|

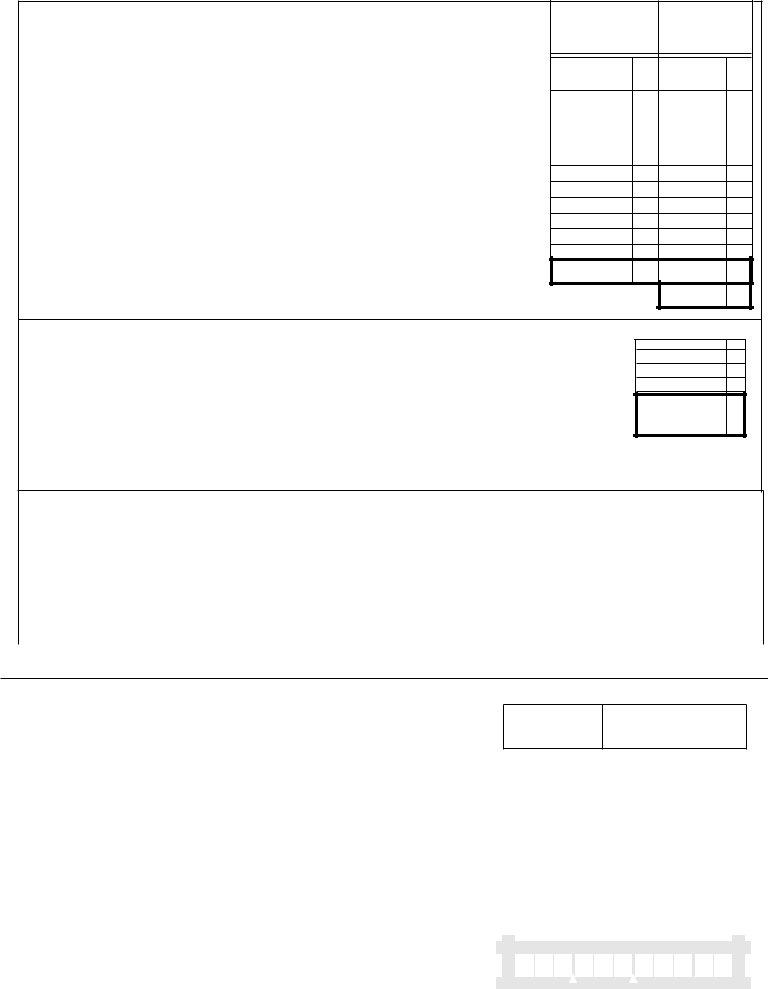

Commissioner of the Revenue |

|

|

|

Treasurer |

|

|

|

|

* Denotes Department of Taxation |

|

|

|

* Denotes Department of Taxation |

|

|

|

|

|

|

|

|

|

|

|

|

City/County |

Local Phone |

Address |

ZIP Code |

City/County |

Local Phone Address |

|

ZIP Code |

099 |

King George Co |

540-775-4664 |

. 10459 Courthouse Dr., Suite 101, |

|

099 |

King George Co |

540-775-2571 . 10459 Courthouse Dr., Suite 100, |

|

|

|

|

|

King George |

22485-3865 |

|

|

King George |

. . . . . . |

22485 |

101 |

King William Co |

804-769-4941 |

. P.O. Box 1478, Richmond |

23218-1478 |

101 |

King William Co |

804-769-4930 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

103 |

Lancaster County . . . |

804-462-7920 |

. 8311 Mary Ball Rd., Ste. 203, |

|

|

103 |

Lancaster County . . . |

804-462-5630 . 8311 Mary Ball Rd., Suite 204, |

|

|

|

|

|

|

Lancaster |

. . . . . |

22503 |

|

|

Lancaster |

. . . . . . |

22503 |

105 |

Lee County |

276-346-7722 |

. P.O. Box 96, Jonesville |

. . . . . |

24263 |

105 |

Lee County |

276-346-7716 . P.O. Box 70, Jonesville |

. . . . . . |

24263 |

678 |

Lexington City |

540-462-3701 |

300 E Washington St., Ste 103 |

|

|

678 |

Lexington City |

540-462-3707 . P.O. Box 920, Lexington |

. . . . . . |

24450 |

|

|

|

Lexington |

. . . . . |

24450 |

107 |

Loudoun County* . . . |

703-777-0260 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

107 |

Loudoun County* |

703-777-0260 |

. P.O. Box 1478, Richmond |

23218-1478 |

109 |

Louisa County |

540-967-3435 . 1 Woolfolk Ave., Ste. 202, Louisa. . . . |

23093 |

109 |

Louisa County |

540-967-3432 |

. 1 Woolfolk Ave, Ste. 203, Louisa . . . . |

23093 |

111 Lunenburg County . . |

434-696-3354 . 11512 Courthouse Rd.,Suite 100, |

|

|

111 Lunenburg County . . |

434-696-2516 |

. 11512 Courthouse Rd., Ste. 101 |

|

|

|

Lunenburg |

. . . . . . |

23952 |

|

|

|

Lunenburg |

. . . . . |

23952 |

680 |

Lynchburg City |

434-455-4242 . 900 Church St., Lynchburg . . |

. . . . . . |

24504 |

680 |

Lynchburg City |

434-455-3870 |

. P.O. Box 858, Lynchburg |

24505-0858 |

113 Madison County . . . . |

540-948-4409 . P.O. Box 309, Madison |

. . . . . . |

22727 |

113 Madison County . . . . |

540-948-4421 |

. P.O. Box 56, Madison |

. . . . . |

22727 |

683 |

Manassas City* |

703-257-8222 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

683 |

Manassas City* |

703-257-8222 |

. P.O. Box 1478, Richmond |

23218-1478 |

685 |

Manassas Park City* |

703-335-8835 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

685 |

Manassas Park City* |

