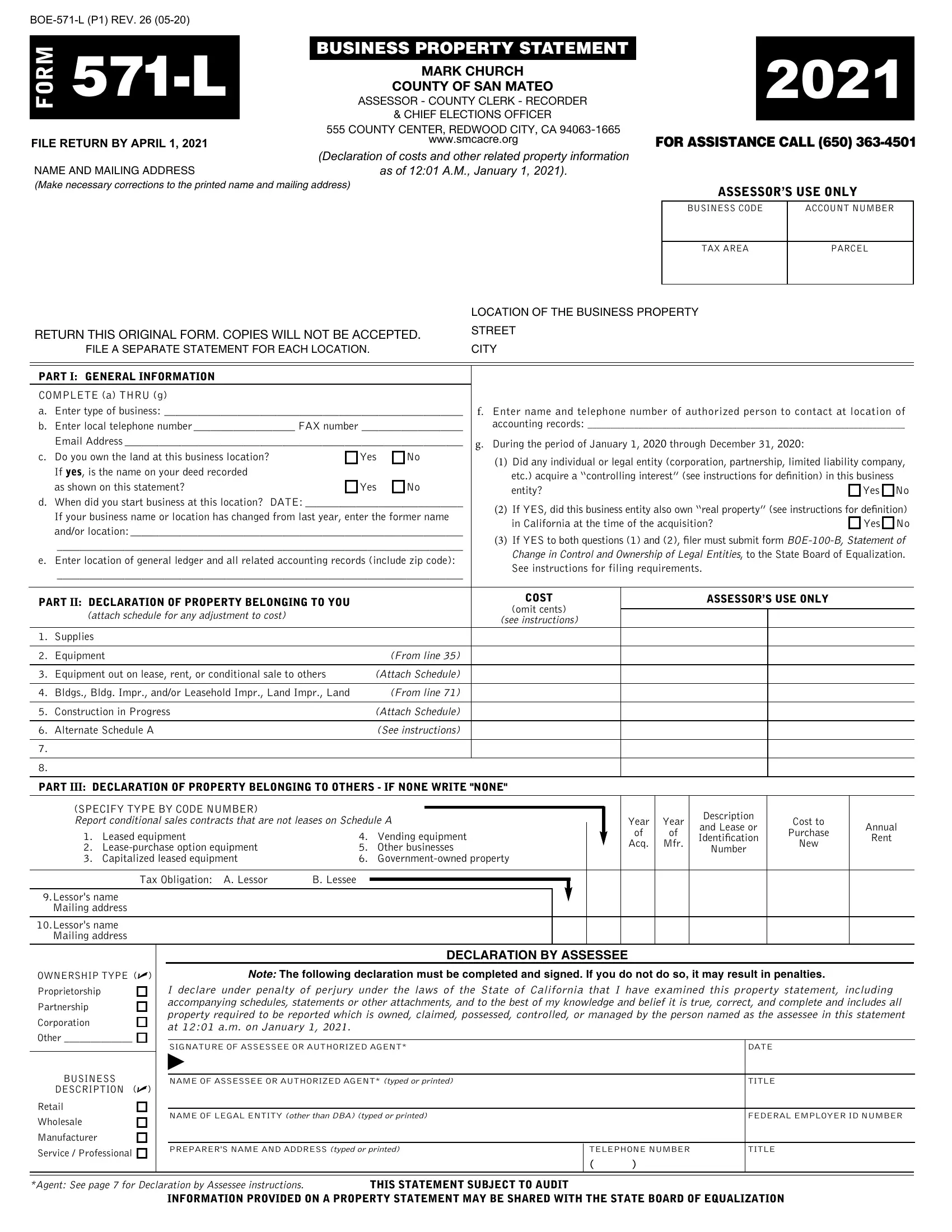

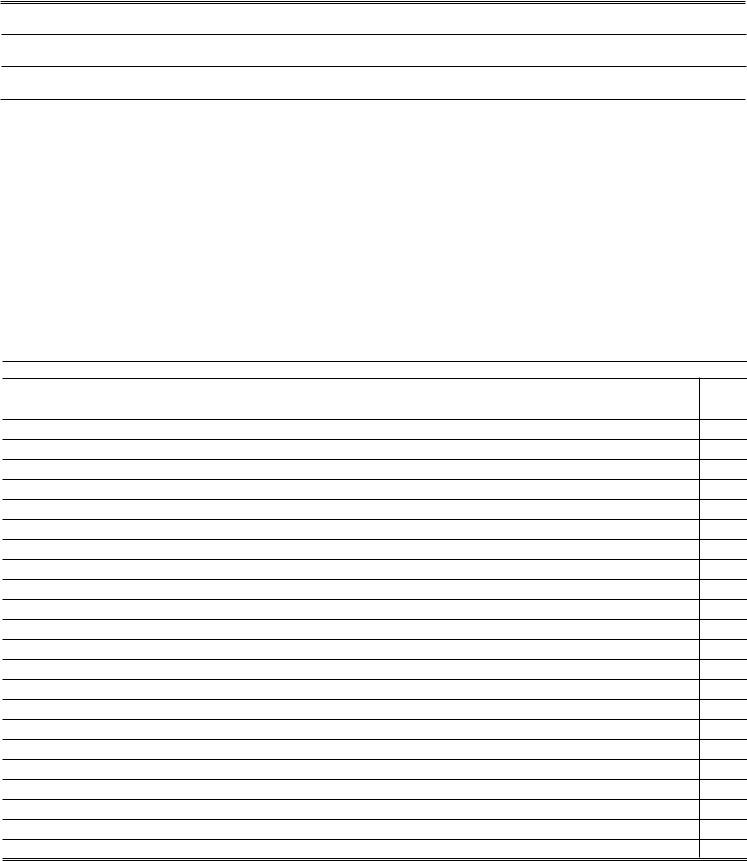

BOE-571-L (P1) REV. 16 (08-10)

