In order to properly file your taxes, you will need to fill out a Form 84 132 11 8 1 000. This form is used to calculate your taxable income and report any deductions or credits that you may be eligible for. By taking the time to complete this form correctly, you can ensure that your tax return is filed accurately and that you receive the maximum amount of tax savings possible.

| Question | Answer |

|---|---|

| Form Name | Form 84 132 11 8 1 000 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Distributions, S-Corporation, Mississippi, PTP |

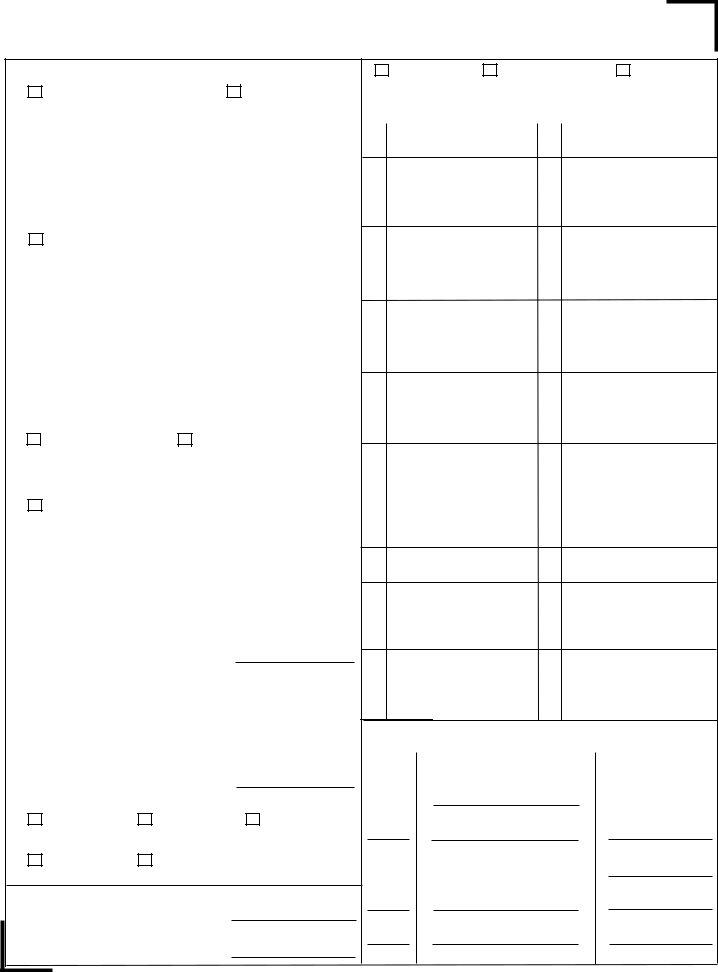

Form

Mississippi

Schedule

|

|

Part I |

|

Information About the Entity |

|

|

|

|

Final |

Amended |

Composite |

|||||

|

|

|

Partnership |

Part III |

|

Partner's Share of Current Year Income, |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions, Credits and Other Items |

|||

|

A |

Entity FEIN |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

1 |

Ordinary Business Income (Loss) |

15 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

B Entity's Name, Address, City, State and ZIP Code |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

2 |

Net Rental Real Estate Income (Loss) |

16 |

Credits |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

3 |

Other Net Rental Income (Loss) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Foreign Transactions |

|||

|

C |

If partnership box was checked above, is the partnership a |

4 |

Guaranteed Payments |

||||||||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

Publicly Traded Partnership (PTP)? |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

5 |

Interest Income |

|

|

|

||

|

|

Part II |

|

Information About the Owner / Partner |

|

|

|

|

|

|

|

|

||||

|

D |

Owner / Partner's SSN or FEIN |

|

|

|

|

|

6a |

Ordinary Dividends |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

E |

Owner / Partner's Name, Address, City, State and ZIP Code |

6b |

Qualified Dividends |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

7 |

Royalties |

|

18 |

Alternative Minimum Tax (AMT) Items |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

8 |

Net |

|

|

|

||

|

F |

General Partner or LLC |

Limited Partner or Other LLC |

|

|

|

|

|

|

|

||||||

|

|

Member |

|

|

|

9a |

Net |

19 |

Items Affecting Shareholder Basis |

|||||||

|

G |

What type of entity is the partner? |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

9b |

Collectibles (28%) Gain (Loss) |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

H |

Check box if 5% of the net gain / profit was withheld? |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

Enter amount of withholding remitted for Partner |

|

|

|

|

|

|

|

|||||||

|

|

$ ___________ |

|

|

9c |

Unrecaptured Section 1250 Gain |

20 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

IPartner's Share of Profit, Loss and Capital:

|

|

|

|

|

|

|

|

|

|

|

10 Net Section 1231 Gain (Loss) |

|

|

|

|

|

Beginning |

|

Ending |

|

|

|

|||||||

|

Profit |

% |

|

|

% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Other Income (Loss) |

21 |

Distributions |

||

|

Loss |

% |

|

|

|

|

11 |

|||||||

|

|

|

% |

|

|

|

|

|

|

|||||

|

Capital |

% |

|

|

% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J Partner's Share of Liablities at Year End: |

|

12 |

Section 179 Deduction |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

Nonrecourse |

$ |

13 |

Charitable Contributions |

22 |

Other Information |

||||||||

|

|

|

|

|

|

|

||||||||

|

Qualified Nonrecourse Financing |

$ |

|

|

|

|

|

|

|

|

|

|

||

|

Recourse |

$ |

14 |

Other Deductions |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KPartner's Mississippi Capital Account Analysis:

Beginning Capital Account . . |

$ |

|

|

|

|

|

Part IV |

Mississippi Tax Credits |

|||||

Capital Contributed During the Year |

$ |

|

|

|

|

|

|

|

(Enter Credit Code and Name from Form |

||||

|

|

|

|

|

|

|

|

|

|

|

|||

Current Year Increase (Decrease) |

$ |

|

|

|

|

|

Code |

Credit |

|

Amount |

|||

Withdrawals & Distributions |

$ |

( |

) |

|

|

|

|

|

|

|

|||

Ending Capital Account . . . |

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

Tax Basis |

GAAP |

|

|

|

Other (Explain) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

LDid the Partner Contribute Property With a

Yes |

No |

||||

If "Yes", Attach Statement. |

|

|

|

|

$ |

|

|

|

|

|

|

M |

Shareholder's Percentage of Stock Ownership for Tax Year |

$ |

|

|

|

|

|

% |

N |

Mississippi Apportionment Ratio for Tax Year |

$ |

|

|

|

|

|

% |