703-335-8825 |

. P.O. Box 1478, Richmond |

23218-1478 |

690 |

Martinsville City*. . . . |

276-403-5240 . P.O. Box 1478, Richmond. . . . |

23218-14783 |

690 |

Martinsville City*. . . . |

276-403-5131 |

. P.O. Box 1478, Richmond |

23218-1478 |

115 Mathews County* . . . |

804-725-2341 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

115 Mathews County* . . . |

804-725-7168 |

. P.O. Box 1478, Richmond |

23218-1478 |

117 Mecklenburg Co |

434-738-6191 . P.O. Box 250, Boydton |

. . . . . . |

23917 |

117 Mecklenburg Co |

434-738-6191 |

. P.O. Box 360, Boydton |

. . . . . |

23917 |

119 Middlesex County . . . |

804-758-5302 . P.O. Box |

182 Saluda |

. 23149-0182 |

119 Middlesex County . . . |

804-758-5331 |

. P.O. Box 148, Saluda |

23149-0148 |

121 |

Montgomery Co |

540-382-5723 . 755 Roanoke St., Suite 1B, |

|

|

|

121 |

Montgomery Co |

540-382-5710 |

. 755 Roanoke St., Ste. 1-A, |

|

|

|

|

Christiansburg |

. 24073-3169 |

|

|

|

Christiansburg |

24073-3170 |

125 |

Nelson County |

434-263-7060 . P.O. Box 100, Lovingston . . . . |

. . . . . . |

22949 |

125 |

Nelson County |

434-263-7070 |

. P.O. Box 246, Lovingston |

. . . . . |

22949 |

127 |

New Kent County . . . |

804-966-9615 . P.O. Box 109, New Kent |

. . . . . . |

23124 |

127 |

New Kent County . . . |

804-966-9610 |

. P.O. Box 99, New Kent |

. . . . . |

23124 |

700 |

Newport News City. . |

757-926-8740 . P.O. Box 975, Newport News . |

. . . . . . |

23607 |

700 |

Newport News City. . |

757-926-8653 |

. 2400 Washington Ave., Newport News 23607 |

710 |

Norfolk City |

757-664-7800 . P.O. Box 3215, Norfolk |

. 23514-3215 |

710 |

Norfolk City |

757-664-7885 |

. P.O. Box 2260, Norfolk |

23501-2260 |

131 |

Northampton Co. . . . |

757-678-0450 . P.O. Box 598, Eastville |

. . . . . . |

23347 |

131 |

Northampton Co. . . . |

757-678-0446 |

. P.O. Box 65, Eastville |

. . . . . |

23347 |

133 |

Northumberland Co. . |

804-580-5201 . P.O. Box 297, Heathsville . . . . |

. . . . . . |

22473 |

133 |

Northumberland Co. . |

804-580-4600 |

. P.O. Box 309, Heathsville |

. . . . . |

22473 |

720 |

Norton City |

276-679-7246 . P.O. Box 618, Norton |

. . . . . . |

24273 |

720 |

Norton City |

276-679-0031 |

. P.O. Box 347, Norton |

. . . . . |

24273 |

135 |

Nottoway County . . . |

434-645-9318 . P.O. Box 85, Nottoway |

. . . . . . |

23955 |

135 |

Nottoway County . . . |

434-645-9317 |

. P.O. Box 5, Nottoway |

. . . . . |

23955 |

137 |

Orange County |

540-672-2656 . P.O. Box 469, Orange |

. . . . . . |

22960 |

137 |

Orange County |

540-672-4441 |

. P.O. Box 389, Orange |

. . . . . |

22960 |