FORM |

571-L |

|

BUSINESS PROPERTY STATEMENT |

|

|

|

|

MARK CHURCH |

|

|

|

COUNTY OF SAN MATEO |

|

|

|

CHIEF ELECTIONS OFFICER & |

|

|

|

ASSESSOR - COUNTY CLERK - RECORDER |

|

|

|

555 COUNTY CENTER, REDWOOD CITY, CA 94063-1665 |

FILE RETURN BY APRIL 1, 2011 |

|

WWW.SMCARE.ORG |

|

|

|

(Declaration of costs and other related property information |

NAME AND MAILING ADDRESS |

|

as of 12:01 A.M., January 1, 2011). |

(Make necessary corrections to the printed name and mailing address)

2011

FOR ASSISTANCE CALL (650) 363-4501

ASSESSOR’S USE ONLY

BUSINESS CODE |

ACCOUNT NUMBER |

|

|

TAX AREA |

PARCEL |

|

|

|

|

|

|

|

|

|

|

|

LOCATION OF THE BUSINESS PROPERTY |

|

|

|

RETURN THIS ORIGINAL FORM. COPIES WILL NOT BE ACCEPTED. |

STREET |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILE A SEPARATE STATEMENT FOR EACH LOCATION. |

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

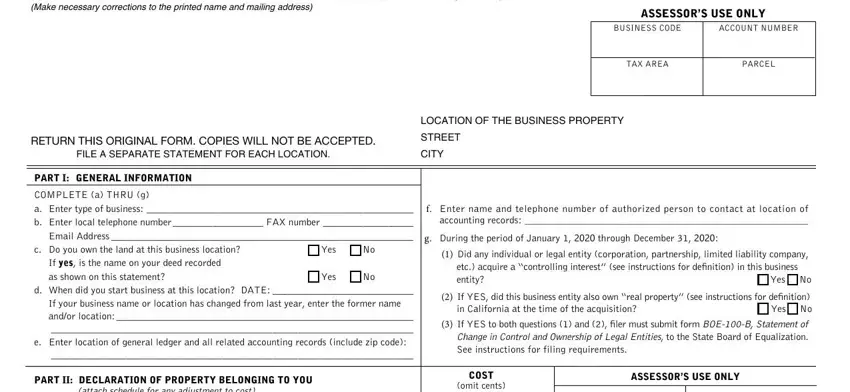

PART I: GENERAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPLETE (a) THRU (g) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Enter type of business: _____________________________________________________ |

f. Enter name and telephone number of authorized person to contact at location of |

|

b. Enter local telephone number __________________ FAX number __________________ |

accounting records:_____________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-Mail Address (optional) __________________________________________________ |

g. During the period of January 1, 2010 through December 31, 2010: |

|

|

c. |

Do you own the land at this business location? |

Yes |

No |

(1) Did any individual or legal entity (corporation, partnership, limited liability company, |

|

|

If yes, is the name on your deed recorded |

|

|

|

|

|

|

|

|

|

|

|

|

etc.) acquire a “controlling interest” (see instructions for definition) in this business |

|

|

|

|

|

|

|

|

|

|

|

as shown on this statement? |

Yes |

No |

entity? |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

d. When did you start business at this location? DATE: ____________________________ |

(2) If YES, did this business entity also own “real property” (see instructions for definition) |

|

|

If your business name or location has changed from last year, enter the former name |

|

|

in California at the time of the acquisition? |

Yes |

No |

|

|

and/or location: ___________________________________________________________ |

|

|

(3) If YES to both questions (1) and (2), filer must submit form BOE-100-B, Statement of |

|

|

________________________________________________________________________ |

|

|

Change in Control and Ownership of Legal Entities, to the State Board of Equalization. |

|

e. Enter location of general ledger and all related accounting records (include zip code): |

|

See instructions for filing requirements. |

|

|

|

|

________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II: DECLARATION OF PROPERTY BELONGING TO YOU |

|

|

|

COST |

|

|

ASSESSOR’S USE ONLY |

|

|

|

|

|

(omit cents) |

|

|

|

|

|

|

|

(attach schedule for any adjustment to cost) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Equipment |

