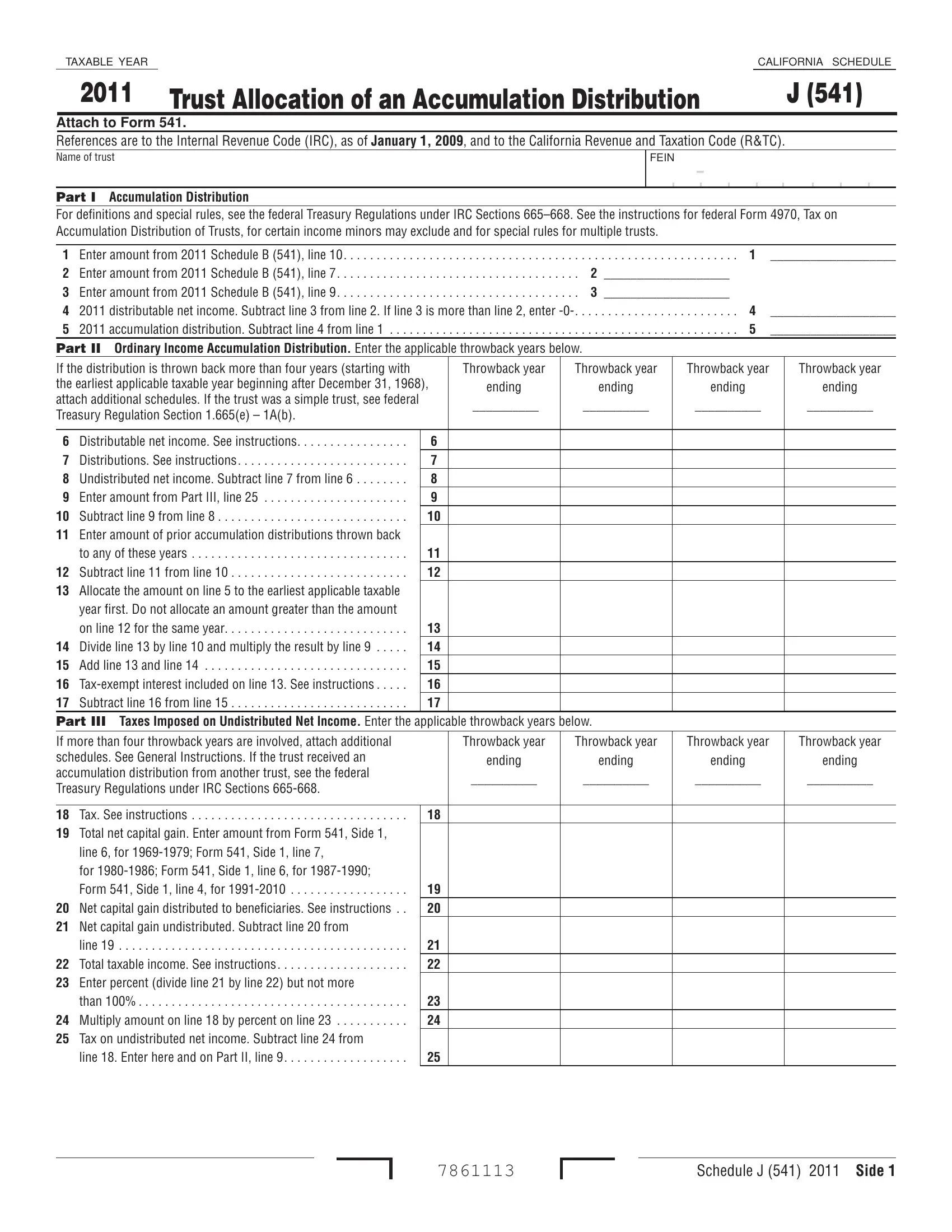

General Information

California has conformed to federal provisions of the Taxpayer Relief Act of 1997 repealing the throwback rules for certain domestic trusts. However, if the trust did not pay tax on the beneficiary’s interest because the beneficiary was contingent, the income that would have been taxed is included by the beneficiary in the year it is distributable or distributed; see California Revenue and Taxation Code (R&TC) Section 17745(b).

Purpose

File Schedule J (541), Trust Allocation of an Accumulation Distribution, with Form 541, California Fiduciary Income Tax Return, to report an accumulation distribution by domestic complex trusts and certain foreign trusts.

