You could work with 49aa online form instantly by using our online PDF tool. Our editor is constantly developing to deliver the very best user experience attainable, and that is because of our resolve for continual improvement and listening closely to user opinions. Should you be seeking to start, this is what you will need to do:

Step 1: Hit the "Get Form" button above. It is going to open our pdf editor so that you can start completing your form.

Step 2: When you launch the PDF editor, you will notice the document made ready to be filled in. In addition to filling in various blanks, it's also possible to perform other sorts of things with the PDF, such as adding custom words, modifying the original textual content, inserting images, affixing your signature to the form, and a lot more.

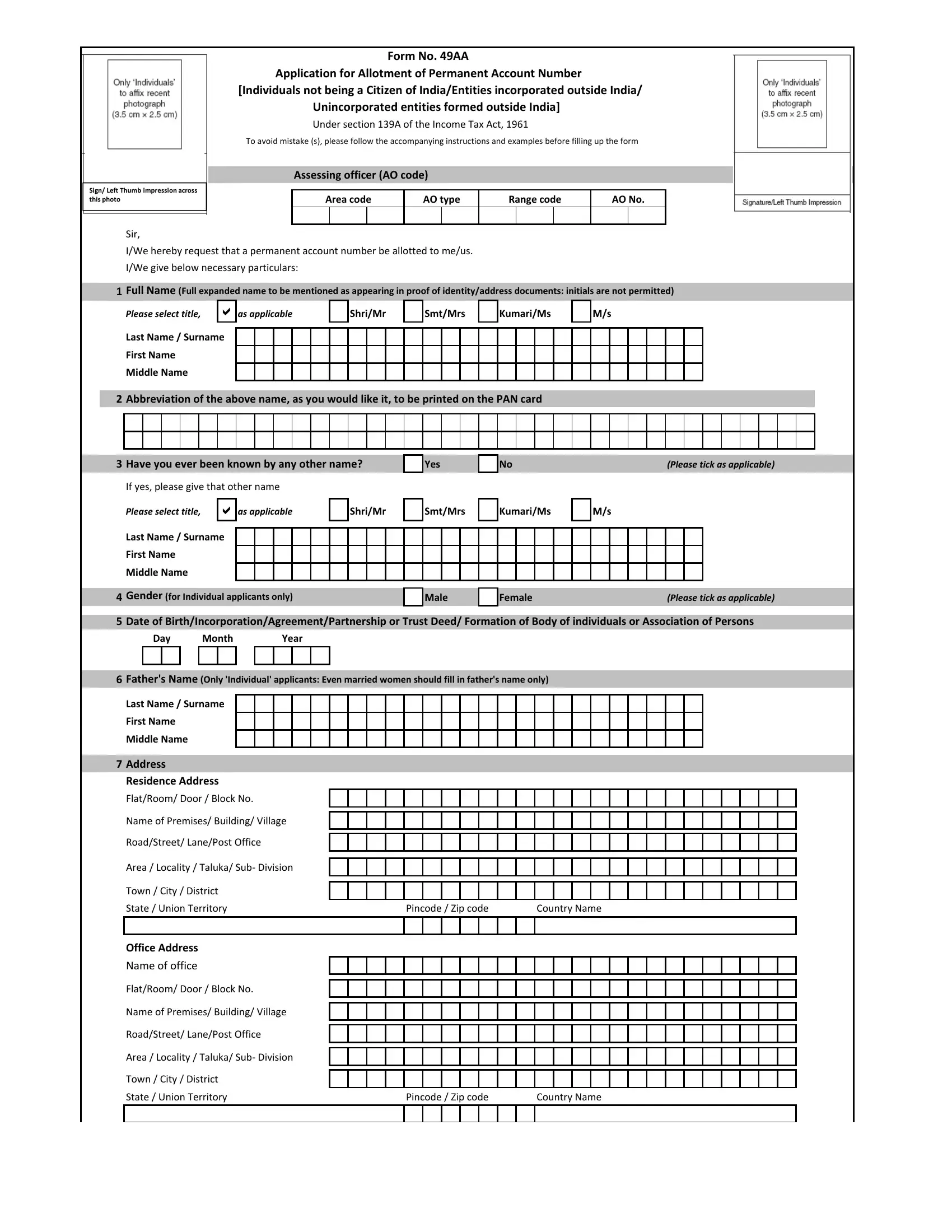

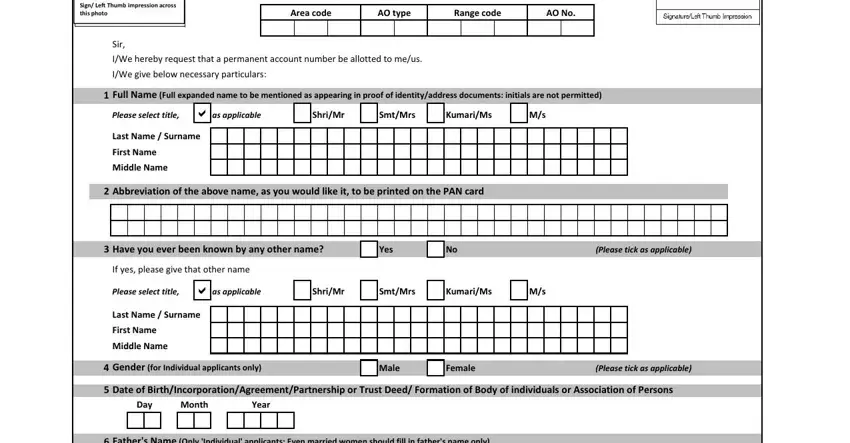