|

|

|

(From line 35) |

|

|

|

|

|

|

|

|

|

|

|

3. |

Equipment out on lease, rent, or conditional sale to others |

(Attach Schedule) |

|

|

|

|

|

|

|

|

|

|

|

4. |

Bldgs., Bldg. Impr., and/or Leasehold Impr., Land Impr., Land |

|

(From line 71) |

|

|

|

|

|

|

|

|

|

|

|

5. |

Construction in Progress |

|

|

(Attach Schedule) |

|

|

|

|

|

|

|

|

|

|

|

6. |

Alternate Schedule A |

|

|

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

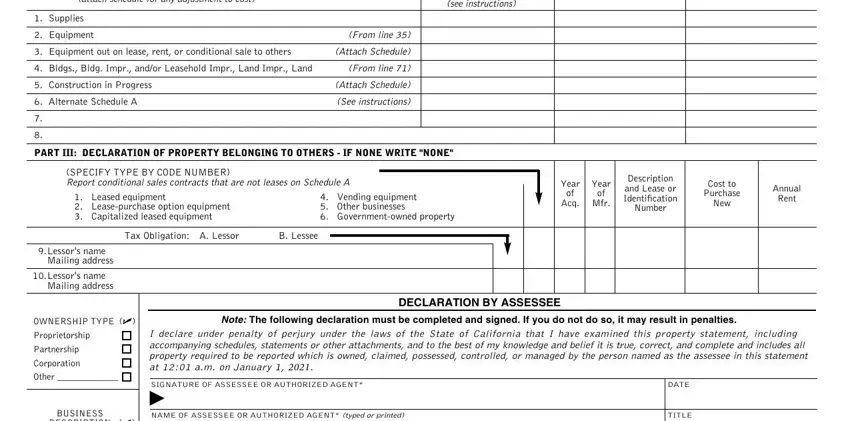

PART III: DECLARATION OF PROPERTY BELONGING TO OTHERS – IF NONE WRITE “NONE” |

|

|

|

|

|

|

(SPECIFY TYPE BY CODE NUMBER) |

|

|

|

|

|

|

|

|

|

|

|

|

Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report conditional sales contracts that are not leases on Schedule A |

|

|

|

|

|

Year |

Year |

Cost to |

|

|

|

|

|

|

|

|

and Lease or |

Annual |

|

|

1. |

Leased equipment |

4. |

|

|

Vending equipment |

|

|

|

|

|

of |

of |

Purchase |

|

|

|

|

|

|

|

|

|

Identification |

Rent |

|

|

|

|

|

|

|

|

|

Acq. |

Mfr. |

New |

|

|

2. |

Lease-purchase option equipment |

5. |

|

|

Other businesses |

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Capitalized leased equipment |

6. |

|

|

Government-owned property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Obligation: A. Lessor |

B. Lessee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.Lessor’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.Lessor’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNERSHIP TYPE () |

Proprietorship |

|

Partnership |

|

Corporation |

|

Other _____________ |

BUSINESS DESCRIPTION ()

Retail

Wholesale

Manufacturer Service / Professional

DECLARATION BY ASSESSEE

Note: The following declaration must be completed and signed. If you do not do so, it may result in penalties.

I declare under penalty of perjury under the laws of the State of California that I have examined this property statement, including accompanying schedules, statements or other attachments, and to the best of my knowledge and belief it is true, correct, and complete and includes all property required to be reported which is owned, claimed, possessed, controlled, or managed by the person named as the assessee in this statement at 12:01 a.m. on January 1, 2011.

SIGNATURE OF ASSESSEE OR AUTHORIZED AGENT* |

|

|

|

|

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF ASSESSEE OR AUTHORIZED AGENT* (typed or printed) |

|

|

|

|

TITLE |

|

|

|

|

|

|

NAME OF LEGAL ENTITY (other than DBA) (typed or printed) |

|

|

|

|

FEDERAL EMPLOYER ID NUMBER |

|

|

|

|

|

PREPARER’S NAME AND ADDRESS (typed or printed) |

|

TELEPHONE NUMBER |

TITLE |

|

|

( |

) |

|

|

|

|

|

|

|

|

*Agent: See page 7 for Declaration by Assessee instructions. |

THIS STATEMENT SUBJECT TO AUDIT |

INFORMATION PROVIDED ON A PROPERTY STATEMENT MAY BE SHARED WITH THE STATE BOARD OF EQUALIZATION

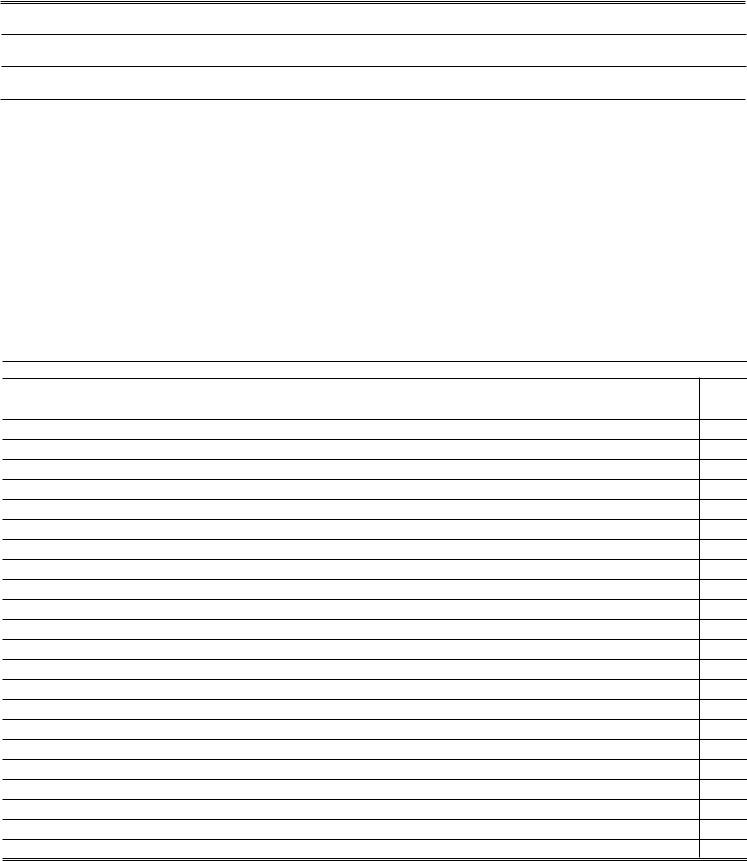

BOE-571-L (P2) REV. 16 (08-10)

