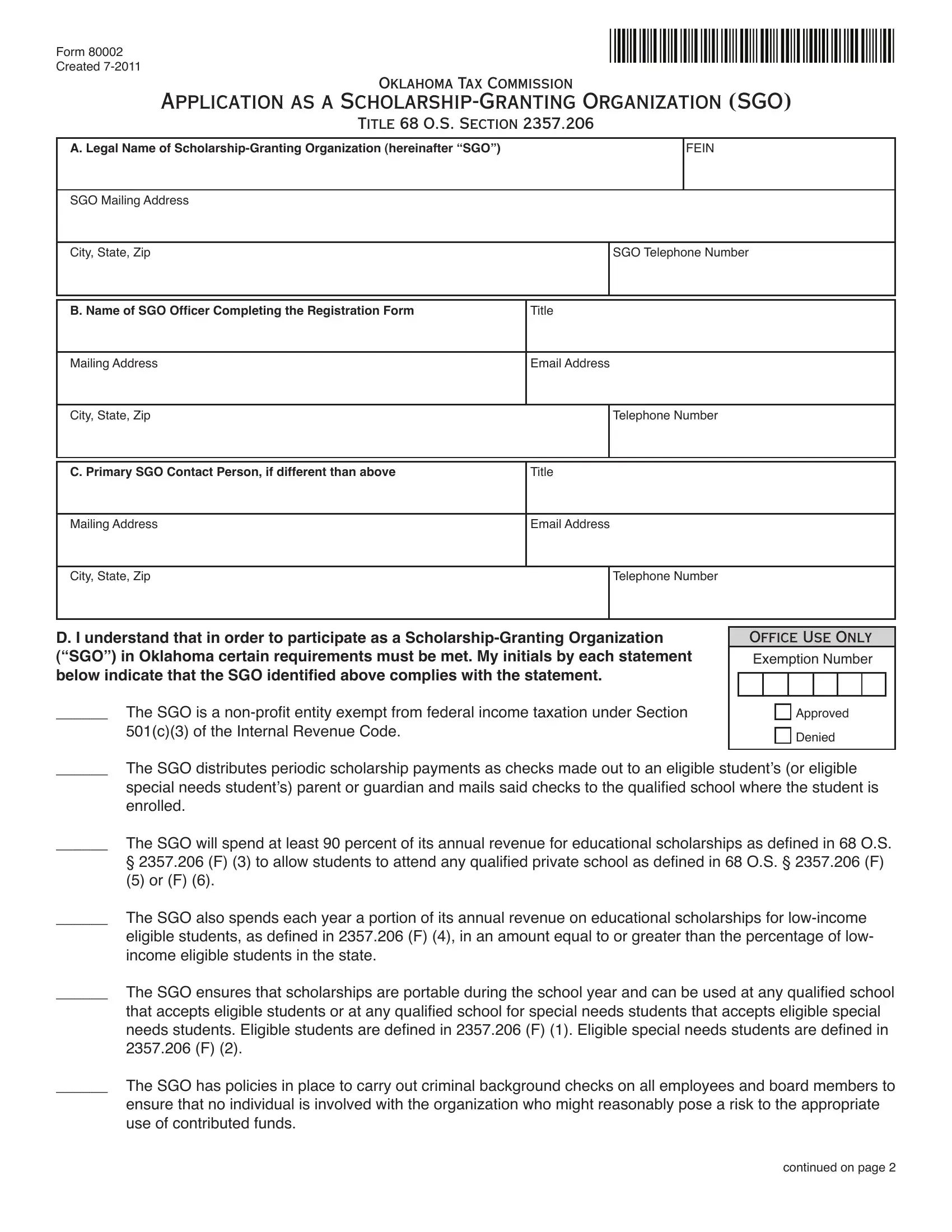

Form 80002

Created 7-2011

Oklahoma Tax Commission

Application as a Scholarship-Granting Organization (SGO)

Title 68 O.S. Section 2357.206

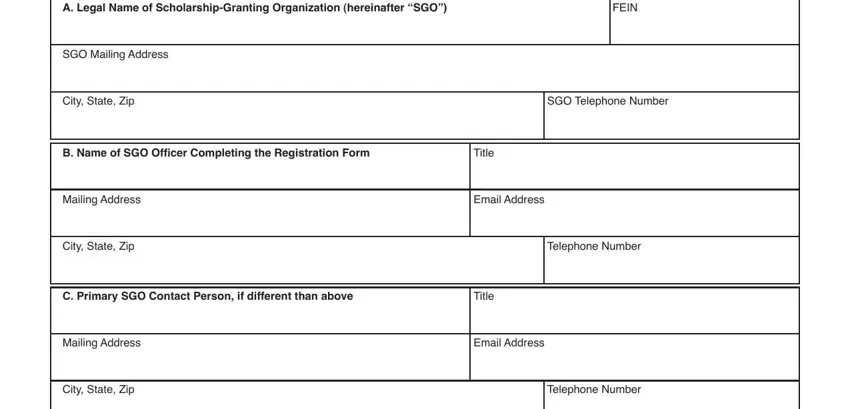

A. Legal Name of Scholarship-Granting Organization (hereinafter “SGO”)

B. Name of SGO Oficer Completing the Registration Form

C. Primary SGO Contact Person, if different than above

D. I understand that in order to participate as a Scholarship-Granting Organization (“SGO”) in Oklahoma certain requirements must be met. My initials by each statement

below indicate that the SGO identiied above complies with the statement.

______ The SGO is a non-proit entity exempt from federal income taxation under Section

501(c)(3) of the Internal Revenue Code.

OFFICE USE ONLY

Exemption Number

Approved

Denied

______ The SGO distributes periodic scholarship payments as checks made out to an eligible student’s (or eligible

special needs student’s) parent or guardian and mails said checks to the qualiied school where the student is enrolled.