Access by Internet

You can download, view, and print California tax forms and publications at ftb.ca.gov.

Specific Instructions

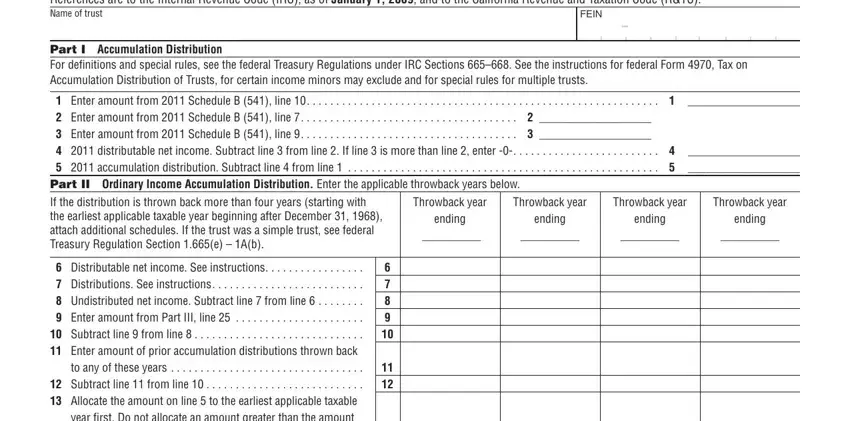

Part I

Accumulation Distribution in 2011

Generally, the beneficiary may exclude amounts accumulated before the beneficiary becomes

age 21. For multiple trusts exceptions, see Internal Revenue Code (IRC) Sections 665 and 667(c). The trustee reports the total amount of the accumulation distribution before any reduction for income accumulated before the beneficiary becomes age 21. The beneficiary claims the exclusion when filing form FTB 5870A, Tax on Accumulation Distribution of Trusts, if the multiple trust rules do not apply. This is because one trustee may be unaware that the beneficiary may be a beneficiary of other trusts with other trustees.

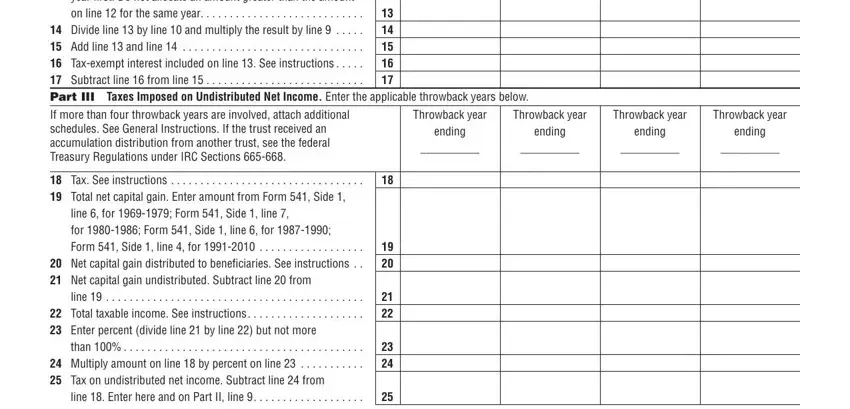

Part II

You must complete Part III before completing this part.