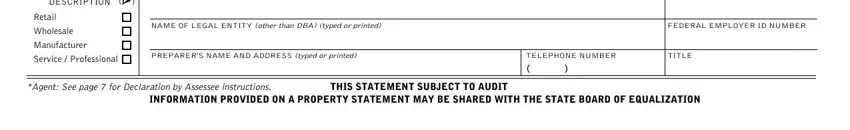

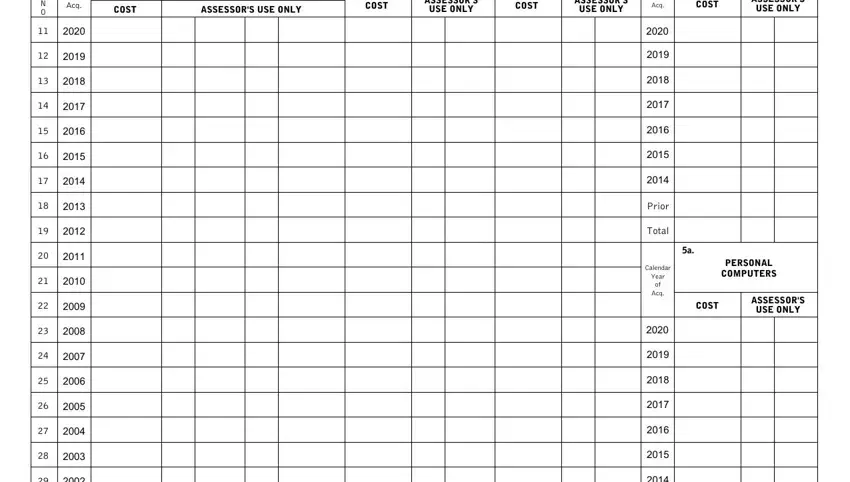

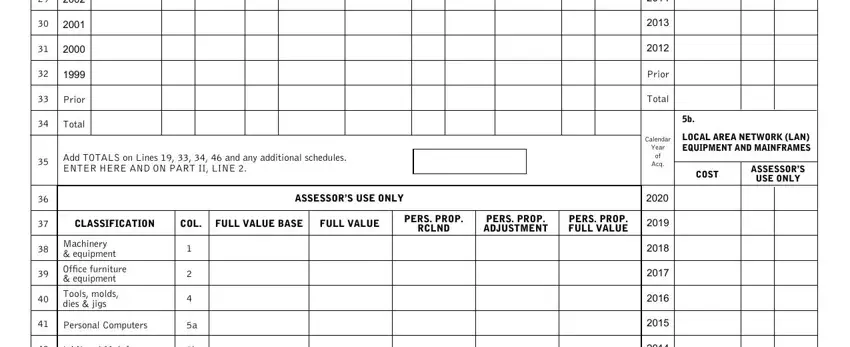

SCHEDULE A — COST DETAIL: EQUIPMENT (Do not include property reported in Part III.)

Include expensed equipment and fully depreciated items. Include sales or use tax (see instructions for important use tax information), freight and installation costs. Attach schedules as needed. Lines 18, 32, 33, and 45 “Prior” –– Report detail by year(s) of acquisition on a separate schedule.

L |

Calendar |

1. |

MACHINERY AND EQUIPMENT FOR |

|

2. |

|

|

|

|

|

|

|

3. |

|

|

|

|

|

4. |

|

|

|

I |

|

|

OFFICE FURNITURE |

|

|

OTHER EQUIPMENT |

Calendar |

TOOLS, MOLDS, |

N |

Year |

|

INDUSTRY, PROFESSION, OR TRADE |

|

|

AND EQUIPMENT |

|

|

|

(describe) |

Year |

|

DIES, JIGS |

of |

|

|

|

|

|

|

|

E |

|

(do not include licensed vehicles) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

N |

Acq. |

|

|

|

|

|

|

|

|

|

|

COST |

|

ASSESSOR’S |

|

COST |

ASSESSOR’S |

Acq. |

COST |

|

ASSESSOR’S |

COST |

|

|

ASSESSOR’S USE ONLY |

|

|

|

|

|

|

|

USE ONLY |

|

|

USE ONLY |

|

|

USE ONLY |

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

2004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

2002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPUTERS |

21 |

2000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acq. |

|

|

|

|

22 |

1999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST |

|

ASSESSOR’S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

1998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

1997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

1996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

1995 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

1994 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

1993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

1992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

1991 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

1990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

1989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar |

LOCAL AREA NETWORK (LAN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

EQUIPMENT AND MAINFRAMES |

|

Add TOTALS on lines 19, 33, 34, 46 and any additional schedules. |

|

|

|

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

35 |

ENTER HERE AND ON PART II, LINE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acq. |

