form 5013 can be completed online without difficulty. Just make use of FormsPal PDF editor to finish the job right away. Our team is devoted to giving you the absolute best experience with our tool by constantly introducing new capabilities and upgrades. Our editor is now much more useful as the result of the newest updates! Now, editing PDF forms is simpler and faster than ever. This is what you'd have to do to begin:

Step 1: Open the PDF doc inside our editor by pressing the "Get Form Button" in the top section of this page.

Step 2: The tool gives you the capability to work with the majority of PDF forms in various ways. Improve it by writing any text, correct existing content, and put in a signature - all at your disposal!

This form will involve some specific details; to guarantee accuracy and reliability, please be sure to adhere to the following steps:

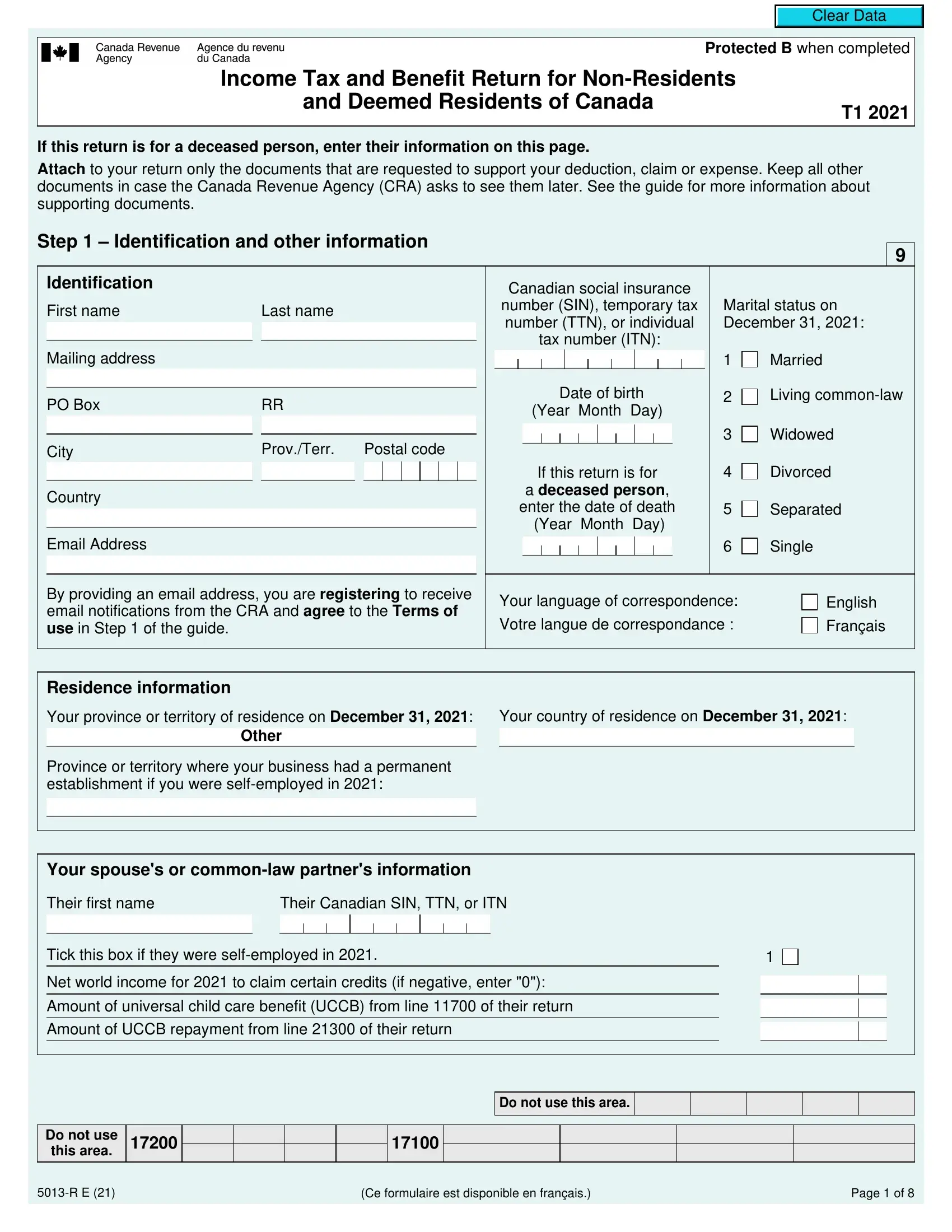

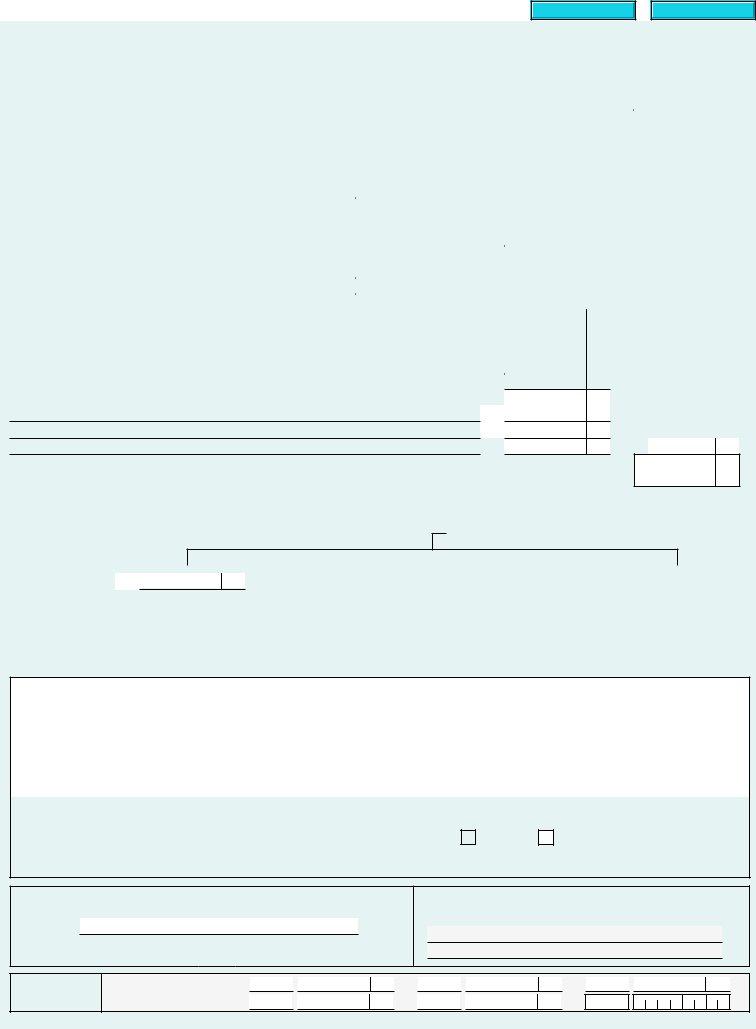

1. To start with, while completing the form 5013, start with the area that includes the next blanks:

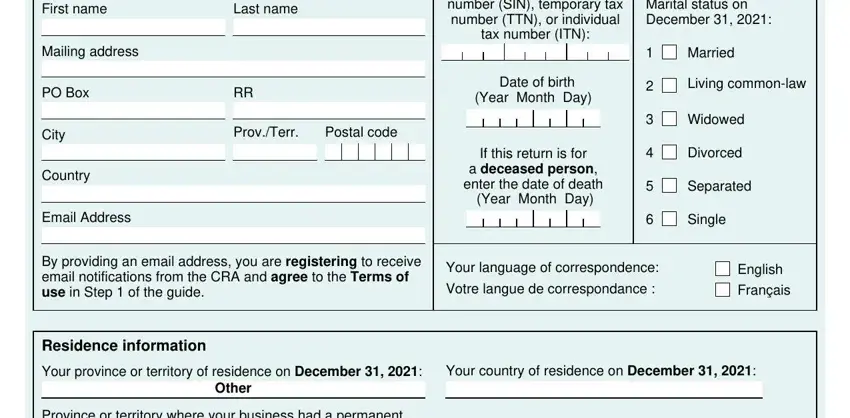

2. Just after filling out this part, go to the next stage and fill out all required details in all these fields - Province or territory where your, Your spouses or commonlaw partners, Their first name, Their Canadian SIN TTN or ITN, Tick this box if they were, Net world income for to claim, Amount of universal child care, Amount of UCCB repayment from line, Do not use this area, Do not use this area, R E, Ce formulaire est disponible en, and Page of.

