of all members and enter sum here.

Line 30: Enter on this line income from the production of oil and gas if that production of oil and gas is subject to Michigan severance tax on oil and gas in 1929 PA 48, to the extent that income was included in federal taxable income. Also enter income derived from a mineral to the extent included in federal taxable income.

UBGs: Enter here the sum of Form 4897, line 35 of all members.

Line 31: Eligible licensed marihuana trades or businesses may subtract ordinary and necessary expenses paid or incurred during the tax year that would be allowed if section 280E of the internal revenue code were not in effect. Under the Michigan Regulation and Taxation of Marihuana Act (which allows for what is often referred to as “recreational” or “adult use” marihuana), a marihuana establishment licensed under that act is allowed a deduction from Michigan income tax for certain expenses not allowed in arriving at federal taxable income. IRC 280E prohibits a deduction for any amount paid or incurred in carrying on a trade or business that consists of trafficking in Schedule I and II controlled substances (e.g., marihuana). However, the IRC is also structured to recognize the cost of goods sold before reaching gross profit, regardless whether taxpayer is in the business of trafficking in marihuana. Therefore, any expenses related to cost of goods sold (and any other expenses already allowed in reaching federal taxable income) may not be subtracted from the Michigan base.

There are no other miscellaneous subtractions that can be entered on this line.

Line 35: Enter on this line the sum of entries from Column E of Form 4898. If an amount is entered on this line, Form 4898 must be completed and included with the filing of this form.

UBGs: The amount entered on Line 35 must equal the sum of all entries in Column E of all Forms 4898 that were filed by the UBG.

Line 37a: Enter any unused CIT business loss carryforward that was reported on the CIT return for the immediately preceding tax period on the appropriate group member copy of this form as explained below. Only CIT business loss incurred after December 31, 2011, may be entered on this line.

Business loss means a negative business income tax base after allocation or apportionment. The business loss will be carried forward to the year immediately succeeding the loss year as an offset to the allocated or apportioned Business Income Tax base, then successively to the next nine taxable years following the loss year or until the business loss is used up, whichever occurs first, but for not more than ten taxable years after the loss year.

Under PA 13 of 2014, a taxpayer that acquires the assets of another corporation in a transaction described under section 381(a)(1) or (2) of the Internal Revenue Code (IRC) may deduct any CIT business loss carryforward attributable to that other corporation. Losses acquired via IRC § 381(a) (1) or (2) are reported on this line.

22

NOTE: CIT business loss carryforward is not the same as a federal net operating loss carryover or a Michigan Business Tax (MBT) business loss carryforward, neither of which can be claimed as a deduction on a CIT return.

UBGs: If the group created a business loss carryforward in a preceding CIT tax period, Treasury will have maintained that carryforward on the DM’s account. Enter unused carryforwards of this type from line 11 of the DM’s copy of Form 4897.

If a member created a CIT business loss carryforward from a CIT tax period prior to joining the UBG, Treasury will maintain that carryforward on that member’s account, subject to use by the group, until it is fully consumed or that member leaves the group. Enter unused carryforwards of this type on the copy of Form 4897 filed for the member that brought the carryforward to the group.

Business loss carryforward consumed on a return is always the oldest available on that return, regardless of whether the oldest business loss carryforward was generated by the group, brought by an incoming member, or acquired by a member of the group via IRC § 381. For a business loss carryforward acquired via IRC § 381 transaction, the years of carryforward consumed before acquisition should be counted when determining the carryforward period remaining. Business loss carryforward of a UBG, including business loss carryforward brought by an incoming member and business loss carryforward acquired by the group or its members via IRC § 381, ages according to the tax years of the group, rather than tax years of any particular member.

If two members each created carryforwards that are the same age, and together they exceed the amount allowable in this filing period, those members’ respective carryforwards are used in proportion to the amount they contributed to the group. If a member that generated a carryforward in a prior period leaves the group, that member will take with it an amount equal to the group’s remaining carryforward from that period multiplied by the amount that member contributed relative to the total amount contributed by all group members for the carryforward in that same period. It is important to review a carryforward for the possibility that some or all of it has expired, or that some or all of it was withdrawn from the group by a departing member.

Line 37a is the amount of the business loss carryforward that may be claimed in this filing period. See the “Supplemental Instructions for Standard Members in UBGs” in Form 4890 for more information on the effects of members leaving or joining a UBG.

Line 37b: Check this box if any of the business loss reported on line 37a was distributed or transferred to this taxpayer in an IRC 381(a) transaction during this filing period. Attach to the return a statement of the name, FEIN, business loss amount of each such distributor or transferor corporation, and year the business loss was created.