139 |

Page County |

540-743-3975 . 103 S. Court St., Ste. A, Luray |

. . . . . . |

22835 |

139 |

Page County |

540-743-3840 |

. 103 S. Court St., Suite C, Luray |

. . . . . |

22835 |

141 |

Patrick County* |

276-694-7257 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

141 |

Patrick County* |

276-694-7131 |

. P.O. Box 1478, Richmond |

23218-1478 |

730 |

Petersburg City |

804-733-2322 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

730 |

Petersburg City |

804-733-2315 |

. P.O. Box 1478, Richmond |

23218-1478 |

143 |

Pittsylvania Co |

434-432-7960 . P.O. Box 230, Chatham |

. 24531-0230 |

143 |

Pittsylvania Co |

434-432-7940 |

. P.O. Box 272, Chatham |

24531-0272 |

735 |

Poquoson City |

757-868-3015 . P.O. Box 2319, Poquoson . . . |

. 23662-0319 |

735 |

Poquoson City |

757-868-3020 |

. 500 City Hall Ave., Poquoson . . |

. . . . . |

23662 |

740 |

Portsmouth City . . . . |

757-393-8651 . 801 Crawford St., Portsmouth |

. . . . . . |

23704 |

740 |

Portsmouth City . . . . |

757-393-8773 |

. 801 Crawford St., Portsmouth . |

. . . . . |

23704 |

145 |

Powhatan County . . . |

804-598-5625 . 3834 Old Buckingham Rd., Ste. D, |

|

|

145 Powhatan County |

804-598-5616. . .3834 Old Buckingham Rd., Suite C, |

|

|

|

Powhatan |

. . . . . . |

23139 |

|

|

|

Powhatan |

. . . . . . |

23139 |

147 |

Prince Edward Co. . . |

434-392-3454 . P.O. Box 522, Farmville |

. . . . . . |

23901 |

147 |

Prince Edward Co. . . |

434-392-3231 |

. P.O. Box 446, Farmville |

. . . . . |

23901 |

149 |

Prince George Co. . . |

804-722-8750 . P.O. Box 156, Prince George |

. . . . . . |

23875 |

149 |

Prince George Co. . . |

804-722-8740 |

. P.O. Box 155, Prince George . |

. . . . . |

23875 |

153 |

Prince William Co.* . |

703-792-6710 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

153 |

Prince William Co.*. . |

703-792-6710 |

. P.O. Box 1478, Richmond |

23218-1478 |

155 |

Pulaski County |

540-980-7785 . 52 W. Main St., Ste.100, Pulaski . . . . |

24301 |

155 |

Pulaski County |

540-980-7750 |

. 52 W. Main Street, Suite 200, Pulaski 24301 |

750 |

Radford City* |

540-731-3661 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

750 |

Radford City* |

540-731-3613 |

. P.O. Box 1478, Richmond |

23218-1478 |

157 |

Rappahannock Co. . |

540-675-5360 . P.O. Box 37, Washington . . . . |

. . . . . . |

22747 |

157 |

Rappahannock Co.. . |

540-675-5370 |

. P.O. Box 115, Washington . . . . |

. . . . . |

22747 |

760 |

Richmond City* |

804-646-6474 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

760 |

Richmond City * . . . . |

804-646-5195 |

. P.O. Box 1478, Richmond |

