Using the online PDF editor by FormsPal, you are able to fill in or change Form 760Py here. In order to make our tool better and easier to use, we constantly come up with new features, taking into account suggestions coming from our users. With just a few basic steps, you can begin your PDF journey:

Step 1: Firstly, access the pdf editor by pressing the "Get Form Button" at the top of this page.

Step 2: With the help of our advanced PDF tool, you'll be able to accomplish more than just fill in blank fields. Try all the features and make your docs appear great with custom textual content incorporated, or modify the original content to excellence - all comes with the capability to insert just about any photos and sign the file off.

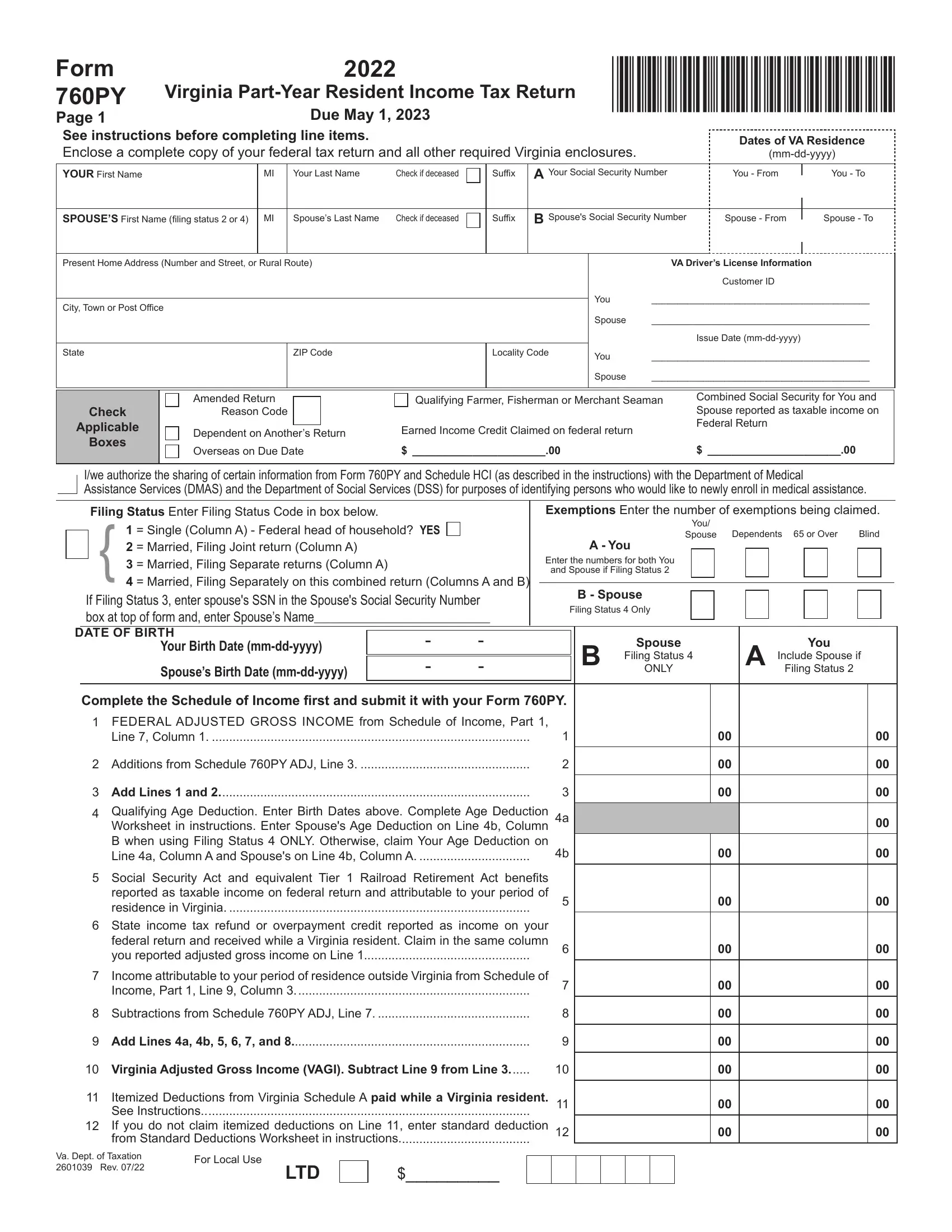

This PDF form will need particular data to be typed in, hence you must take the time to provide what's requested:

