series ee bonds can be completed online effortlessly. Simply try FormsPal PDF editing tool to get it done quickly. To make our tool better and more convenient to work with, we constantly implement new features, with our users' feedback in mind. If you're seeking to begin, here's what it will require:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: This tool helps you change the majority of PDF forms in various ways. Enhance it with your own text, correct original content, and include a signature - all possible within minutes!

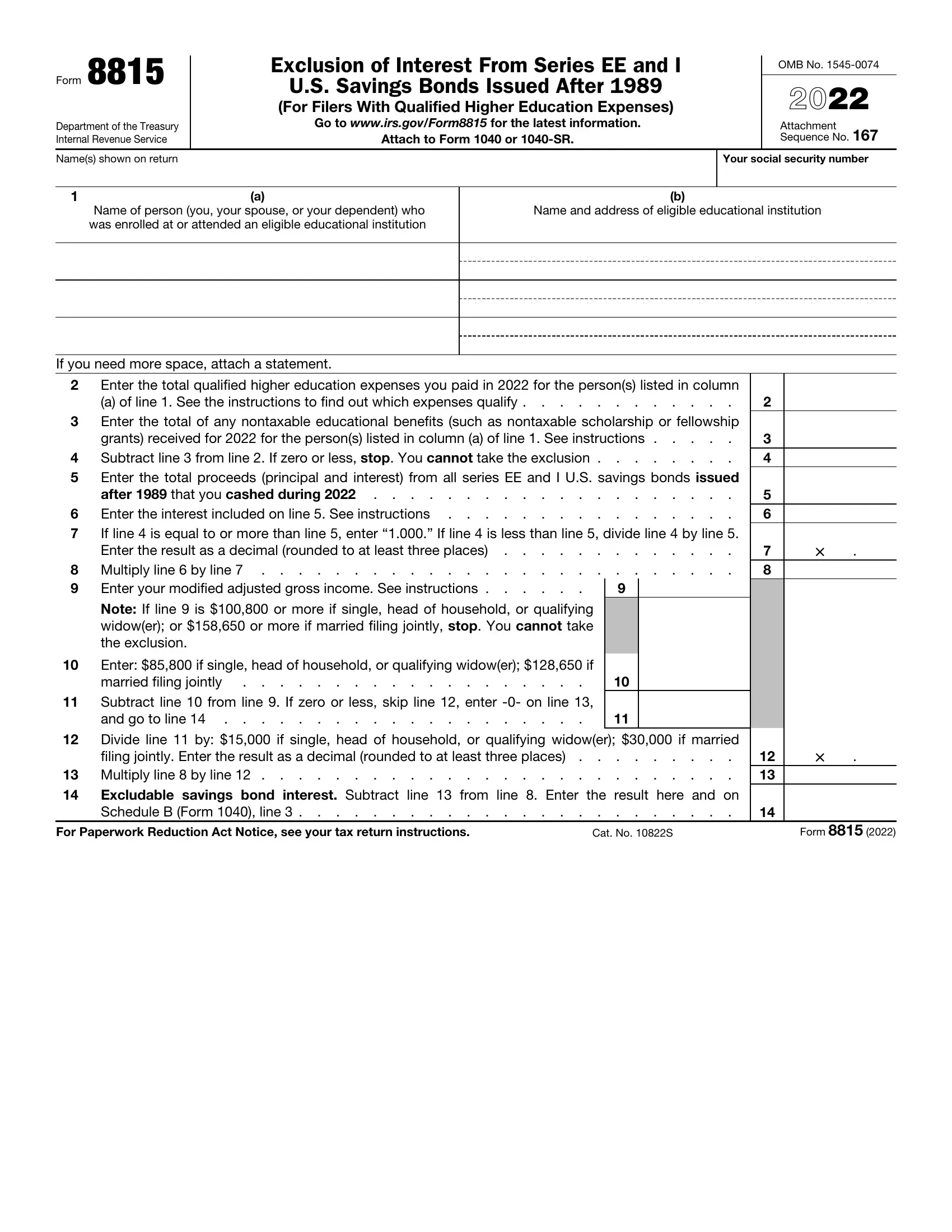

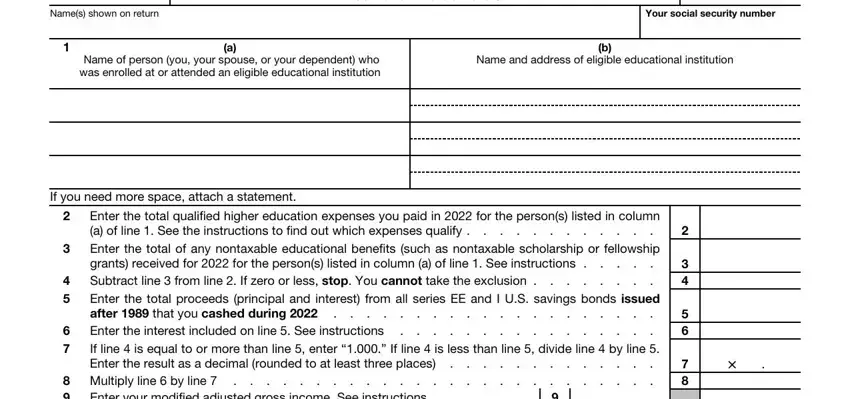

As for the fields of this particular form, here is what you need to do:

1. When completing the series ee bonds, be sure to incorporate all needed fields in the associated section. It will help speed up the work, allowing for your information to be processed without delay and properly.