COST |

|

ASSESSOR’S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

|

ASSESSOR’S USE ONLY |

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

CLASSIFICATION |

COL |

FULL VALUE BASE |

|

FULL VALUE |

|

PERS. PROP. |

|

|

PERS. PROP. |

|

PERS. PROP. |

2009 |

|

|

|

|

|

|

|

RCLND |

|

ADJUSTMENT |

|

FULL VALUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

Machinery |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

& equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

Ofice furniture |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 |

|

|

|

|

& equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

Tools, molds, |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006 |

|

|

|

|

dies & jigs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

Personal Computers |

5a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

LAN and Mainframe |

5b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

Other |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2002 |

|

|

|

|

equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 |

Schedule B |

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior |

|

|

|

|

— Fixtures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOE-571-L (P3) REV. 16 (08-10)

SCHEDULE B — COST DETAIL: BUILDINGS, BUILDING IMPROVEMENTS, AND/OR LEASEHOLD IMPROVEMENTS, LAND IMPROVEMENTS, LAND AND LAND DEVELOPMENT

Attach schedules as needed. Line 69 “Prior”—Report detail by year(s) of acquisition on a separate schedule.

|

|

|

|

BUILDINGS, BUILDING IMPROVEMENTS, AND / OR |

3. |

|

|

|

|

|

|

|

4. |

|

|

|

L |

|

|

|

|

|

LEASEHOLD IMPROVEMENTS |

|

|

|

|

LAND |

|

|

|

LAND AND LAND |

I |

Calendar |

|

|

|

|

|

|

|

|

|

|

IMPROVEMENTS |

|

|

|

DEVELOPMENT |

N |

Yr. |

1. |

STRUCTURE ITEMS ONLY |

2. |

FIXTURES ONLY |

(e.g., blacktop, curbs, fences) |

|

|

(e.g., fill, grading) |

E |

|

|

(see instructions) |

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

Acq. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

COST |

|

ASSESSOR’S |

COST |

|

ASSESSOR’S |

COST |

|

|

ASSESSOR’S |

|

|

COST |

|

ASSESSOR’S |

|

|

|

|

USE ONLY |

|

USE ONLY |

|

|

USE ONLY |

|

|

|

USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 |

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 |

2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52 |

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

53 |

2004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 |

2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55 |

2002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56 |

2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57 |

2000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58 |

1999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

59 |

1998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

1997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

61 |

1996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62 |

1995 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63 |

1994 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64 |

1993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65 |

1992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66 |

1991 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67 |

1990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68 |

1987 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69 |

Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70 |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add TOTALS on Line 70 and any additional schedules. ENTER HERE AND ON PART II, LINE 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

72 |

|

|

|

|

|

If yes indicate amount $ ______________ |

Have you received allowances for tenant improvements for the current reporting period that are not reported above? |

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMARKS:

BOE-571-D (FRONT) REV. 12 (08-10)

SUPPLEMENTAL SCHEDULE FOR REPORTING

MONTHLY ACQUISITIONS AND DISPOSALS OF

PROPERTY REPORTED ON SCHEDULE B OF THE

BUSINESS PROPERTY STATEMENT

OWNER NAME

MAILING ADDRESS

LOCATION OF PROPERTY

INSTRUCTIONS

Report all acquisitions and disposals reported in Columns 1, 2, 3, or 4 on Schedule B for the period January 1, 2010 through December 31, 2010. Indicate the applicable column number in the space provided.

ADDITIONS – Describe and enter the total acquisition cost(s), including excise, sales, and use taxes, freight-in, and installation charges, by month of acquisition; transfers-in should also be included. The former property address and date of transfer should be reported, as well as original date and cost(s) of acquisition.

Only completed projects should be reported here (e.g., the date the property becomes functional and/or operational, otherwise it should be reported as construction-in-progress).

Identify completed construction that was reported as construction-in-progress on your 2008 property statement. Describe the item(s) and cost(s), as previously reported, on a separate schedule and attach to BOE-571-D.

DISPOSALS – Information on this property should include the disposal date, method of disposal (transfer, scrapped, abandoned, sold, etc.) and names and addresses of purchasers when items are either sold or transferred.

|

|

|

ADDITIONS |

|

|

|

|

|

|

DISPOSALS |

FROM |

|

ENTER MONTH |

|

|

FROM |

|

ENTER MONTH |

|

YEAR |

|

|

|

|

|

|

|

COLUMN |

|

& YEAR OF |

DESCRIPTION |

COST |

COLUMN |

|

& YEAR OF |

|

DESCRIPTION |

|

|

|

ACQUIRED |

NUMBER |

|

ACQUISITION |

|

|

NUMBER |

|

DISPOSAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS STATEMENT SUBJECT TO AUDIT

BOE-571-L (P4) REV. 16 (08-10)

OFFICIAL REQUEST

DO NOT RETURN THESE INSTRUCTIONS

California law prescribes a yearly ad valorem tax based on property as it exists at 12:01 a.m. on January 1 (tax lien date). This form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the Assessor’s Office by the date cited on the face of the form as required by law. Failure to file the statement during the time provided in section 441 of the Revenue and Taxation Code will compel the Assessor to estimate the value of your property from other information in the Assessor’s possession and add a penalty of 10 percent of the assessed value as required by section 463 of the Code.

If you own taxable personal property in any other county whose aggregate cost is $100,000 or more for any assessment year, you must file a property statement with the Assessor of that county whether or not you are requested to do so. Any person not otherwise required to file a statement shall do so upon request of the Assessor regardless of aggregate cost of property. The Assessor of the county will supply you with a form upon request.

