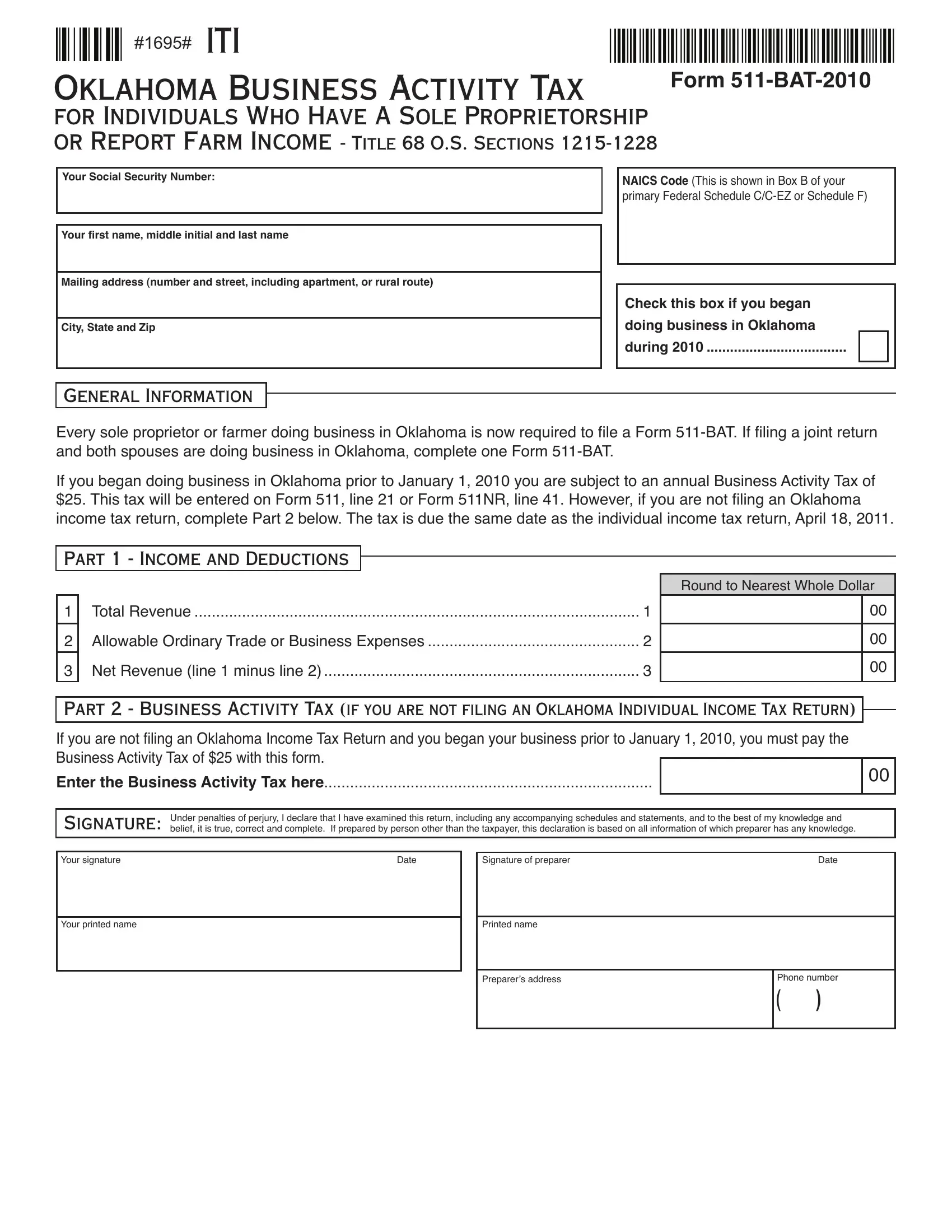

#1695# ITI

Oklahoma Business Activity Tax |

Form 511-BAT-2010 |

|

for Individuals Who Have A Sole Proprietorship |

|

or Report Farm Income - Title 68 O.S. Sections 1215-1228 |

|

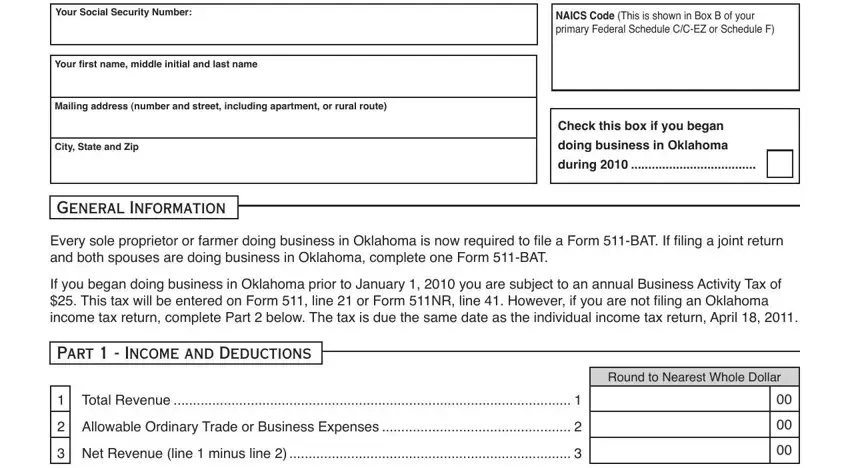

Your Social Security Number:

Your irst name, middle initial and last name

Mailing address (number and street, including apartment, or rural route)

City, State and Zip

NAICS Code (This is shown in Box B of your primary Federal Schedule C/C-EZ or Schedule F)

Check this box if you began

doing business in Oklahoma

during 2010 ....................................

