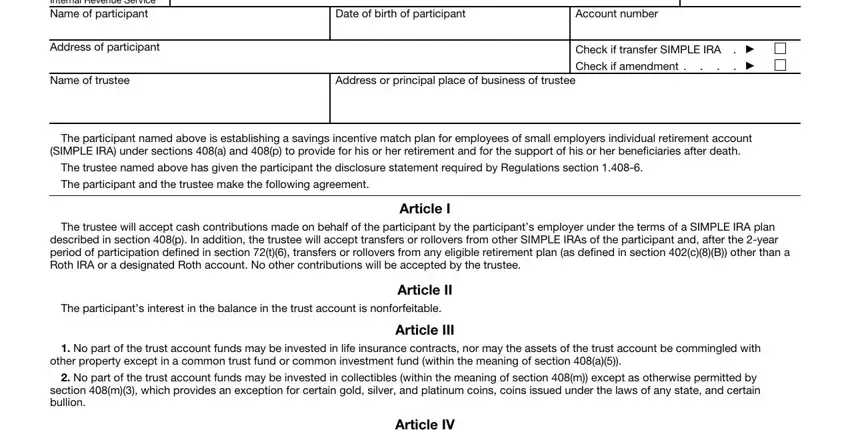

Name of participant |

Date of birth of participant |

|

Account number |

|

|

|

|

|

|

|

|

Address of participant |

|

|

Check if transfer SIMPLE IRA |

. |

▶ |

|

|

|

Check if amendment . . . |

. |

▶ |

Name of trustee |

Address or principal place of business of trustee |

|

|

|

|

|

|

|

|

|

The participant named above is establishing a savings incentive match plan for employees of small employers individual retirement account (SIMPLE IRA) under sections 408(a) and 408(p) to provide for his or her retirement and for the support of his or her beneficiaries after death.

The trustee named above has given the participant the disclosure statement required by Regulations section 1.408-6.

The participant and the trustee make the following agreement.

Article I

The trustee will accept cash contributions made on behalf of the participant by the participant’s employer under the terms of a SIMPLE IRA plan described in section 408(p). In addition, the trustee will accept transfers or rollovers from other SIMPLE IRAs of the participant and, after the 2-year period of participation defined in section 72(t)(6), transfers or rollovers from any eligible retirement plan (as defined in section 402(c)(8)(B)) other than a Roth IRA or a designated Roth account. No other contributions will be accepted by the trustee.

Article II

The participant’s interest in the balance in the trust account is nonforfeitable.

Article III

1.No part of the trust account funds may be invested in life insurance contracts, nor may the assets of the trust account be commingled with other property except in a common trust fund or common investment fund (within the meaning of section 408(a)(5)).

2.No part of the trust account funds may be invested in collectibles (within the meaning of section 408(m)) except as otherwise permitted by section 408(m)(3), which provides an exception for certain gold, silver, and platinum coins, coins issued under the laws of any state, and certain bullion.