This form needs specific information; in order to guarantee accuracy, you should consider the subsequent guidelines:

1. When filling in the 49aa online form, be sure to complete all necessary fields in the associated section. This will help to expedite the work, enabling your details to be processed efficiently and accurately.

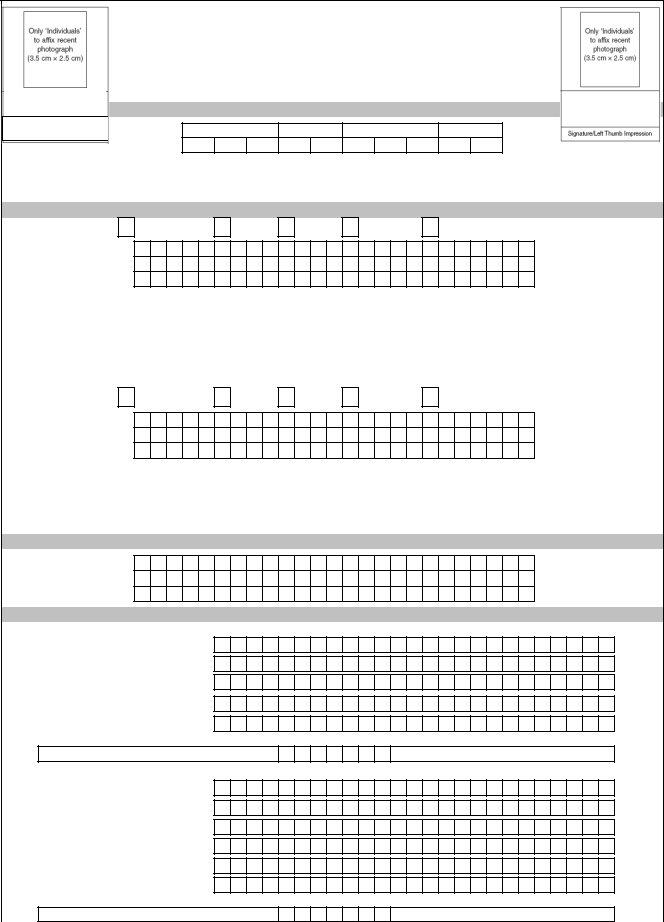

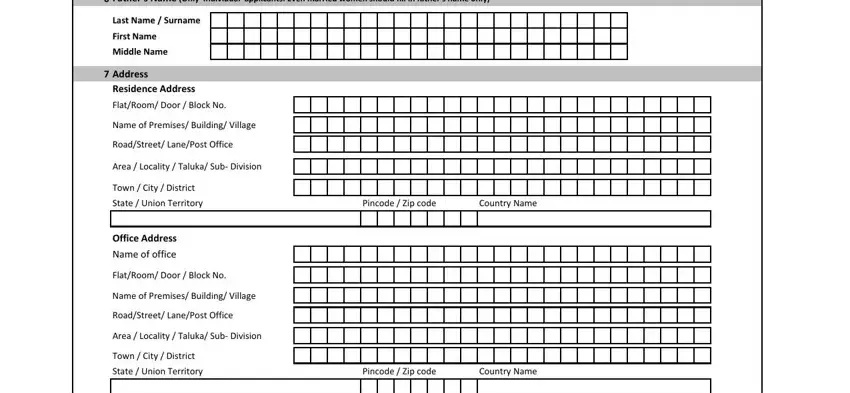

2. The subsequent part is usually to complete the next few blanks: Fathers Name Only Individual, Last Name Surname First Name, Address, Residence Address FlatRoom Door, Name of Premises Building Village, RoadStreet LanePost Office, Area Locality Taluka Sub Division, Town City District State Union, Office Address Name of office, FlatRoom Door Block No, Name of Premises Building Village, RoadStreet LanePost Office, Area Locality Taluka Sub Division, Town City District State Union, and Pincode Zip code.

