W-2 can be completed online without any problem. Just use FormsPal PDF editor to complete the task without delay. Our team is dedicated to providing you the best possible experience with our tool by constantly adding new features and enhancements. With these improvements, using our tool gets easier than ever! To get started on your journey, take these basic steps:

Step 1: Simply click the "Get Form Button" above on this webpage to launch our pdf file editor. Here you'll find all that is needed to work with your document.

Step 2: After you open the editor, you will see the form all set to be filled out. Besides filling in different blanks, you could also do many other things with the form, such as putting on your own textual content, modifying the original textual content, inserting graphics, placing your signature to the form, and more.

This PDF form will require specific details; in order to ensure accuracy and reliability, make sure you bear in mind the suggestions directly below:

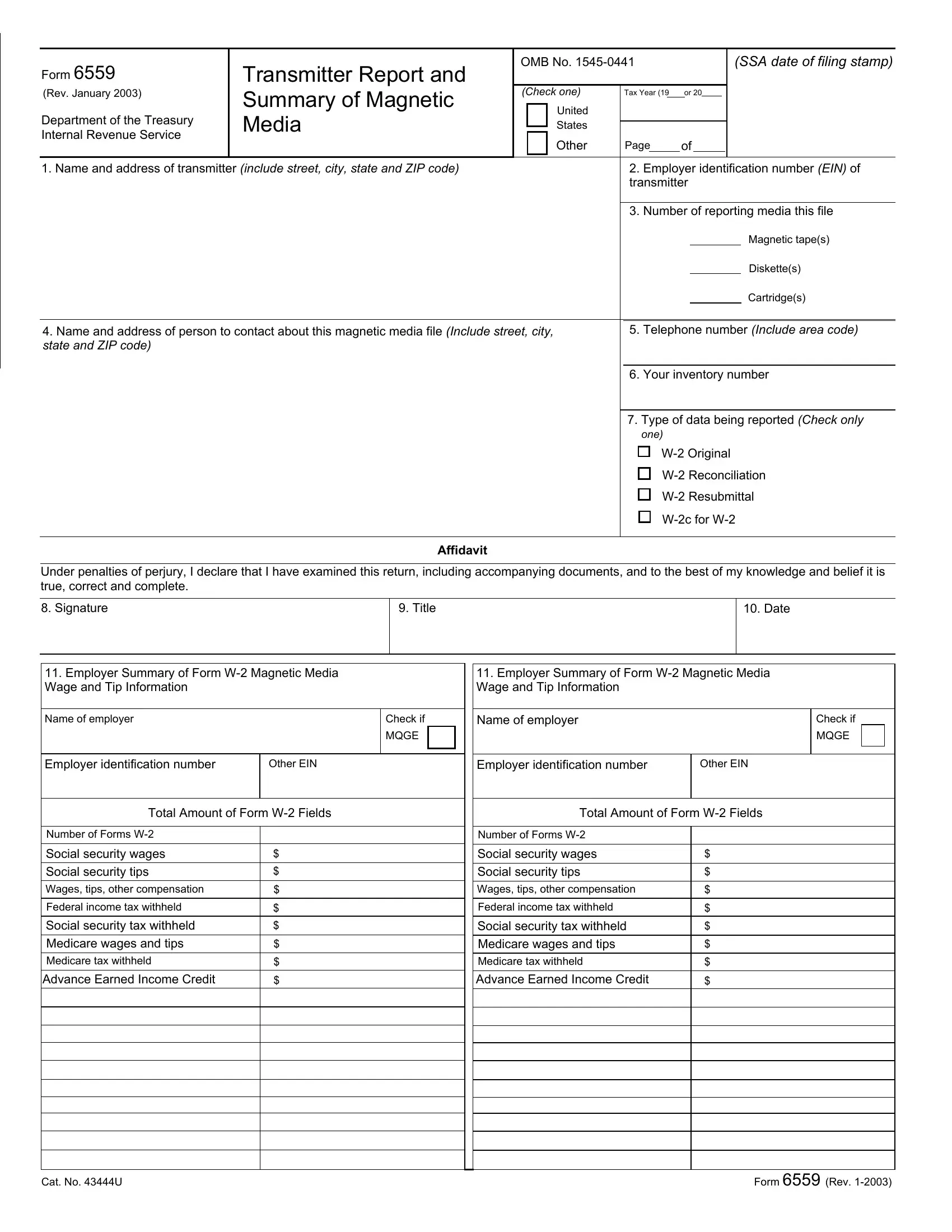

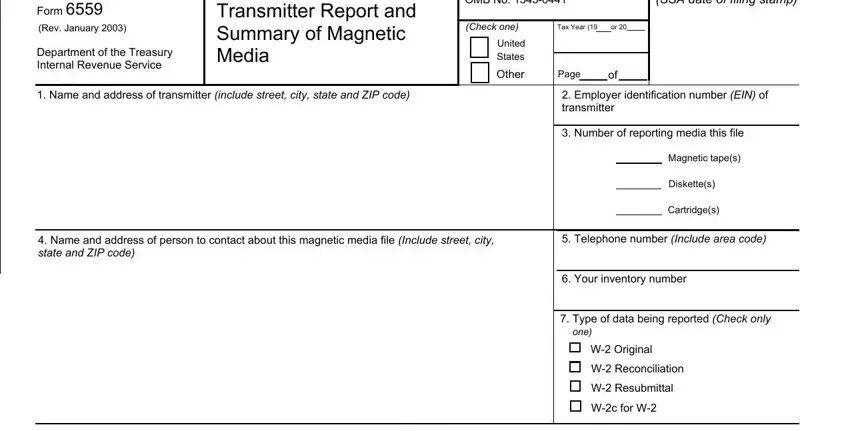

1. The W-2 involves certain information to be typed in. Make sure the subsequent blank fields are filled out:

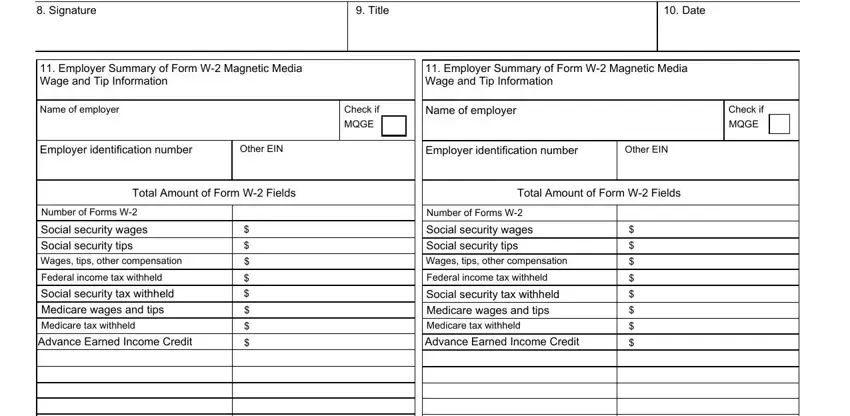

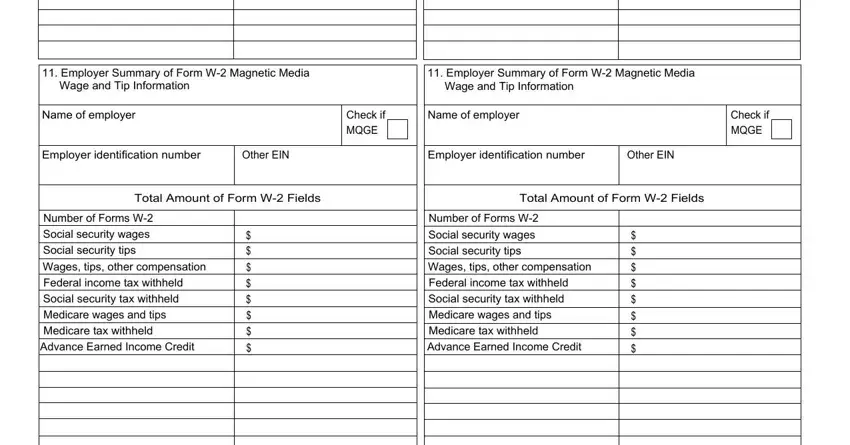

2. Just after filling out the previous part, go to the subsequent part and enter the essential details in these blanks - Signature, Title, Date, Employer Summary of Form W, Employer Summary of Form W, Name of employer, Check if, MQGE, Name of employer, Check if, MQGE, Employer identification number, Other EIN, Employer identification number, and Other EIN.

