When working in the online tool for PDF editing by FormsPal, you may fill in or alter 641 form sba right here. To have our editor on the cutting edge of practicality, we work to implement user-oriented capabilities and improvements regularly. We are routinely pleased to receive suggestions - play a vital role in revolutionizing PDF editing. For anyone who is seeking to get started, this is what it takes:

Step 1: Click on the orange "Get Form" button above. It's going to open up our pdf tool so that you could begin filling in your form.

Step 2: Once you access the online editor, you'll notice the document made ready to be filled out. In addition to filling out various fields, you could also do other actions with the PDF, namely writing custom words, editing the original text, adding graphics, placing your signature to the PDF, and much more.

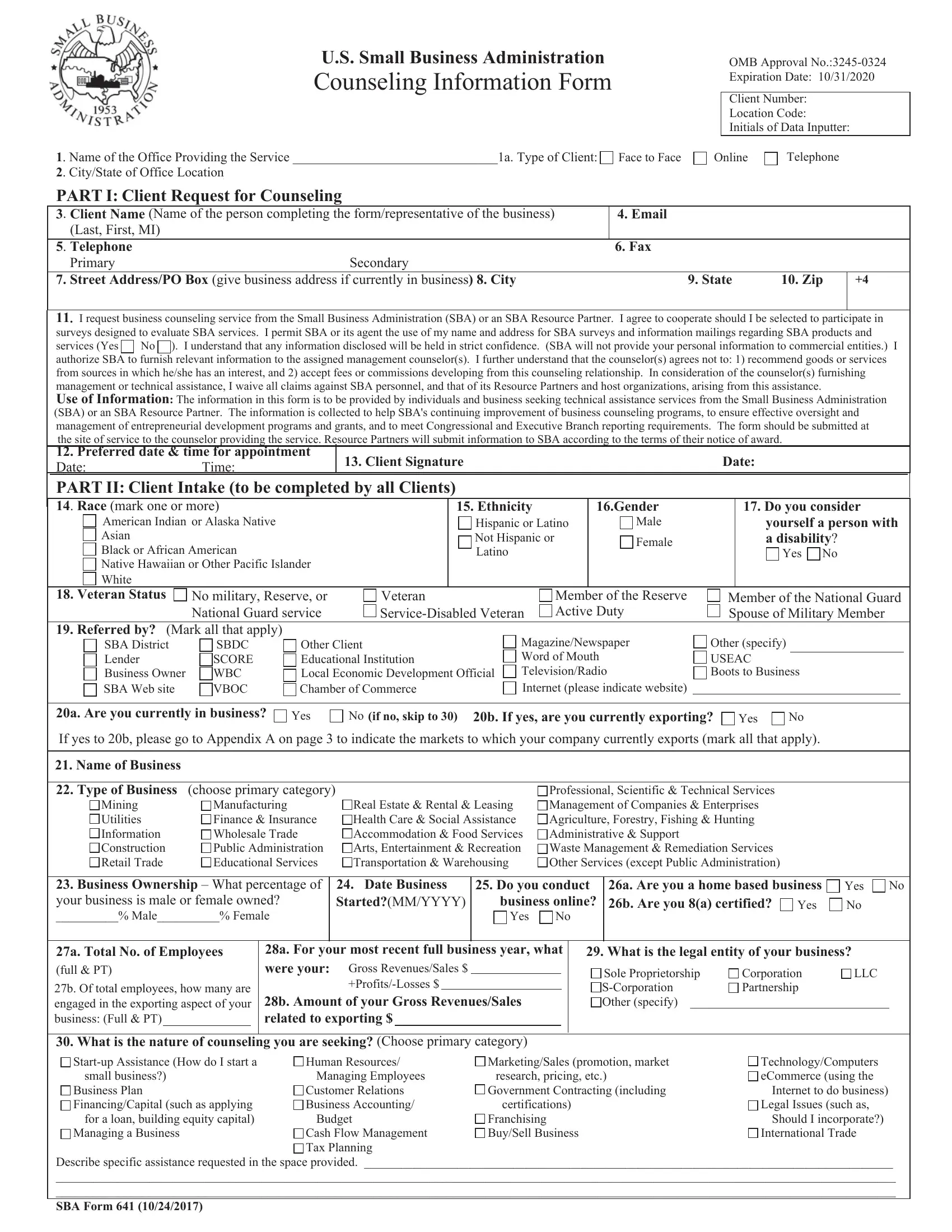

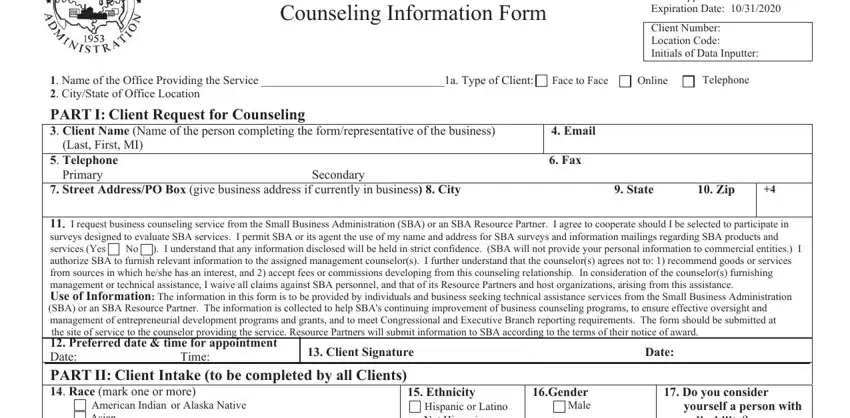

This document requires specific info to be typed in, thus you should take the time to enter what is expected:

1. While submitting the 641 form sba, be certain to complete all necessary blank fields in their corresponding part. It will help to expedite the process, making it possible for your details to be handled fast and correctly.

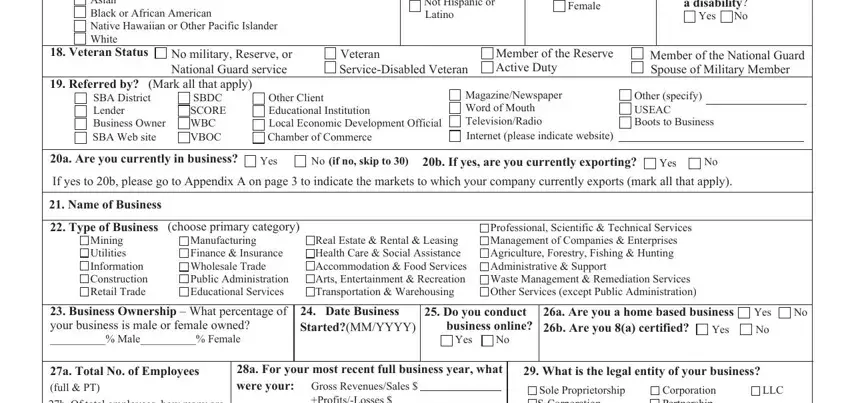

2. Soon after the first array of fields is done, go to type in the relevant information in these - Hispanic or Latino Not Hispanic or, Female, yourself a person with a, American Indian or Alaska Native, No military Reserve or National, Veteran Status, Referred by Mark all that apply, Veteran ServiceDisabled Veteran, Member of the Reserve Active Duty, Member of the National Guard, SBA District Lender Business Owner, SBDC SCORE WBC VBOC, Other Client Educational, MagazineNewspaper Word of Mouth, and Other specify USEAC Boots to.

Lots of people generally make errors while completing SBA District Lender Business Owner in this part. Make sure you double-check whatever you enter here.

