Form 740 Np R can be completed online in no time. Simply make use of FormsPal PDF editor to accomplish the job without delay. FormsPal is committed to providing you the ideal experience with our tool by constantly adding new capabilities and enhancements. Our editor has become much more intuitive as the result of the most recent updates! Now, filling out documents is easier and faster than ever before. Here is what you would want to do to begin:

Step 1: Simply press the "Get Form Button" above on this page to get into our pdf form editor. Here you'll find everything that is required to work with your document.

Step 2: With our online PDF file editor, it's possible to accomplish more than merely fill in blank form fields. Express yourself and make your docs look high-quality with custom textual content incorporated, or optimize the file's original input to perfection - all supported by an ability to incorporate your own graphics and sign the file off.

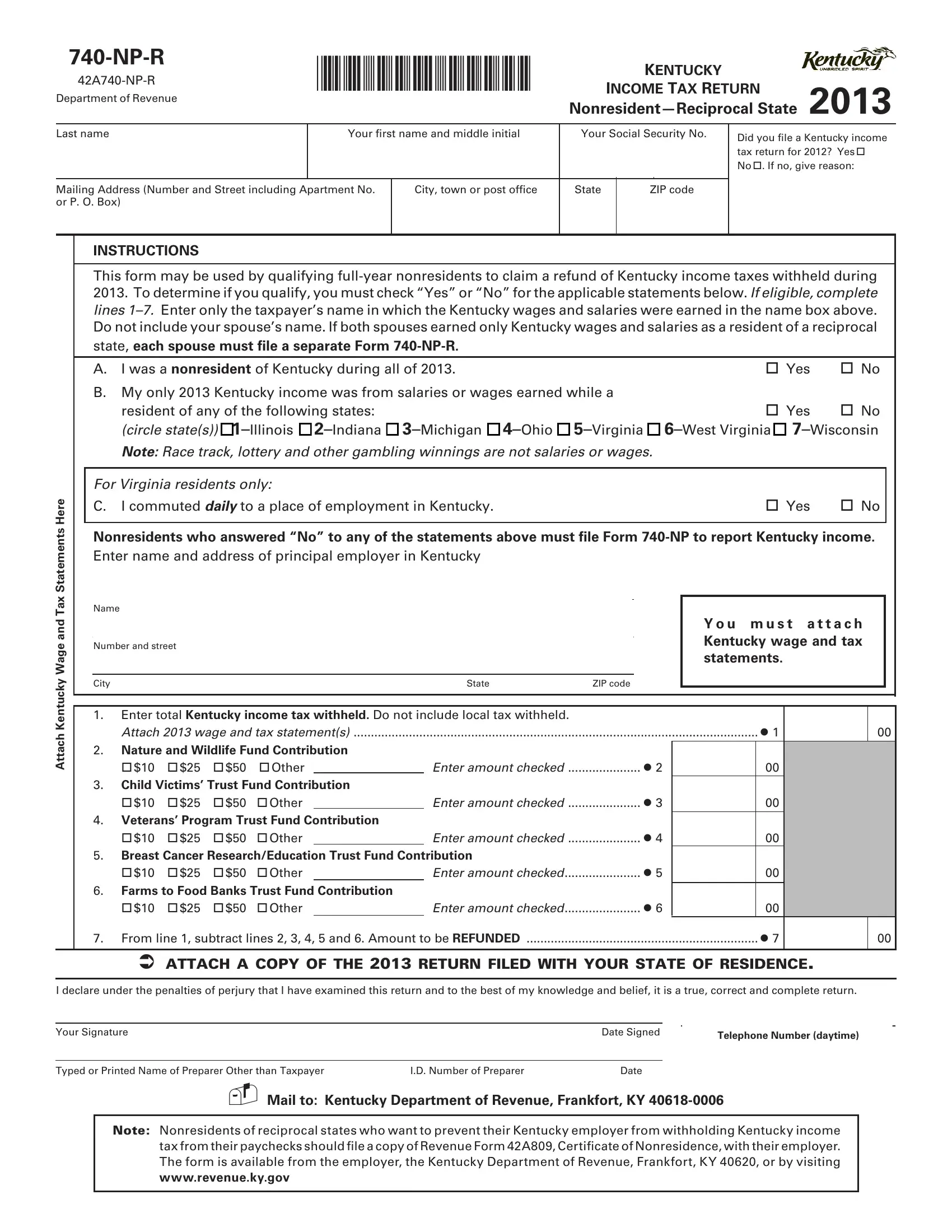

As a way to finalize this PDF document, ensure you type in the necessary details in every field:

1. It is crucial to complete the Form 740 Np R correctly, hence take care while filling out the parts that contain all of these blank fields:

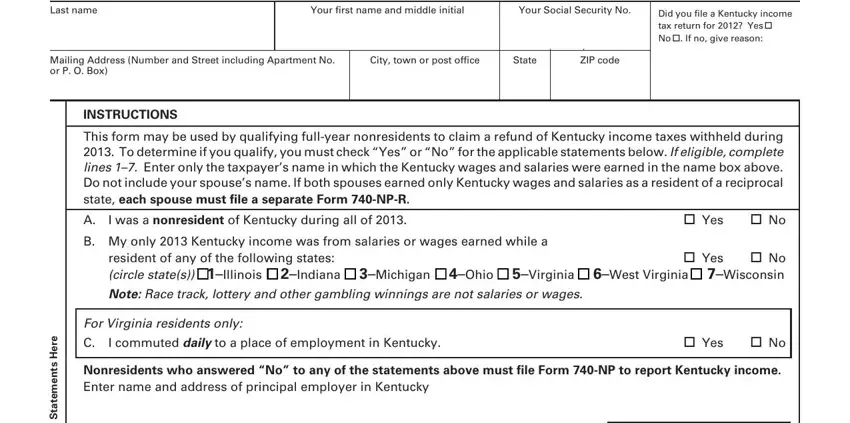

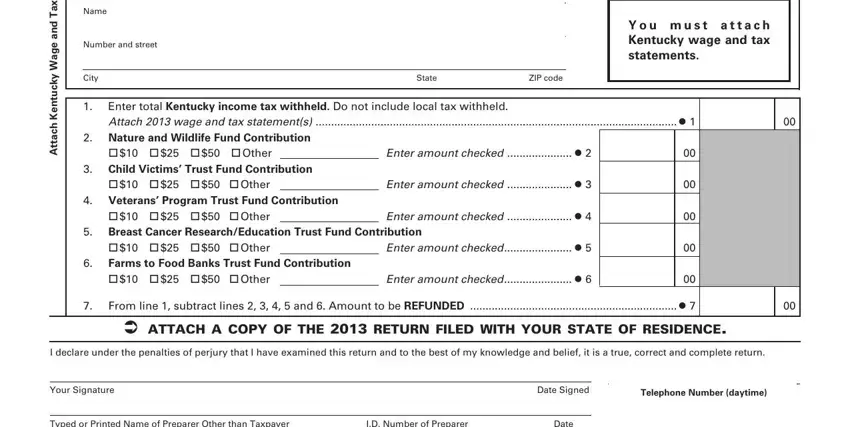

2. After this part is finished, you'll want to insert the necessary particulars in e r e H s t n e m e t a t S x a T, Name, Number and street, City, Y o u m u s t a t t a c h Kentucky, State, ZIP code, Attach wage and tax statements l, Other, Other, Enter total Kentucky income tax, Other Farms to Food Banks, Other, Enter amount checked l, and Enter amount checked l in order to move forward further.

People who work with this PDF frequently make some mistakes while completing Enter amount checked l in this part. Don't forget to reread whatever you enter here.

Step 3: Check what you have entered into the blanks and hit the "Done" button. After registering afree trial account at FormsPal, you will be able to download Form 740 Np R or send it through email right off. The PDF form will also be accessible via your personal account menu with your every single edit. At FormsPal.com, we do everything we can to make sure all your information is maintained private.