With the online tool for PDF editing by FormsPal, you can easily fill in or alter Form 760 Adj right here and now. Our professional team is always endeavoring to improve the tool and make it much easier for clients with its many functions. Unlock an endlessly innovative experience now - explore and uncover new possibilities along the way! Starting is effortless! Everything you need to do is take the next simple steps below:

Step 1: Click on the "Get Form" button above on this webpage to open our tool.

Step 2: Using this advanced PDF editor, you can do more than just complete forms. Express yourself and make your docs appear great with customized text put in, or modify the original input to perfection - all that accompanied by the capability to insert your personal photos and sign it off.

It is actually an easy task to complete the pdf following our detailed guide! Here's what you should do:

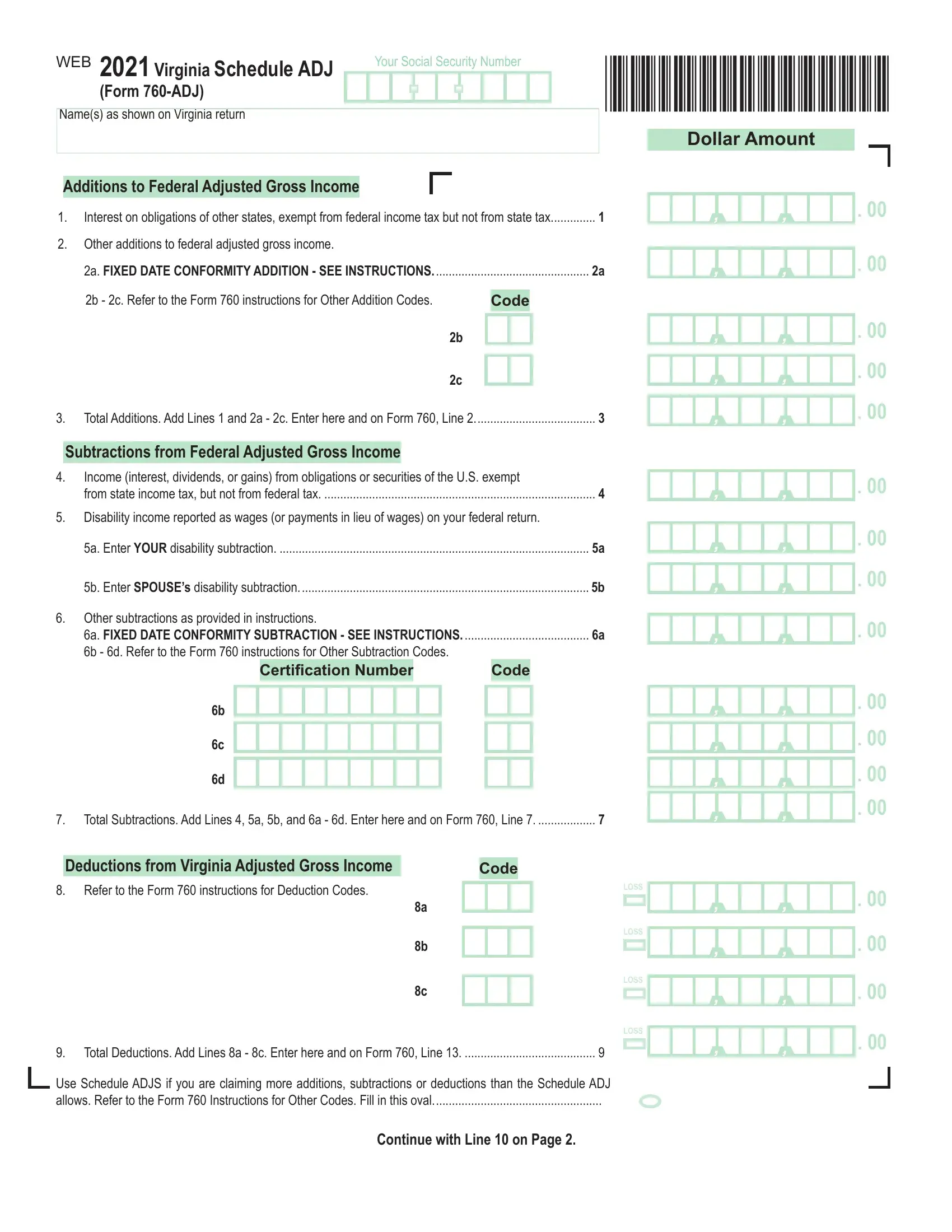

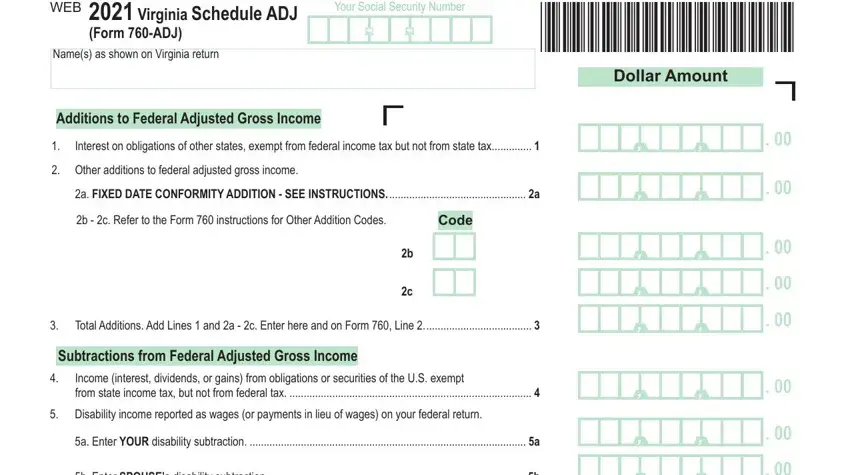

1. The Form 760 Adj needs certain details to be entered. Make sure the next fields are completed:

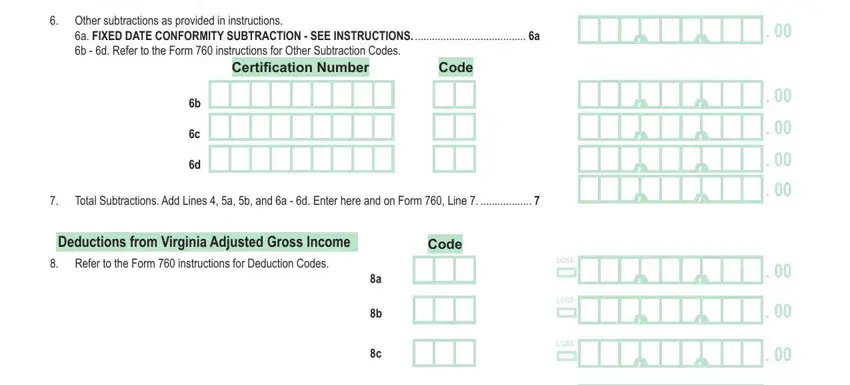

2. After the prior section is completed, go on to enter the suitable details in all these: b Enter SPOUSEs disability, Other subtractions as provided in, a FIXED DATE CONFORMITY, Certification Number, Code, Total Subtractions Add Lines a b, Deductions from Virginia Adjusted, Code, Refer to the Form instructions, loss, loss, and loss.

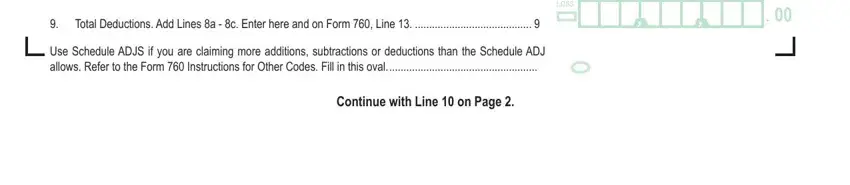

3. In this particular stage, check out loss, Total Deductions Add Lines a c, Use Schedule ADJS if you are, and Continue with Line on Page. These must be completed with utmost accuracy.