Ordinary Income Accumulation Distribution

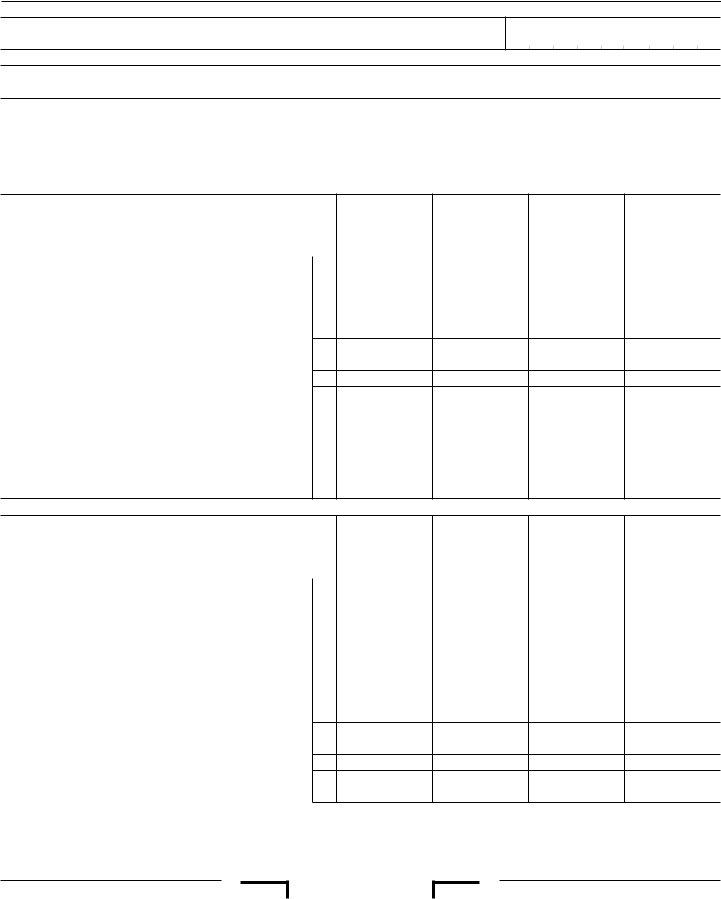

Line 6 – Distributable net income for earlier years. Enter the applicable amounts as follows:

Throwback Year(s): |

Amount From: |

1969-1978 . . . . . . . . Schedule H, (Form 541), line 5 1979 . . . . . . . . . . . . . . . . . Part D, (Form 541), line 5 1980 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 55 1981-1984 . . . . . . . . . . . . . . . . . . .Form 541, line 57 1985-1986 . . . . . . . .Schedule 3, (Form 541), line 11 1987 . . . . . . . . . . . . . .Schedule 3, (Form 541), line 9 1988-1998 . . . . . . . . Schedule B, (Form 541), line 8 1999-2010 . . . . . . . . Schedule B, (Form 541), line 7

Line 7 – Distributions made during earlier years. Enter the applicable amounts as follows:

Throwback Year(s): |

Amount From: |

1969-1978 . . . . . . . . . Schedule I, (Form 541), line 3 1979 . . . . . . . . . . . . . . . . . Part D, (Form 541), line 8 1980 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 58 1981-1984 . . . . . . . . . . . . . . . . . . .Form 541, line 60 1985-1986 . . . . . . . .Schedule 3, (Form 541), line 14 1987 . . . . . . . . . . . . .Schedule 3, (Form 541), line 13 1988-1998 . . . . . . . Schedule B, (Form 541), line 12 1999-2010 . . . . . . . Schedule B, (Form 541), line 11

Line 16 – Tax-exempt interest included on line 13. For each throwback year, divide line 15 by line 6 and multiply the result by one of the following:

Throwback Year(s): |

Amount From: |

1969-1978 . . . . . . Schedule H, (Form 541), line 2(a) 1979 . . . . . . . . . . . . . . . Part D, (Form 541), line 2(a) 1980 . . . . . . . . . . . . . . . . . . . . . Form 541, line 52(a) 1981-1984 . . . . . . . . . . . . . . . . Form 541, line 54(a) 1985-1986 . . . . . . . . Schedule 3, (Form 541), line 3 1987 . . . . . . . . . . . . . Schedule 3, (Form 541), line 2 1988-2010 . . . . . . . . Schedule B, (Form 541), line 2

Part III

Taxes Imposed on Undistributed Net Income

For the regular tax computation, if there is a capital gain, complete line 18 through line 25 for each throwback year. If there is no capital gain for any year (or there is a capital loss for every year), enter on line 9 the amount of the tax for each year entered for line 18; do not complete Part III.

If the trust received an accumulation distribution from another trust, see the federal Treasury Regulations under IRC Sections 665-668.

Line 18 – Tax

Enter the applicable tax amounts as follows:

Throwback Year(s): |

Amount From: |

1969 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 20 1970-1971 . . . . . . . . . . . . . . . . . . .Form 541, line 21 1972-1979 . . . . . . . . . . . . . . . . . . .Form 541, line 19 1980-1981 . . . . . . . . . . . . . . . . . . .Form 541, line 23 1982-1984 . . . . . . . . . . . . . . . . Form 541, line 23(c) 1985-1986 . . . . . . . . . . . . . . . . Form 541, line 24(c) 1987-1989 . . . . . . . . . . . . . . . . Form 541, line 22(c) 1990-1996 . . . . . . . . . . . . . . . . Form 541, line 20(a) 1997-2010 . . . . . . . . . . . . . . . . Form 541, line 21(a)