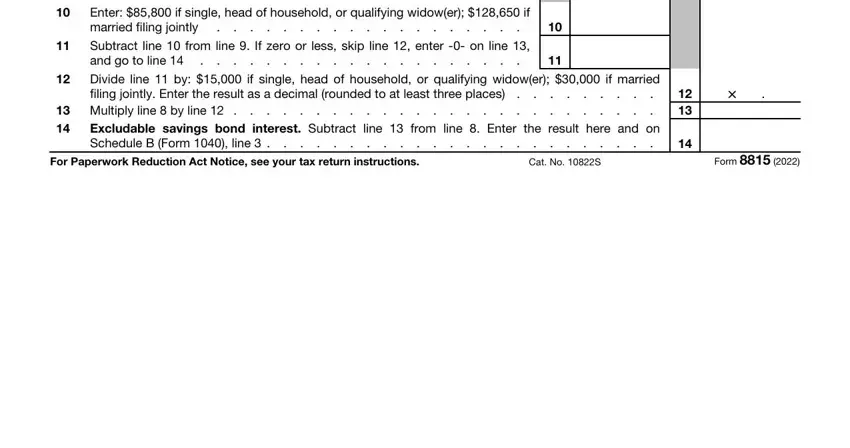

2. When the previous segment is complete, you're ready insert the necessary details in Enter if single head of household, Divide line by if single head, filing jointly Enter the result as, Excludable savings bond interest, Multiply line by line, For Paperwork Reduction Act Notice, Cat No S, and Form allowing you to go further.

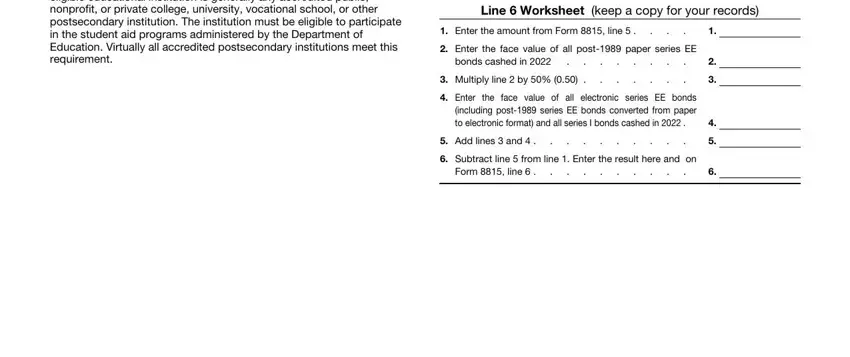

3. In this step, examine Specific Instructions Line Column, Line Worksheet keep a copy for, Enter the amount from Form line, Enter the face value of all post, bonds cashed in, Multiply line by, Enter the face value of all, Add lines and, Subtract line from line Enter, and Form line. Each of these should be completed with greatest accuracy.

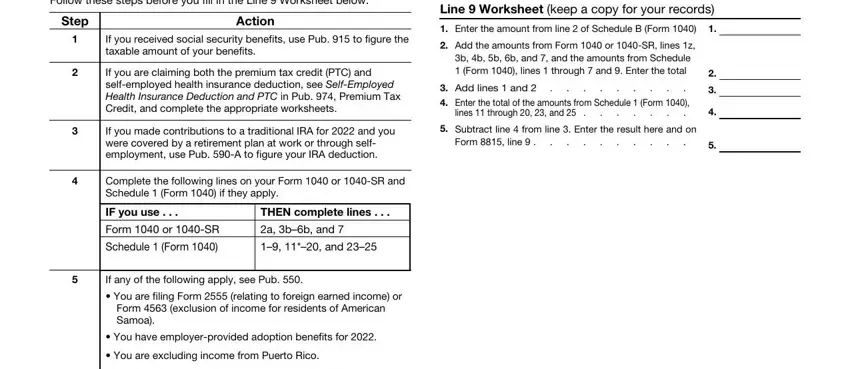

4. Your next paragraph needs your details in the following parts: Line Worksheet keep a copy for, Enter the amount from line of, Add the amounts from Form or SR, Add lines and Enter the total, lines through and, Subtract line from line Enter, Form line, Line Follow these steps before, Step, Action, If you received social security, If you are claiming both the, If you made contributions to a, Complete the following lines on, and IF you use. Make sure that you fill out all requested information to go further.

Be very mindful when filling out Line Follow these steps before and If you received social security, since this is the section where a lot of people make some mistakes.

Step 3: Right after double-checking the form fields, press "Done" and you're all set! Try a free trial plan at FormsPal and gain instant access to series ee bonds - which you are able to then use as you wish inside your FormsPal account page. FormsPal ensures your information privacy via a protected method that in no way saves or shares any sort of personal data used. Rest assured knowing your docs are kept safe every time you work with our tools!