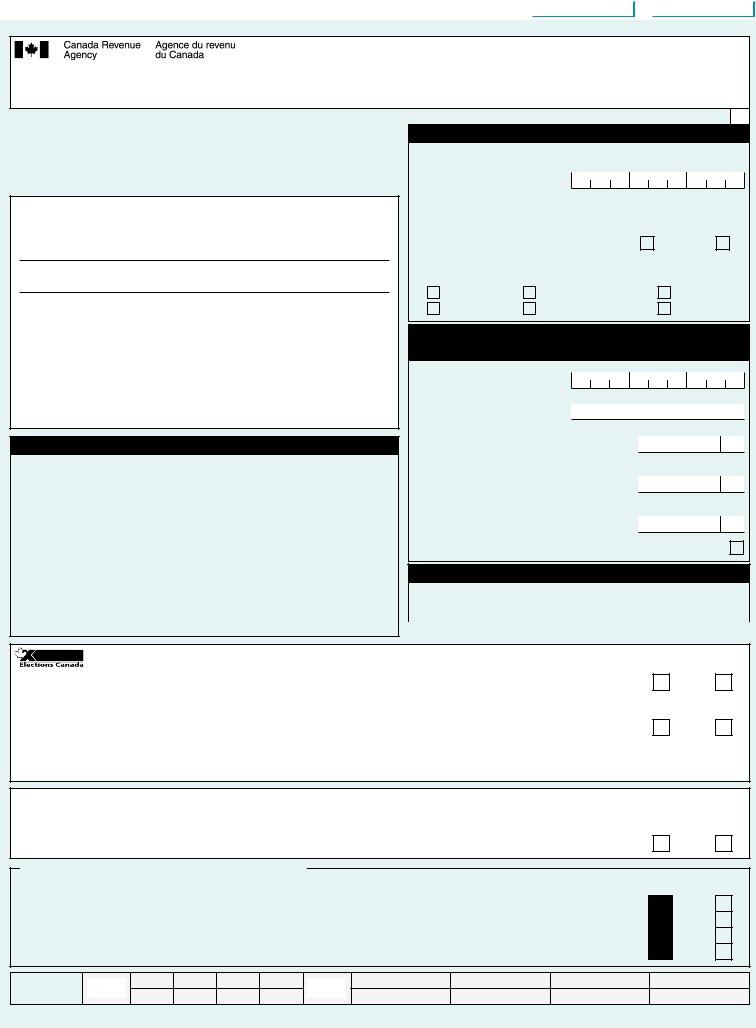

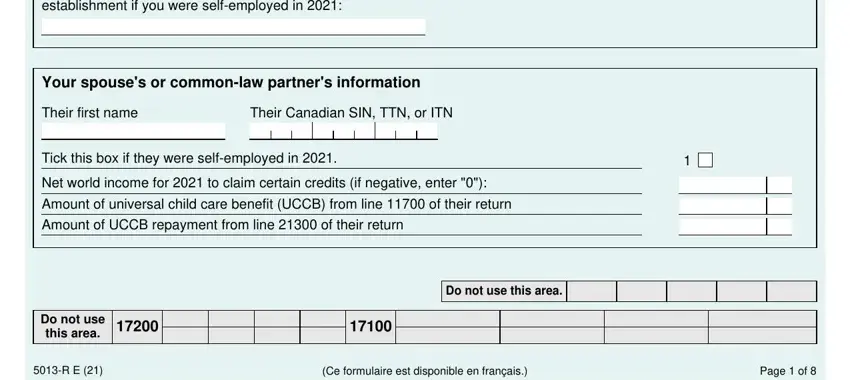

3. Completing A Do you have Canadian citizenship, If yes go to question B If no skip, B As a Canadian citizen do you, Yes, Yes, Your authorization is valid until, Your information in the Register, Indian Act Exempt income, Tick this box if you have income, If you ticked the box above, and Information about your residency is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

In terms of Indian Act Exempt income and Information about your residency, ensure that you do everything properly in this section. These two are the most significant fields in this document.