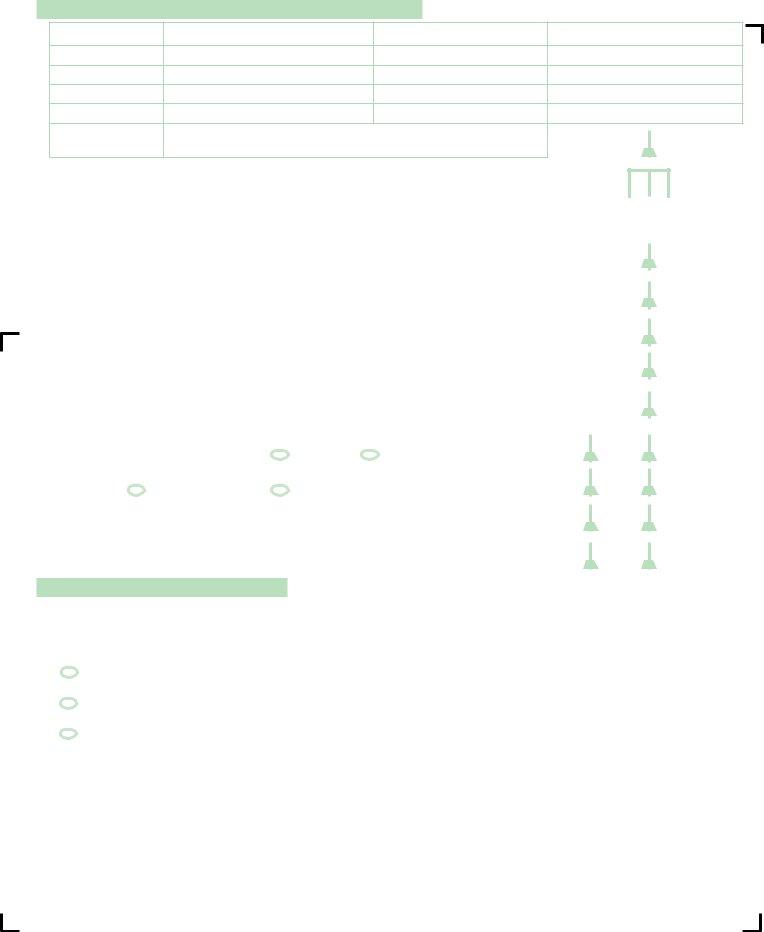

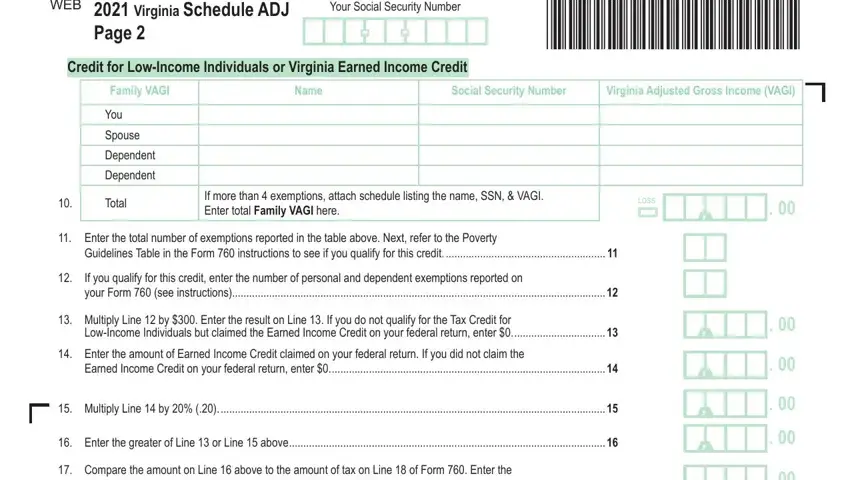

4. This specific paragraph comes with these particular blank fields to consider: WEB, Virginia Schedule ADJ Page, Your Social Security Number, VAADJ, Credit for LowIncome Individuals, Family VAGI, Name, Social Security Number, Virginia Adjusted Gross Income VAGI, You, Spouse, Dependent, Dependent, Total, and If more than exemptions attach.

Be really attentive when completing Virginia Adjusted Gross Income VAGI and VAADJ, as this is the part where many people make some mistakes.

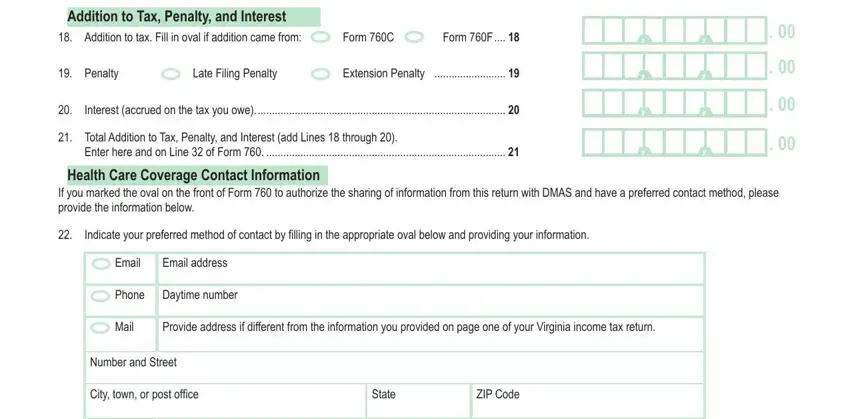

5. The document has to be finished by going through this section. Below you'll find a full listing of blank fields that need appropriate details to allow your document usage to be complete: Addition to Tax Penalty and, Addition to tax Fill in oval if, Form C, Form F, Penalty, Late Filing Penalty, Extension Penalty, Interest accrued on the tax you, Total Addition to Tax Penalty and, Enter here and on Line of Form, Health Care Coverage Contact, If you marked the oval on the, Indicate your preferred method of, Email, and Email address.

Step 3: Right after you've looked once again at the details in the file's blank fields, click "Done" to conclude your form. Sign up with us today and instantly get access to Form 760 Adj, available for downloading. All adjustments made by you are kept , helping you to change the pdf at a later time when necessary. Here at FormsPal, we do our utmost to guarantee that all of your information is stored secure.