Whenever you would like to fill out missouri tax exemption form 5095, you don't have to download and install any sort of software - simply use our PDF editor. To retain our tool on the leading edge of practicality, we work to integrate user-oriented features and enhancements regularly. We are always happy to receive suggestions - play a pivotal part in revolutionizing PDF editing. To begin your journey, consider these easy steps:

Step 1: Hit the "Get Form" button at the top of this page to access our PDF editor.

Step 2: Once you start the file editor, you will notice the document made ready to be completed. Besides filling out different blanks, you may also do various other things with the file, including writing custom textual content, editing the original text, inserting images, putting your signature on the PDF, and a lot more.

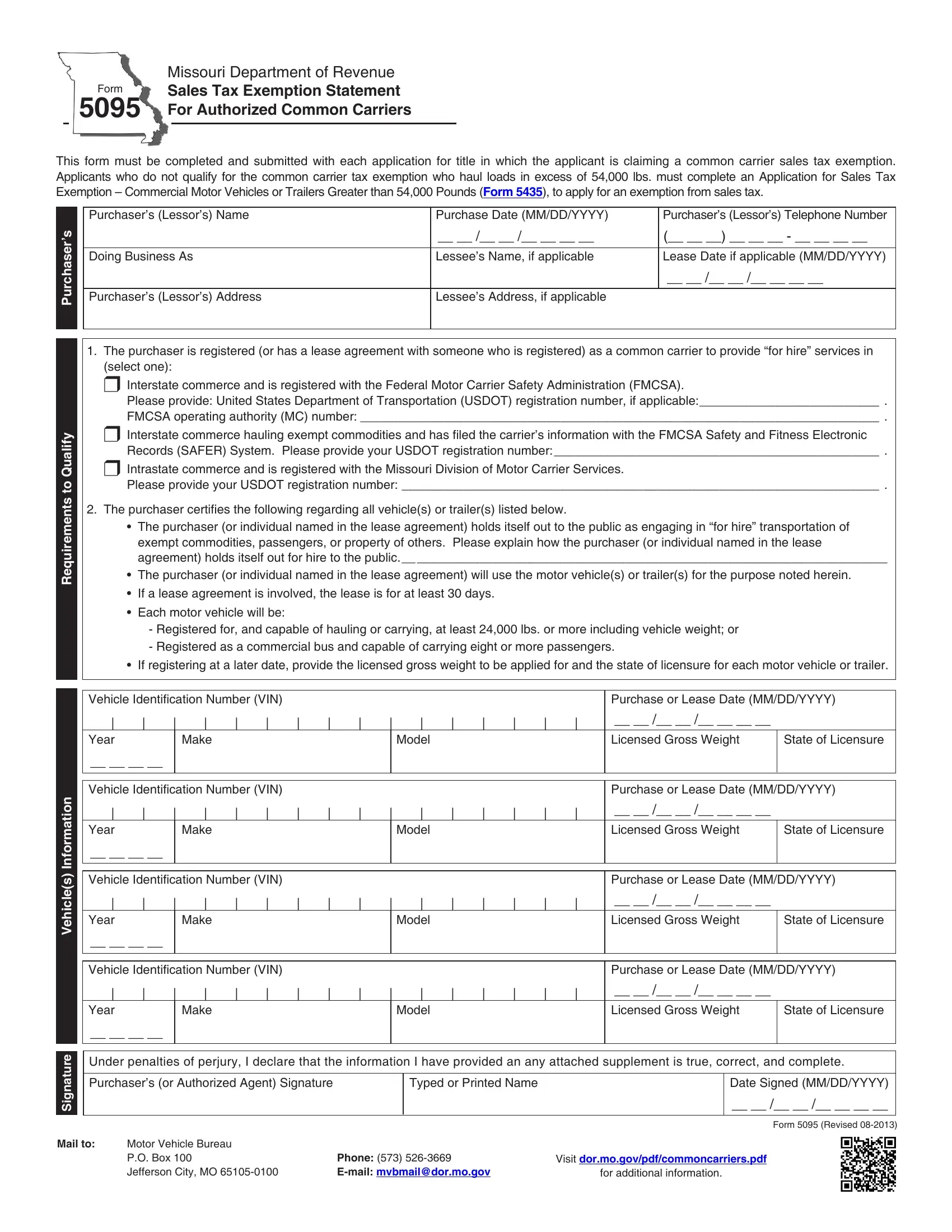

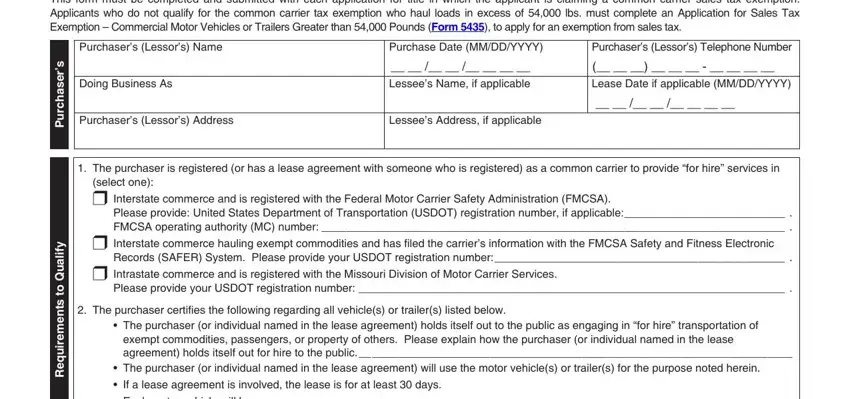

This form will require particular info to be filled out, hence ensure that you take whatever time to enter what is requested:

1. First, while completing the missouri tax exemption form 5095, start in the section that includes the subsequent blanks:

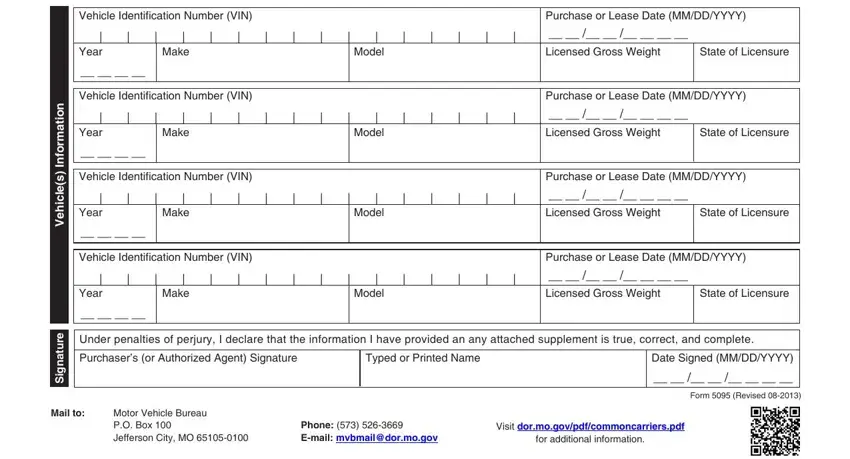

2. Given that the previous array of fields is complete, you're ready put in the needed specifics in Vehicle Identification Number VIN, Year, Model, Make, Vehicle Identification Number VIN, Year, Model, Make, Vehicle Identification Number VIN, Year, Model, Make, Vehicle Identification Number VIN, Year, and Model in order to move forward further.

Be really careful when filling out Model and Make, since this is the part in which many people make a few mistakes.

Step 3: Reread the information you've inserted in the blank fields and then click the "Done" button. Get hold of your missouri tax exemption form 5095 the instant you register at FormsPal for a 7-day free trial. Easily gain access to the pdf document in your personal account, with any edits and adjustments all synced! FormsPal ensures your information privacy via a secure method that in no way records or distributes any kind of personal information used. Feel safe knowing your files are kept confidential any time you use our services!