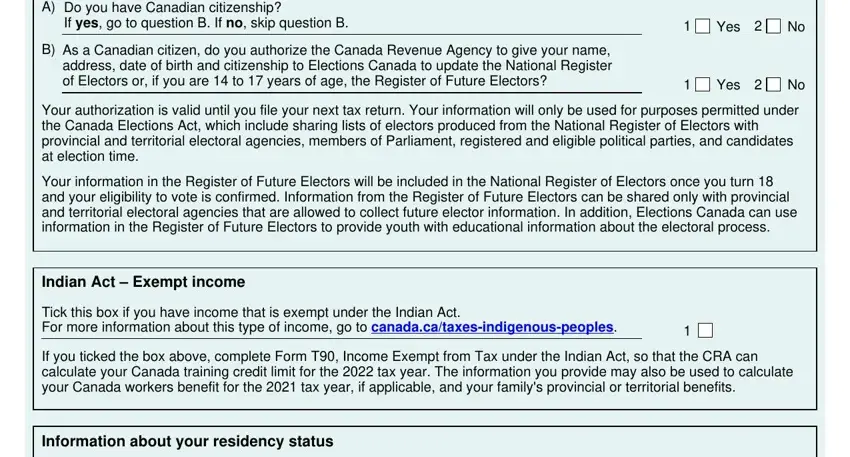

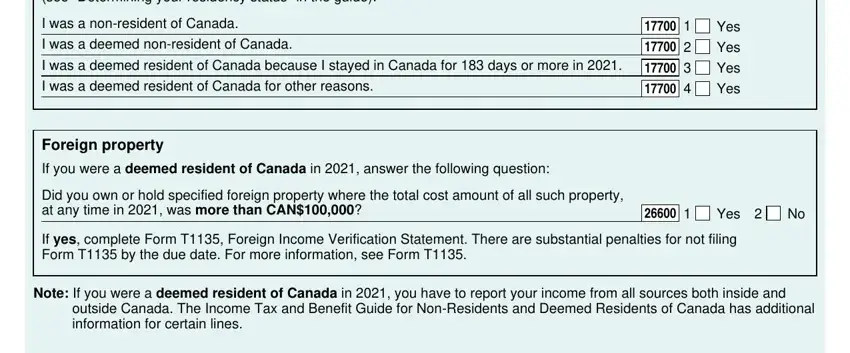

4. It is time to fill in this next part! Here you've got all of these Tick the box that describes your, I was a nonresident of Canada, I was a deemed nonresident of, I was a deemed resident of Canada, I was a deemed resident of Canada, Yes, Yes, Yes, Yes, Foreign property, If you were a deemed resident of, Did you own or hold specified, Yes, If yes complete Form T Foreign, and Note If you were a deemed resident form blanks to complete.

