When individuals receive lump-sum distributions from qualified retirement plans, understanding the tax implications becomes crucial for effective financial planning. In Kentucky, the Form 4972-K, also known as the Kentucky 4972-K Tax on Lump-Sum Distributions, serves this very purpose. This form is designed as a companion to the federal Form 4972 and is to be used exclusively for reporting lump-sum distributions for tax purposes. It must be attached to either Form 740, Form 740-NP, or Form 741, depending on the filer's circumstances. The form intricately details the process of calculating taxes on lump-sum distributions, allowing for calculations related to excludable amounts, the special 20% federal capital gain election, and even provisions for five-year and ten-year averaging options, depending on the taxpayer’s eligibility. It outlines specific qualifications that mirror those at the federal level, ensuring individuals who file federal Form 4972 are also qualified to utilize Form 4972-K. This connection between federal and state tax requirements emphasizes the necessity for thorough attention to both levels of tax obligations. Completing this form accurately is essential for Kentucky residents seeking to manage the tax impact of their retirement plan distributions effectively, thereby optimizing their financial outcomes during retirement.

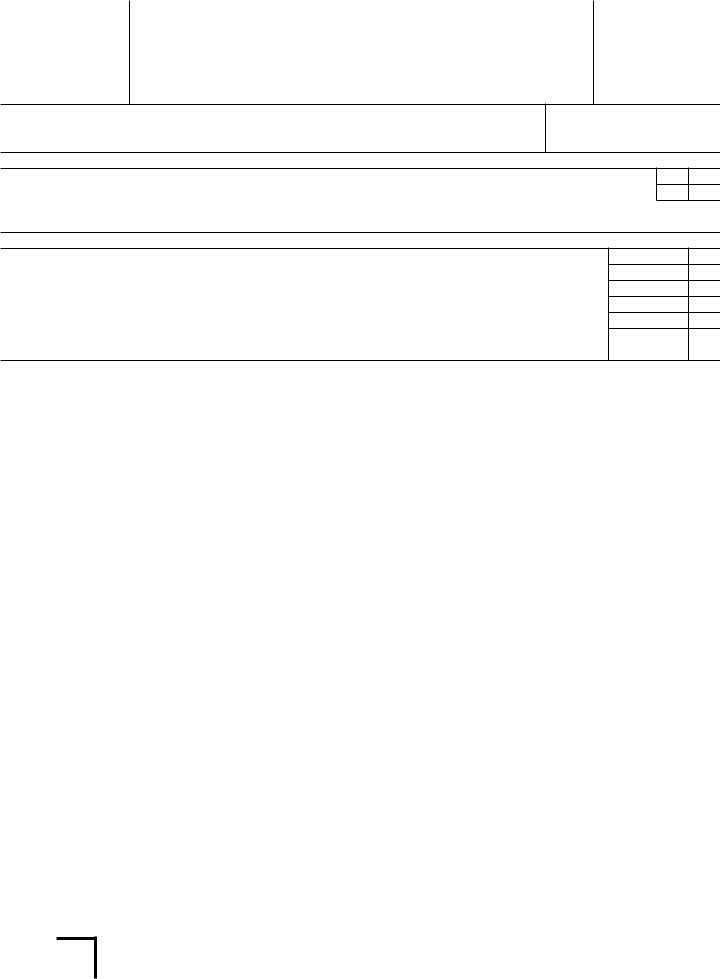

| Question | Answer |

|---|---|

| Form Name | Form 4972 K |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 42a740s21 form 4972 k instructions |

