Dealing with PDF files online is definitely very simple using our PDF tool. Anyone can fill in san francisco form 571 l 2021 here in a matter of minutes. The editor is consistently improved by us, getting powerful features and growing to be greater. To get the ball rolling, consider these basic steps:

Step 1: First, access the editor by pressing the "Get Form Button" above on this page.

Step 2: When you start the PDF editor, you will notice the form all set to be filled in. Other than filling in various blanks, you could also do various other actions with the Document, that is writing any textual content, modifying the initial textual content, adding illustrations or photos, placing your signature to the form, and a lot more.

It is an easy task to finish the pdf with our helpful guide! Here's what you need to do:

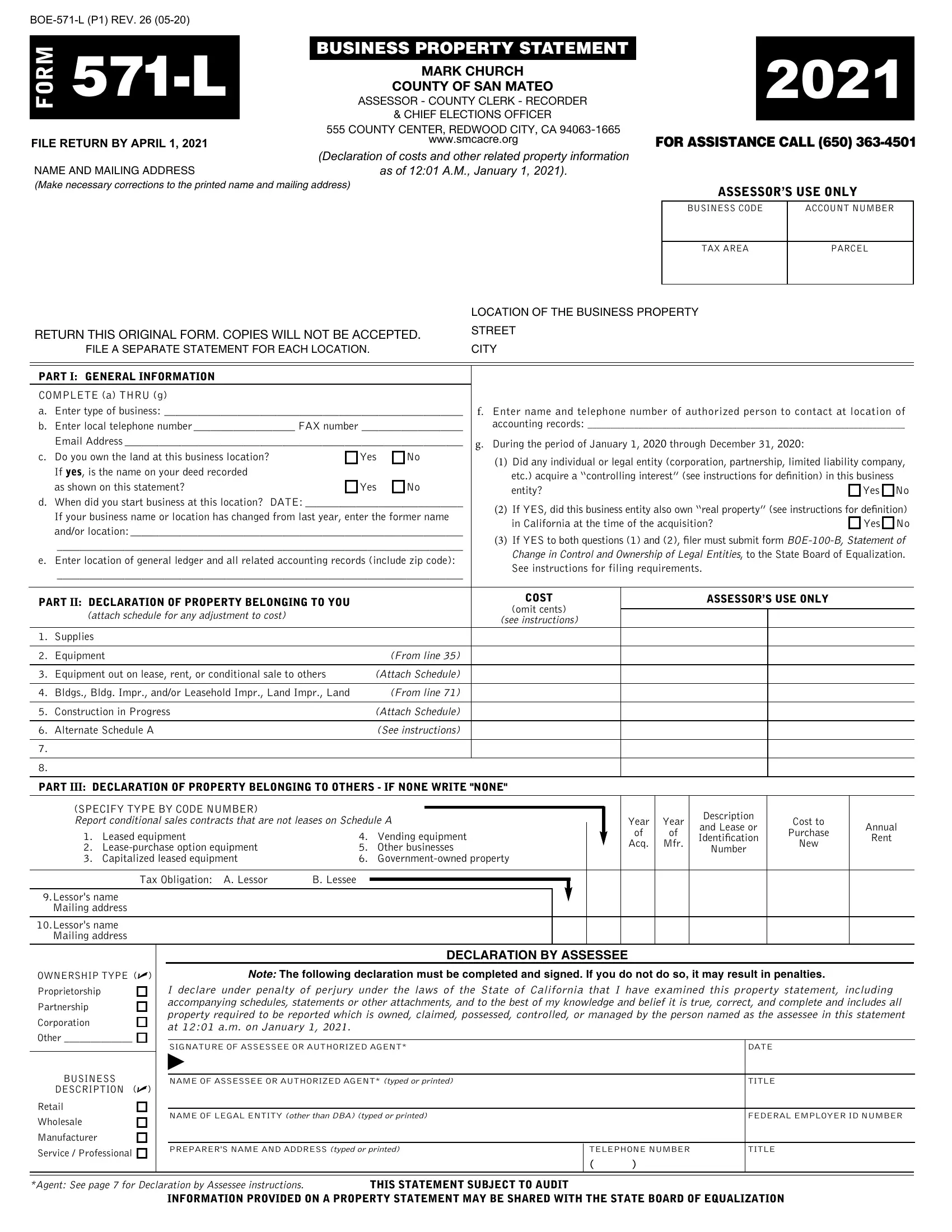

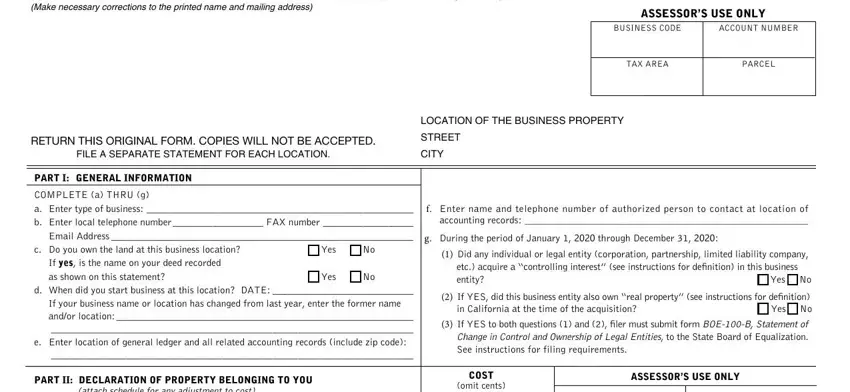

