Form 8275 R can be filled in online effortlessly. Just open FormsPal PDF editing tool to do the job promptly. Our tool is constantly evolving to grant the very best user experience attainable, and that is thanks to our dedication to continual improvement and listening closely to comments from customers. With just a couple of basic steps, it is possible to start your PDF journey:

Step 1: Hit the orange "Get Form" button above. It'll open our pdf tool so you can start filling out your form.

Step 2: Once you start the file editor, you will notice the document prepared to be filled in. Apart from filling out various blank fields, you could also perform various other actions with the Document, including adding your own textual content, changing the initial text, adding graphics, putting your signature on the form, and a lot more.

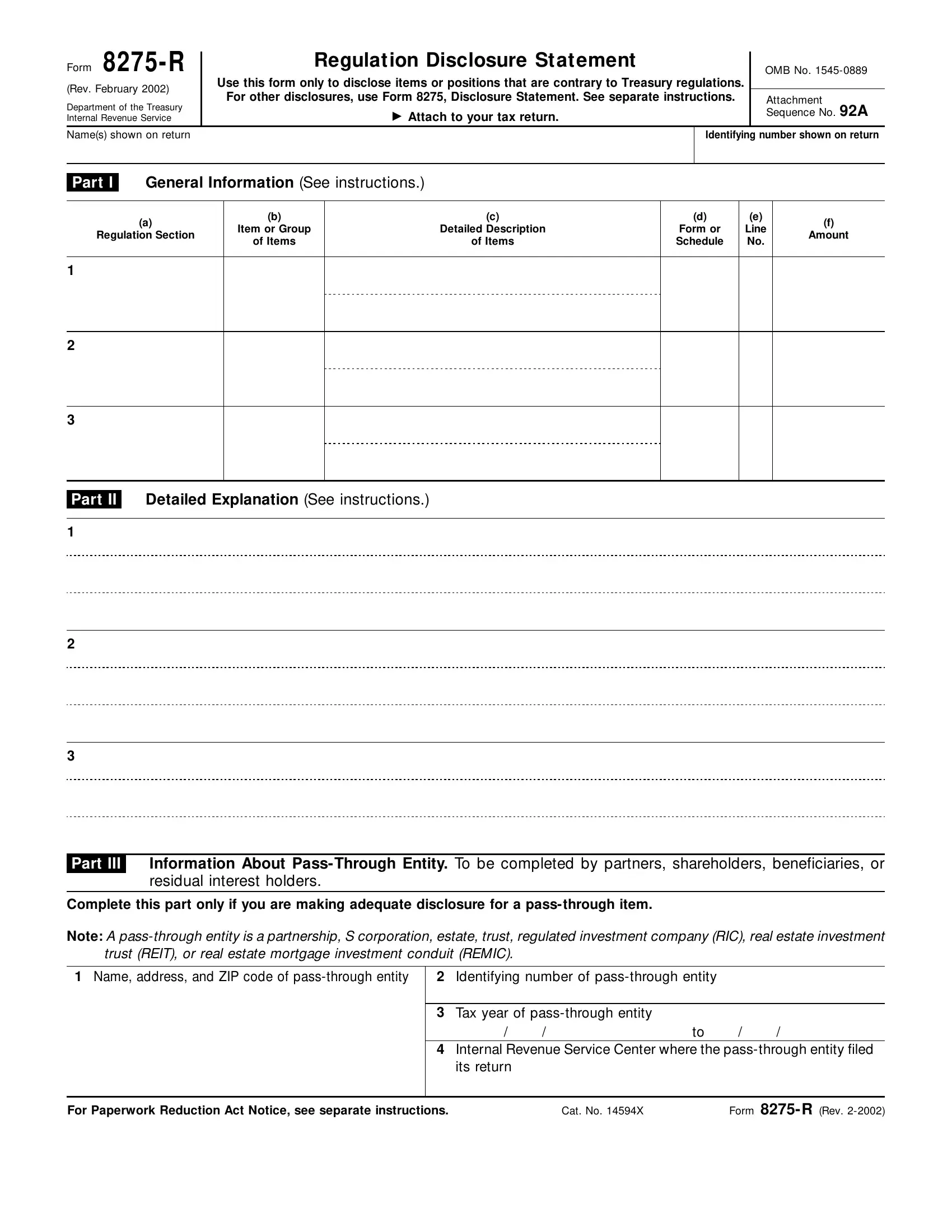

This form will involve specific information; in order to ensure consistency, take the time to consider the following suggestions:

1. The Form 8275 R requires specific details to be inserted. Ensure the following blanks are complete:

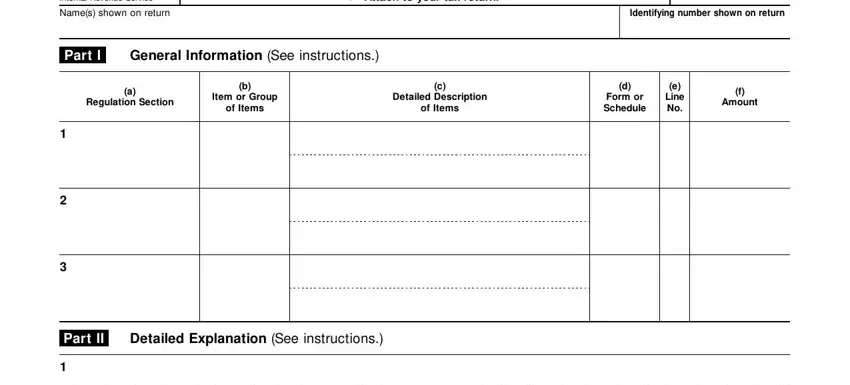

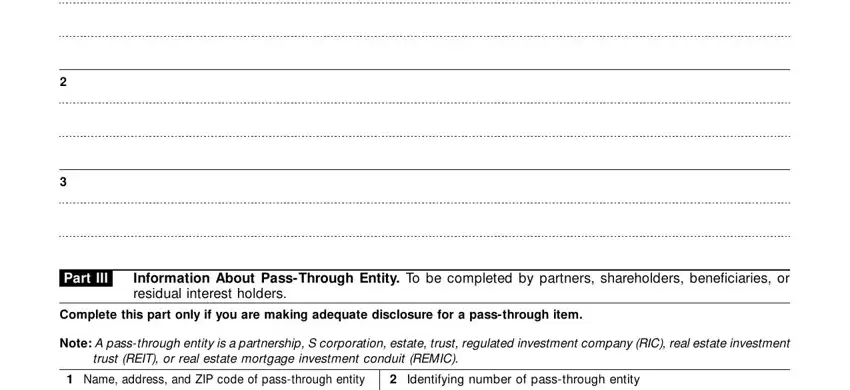

2. After finishing the previous part, go on to the subsequent step and fill out all required details in all these blanks - Part III, Information About PassThrough, Complete this part only if you are, Note A passthrough entity is a, trust REIT or real estate mortgage, Name address and ZIP code of, and Identifying number of passthrough.

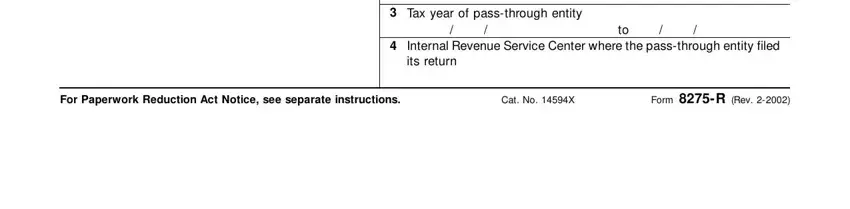

3. Completing Tax year of passthrough entity, Internal Revenue Service Center, For Paperwork Reduction Act Notice, Cat No X, and Form R Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. It is time to start working on the next portion! In this case you will get all of these Form R Rev Part IV, and Explanations continued from Parts fields to fill out.

5. Finally, the following final part is precisely what you'll have to finish before finalizing the document. The blanks in question include the following: .

People often make mistakes while filling in this field in this part. Remember to double-check whatever you type in here.

Step 3: Go through what you've entered into the blank fields and then press the "Done" button. Right after creating a7-day free trial account with us, it will be possible to download Form 8275 R or email it immediately. The PDF will also be accessible in your personal cabinet with all your modifications. FormsPal is focused on the confidentiality of our users; we make sure that all personal information used in our tool remains secure.