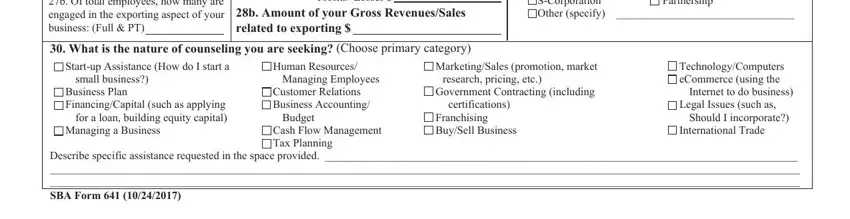

3. The third stage is normally straightforward - fill out every one of the blanks in Gross RevenuesSales ProfitsLosses, b Of total employees how many are, b Amount of your Gross, Sole Proprietorship SCorporation, Corporation Partnership, Startup Assistance How do I start a, Human Resources, MarketingSales promotion market, small business, Business Plan FinancingCapital, Managing a Business, Managing Employees, Customer Relations Business, Budget, and Cash Flow Management Tax Planning in order to complete the current step.

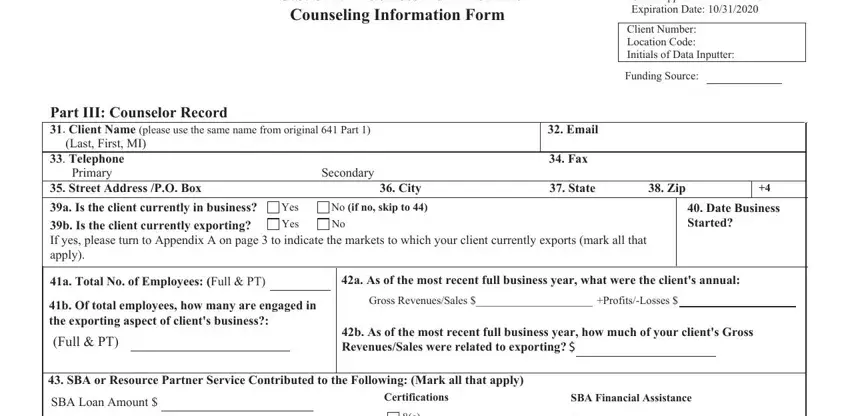

4. This part arrives with the following blank fields to type in your information in: US Small Business Administration, OMB Approval No Expiration Date, Client Number Location Code, Funding Source, Part III Counselor Record Client, Last First MI, Telephone, Email, Fax, Primary, Secondary, Street Address PO Box a Is the, City No if no skip to No, State, and Yes.

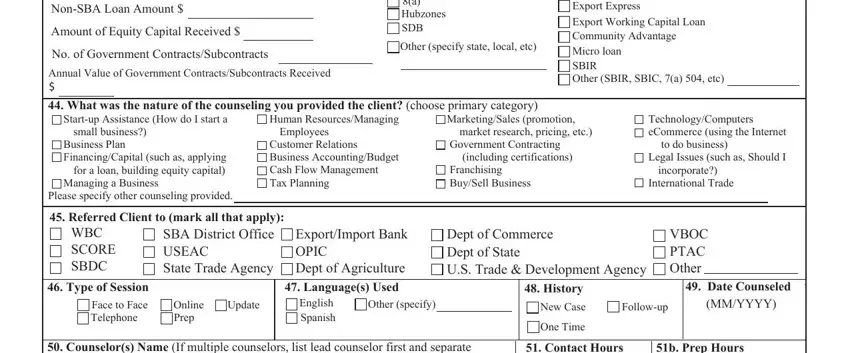

5. While you come near to the end of the form, there are actually just a few extra things to complete. In particular, NonSBA Loan Amount, Amount of Equity Capital Received, No of Government, a Hubzones SDB, Other specify state local etc, Annual Value of Government, Startup Assistance How do I start a, Human ResourcesManaging, MarketingSales promotion, small business, Business Plan FinancingCapital, Managing a Business, Employees, Customer Relations Business, and market research pricing etc must all be filled out.

Step 3: Check the information you've typed into the form fields and press the "Done" button. Get hold of the 641 form sba after you subscribe to a free trial. Quickly access the pdf form in your personal account, with any modifications and adjustments being automatically synced! At FormsPal, we strive to ensure that all your information is maintained secure.