23218-1478 |

159 |

Richmond County. . . |

804-333-3555 . P.O. Box 400, Warsaw |

. . . . . . |

22572 |

159 |

Richmond County. . . |

804-333-3722 |

. P.O. Box 366, Warsaw |

. . . . . |

22572 |

770 |

Roanoke City |

540-853-2561 . P.O. Box 1451, Roanoke . . . . |

. . . . . . |

24007 |

770 |

Roanoke City |

540-853-6543 |

. P.O. Box 718, Roanoke |

. . . . . |

24004 |

161 |

Roanoke County. . . . |

540-772-2056 . P.O. Box 21009, Roanoke . . . |

. . . . . . |

24018 |

161 |

Roanoke County. . . . |

540-772-2049 |

. P.O. Box 21709, Roanoke . . . . |

. . . . . |

24018 |

163 |

Rockbridge Co |

540-463-2613 . P.O. Box 784, Lexington |

. . . . . . |

24450 |

163 |

Rockbridge Co |

540-463-3431 |

. P.O. Box 1160, Lexington |

. . . . . |

24450 |

165 |

Rockingham Co |

540-564-3053 . P.O. Box 471, Harrisonburg . . |

. 22803-0471 |

165 |

Rockingham Co |

540-564-3071 |

. 20 E. Gay St., Harrisonburg . . . |

. . . . . |

22802 |

167 |

Russell County |

276-889-8028 . 137 Highland Dr., Ste B, Lebanon . . . |

24266 |

167 |

Russell County |

276-889-8018 |

. 137 Highland Dr., Ste C, Lebanon . . . |

24266 |

775 |

Salem City |

540-375-3024 . P.O. Box 869, Salem |

. 24153-0869 |

775 |

Salem City |

540-375-3019 |

. P.O. Box 869, Salem |

24153-0869 |

169 |

Scott County |

276-386-7742 . 190 Beech St., Suite 205, |

|

|

|

169 |

Scott County |

276-386-7692 |

. 190 Beech Street, Suite 206, |

|

|

|

|

Gate City |

. . . . . . |

24251 |

|

|

|

Gate City |

. . . . . |

24251 |

171 |

Shenandoah Co.* . . . |

540-459-6180 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

171 |

Shenandoah Co.* . . . |

540-459-6170 |

. P.O. Box 1478, Richmond |

23218-1478 |

173 |

Smyth County |

276-782-4059 . P.O. Box 549, Marion |

. . . . . . |

24354 |

173 |

Smyth County |

276-782-4040 |

. P.O. Box 985, Marion |

. . . . . |

24354 |

175 |

Southampton Co. . . . |

757-653-3025 . P.O. Box 250, Courtland |

. . . . . . |

23837 |

175 |

Southampton Co. . . . |

757-653-3030 |

. P.O. Box 760, Courtland |

. . . . . |

23837 |

177 |

Spotsylvania Co |

540-507-7058 . P.O. Box 100, Spotsylvania . . |

. . . . . . |

22553 |

177 |

Spotsylvania Co |

540-507-7054 |

. P.O. Box 175, Spotsylvania . . . |

. . . . . |

22553 |

179 |

Stafford County |

540-658-8700 . P.O. Box 68, Stafford |

. . . . . . |

22555 |

179 |

Stafford County |

540-658-4132 |

. P.O. Box 98, Stafford |

22555-0098 |

790 |

Staunton City |

540-332-3833 . P.O. Box 474, Staunton |

. . . . . . |

24402 |

790 |

Staunton City |

540-332-3829 |

. P.O. Box 4, Staunton |

24402-0004 |

800 |

Suffolk City |

757-514-4275 . P.O. Box 1583, Suffolk |