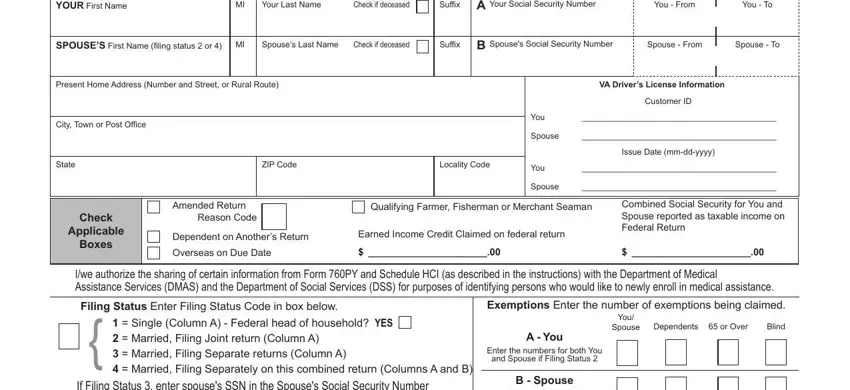

1. Whenever submitting the Form 760Py, make sure to complete all of the essential blanks within its corresponding form section. This will help hasten the process, allowing your information to be processed efficiently and correctly.

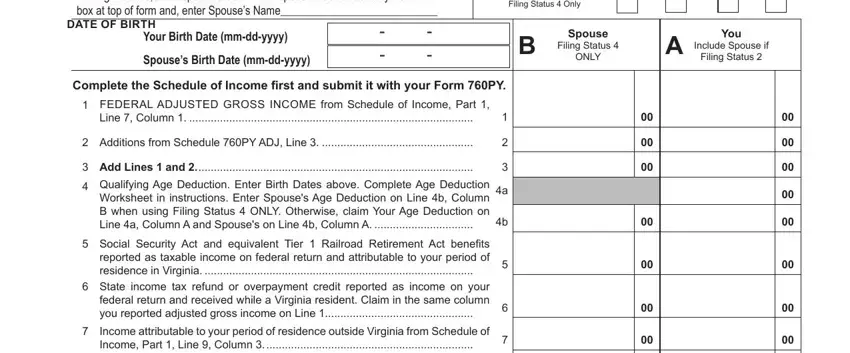

2. Given that the previous part is finished, you need to add the required specifics in DATE OF BIRTH, If Filing Status enter spouses, Your Birth Date mmddyyyy, Spouses Birth Date mmddyyyy, Complete the Schedule of Income, FEDERAL ADJUSTED GROSS INCOME, Line Column, Additions from Schedule PY ADJ, Add Lines and Qualifying Age, Social Security Act and, State income tax refund or, Income attributable to your, Income Part Line Column, Filing Status Only, and B Spouse so that you can go further.

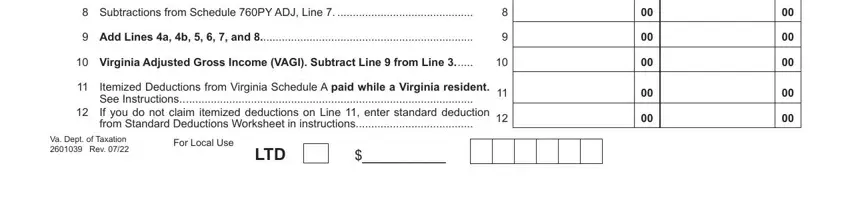

3. This 3rd section is relatively easy, Subtractions from Schedule PY ADJ, Add Lines a b and, Virginia Adjusted Gross Income, Itemized Deductions from Virginia, See Instructions, If you do not claim itemized, from Standard Deductions Worksheet, Va Dept of Taxation Rev, For Local Use, and LTD - all these empty fields is required to be completed here.