Line 20 – Enter the applicable net capital gain distributed as follows:

Throwback Year(s): |

Amount From: |

1969. . . . . . . Form 541, Side 1, line 17 plus amounts from Schedule F-1 (541), lines 1 and 2 1970-1971 . . Form 541, Side 1, line 18 plus amounts from Schedule F-1 (541), lines 1 and 2

1972-1979 . . . . . .Schedule F-1 (541), lines 1(a)-1(c) 1980. . . . . . . . . . . . . . . Schedule K-1 (541), lines 2-4

1981. . . . . . . . . . . . . . . Schedule K-1 (541), lines 1-3

1982. . . . . . . . . . . . . . . . . . Schedule D (541), line 25

1983. . . . . . . . . . . . . . . . . . Schedule D (541), line 30

1984. . . . . . . . . . . . . . . . . . Schedule D (541), line 33 1985-1986 . . . . . . . . . . . . . Schedule D (541), line 28 1987. . . . . . . . . . . . . . . . . . Schedule D (541), line 24 1988-2010 . . . . . . . . . . . . Schedule D (541), line 9(a)

Line 22 – Total taxable income

Enter the applicable amounts as follows:

Throwback Year(s): |

Amount From: |

1969 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 19 1970-1971 . . . . . . . . . . . . . . . . . . .Form 541, line 20 1972-1979 . . . . . . . . . . . . . . . . . . .Form 541, line 18 1980-1984 . . . . . . . . . . . . . . . . . . .Form 541, line 22 1985-1986 . . . . . . . . . . . . . . . . . . .Form 541, line 23 1987-1989 . . . . . . . . . . . . . . . . . . .Form 541, line 21 1990-1996 . . . . . . . . . . . . . . . . . . .Form 541, line 19 1997-2010 . . . . . . . . . . . . . . . . . . .Form 541, line 20

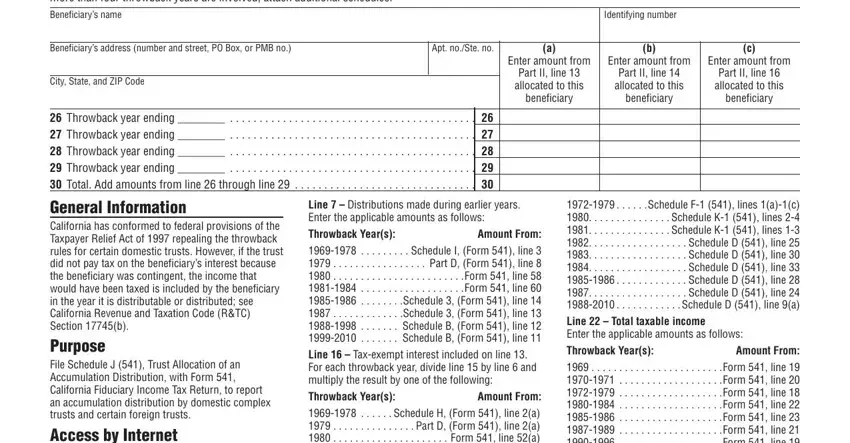

Part IV

Allocation to Beneficiary

Complete Part IV for each beneficiary. If the accumulation distribution is allocated to more than one beneficiary, attach an additional copy of Schedule J with Part IV completed for each additional beneficiary. If more than four throwback years are involved, attach additional schedules.

Nonresident Beneficiaries. In the case of a nonresident beneficiary, enter on line 26 through line 29, column (a), only that ratio of income from California sources as the amount on Part II, line 13 bears to the amount on Part II, line 10. Enter on line 26 through line 29, column (b), only that ratio of the amount on Part II, line 14 as the amount in column (a) bears to the amount on Part II, line 13.

Attach separate schedules supporting allocation of income to sources within and outside California.

Under R&TC Section 17953, income from trusts deemed distributed to nonresident beneficiaries is income from sources within California only if derived out of trust income derived from sources within California. Generally, for purposes of R&TC Section 17953, the nonresident beneficiary shall be deemed to be the owner of intangible personal property from which the income of the trust is derived.

If the beneficiary is a nonresident individual or a foreign corporation, see IRC Section 667(e) about retaining the character of the amounts distributed to determine the amount of withholding tax.

The beneficiary may use form FTB 5870A to compute the tax on the distribution.