|

Kentucky |

|

|

|

|

|

|

|

Tax on |

|

|

|

|

|

|

|

‰(Use this form only for lum |

1999 |

|

Com m onw ealth of Kentucky |

|

|

|

REVENUE CABINET |

Attach to Form 740, Form |

‰See federal instructions. |

|

Enter nam e of recipient of distribution. |

|

Social Security or |

|

|

|

federal identification num ber |

|

PART |

|

|

|

1. An individual w ho qualifies to file federal Form 4972 qualifies to file Form |

Yes No |

||

Are you filing federal Form 4972? |

|

||

If "yes," you are qualified to file Form |

|||

Form 740, page 2, line 44 (Form |

|

|

|

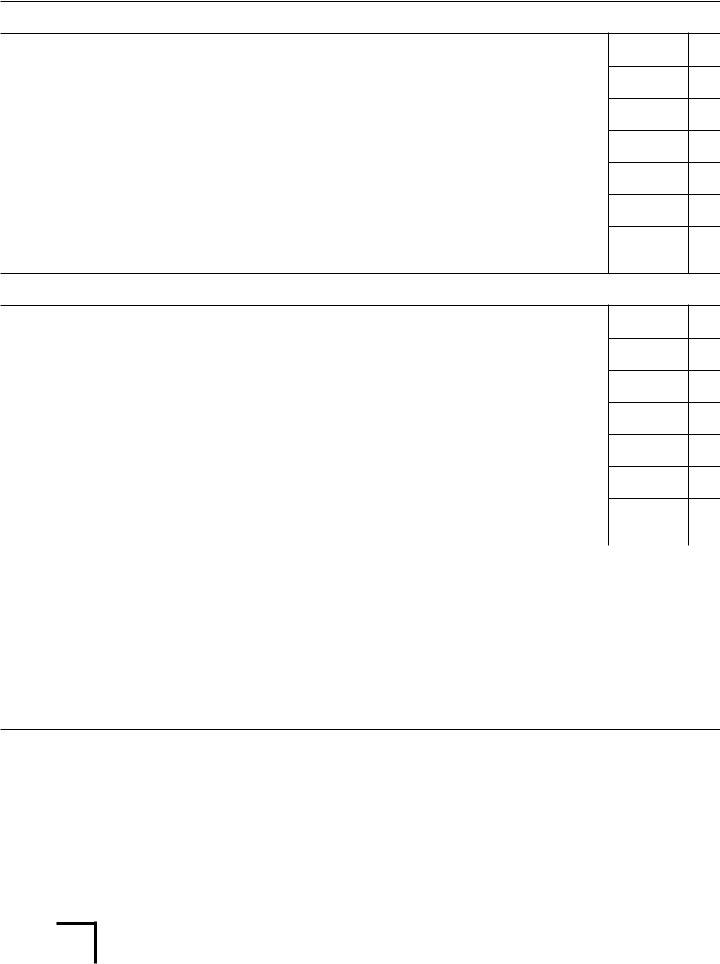

PART

2. |

Enter the am ount from Schedule P, line 3 |

2 |

3. |

Subtract line 2 from $35,700 |

3 |

4. |

Enter the am ount from line 8(a) plus line 9 |

4 |

5. |

Enter the lesser of line 3 or line 4 |

5 |

6. |

Am ount of line 5 to be applied to capital gain distributions. enter here and on line 8(b) |

6 |

7. |

Am ount of line 5 to be applied to regular lum |

|

|

and on line 12 |

7 |

PART

8. |

(a) |

Capital gain part from Box 3, Form |

|

|

|

8(a) |

|

|

|

|

(b) |

Enter the exclusion from line 6 |

|

|

|

8(b) |

|

|

|

|

(c) Subtract line 8(b) from line 8(a). Enter here and include on Schedule M , line 4 |

|

|

|

|

|

|||

|

|

(Form |

|

|

8(c) |

|

|

||

|

|

If you chose the |

|

|

|||||

|

|

If you chose the |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

9. |

Ordinary incom e from Form |

|

|

|

|||||

|

am ount from Box 2a of Form |

|

|

9 |

|

|

|||

10. |

Death benefit exclusion for a beneficiary of a plan participant w ho died before August 21, 1996 |