1. To start off, when completing the san francisco form 571 l 2021, beging with the form section that has the following blank fields:

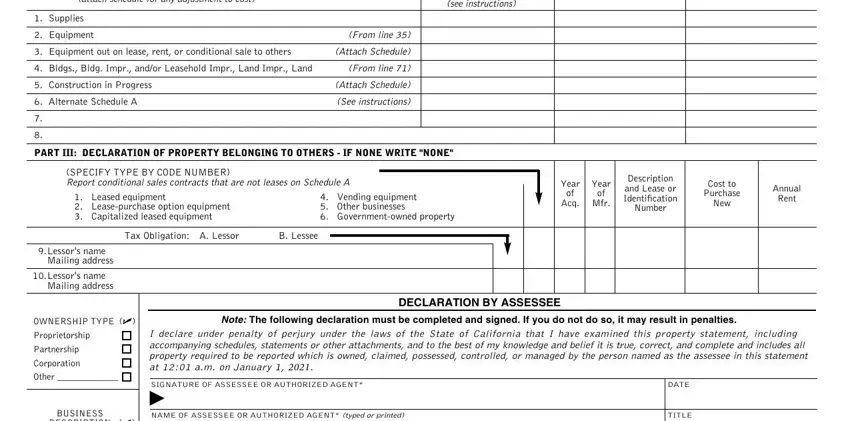

2. The next part is usually to fill in all of the following fields: attach schedule for any adjustment, see instructions, Supplies, Equipment, From line, Equipment out on lease rent or, Attach Schedule, Bldgs Bldg Impr andor Leasehold, From line, Construction in Progress, Alternate Schedule A, Attach Schedule, See instructions, PART III DECLARATION OF PROPERTY, and SPECIFY TYPE BY CODE NUMBER Report.

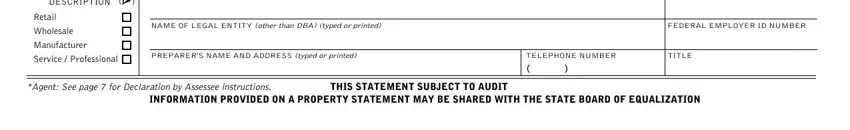

3. This third part should be rather easy, DESCRIPTION, Retail, Wholesale, Manufacturer, Service Professional, NAME OF LEGAL ENTITY other than, FEDERAL EMPLOYER ID NUMBER, PREPARERS NAME AND ADDRESS typed, TELEPHONE NUMBER, TITLE, Agent See page for Declaration by, THIS STATEMENT SUBJECT TO AUDIT, and INFORMATION PROVIDED ON A PROPERTY - all of these blanks has to be filled out here.

