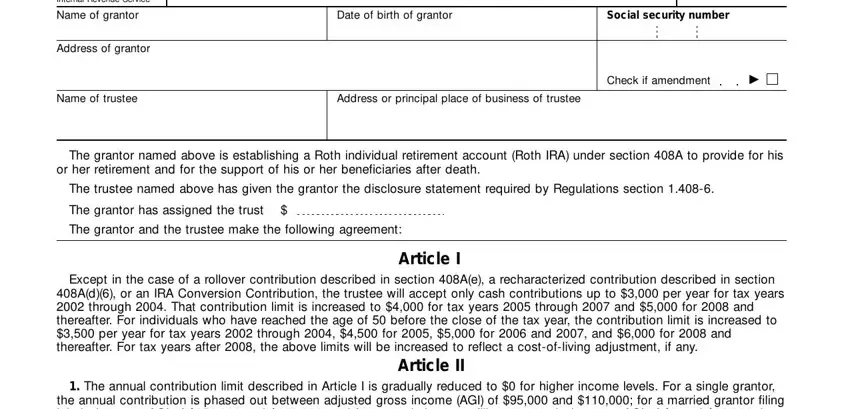

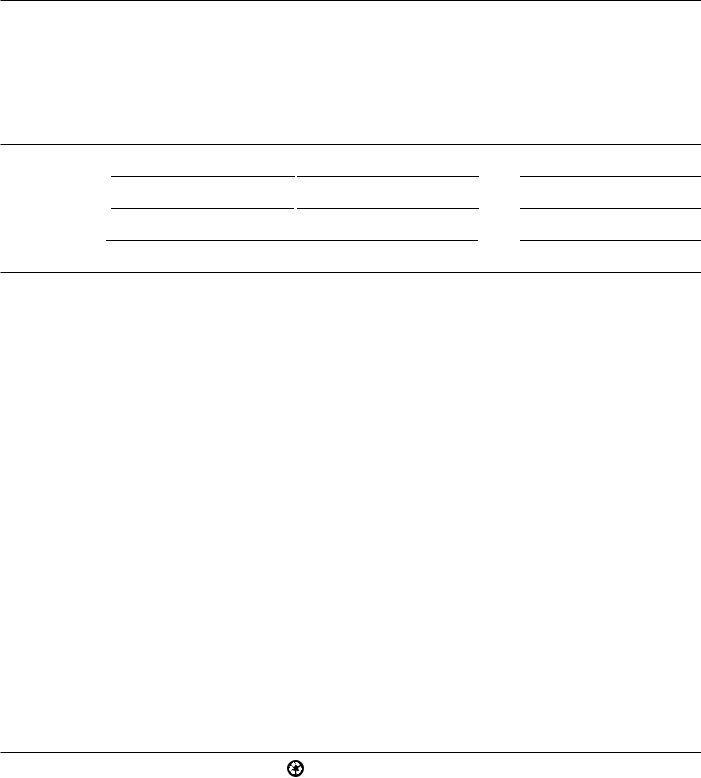

Name of grantor |

Date of birth of grantor |

Social security number |

|

|

|

|

|

Address of grantor |

|

|

|

|

|

Check if amendment |

▶ |

|

|

|

|

Name of trustee |

Address or principal place of business of trustee |

|

|

|

|

|

|

The grantor named above is establishing a Roth individual retirement account (Roth IRA) under section 408A to provide for his or her retirement and for the support of his or her beneficiaries after death.

The trustee named above has given the grantor the disclosure statement required by Regulations section 1.408-6.

The grantor has assigned the trust $

The grantor and the trustee make the following agreement:

Article I

Except in the case of a rollover contribution described in section 408A(e), a recharacterized contribution described in section 408A(d)(6), or an IRA Conversion Contribution, the trustee will accept only cash contributions up to $3,000 per year for tax years 2002 through 2004. That contribution limit is increased to $4,000 for tax years 2005 through 2007 and $5,000 for 2008 and thereafter. For individuals who have reached the age of 50 before the close of the tax year, the contribution limit is increased to $3,500 per year for tax years 2002 through 2004, $4,500 for 2005, $5,000 for 2006 and 2007, and $6,000 for 2008 and thereafter. For tax years after 2008, the above limits will be increased to reflect a cost-of-living adjustment, if any.

Article II

1.The annual contribution limit described in Article I is gradually reduced to $0 for higher income levels. For a single grantor, the annual contribution is phased out between adjusted gross income (AGI) of $95,000 and $110,000; for a married grantor filing jointly, between AGI of $150,000 and $160,000; and for a married grantor filing separately, between AGI of $0 and $10,000. In the case of a conversion, the trustee will not accept IRA Conversion Contributions in a tax year if the grantor’s AGI for the tax year the funds were distributed from the other IRA exceeds $100,000 or if the grantor is married and files a separate return. Adjusted gross income is defined in section 408A(c)(3) and does not include IRA Conversion Contributions.

2.In the case of a joint return, the AGI limits in the preceding paragraph apply to the combined AGI of the grantor and his or her spouse.