10 |

|

|

|||||

11. |

Subtract line 10 from line 9 (total federal taxable am ount) |

|

|

|

11 |

|

|

||

12. |

Enter the exclusion from line 7 |

|

|

|

12 |

|

|

||

13 |

Subtract line 12 from line 11 (total Kentucky taxable am ount) |

|

|

|

13 |

|

|

||

14. |

Current actuarial value of annuity, if applicable (from Form |

|

|

14 |

|

|

|||

15. |

Add lines 13 and 14 (adjusted total taxable am ount). If this am ount is $70,000 or m ore, skip lines 16 |

|

|

|

|||||

|

through 19, and enter this am ount on line 20 |

|

|

|

15 |

|

|

||

16. |

M ultiply line 15 by 50% (.50), but do not enter m ore than $10,000 |

16 |

|

|

|

|

|||

17. |

Subtract $20,000 from line 15. Enter difference. If line 15 |

|

|

|

|

|

|

|

|

|

is $20,000 or less, enter zero |

17 |

|

|

|

|

|

|

|

18. |

M ultiply line 17 by 20% (.20) |

|

18 |

|

|

|

|

||

19. |

Subtract line 18 from line 16 (m inim um distribution allow ance) |

|

|

|

19 |

|

|

||

20. |

Subtract line 19 from line 15 |

|

|

|

20 |

|

|

||

21. |

Federal estate tax attributable to lum |

|

|

|

|||||

|

740S219913 |

|

|

|

......... |

21 |

|

|

|

|

Form 741 the am ount attributable to the ordinary incom e entered on line 9 (see federal instructions) |

|

|

||||||

22. |

Subtract line 21 from line 20 |

|

|

|

22 |

|

|

||

|

|

If line 4 is blank, skip lines 23 through 25 and go to Part V or VI. |

|

|

|

|

|

||

23. |

Divide line 14 by line 15 and enter the result as a decim al (round to four places) |

|

|

23 |

|

|

|||

24. |

M ultiply line by the decim al am ount on line 23 |

|

|

|

24 |

|

|

||

25. |

Subtract line 24 from line 14 |

|

|

|

25 |

|

|

||

Form |

Page 2 |

|

PART |

|

|

26. |

M ultiply line 22 by 20% (.20) |

26 |

27. |

Tax on am ount on line 26. Use Tax Rate Schedule below |

27 |

28. |

M ultiply line 27 by 5. If no entry on line 14, skip lines 29 through 31, and |

|

|

enter this am ount on line 32 |

28 |

29. |

M ultiply line 25 by 20% (.20) |

29 |

30. |

Tax on am ount on line 29. Use Tax Rate Schedule below |

30 |

31. |

M ultiply line 30 by 5 |

31 |

32.Tax on

(m ultiple recipients, see federal instructions) |

32 |

PART

33. |

M ultiply line 22 by 10% (.10) |

33 |

34. |

Tax on am ount on line 33. Use Tax Rate Schedule below |

34 |

35. |

M ultiply line 34 by 10. If no entry on line 14, skip lines 36 through 38, and |

|

|

enter this am ount on line 39 |

35 |

36. |

M ultiply line 25 by 10% (.10) |

36 |

37. |

Tax on am ount on line 36. Use Tax Rate Schedule below |

37 |

38. |

M ultiply line 37 by 10 |

38 |

39.Tax on

(m ultiple recipients, see federal instructions) |

39 |

TAX RATE SCHEDULE |

|

If taxable am ount is: |

Tax is: |

$3,000 or less |

2% of taxable am ount |

over $3,000 but not over $4,000 |

$60 plus 3% of am ount over $3,000 |

over $4,000 but not over $5,000 |

$90 plus 4% of am ount over $4,000 |

over $5,000 but not over $8,000 |

$130 plus 5% of am ount over $5,000 |

over $8,000 |

$280 plus 6% of am ount over $8,000 |

740S219923