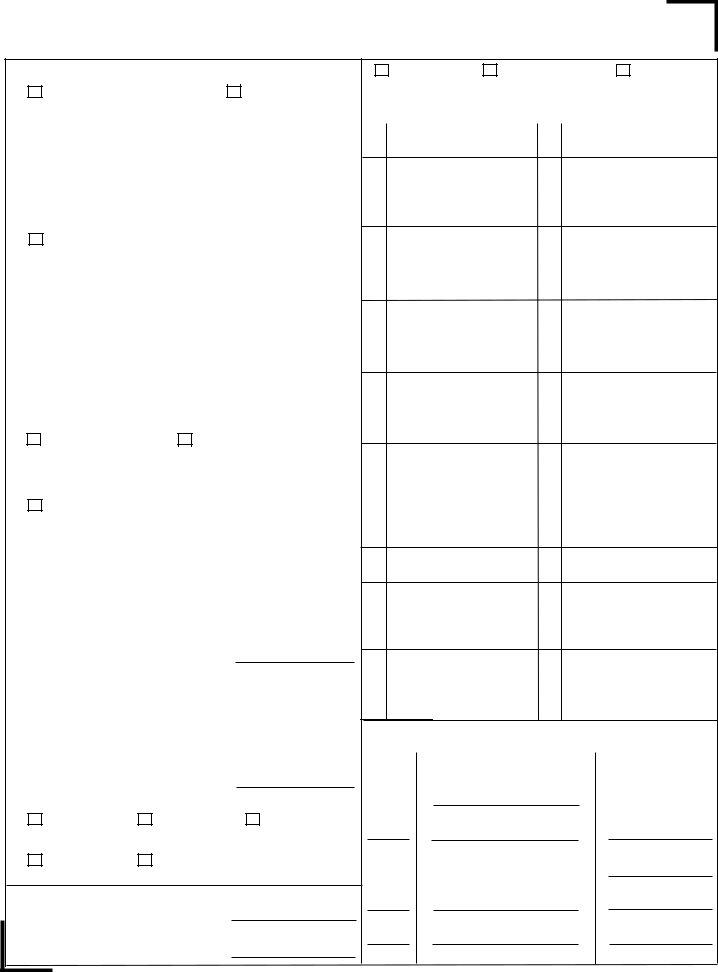

When it comes to understanding the intricacies of state taxation and the distribution of income within entities such as S-corporations or partnerships, the Mississippi Schedule K-1 2011 form, officially cited as Form 84-132-11-8-1-000 (Rev. 08/11), plays a pivotal role. This document is designed to provide detailed insights into the financial operations and obligations of both the entity and its members throughout the tax year. It encompasses a broad range of financial data, including but not limited to ordinary business income or losses, net rental real estate income, guaranteed payments to members, and specifics regarding partners' shares in income, deductions, credits, and various other financial items. Furthermore, the form serves as a critical tool for reporting the partner's share of current year income, adjustments, and tax credits, alongside detailing information about the entity itself and the personal details of the owners or partners involved. With segments delicately crafted to capture the essence of partnership or S-corporation financial dynamics, especially focusing on aspects like foreign transactions, self-employment earnings, and distributions affecting shareholder basis, this form ensures comprehensive reporting to both the partners and the Mississippi Department of Revenue. Accordingly, through capturing an array of financial activities and their tax implications, Form 84-132-11-8-1-000 facilitates a clear understanding of an entity's fiscal health and taxation commitments within the state of Mississippi.

| Question | Answer |

|---|---|

| Form Name | Form 84 132 11 8 1 000 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Distributions, S-Corporation, Mississippi, PTP |

Form

Mississippi

Schedule

|

|

Part I |

|

Information About the Entity |

|

|

|

|

Final |

Amended |

Composite |

|||||

|

|

|

Partnership |

Part III |

|

Partner's Share of Current Year Income, |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions, Credits and Other Items |

|||

|

A |

Entity FEIN |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

1 |

Ordinary Business Income (Loss) |

15 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

B Entity's Name, Address, City, State and ZIP Code |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

2 |

Net Rental Real Estate Income (Loss) |

16 |

Credits |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

3 |

Other Net Rental Income (Loss) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Foreign Transactions |

|||

|

C |

If partnership box was checked above, is the partnership a |

4 |

Guaranteed Payments |

||||||||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

Publicly Traded Partnership (PTP)? |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

5 |

Interest Income |

|

|

|

||

|

|

Part II |

|

Information About the Owner / Partner |

|

|

|

|

|

|

|

|

||||

|

D |

Owner / Partner's SSN or FEIN |

|

|

|

|

|

6a |

Ordinary Dividends |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

E |

Owner / Partner's Name, Address, City, State and ZIP Code |

6b |

Qualified Dividends |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

7 |

Royalties |

|

18 |

Alternative Minimum Tax (AMT) Items |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

8 |

Net |

|

|

|

||

|

F |

General Partner or LLC |

Limited Partner or Other LLC |

|

|

|

|

|

|

|

||||||

|

|

Member |

|

|

|

9a |

Net |

19 |

Items Affecting Shareholder Basis |

|||||||

|

G |

What type of entity is the partner? |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

9b |

Collectibles (28%) Gain (Loss) |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

H |

Check box if 5% of the net gain / profit was withheld? |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

Enter amount of withholding remitted for Partner |

|

|

|

|

|

|

|

|||||||

|

|

$ ___________ |

|

|

9c |

Unrecaptured Section 1250 Gain |

20 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

IPartner's Share of Profit, Loss and Capital:

|

|

|

|

|

|

|

|

|

|

|

10 Net Section 1231 Gain (Loss) |

|

|

|

|

|

Beginning |

|

Ending |

|

|

|

|||||||

|

Profit |

% |

|

|

% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Other Income (Loss) |

21 |

Distributions |

||

|

Loss |

% |

|

|

|

|

11 |

|||||||

|

|

|

% |

|

|

|

|

|

|

|||||

|

Capital |

% |

|

|

% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J Partner's Share of Liablities at Year End: |

|

12 |

Section 179 Deduction |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

Nonrecourse |

$ |

13 |

Charitable Contributions |

22 |

Other Information |

||||||||

|

|

|

|

|

|

|

||||||||

|

Qualified Nonrecourse Financing |

$ |

|

|

|

|

|

|

|

|

|

|

||

|

Recourse |

$ |

14 |

Other Deductions |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KPartner's Mississippi Capital Account Analysis:

Beginning Capital Account . . |

$ |

|

|

|

|

|

Part IV |

Mississippi Tax Credits |

|||||

Capital Contributed During the Year |

$ |

|

|

|

|

|

|

|

(Enter Credit Code and Name from Form |

||||

|

|

|

|

|

|

|

|

|

|

|

|||

Current Year Increase (Decrease) |

$ |

|

|

|

|

|

Code |

Credit |

|

Amount |

|||

Withdrawals & Distributions |

$ |

( |

) |

|

|

|

|

|

|

|

|||

Ending Capital Account . . . |

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

Tax Basis |

GAAP |

|

|

|

Other (Explain) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

LDid the Partner Contribute Property With a

Yes |

No |

||||

If "Yes", Attach Statement. |

|

|

|

|

$ |

|

|

|

|

|

|

M |

Shareholder's Percentage of Stock Ownership for Tax Year |

$ |

|

|

|

|

|

% |

N |

Mississippi Apportionment Ratio for Tax Year |

$ |

|

|

|

|

|

% |