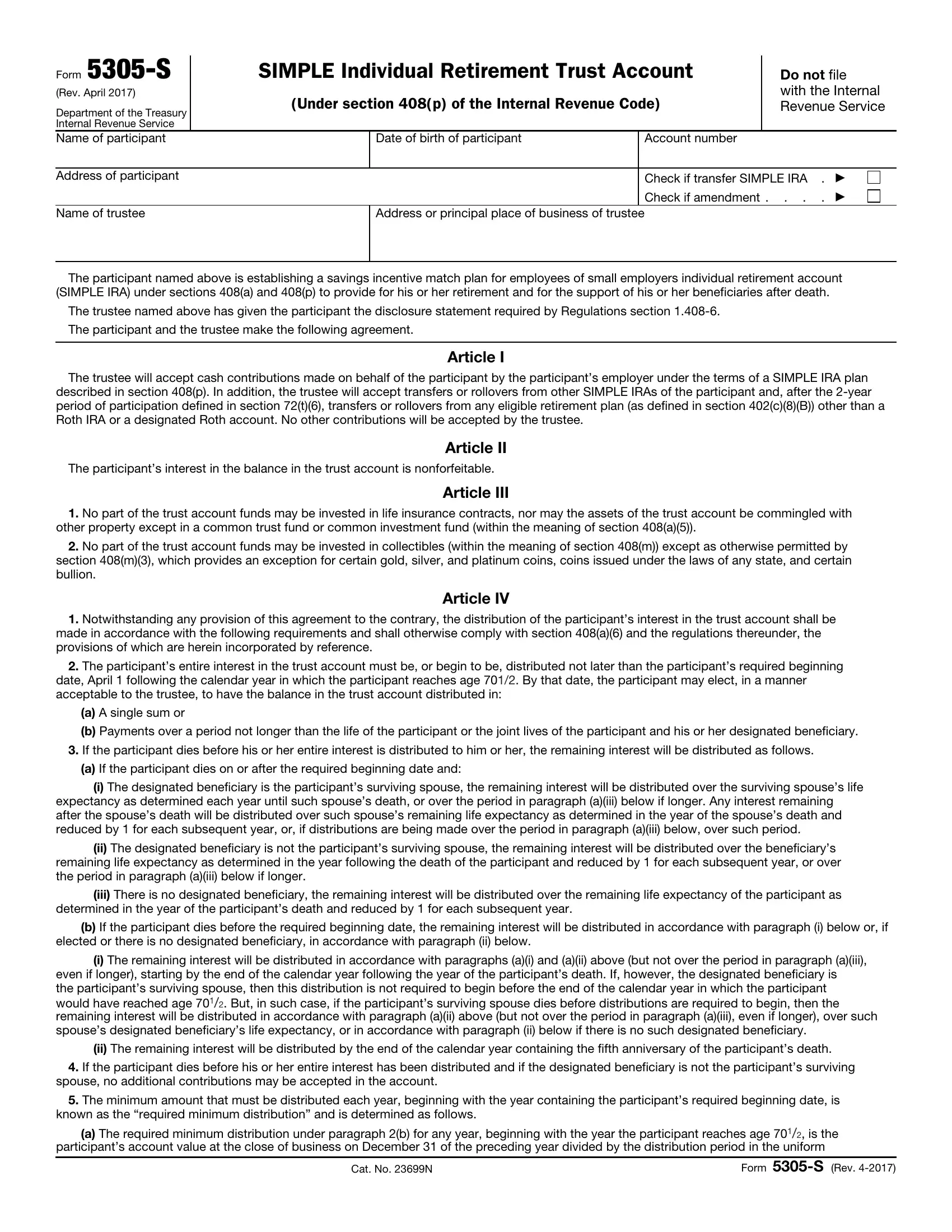

Article IV

1.Notwithstanding any provision of this agreement to the contrary, the distribution of the participant’s interest in the trust account shall be made in accordance with the following requirements and shall otherwise comply with section 408(a)(6) and the regulations thereunder, the provisions of which are herein incorporated by reference.

2.The participant’s entire interest in the trust account must be, or begin to be, distributed not later than the participant’s required beginning date, April 1 following the calendar year in which the participant reaches age 701/2. By that date, the participant may elect, in a manner acceptable to the trustee, to have the balance in the trust account distributed in:

(a)A single sum or

(b)Payments over a period not longer than the life of the participant or the joint lives of the participant and his or her designated beneficiary.

3.If the participant dies before his or her entire interest is distributed to him or her, the remaining interest will be distributed as follows.

(a)If the participant dies on or after the required beginning date and:

(i)The designated beneficiary is the participant’s surviving spouse, the remaining interest will be distributed over the surviving spouse’s life expectancy as determined each year until such spouse’s death, or over the period in paragraph (a)(iii) below if longer. Any interest remaining after the spouse’s death will be distributed over such spouse’s remaining life expectancy as determined in the year of the spouse’s death and reduced by 1 for each subsequent year, or, if distributions are being made over the period in paragraph (a)(iii) below, over such period.

(ii)The designated beneficiary is not the participant’s surviving spouse, the remaining interest will be distributed over the beneficiary’s remaining life expectancy as determined in the year following the death of the participant and reduced by 1 for each subsequent year, or over the period in paragraph (a)(iii) below if longer.

(iii)There is no designated beneficiary, the remaining interest will be distributed over the remaining life expectancy of the participant as determined in the year of the participant’s death and reduced by 1 for each subsequent year.

(b)If the participant dies before the required beginning date, the remaining interest will be distributed in accordance with paragraph (i) below or, if elected or there is no designated beneficiary, in accordance with paragraph (ii) below.

(i)The remaining interest will be distributed in accordance with paragraphs (a)(i) and (a)(ii) above (but not over the period in paragraph (a)(iii), even if longer), starting by the end of the calendar year following the year of the participant’s death. If, however, the designated beneficiary is

the participant’s surviving spouse, then this distribution is not required to begin before the end of the calendar year in which the participant would have reached age 701/2. But, in such case, if the participant’s surviving spouse dies before distributions are required to begin, then the remaining interest will be distributed in accordance with paragraph (a)(ii) above (but not over the period in paragraph (a)(iii), even if longer), over such spouse’s designated beneficiary’s life expectancy, or in accordance with paragraph (ii) below if there is no such designated beneficiary.

(ii)The remaining interest will be distributed by the end of the calendar year containing the fifth anniversary of the participant’s death.

4.If the participant dies before his or her entire interest has been distributed and if the designated beneficiary is not the participant’s surviving spouse, no additional contributions may be accepted in the account.

5.The minimum amount that must be distributed each year, beginning with the year containing the participant’s required beginning date, is

known as the “required minimum distribution” and is determined as follows.

(a)The required minimum distribution under paragraph 2(b) for any year, beginning with the year the participant reaches age 701/2, is the participant’s account value at the close of business on December 31 of the preceding year divided by the distribution period in the uniform