Line 38: Subtract line 37a from line 36. Any negative amount on line 38 is a CIT business loss which may be carried forward to the next filing period, except to the extent that all or some portion of this business loss has exceeded its usable life of ten tax years.

PART 2: TOTAL CORPORATE INCOME TAX

Line 41: IMPORTANT: If apportioned or allocated gross receipts are less than $350,000, enter zero on this line. If a business operated less than 12 months, annualize gross receipts to determine if a filing requirement exists. For instructions on how to calculate the taxpayer’s allocated or apportioned gross receipts, see the instructions to Line 11.

NOTE: If calculated annual liability is less than or equal to $100, enter zero.

UBGs: If apportioned or allocated gross receipts after intercompany eliminations are less than $350,000, enter zero on this line. For guidance on how to calculate the taxpayer’s allocated or apportioned gross receipts, see the instructions to Line 11.

Line 42: Enter the amount of recapture from line 17 of Form 4902. A taxpayer subject to recapture is required to report and pay the amount of recapture due regardless of whether the taxpayer has $350,000 or more of apportioned or allocated gross receipts.

PART 3: PAYMENTS AND TAX DUE

Line 45: Enter the total estimated CIT tax paid with the CIT Quarterly Tax Return (Form 4913) or the amount of estimated

CIT tax paid through Electronic Funds Transfer. Include all payments made on returns that apply to the tax year included in this return. For example, calendar year filers include money paid with the above listed returns for return periods January through December.

UBGs: Include all applicable estimated payments made by the members of the UBG for the tax year included in this return. The amount entered on this line will equal the sum of Form 4897, line 37, for all members.

Line 49: If penalty and/or interest are owed for not filing estimated returns or for underestimating tax, complete the CIT

Penalty and Interest Computation for Underpaid Estimated Tax (Form 4899), to compute penalty and interest due. If a taxpayer chooses not to file Form 4899, Treasury will compute penalty and interest and bill for payment.

Line 50: Enter the overdue tax penalty. Use the following “Overdue Tax Penalty” worksheet. Refer to the “Computing Penalty and Interest” section in Form 4890 to determine the appropriate penalty percentage.

WORKSHEET – OVERDUE TAX PENALTY |

|

A. Tax due from Form 4891, line 49 |

00 |

B. Late/extension or insufficient |

|

payment penalty percentage |

% |

C. Multiply line A by line B |

00 |

Carry amount from line C to Form 4891, line 50. |

|

Line 51: Enter the overdue tax interest. Use the following “Overdue Tax Interest” worksheet. Refer to the “Computing Penalty and Interest” section in Form 4890 to determine the appropriate penalty percentage.

23

WORKSHEET – OVERDUE TAX INTEREST

A.Tax due from Form 4891, line 49.........

B.Applicable daily interest percentage ..

C.Number of days return was past due ...

D.Multiply line B by line C ....................

E.Multiply line A by line D ....................

Carry amount from line E to Form 4891, line 51.

00

%

%

00

Line 51 NOTE: If the late period spans more than one interest rate period, divide the late period into the number of days in each of the interest rate periods identified in the “Computing Penalty and Interest” section in Form 4890, and apply the calculations in the “Overdue Tax Interest” worksheet separately to each portion of the late period. Combine these interest subtotals and carry the total to line 51.

PART 4: REFUND OR CREDIT FORWARD

Line 53: If the amount of the tax overpayment, less any penalty and interest due on lines 49, 50 and 51 is less than zero, enter the difference (as a positive number) on line 52. If the amount is greater than zero, enter on this line.

NOTE: If an overpayment exists, a taxpayer may elect a refund of all or a portion of the amount and/or designate all or a portion of the overpayment to be used as an estimate for the next CIT tax year. Complete lines 54 and 55 as applicable.

Line 54: If the taxpayer anticipates a CIT liability in the filing period subsequent to this return, some or all of any overpayment from line 53 may be credited forward to the next tax year as an estimated payment. Enter on this line the desired amount to use as an estimate for the next CIT tax year.

Line 55: Enter the amount of refund requested.

Reminder: Taxpayers must sign and date returns. Preparers must provide a Preparer Taxpayer Identification Number (PTIN), FEIN or Social Security number (SSN), a well as a business name, business address and phone number.

Other Supporting Forms and Schedules

Federal Forms: Include copies of these forms with the return.

•C Corporations: Federal Form 1120 (pages 1 through 6), Schedule D, Form 851, Form 965, Form 4562, Form 4797, and Form 5471. If filing as part of a consolidated federal return, attach a pro forma or consolidated schedule.

•Limited Liability Companies: Attach appropriate schedules listed above if the business has elected to be taxed as a C Corporation.

•Federally Exempt Entities: In certain circumstances, a federally tax exempt entity must file a CIT return. In those cases, attach federal Form

*Do not send copies of Federal

24