______ The SGO will spend at least 90 percent of its annual revenue for educational scholarships as deined in 68 O.S.

§2357.206 (F) (3) to allow students to attend any qualiied private school as deined in 68 O.S. § 2357.206 (F)

(5) or (F) (6).

______ The SGO also spends each year a portion of its annual revenue on educational scholarships for low-income

eligible students, as deined in 2357.206 (F) (4), in an amount equal to or greater than the percentage of low- income eligible students in the state.

______ The SGO ensures that scholarships are portable during the school year and can be used at any qualiied school

that accepts eligible students or at any qualiied school for special needs students that accepts eligible special needs students. Eligible students are deined in 2357.206 (F) (1). Eligible special needs students are deined in 2357.206 (F) (2).

______ The SGO has policies in place to carry out criminal background checks on all employees and board members to

ensure that no individual is involved with the organization who might reasonably pose a risk to the appropriate use of contributed funds.

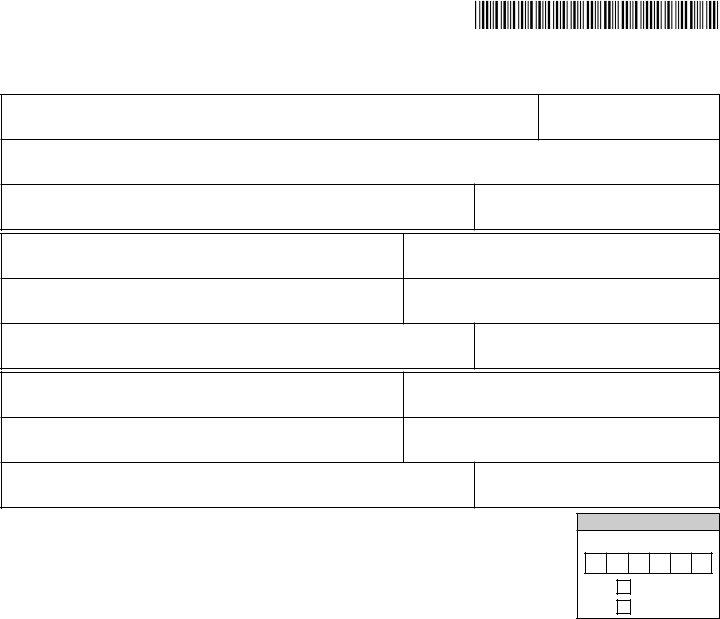

Form 80002 - Page 2

Application as a Scholarship-Granting Organization (SGO)

Title 68 O.S. Section 2357.206

D. I understand that in order to participate as a Scholarship-Granting Organization (“SGO”) in Oklahoma certain

requirements must be met. My initials by each statement below indicate that the SGO identiied above complies

with the statement. (continued)

______ The SGO will maintain full and accurate records with respect to the receipt of contributions and expenditures of

those contributions and will supply such records and any other documentation required by the Tax Commission to demonstrate inancial accountability.

______ The SGO will notify each contributor that Oklahoma law provides for a total, statewide cap on the amount of

income tax credits allowed annually.

______ The SGO will report to the Oklahoma Tax Commission, via electronic means established by the Oklahoma Tax

Commission, by January 10 of each tax year the following:

•The total number and dollar value of contributions

•A list of donors and their Social Security Number or if applicable their Federal Employer Identiication Number, including the dollar value of each donation.

I certify that the information provided on this form is true and correct to the best of my knowledge and belief. I certify that I am authorized by the SGO to make these representations. I further certify that I have attached hereto an accurate copy of the 501(c)(3) Non-Proit Exemption Determination Letter.

___________________________________________________ |

__________________________________________ |

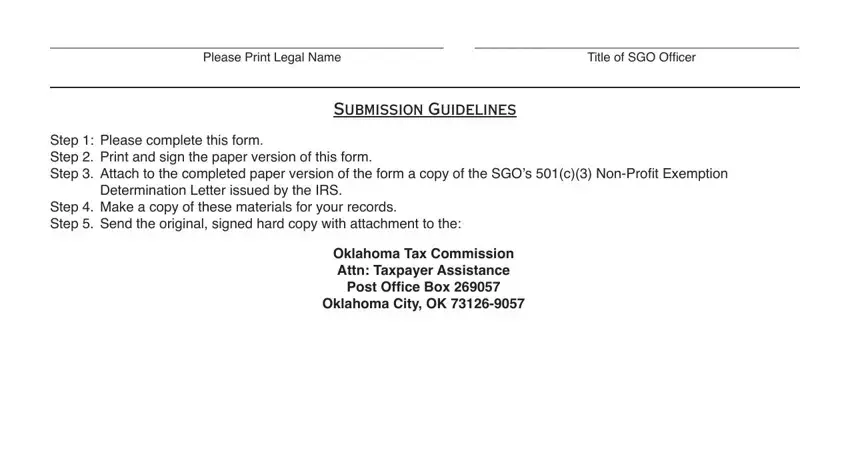

Please Sign Legal Name |

Date |

___________________________________________________ |

__________________________________________ |

Please Print Legal Name |

Title of SGO Oficer |

SUBMISSION GUIDELINES

Step 1: Please complete this form.

Step 2. Print and sign the paper version of this form.

Step 3. Attach to the completed paper version of the form a copy of the SGO’s 501(c)(3) Non-Proit Exemption Determination Letter issued by the IRS.

Step 4. Make a copy of these materials for your records.

Step 5. Send the original, signed hard copy with attachment to the:

Oklahoma Tax Commission

Attn: Taxpayer Assistance

Post Ofice Box 269057

Oklahoma City, OK 73126-9057