Except for the “DECLARATION BY ASSESSEE” section, you may furnish attachments in lieu of entering the information on this property statement. However, such attachments must contain all the information requested by the statement and these instructions. The attachments must be in a format acceptable to the Assessor, and the property statement must contain appropriate references to the attachments and must be properly signed. In all instances, you must return the original BOE-571-L.

THIS |

THIS STATEMENT IS NOT |

IF ANY SITUATION EXISTS WHICH |

STATEMENT |

A PUBLIC DOCUMENT. THE |

NECESSITATES A DEVIATION FROM |

IS SUBJECT |

INFORMATION DECLARED WILL |

TOTAL COST PER BOOKS AND RECORDS |

TO AUDIT. |

BE HELD SECRET BY THE ASSESSOR. |

FULLY EXPLAIN ALL ADJUSTMENTS. |

|

|

|

INSTRUCTIONS

(complete the statement as follows)

NAME. If the information has been preprinted by the Assessor, make necessary corrections. INDIVIDUALS, enter the last name first, then the first name and middle initial. PARTNERSHIPS must enter at least two names, showing last name, first name and middle initial for each partner. CORPORATIONS report the full corporate name. If the business operates under a DBA (Doing Business As) or FICTITIOUS NAME, enter the DBA (Fictitious) name under which you are operating in this county below the name of the sole owner, partnership, or corporation.

LOCATION OF THE PROPERTY. Enter the complete street address. Forms for additional business or warehouse locations will be furnished upon request. A listing may be attached to a single property statement for your vending equipment leased or rented to others, when any such properties are situated at many locations within this county.

USE TAX INFORMATION

California use tax is imposed on consumers of tangible personal property that is used, consumed, given away or stored in this state. Businesses must report and pay use tax on items purchased from out-of-state vendors not required to collect California tax on their sales. If your business is not required to have a seller’s permit with the State Board of Equalization, the use tax may be reported and paid on your California State Income Tax Return or directly to the State Board of Equalization on the tax return provided in Publication 79-B, California Use Tax. Obtain additional use tax information by calling the State Board of Equalization Information Center at 800-400-7115 or from the website www.boe.ca.gov / sutax / usetaxreturn.htm.

Part I: GENERAL INFORMATION

[complete items (a) through (g)]

OWNERSHIP OF LAND — (c). Check either the YES or the NO box to indicate whether you own the land at the LOCATION OF THE PROPERTY shown on this statement. If YES is checked, verify the official RECORDED NAME on your DEED. If it agrees with the name shown on this statement, check the second YES box. If it does not agree, check the second NO box.

LOCATION OF RECORDS — (e and f). Enter the address or addresses at which your general ledger and all related accounting records are maintained and available for audit. If you enter your tax agent or representative’s address, indicate whether all or only part of the records are at that address, and the location of the remainder, if applicable.

PROPERTY TRANSFER — (g).

Real Property – For purposes of reporting a change in control, real property includes land, structures, or fixtures owned or held under lease from (1) a private owner if the remaining term of the lease exceeds 35 years, including written renewal options, (2) a public owner (any arm or agency of local, state, or federal government) for any term or (3) mineral rights owned or held on lease for any term, whether in production or not.

BOE-571-L (P5) REV. 16 (08-10)

Controlling Interest – When any person or legal entity obtains more than 50 percent of the voting stock of a corporation, or more than a 50 percent ownership interest in any other type of legal entity. The interest obtained includes what is acquired directly or indirectly by a parent or affiliated entity.

Forms, Filing Requirements & Penalty Information – Contact the Legal Entity Ownership Program Section at 916-323-5685 or refer to the Board’s website at www.boe.ca.gov to obtain form BOE-100-B, applicable filing requirements, and penalty information.

Part II: DECLARATION OF PROPERTY BELONGING TO YOU.

Report book cost (100 percent of actual cost). Include excise, sales, and use taxes, freight-in, installation charges, and all other relevant costs. Report any additional information which will assist the Assessor in arriving at a fair market value. Include finance charges for buildings and improvements that are constructed or otherwise produced for an enterprise’s own use (including assets constructed or produced by others) for which deposits or progress payments have been made. Do not include finance charges for purchased equipment.

LINE 1. SUPPLIES. Report supplies on hand, such as stationery and office supplies, chemicals used to produce a chemical or physical reaction, janitorial and lavatory supplies, fuel, sandpaper, etc., at their current replacement costs. Include medical, legal, or accounting supplies held by a person in connection with a profession that is primarily a service activity. Do not include supplies which will become a component part of the product you manufacture or sell.

LINE 2. EQUIPMENT. Enter total from Schedule A, Line 35 (see instructions for Schedule A).

LINE 3. EQUIPMENT OUT ON LEASE, RENT, OR CONDITIONAL SALE TO OTHERS. Report cost on Line 3 and attach schedules showing the following (equipment actually out on lease or rent, equipment out on a conditional sale agreement, and equipment held for lease or rent which you have used or intend to use must be reported). Equipment held for lease or rent and not otherwise used by you is exempt and should not be reported.

Equipment out on lease, rent, or conditional sale. (1) Name and address of party in possession, (2) location of the property, (3) quantity and description, (4) date of acquisition, (5) your cost, selling price, and annual rent, (6) lease or identification number, (7) date and duration of lease, (8) how acquired (purchased, manufactured, or other — explain), (9) whether a lease or a conditional sale agreement. If the property is used by a free public library or a free museum or is used exclusively by a public school, community college, state college, state university, church, or a nonprofit college it may be exempt from property taxes, provided the lessor’s exemption claim is filed by February 15. Obtain BOE-263, Lessors’ Exemption Claim, from the Assessor. Also include equipment on your premises held for lease or rent which you have used or intend to use. Report your cost and your selling price by year of acquisition.