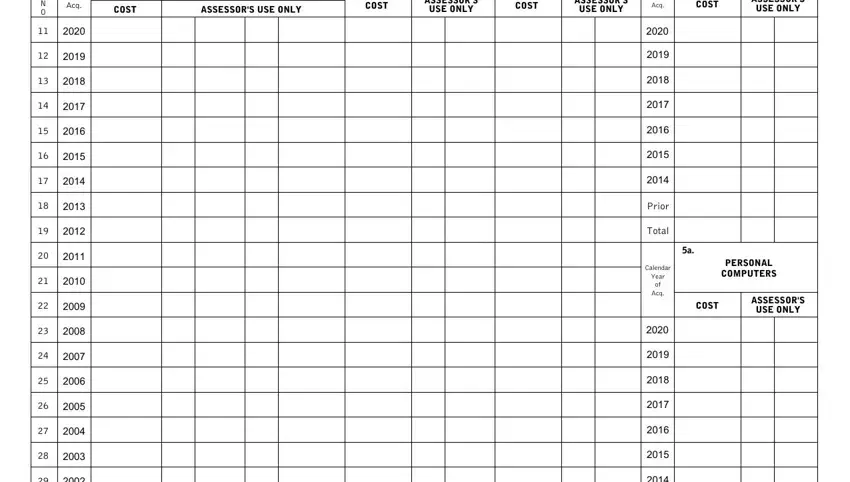

4. Your next part needs your involvement in the subsequent places: COST, ASSESSORS USE ONLY, COST, ASSESSORS, USE ONLY, COST, ASSESSORS, USE ONLY, L I N E N O, dar Yr of, Acq, COST, ASSESSORS, USE ONLY, and PERSONAL COMPUTERS. Make certain you fill out all needed details to go onward.

Concerning dar Yr of and ASSESSORS USE ONLY, make sure that you take another look here. These are the most important fields in this PDF.

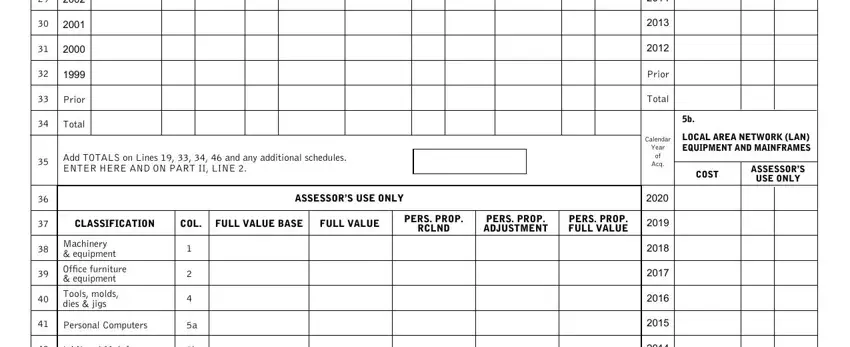

5. Because you come close to the final sections of the form, you'll find several more things to complete. Notably, Prior, Total, Add TOTALS on Lines and any, CLASSIFICATION, COL, FULL VALUE BASE, FULL VALUE, PERS PROP, RCLND, PERS PROP ADJUSTMENT, PERS PROP FULL VALUE, ASSESSORS USE ONLY, Machinery equipment, Office furniture equipment, and Tools molds dies jigs should all be done.

Step 3: Prior to moving forward, you should make sure that form fields were filled in as intended. When you believe it's all fine, press “Done." Right after creating a7-day free trial account here, you'll be able to download san francisco form 571 l 2021 or send it through email promptly. The PDF form will also be easily accessible in your personal account menu with your adjustments. FormsPal is devoted to the confidentiality of all our users; we make sure all information going through our tool remains confidential.