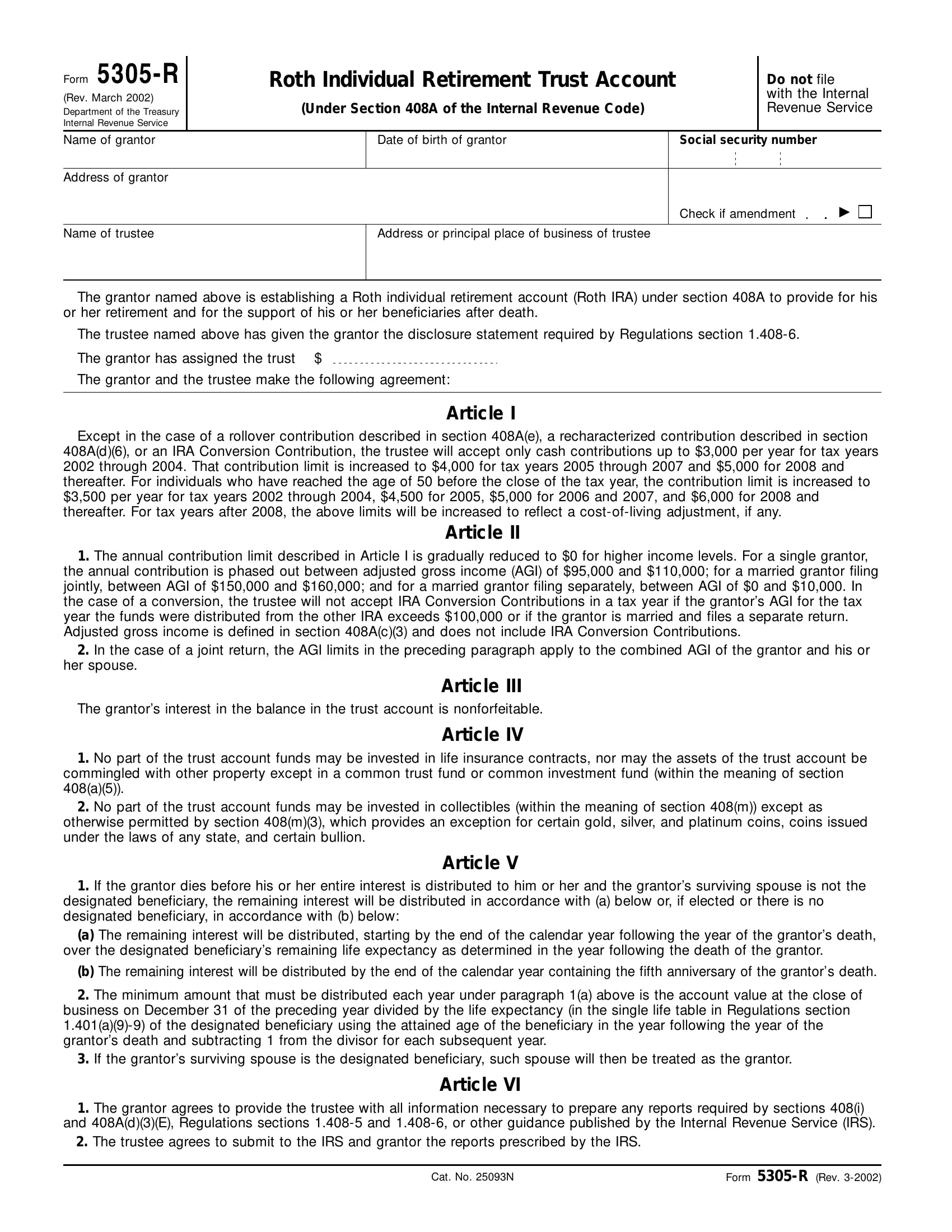

Article III

The grantor’s interest in the balance in the trust account is nonforfeitable.

Article IV

1.No part of the trust account funds may be invested in life insurance contracts, nor may the assets of the trust account be commingled with other property except in a common trust fund or common investment fund (within the meaning of section 408(a)(5)).

2.No part of the trust account funds may be invested in collectibles (within the meaning of section 408(m)) except as otherwise permitted by section 408(m)(3), which provides an exception for certain gold, silver, and platinum coins, coins issued under the laws of any state, and certain bullion.

Article V

1.If the grantor dies before his or her entire interest is distributed to him or her and the grantor’s surviving spouse is not the designated beneficiary, the remaining interest will be distributed in accordance with (a) below or, if elected or there is no designated beneficiary, in accordance with (b) below:

(a)The remaining interest will be distributed, starting by the end of the calendar year following the year of the grantor’s death, over the designated beneficiary’s remaining life expectancy as determined in the year following the death of the grantor.

(b)The remaining interest will be distributed by the end of the calendar year containing the fifth anniversary of the grantor’s death.

2.The minimum amount that must be distributed each year under paragraph 1(a) above is the account value at the close of business on December 31 of the preceding year divided by the life expectancy (in the single life table in Regulations section 1.401(a)(9)-9) of the designated beneficiary using the attained age of the beneficiary in the year following the year of the grantor’s death and subtracting 1 from the divisor for each subsequent year.

3.If the grantor’s surviving spouse is the designated beneficiary, such spouse will then be treated as the grantor.

Article VI

1.The grantor agrees to provide the trustee with all information necessary to prepare any reports required by sections 408(i) and 408A(d)(3)(E), Regulations sections 1.408-5 and 1.408-6, or other guidance published by the Internal Revenue Service (IRS).

2.The trustee agrees to submit to the IRS and grantor the reports prescribed by the IRS.