LINE 4. BUILDINGS, BUILDING IMPROVEMENTS, AND/OR LEASEHOLD IMPROVEMENTS, LAND IMPROVEMENTS, LAND AND LAND DEVELOPMENT. Enter total from Schedule B, Line 71 (see Instructions for Schedule B).

LINE 5. CONSTRUCTION IN PROGRESS. If you have unallocated costs of construction in progress for improvements to land, machinery, equipment, furniture, buildings or other improvements, or leasehold improvements, attach an itemized listing. Include all tangible property, even though not entered on your books and records. Enter the total on PART II, Line 5.

LINE 6. ALTERNATE OR IN-LIEU SCHEDULE. If the Assessor enclosed BOE 571-L, Alternate Schedule A, with this property statement, complete the alternate schedule as directed and report the total cost on Line 6.

LINES 7–8. OTHER. Describe and report the cost of tangible property not reported elsewhere on this form.

Part III: DECLARATION OF PROPERTY BELONGING TO OTHERS.

If property belonging to others, or their business entities, is located on your premises, report the owner’s name and mailing address. If it is leased equipment, read your agreement carefully and enter A (Lessor) or B (Lessee), and whether lessor or lessee has the tax obligation. For assessment purposes, the Assessor will consider, but is not bound to, the contractual agreement.

1.LEASED EQUIPMENT. Report the year of acquisition, the year of manufacture, description of the leased property, the lease contract number or other identification number, the total installed cost to purchase (including sales tax), and the annual rent; do not include in Schedule A or B (see No. 3, below).

2.LEASE-PURCHASE OPTION EQUIPMENT. Report here all equipment acquired on lease-purchase option on which the final payment remains to be made. Enter the year of acquisition, the year of manufacture, description of the leased property, the lease contract number or other identification number, the total installed cost to purchase (including sales tax), and the annual rent. If final payment has been made, report full cost in Schedule A or B (see No. 3, below).

3.CAPITALIZED LEASED EQUIPMENT. Report here all leased equipment that has been capitalized at the present value of the minimum lease payments on which a final payment remains to be made. Enter the year of acquisition, the year of manu- facture, description of the leased property, the lease contract number or other identification number, and the total installed cost to purchase (including sales tax). Do not include in Schedule A or B unless final payment has been made.

BOE-571-L (P6) REV. 16 (08-10)

4.VENDING EQUIPMENT. Report the model and description of the equipment; do not include in Schedule A.

5.OTHER BUSINESSES. Report other businesses on your premises.

6.GOVERNMENT-OWNED PROPERTY. If you possess or use government-owned land, improvements, or fixed equipment, or government-owned property is located on your premises, report the name and address of the agency which owns the property, and a description of the property.

SCHEDULE A — COST DETAIL: EQUIPMENT

Do not include property already reported in Part III.

LINES 11–46. Enter in the appropriate column the cost of your equipment segregated by calendar year of acquisition, include short-lived or expensed equipment. Total each column. Report full cost; do not deduct investment credits, trade-in allowances or depreciation. Include equipment acquired through a lease-purchase agreement at the selling price effective at the inception of the lease and report the year of the lease as the year of acquisition (if final payment has not been made, report such equipment in PART III). Report self-constructed equipment used by you at the proper trade level in accordance with Title 18, Section 10, of the California Code of Regulations. Exclude the cost of normal maintenance and repair that does not extend the life nor modify the use of the equipment. Exclude the cost of equipment actually removed from the site. The cost of equipment retired but not removed from the site must be reported. Segregate and report on PART II, Line 3, the cost of equipment out on lease or rent.

Include special mobile equipment (SE Plates). Exclude motor vehicles licensed for operation on the highways. However, you must report overweight and oversized rubber-tired vehicles, except licensed commercial vehicles and cranes, which require permits issued by the Department of Transportation to operate on the highways. If you have paid a license fee prior to January 1 on these large vehicles, contact the Assessor for an Application for Deduction of Vehicle License Fees from Property Tax and file it with the Tax Collector. Report overweight and oversized vehicles in Column 3.

Computers used in any application directly related to manufacturing, or used to control or monitor machinery or equipment, should be reported in Column 1. Non-production computer components and related equipment designed for general business purposes should be reported in Columns 5a, 5b, and 5c. For reporting purposes, a computer component is each asset separately stated in your books and records. Do not include application software costs in accordance with Section 995.2 of the California Revenue and Taxation Code. Report in Column 5a computer assets with a cost of $25,000 or less. Report in Column 5b computer assets with a cost of $25,000.01–$500,000. Report in Column 5c computer assets costing $500,000.01 or more and attach a detailed schedule of such assets by year of acquisition.

If necessary, asset titles in Schedule A may be changed to better fit your property holdings; however, the titles should be of such clarity that the property is adequately defined.

LINES 18, 31, 33 and 45. For “prior” years acquisition, you must attach a separate schedule detailing the cost of such equipment by year(s) of acquisition. Enter the total cost of all such acquisitions on Lines 18, 31, 33 and 45.