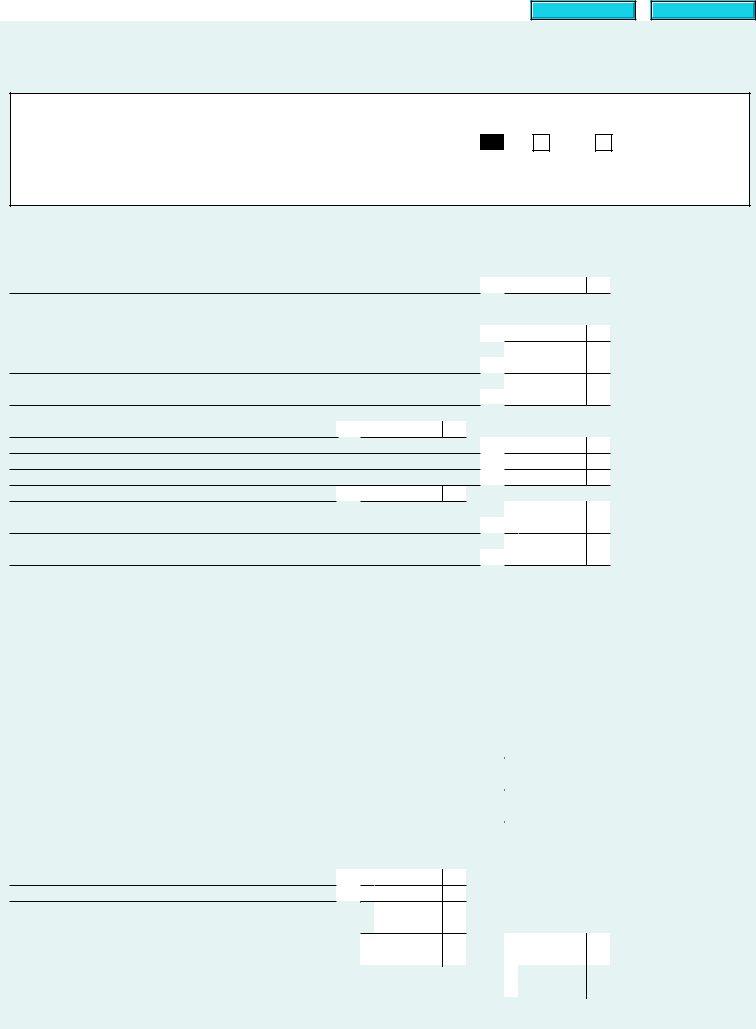

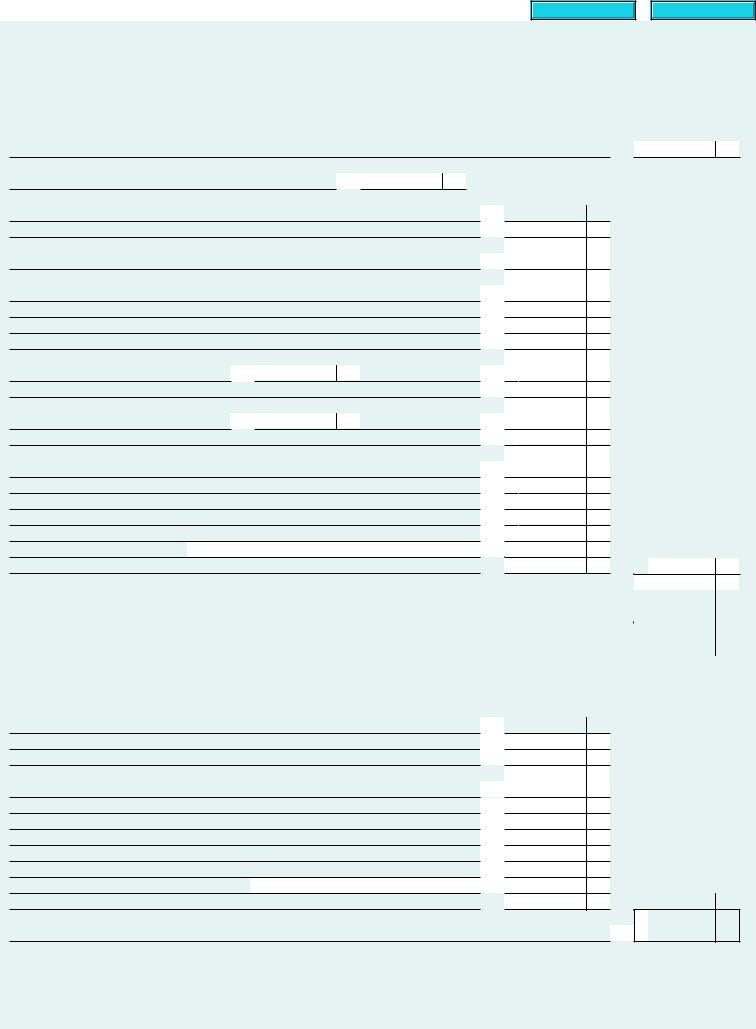

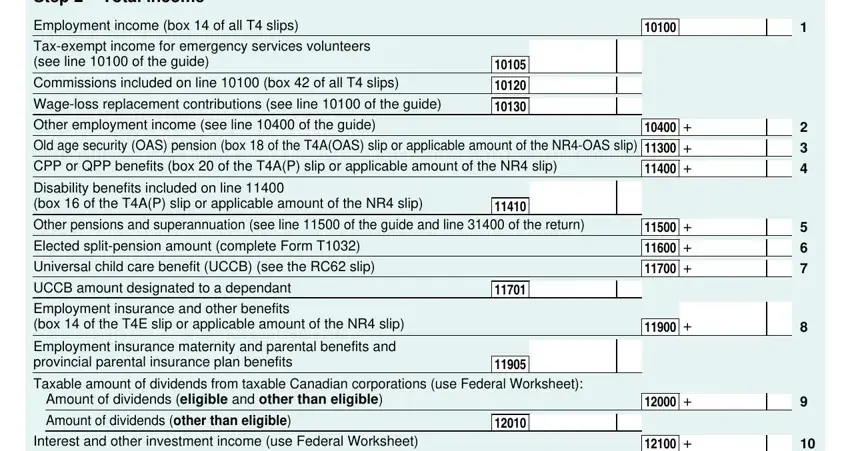

5. Finally, the following last subsection is precisely what you should wrap up before using the PDF. The fields in this case are the next: Step Total income, Employment income box of all T, Taxexempt income for emergency, Commissions included on line box, Wageloss replacement contributions, Other employment income see line, Old age security OAS pension box, CPP or QPP benefits box of the, Disability benefits included on, Other pensions and superannuation, Elected splitpension amount, Universal child care benefit UCCB, UCCB amount designated to a, Employment insurance and other, and Employment insurance maternity and.

Step 3: After you have reviewed the details in the document, press "Done" to conclude your form at FormsPal. Join FormsPal now and immediately use form 5013, ready for download. Every change made is handily kept , which enables you to customize the document at a later time as required. We do not share or sell the information that you use when filling out forms at our website.