General Information

Every sole proprietor or farmer doing business in Oklahoma is now required to ile a Form 511-BAT. If iling a joint return and both spouses are doing business in Oklahoma, complete one Form 511-BAT.

If you began doing business in Oklahoma prior to January 1, 2010 you are subject to an annual Business Activity Tax of $25. This tax will be entered on Form 511, line 21 or Form 511NR, line 41. However, if you are not iling an Oklahoma income tax return, complete Part 2 below. The tax is due the same date as the individual income tax return, April 18, 2011.

Part 1 - Income and Deductions |

|

1 |

Total Revenue |

1 |

2 |

Allowable Ordinary Trade or Business Expenses |

2 |

3 |

Net Revenue (line 1 minus line 2) |

3 |

Round to Nearest Whole Dollar

00

00

00

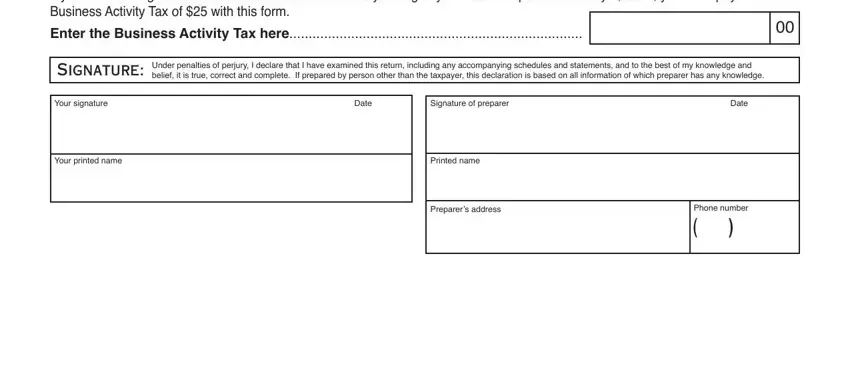

Part 2 - Business Activity Tax (if you are not iling an Oklahoma Individual Income Tax Return) |

|

If you are not iling an Oklahoma Income Tax Return and you began your business prior to January 1, 2010, you must pay the |

|

Business Activity Tax of $25 with this form. |

|

Enter the Business Activity Tax here |

00 |

Signature: Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. If prepared by person other than the taxpayer, this declaration is based on all information of which preparer has any knowledge.

Signature of preparer |

|

Date |

|

|

|

Printed name |

|

|

|

|

Preparer’s address |

Phone number |

|

( |

) |

|

|

|

Form 511-BAT - Page 2OKLAHOMA BUSINESS ACTIVITY TAX

FOR INDIVIDUALS WHO HAVE A SOLE PROPRIETORSHIP OR REPORT FARM INCOME

Title 68 O.S. Sections 1215 - 1228

Instructions

TOP OF FORM:

The NAICS code is your North American Industry Classiication System code. The six-digit code on your Federal Schedule C, C-EZ or F is based on this classiication system. Enter the NAICS code from your primary Schedule C, C-EZ or F; this

should be the Schedule with the most revenue.

The Business Activity Tax of $25 is not due for the irst taxable year you began doing business in Oklahoma. However, this form must be completed and enclosed with your income tax return (Form 511 or 511NR).

PART 1:

If you have more than one Schedule C, C-EZ or F, you will complete only one Form 511-BAT. Combine all of your business income (loss) included in your Oklahoma Adjusted Gross Income (From 511, line 7) or Adjusted Gross Income: Oklahoma Sources (Form 511NR, line 23). Enter the combined revenue on Part 1, line 1 and expenses on Part 2, line 2.

Line 1:

•Enter the gross income from your Federal Schedule C (lines 3 and 6), Schedule C-EZ (line 1) or Schedule F, Part 1 (line 1 plus lines 4 - 10 or the applicable lines from Part 3). Do not include income from royalty or working interest in mineral rights or from real estate rentals. Total Revenue is deined in Title 68 O.S. Section 1217.

•Also enter gains or losses from Sales of Business Property (Federal Form 4797) which low to the front of the Federal return (Form 1040). Do not include any 4797 gains or losses which low to the Federal Schedule D.

Line 2:

Enter all ordinary trade or business expenses, including cost of goods sold. Do not include interest, income taxes, depreciation and amortization. Do not include expenses attributable to tax-exempt income.

PART 2:

If you are not iling an Oklahoma income tax return and you began your business prior to January 1, 2010, you must pay a Business Activity Tax of $25 with this form. The tax is due on the same date as the individual income tax return, April 18, 2011.

Mail Form 511-BAT, along with $25, to:

Oklahoma Tax Commission

Post Ofice Box 26800

Oklahoma City, OK 73126-0800

If you are iling an Oklahoma income tax return, do not complete Part 2. Instead enclose this form with your return. The Business Activity Tax of $25, if due, will be entered on Form 511, line 21 or Form 511NR, line 41.