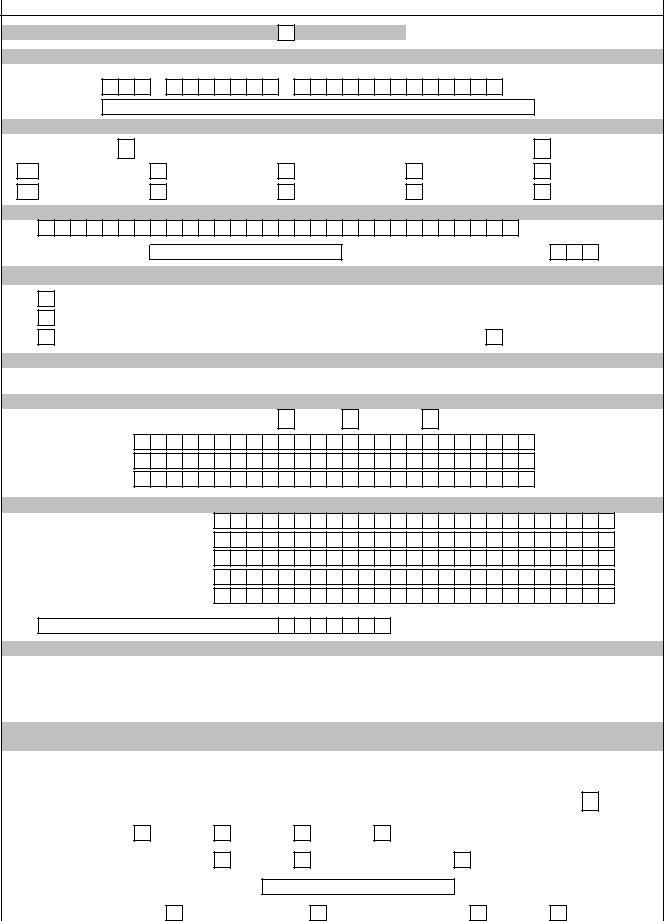

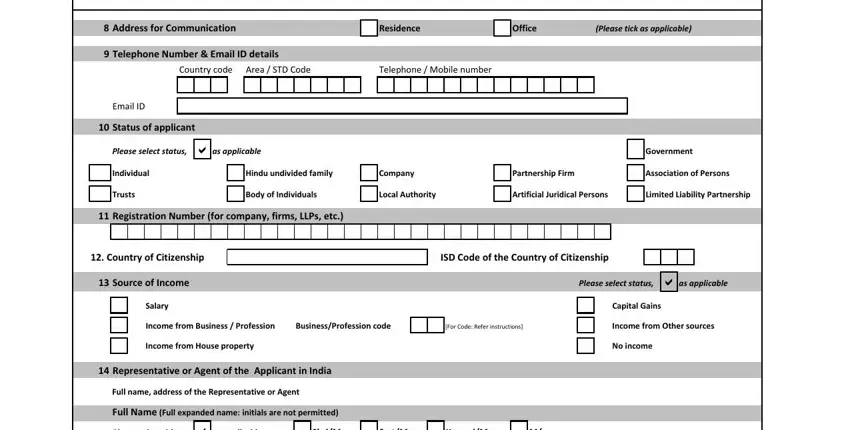

3. The third part is going to be easy - complete all the fields in Address for Communication, Residence, Office, Please tick as applicable, Telephone Number Email ID details, Country code, Area STD Code, Telephone Mobile number, Email ID, Status of applicant, Please, select status cid as applicable, Government, Individual, and Trusts to finish this part.