. . . . . . |

23439 |

800 |

Suffolk City |

757-514-4260 |

. P.O. Box 1459, Suffolk |

23439-1459 |

181 |

Surry County |

757-294-5206 . P.O. Box 286, Surry |

. . . . . . |

23883 |

181 |

Surry County |

757-294-5225 |

. P.O. Box 35, Surry |

. . . . . |

23883 |

183 |

Sussex County |

434-246-1087 . P.O. Box 1399, Sussex |

. . . . . . |

23884 |

183 |

Sussex County |

434-246-1030 |

. P.O. Box 1398, Sussex |

. . . . . |

23884 |

185 |

Tazewell County . . . . |

276-385-1300 . P.O. Box 969, Tazewell |

. 24651-0969 |

185 |

Tazewell County . . . . |

276-385-1239 |

. 135 Court St., Ste. 301, Tazewell . . . . |

24651 |

810 |

Virginia Beach City . . |

757-385-4445 . 2401 Courthouse Dr., Bldg 1., |

|

|

|

810 |

Virginia Beach City . . |

757-385-4483 |

. 2401 Courthouse Dr., Bldg.1, |

|

|

|

|

Virginia Beach |

. 23456-9018 |

|

|

|

Virginia Beach |

23456-9002 |

187 |

Warren County |

540-635-2215 . P.O. Box 1540, Front Royal . . |

. 22630-1540 |

187 |

Warren County |

540-635-2651 |

. P.O. Box 1775, Front Royal . . . |

22630-0038 |

191 |

Washington Co |

276-676-6272 . One Government Center Place, Ste. B, |

191 |

Washington Co |

276-676-6270 |

. One Government Center Place, Ste. C, |

|

|

Abingdon |

. 24210-8484 |

|

|

|

Abingdon |

24210-8484 |

820 |

Waynesboro City . . . |

540-942-6606 . 503 W. Main St., Room 105, |

|

|

|

820 |

Waynesboro City . . . |

540-942-6612 |

. 503 W. Main St., Rm. 107, |

|

|

|

|

Waynesboro |

. . . . . . |

22980 |

|

|

|

Waynesboro |

. . . . . |

22980 |

193 |

Westmoreland Co. . . |

804-493-0124 . P.O. Box 730, Montross |

. . . . . . |

22520 |

193 |

Westmoreland Co. . . |

804-493-0113 |

. P.O. Box 68, Montross |

. . . . . |

22520 |

830 |

Williamsburg City . . . |

757-220-6155 . P.O. Box 886, Williamsburg . . |

. . . . . . |

23187 |

830 |

Williamsburg City . . . |

757-220-6150 |

. P.O. Box 245, Williamsburg . . . |

. . . . . |

23187 |

840 |

Winchester City . . . . |

540-667-1815 . P.O. Box 1478, Richmond. . . . |

. 23218-1478 |

840 |

Winchester City . . . . |

540-667-1815 |

. P.O. Box 1478, Richmond |

23218-1478 |

195 |

Wise County |

276-328-4077 . P.O. Box 1308, Wise |

. . . . . . |

24293 |

195 |

Wise County |

276-328-3556 |

. P.O. Box 1278, Wise |

. . . . . |

24293 |

197 |

Wythe County |

276-223-6070 . 225 S. 4th St., Rm. 104, Wytheville . . |

24382 |

197 |

Wythe County |

276-223-6015 |

. 225 S. 4th St., Ste. 101, Wytheville . . |

24382 |

199 |

York County |

757-890-3420 P.O. Box 251, Yorktown |

. 23690-0251 |

199 |

York County |

757-890-3381 |

. P.O. Box 90, Yorktown |

23690-0090 |

|

|

|

|

|

|

|