3. This 3rd part should be pretty uncomplicated, Cat No U, and Form Rev - each one of these fields will have to be filled in here.

As to Cat No U and Form Rev, make sure you double-check them here. Both these are certainly the most important ones in the PDF.

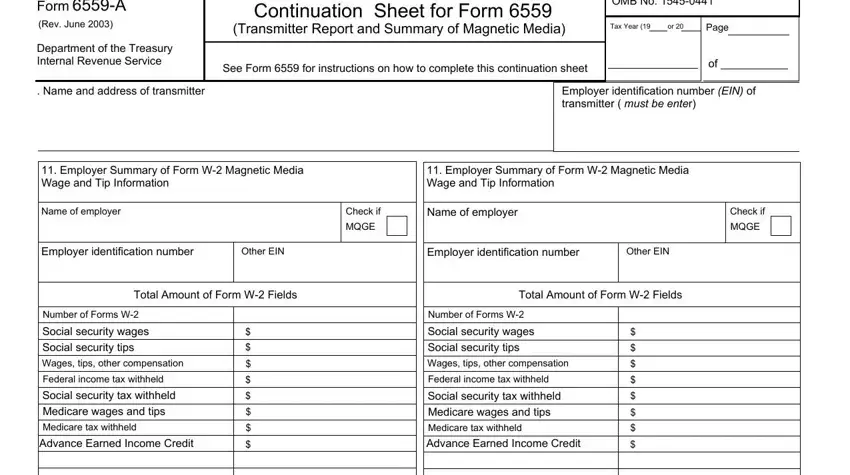

4. Your next part needs your details in the following places: Form A Rev June, Department of the Treasury, Name and address of transmitter, Continuation Sheet for Form, Transmitter Report and Summary of, OMB No, Tax Year or, Page, See Form for instructions on how, Employer identification number EIN, Employer Summary of Form W, Employer Summary of Form W, Name of employer, Check if, and MQGE. Be sure that you enter all requested info to go forward.

5. Now, the following last portion is what you will need to finish before closing the form. The blanks at this stage include the next: Employer Summary of Form W, Employer Summary of Form W, Wage and Tip Information, Wage and Tip Information, Name of employer, Check if MQGE, Name of employer, Check if MQGE, Employer identification number, Other EIN, Employer identification number, Other EIN, Total Amount of Form W Fields, Total Amount of Form W Fields, and Number of Forms W Social security.

Step 3: Make certain your details are accurate and simply click "Done" to conclude the task. Create a free trial plan at FormsPal and obtain instant access to W-2 - which you are able to then use as you would like in your FormsPal account. FormsPal is committed to the privacy of our users; we always make sure that all personal information used in our tool remains protected.