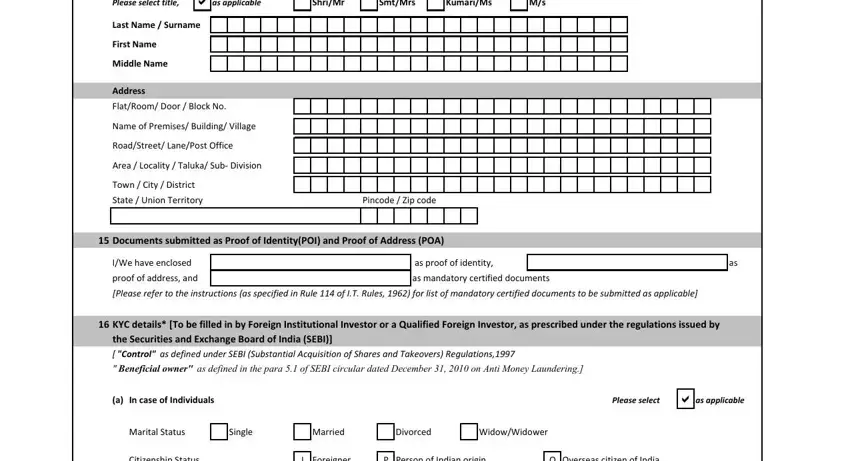

4. This next section requires some additional information. Ensure you complete all the necessary fields - Please, select title cid as applicable, ShriMr, SmtMrs, KumariMs, Last Name Surname, First Name, Middle Name, Address FlatRoom Door Block No, Name of Premises Building Village, RoadStreet LanePost Office, Area Locality Taluka Sub Division, Town City District State Union, Pincode Zip code, and Documents submitted as Proof of - to proceed further in your process!

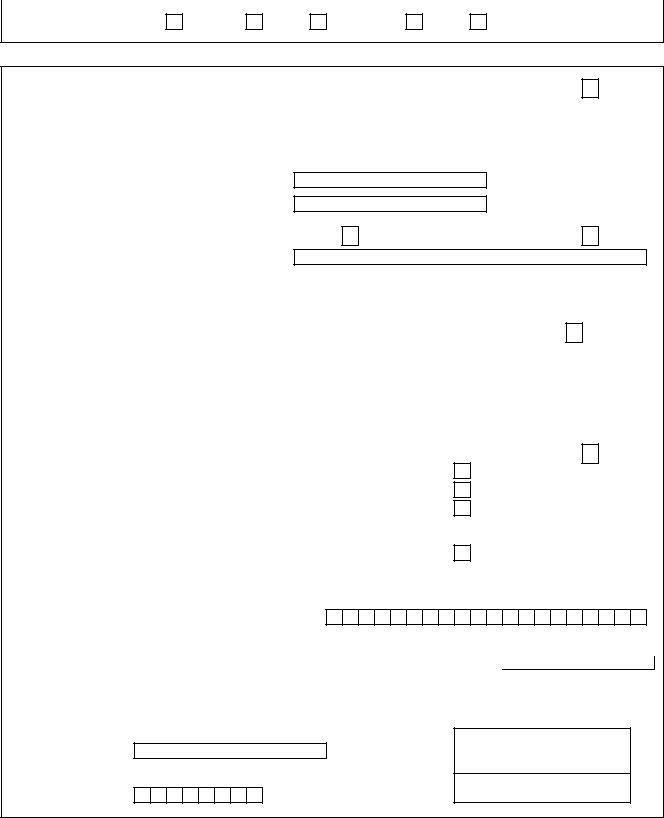

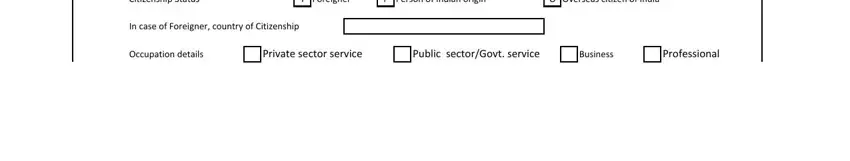

5. As you near the completion of this file, there are actually just a few extra points to undertake. In particular, Citizenship Status, I Foreigner, P Person, In case of Foreigner country of, of Indian origin, O Overseas citizen of India, Occupation details, Private sector service, Public sectorGovt service, Business, and Professional must all be filled out.

It is easy to make errors when filling out your I Foreigner, hence you'll want to reread it before you decide to finalize the form.

Step 3: Reread everything you've entered into the form fields and then press the "Done" button. Create a free trial plan at FormsPal and acquire direct access to 49aa online form - with all adjustments saved and available inside your FormsPal account. FormsPal is devoted to the privacy of all our users; we ensure that all personal information going through our system continues to be secure.