Through the online PDF tool by FormsPal, it is easy to complete or alter Receivable right here and now. The editor is consistently upgraded by our team, getting handy functions and turning out to be better. Getting underway is effortless! All you should do is adhere to the following easy steps directly below:

Step 1: Click the "Get Form" button in the top area of this webpage to open our PDF editor.

Step 2: With our handy PDF editing tool, it is possible to do more than merely complete forms. Try all the functions and make your documents seem sublime with customized text put in, or tweak the original input to perfection - all that backed up by an ability to insert any type of photos and sign the document off.

Completing this form requires attentiveness. Ensure that all necessary areas are done accurately.

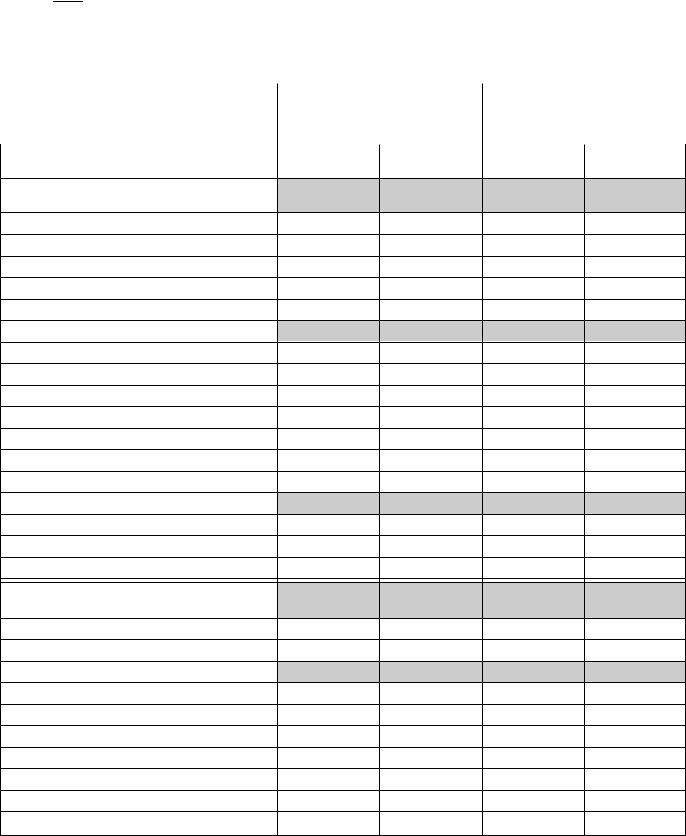

1. Before anything else, when filling out the Receivable, start in the part that features the subsequent blanks:

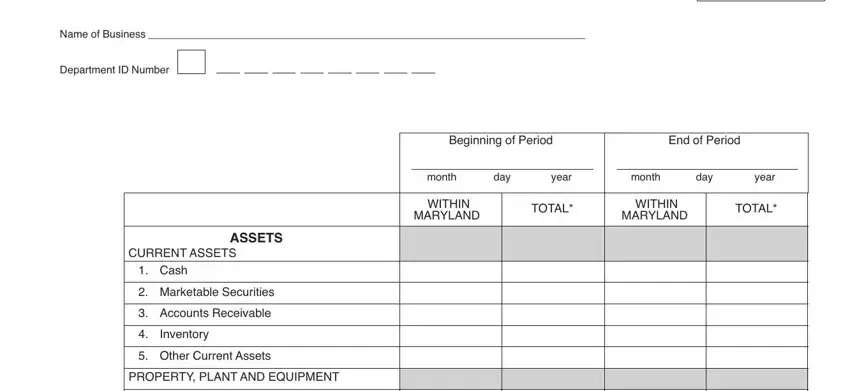

2. The subsequent part is usually to complete all of the following blanks: Land, Buildings, Leasehold Improvements, Equipment, SUBTOTAL Property Plant and, Accumulated Depreciation, Net Property Plant and Equipment, INTANGIBLE AND OTHER ASSETS, Intangible, Other provide schedule, TOTAL ASSETS, LIABILITIES AND EQUITY, CURRENT LIABILITIES, Accounts Payable, and Other Current Liabilities.

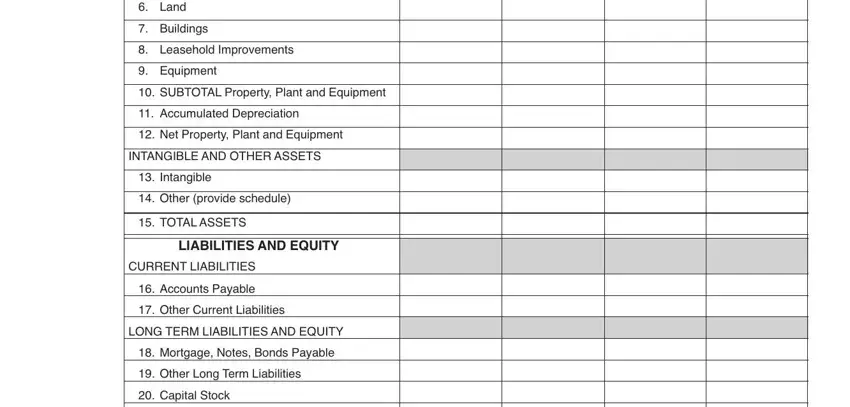

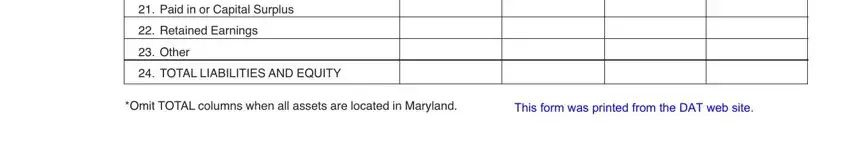

3. Throughout this step, review Paid in or Capital Surplus, Retained Earnings, Other, TOTAL LIABILITIES AND EQUITY, Omit TOTAL columns when all assets, and This form was printed from the DAT. Each of these need to be filled out with utmost focus on detail.

It's simple to make an error when filling out your Omit TOTAL columns when all assets, for that reason be sure to look again prior to deciding to submit it.

Step 3: Just after proofreading your form fields you have filled out, click "Done" and you are all set! Try a 7-day free trial subscription at FormsPal and obtain immediate access to Receivable - readily available inside your FormsPal account. FormsPal guarantees safe form editing without data record-keeping or sharing. Feel safe knowing that your information is in good hands here!