LINE 35. Add totals on lines 19, Column 4; line 33, Column 5a; line 34, Columns 1, 2, 3; line 46, Column 5b; and any additional schedules. Enter the same figure on PART II, line 2, that you entered in the box.

SCHEDULE B — COST DETAIL: BUILDINGS, BUILDING IMPROVEMENTS, AND/OR LEASEHOLD

IMPROVEMENTS, LAND IMPROVEMENTS, LAND AND LAND DEVELOPMENT

LINES 47-71. Report by calendar year of acquisition the original or allocated costs (per your books and records) of buildings and building or leasehold improvements; land improvements; land and land development owned by you at this location on January 1. Include finance charges for buildings or improvements which have been constructed for an enterprise’s own use. If no finance charges were incurred because funding was supplied by the owner, then indicate so in the remarks. In the appropriate column enter costs, including cost of fully depreciated items, by the calendar year of acquisition and total each column. Do not include items that are reported in Schedule A.

If you had any additions or disposals reported in Columns 1, 2, 3, or 4 during the period of January 1, 2009 through December 31, 2010, attach a schedule showing the month and year and description of each addition and disposal. Enclosed for this purpose is BOE-571-D, Supplemental Schedule for Reporting Monthly Acquisitions and Disposals of Property Reported on Schedule B of the Business Property Statement. If additional forms are needed, photocopy the enclosed BOE-571-D.

BOE-571-L (P7) REV. 16 (08-10)

Segregate the buildings and building or leasehold improvements into the two requested categories (items which have dual function will be classified according to their primary function). Examples of some property items and their most common categorization are listed below:

EXAMPLES OF STRUCTURE ITEMS, Column 1

An improvement will be classified as a structure when its primary use or purpose is for housing or accommodation of personnel, personalty, or fixtures and has no direct application to the process or function of the industry, trade, or profession.

Air conditioning (except process cooling) Boilers (except manufacturing process) Central heating & cooling plants Craneways

Elevators

Environmental control devices (if an integral part of the structure) Fans & ducts (part of an air circulation system for the building) Fire alarm systems

Partitions (floor to ceiling)

Pipelines, pipe supports & pumps used to operate the facilities of a building

Pits not used in the trade or process Railroad spurs

Refrigeration systems (integral part of the building) Refrigerators, walk-in (excluding operating equipment)

which are an integral part of the building Restaurants — rough plumbing to fixtures Safes — imbedded

Signs which are an integral part of the building excluding sign cabinet (face & lettering)

Silos or tanks when primarily used for storage or distribution Sprinkler systems

Store fronts

Television & radio antenna towers

EXAMPLES OF FIXTURE ITEMS, Column 2

An improvement will be classified as a fixture if its use or purpose directly applies to or augments the process or function of a trade, industry, or profession.

Air conditioning (process cooling) Boilers (manufacturing process) Burglar alarm systems

Conveyors (to move materials and products) Cranes — traveling

Environmental control devices (used in production process) Fans & ducts (used for processing)

Floors, raised computer rooms Furnaces, process

Ice dispensers, coin operated

Machinery fdns. & pits (not part of normal flooring fdns.) Permanent Partitions (less than floor to ceiling)

Pipelines, pipe supports, pumps used in the production process Pits used as clarifiers, skimmers, sumps & for greasing in the

trade or manufacturing process Plumbing — special purpose

Power wiring, switch gear & power panels used in mfg. process Refrigeration systems (not an integral part of the building) Refrigerators, walk-in unitized; including operating equipment Restaurant equipment used in food & drink preparation or service

(plumbing fixtures, sinks, bars, soda fountains, booths & counters, garbage disposals, dishwashers, hoods, etc.)

Scales including platform & pit

Signs — all sign cabinets (face) & free standing signs including supports

Silos or tanks when primarily used for processing

LINE 69. If you have items reportable in Schedule B which were acquired in 1987 or previously, you must attach a separate schedule detailing the cost of such items by year(s) of acquisition. Enter the total cost of such items on line 69.

LINE 71. Add totals on Line 70 and any additional schedules. Enter the same figure on PART II, Line 4 that you entered in the box.

LINE 72. Report tenant improvements for which you received allowances during this reporting period that are not reported on Schedule B.

DECLARATION BY ASSESSEE

The law requires that this property statement, regardless of where it is executed, shall be declared to be true under penalty of perjury under the laws of the State of California. The declaration must be signed by the assessee, a duly appointed fiduciary, or a person authorized to sign on behalf of the assessee. In the case of a corporation, the declaration must be signed by an officer or by an employee or agent who has been designated in writing by the board of directors, by name or by title, to sign the declaration on behalf of the corporation. In the case of a partnership, the declaration must be signed by a partner or an authorized employee or agent. In the case of a Limited Liability Company (LLC), the declaration must be signed by an LLC manager, or by a member where there is no manager, or by an employee or agent designated by the LLC manager or by the members to sign on behalf of the LLC.

When signed by an employee or agent, other than a member of the bar, a certified public accountant, a public accountant, an enrolled agent or a duly appointed fiduciary, the assessee’s written authorization of the employee or agent to sign the declaration on behalf of the assessee must be filed with the Assessor. The Assessor may at any time require a person who signs a property statement and who is required to have written authorization to provide proof of authorization.

A property statement that is not signed and executed in accordance with the foregoing instructions is not validly filed. The penalty imposed by Section 463 of the Revenue and Taxation Code for failure to file is applicable to unsigned property statements.