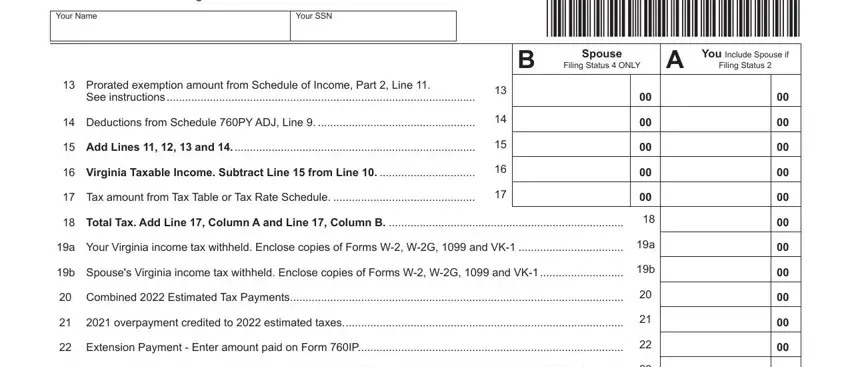

4. The next section needs your information in the subsequent places: Form PY Page, Your Name, Your SSN, VAP, Spouse, Filing Status ONLY A You Include, Filing Status, Prorated exemption amount from, See instructions, Deductions from Schedule PY ADJ, Add Lines and, Virginia Taxable Income Subtract, Tax amount from Tax Table or Tax, Total Tax Add Line Column A and, and a Your Virginia income tax. Remember to fill in all of the requested information to go onward.

You can potentially make errors while filling in the VAP, hence be sure you go through it again before you'll send it in.

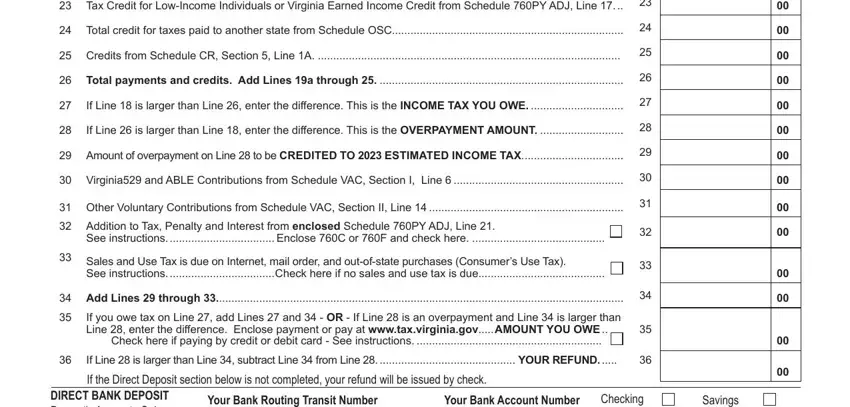

5. Lastly, the following last segment is what you will need to wrap up prior to submitting the form. The blank fields in question include the next: Tax Credit for LowIncome, Total credit for taxes paid to, Credits from Schedule CR Section, Total payments and credits Add, If Line is larger than Line, If Line is larger than Line, Amount of overpayment on Line to, Virginia and ABLE Contributions, Other Voluntary Contributions, Addition to Tax Penalty and, See instructions Enclose C or F, Sales and Use Tax is due on, See instructions Check here if no, Add Lines through If you owe, and DIRECT BANK DEPOSIT Domestic.

Step 3: Right after proofreading your filled in blanks, click "Done" and you are all set! Sign up with us right now and instantly get Form 760Py, available for download. Each and every modification you make is conveniently kept , enabling you to edit the file later when necessary. Here at FormsPal.com, we do everything we can to be certain that all of your information is kept private.