General Instructions

Section references are to the Internal Revenue Code.

What's New

The empowerment zone and renewal community credit carryforwards, carrybacks, and passive activity limitations are no longer reported on Form 8844; instead, they must be reported on Form 3800, General Business Credit.

Purpose of Form

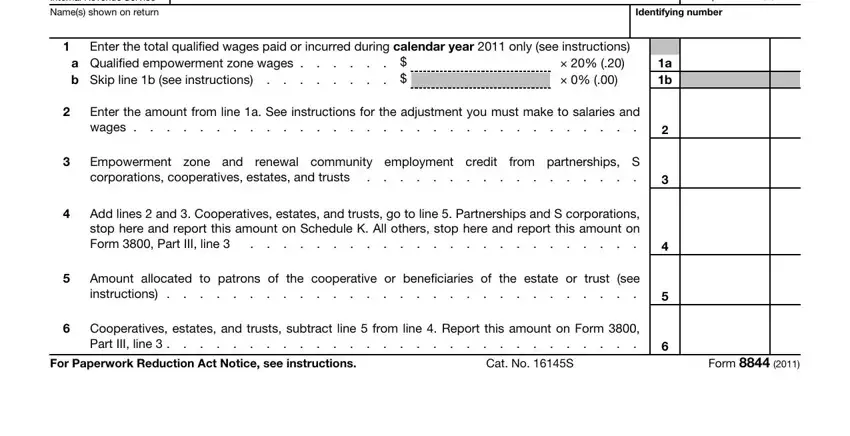

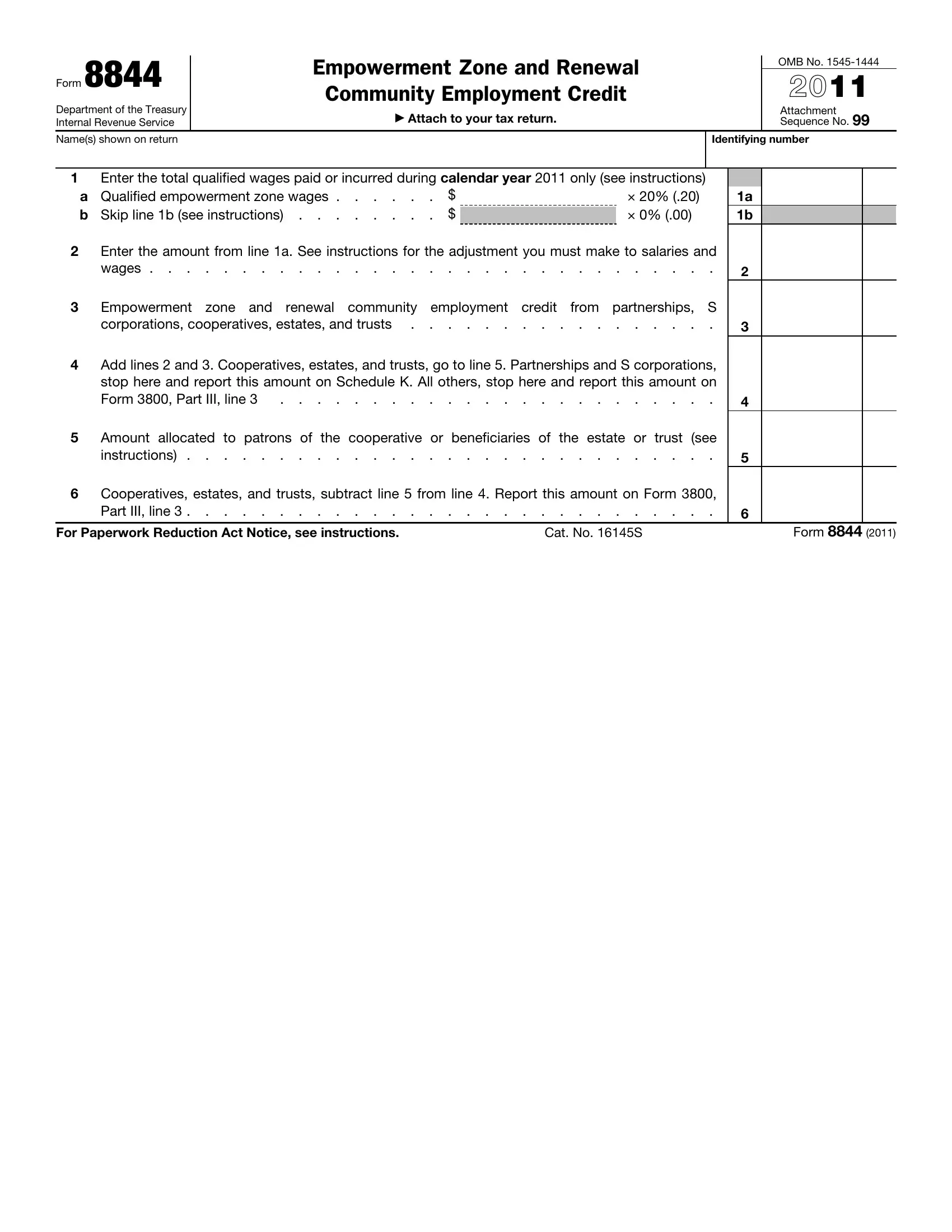

Use Form 8844 to claim the empowerment zone and renewal community employment (EZRCE) credit. For tax years that include December 31, 2011, the credit is 20% of the employer’s qualified wages (up to $15,000) paid or incurred during calendar year 2011 on behalf of qualified empowerment zone employees.

The credit is a component of the general business credit, and a special tax liability limit applies. The allowable credit is figured in Part II of Form 3800, General Business Credit.

Empowerment Zones

Urban areas. Parts of the following urban areas are empowerment zones. You can find out if your business or an employee’s residence is located within an urban empowerment zone by using the RC/EZ/EC Address Locator at www.hud.gov/crlocator or by calling 1-800-998-9999.

•Pulaski County, AR

•Tucson, AZ

•Fresno, CA

•Los Angeles, CA (city and county)

•Santa Ana, CA

•New Haven, CT

•Jacksonville, FL

•Miami/Dade County, FL

•Chicago, IL

•Gary/Hammond/East Chicago, IN

•Boston, MA

•Baltimore, MD

•Detroit, MI

•Minneapolis, MN

•St. Louis, MO/East St. Louis, IL

•Cumberland County, NJ

•New York, NY

•Syracuse, NY

•Yonkers, NY

•Cincinnati, OH

•Cleveland, OH

•Columbus, OH

•Oklahoma City, OK

•Philadelphia, PA/Camden, NJ

•Columbia/Sumter, SC

•Knoxville, TN

•El Paso, TX

•San Antonio, TX

•Norfolk/Portsmouth, VA

•Huntington, WV/Ironton, OH

Washington, DC. Under section 1400, parts of Washington, DC, are treated as an empowerment zone. For details, use the RC/EZ/EC Address Locator at www.hud.gov/crlocator or see Notice 98-57, on page 9 of Internal Revenue Bulletin 1998-47 at www.irs.gov/pub/irs-irbs/irb98-47.pdf.

Rural areas. Parts of the following rural areas are empowerment zones. You can find out if your business or an employee’s residence is located within a rural empowerment zone by using the RC/EZ/EC Address Locator at www.hud.gov/crlocator or by calling 1-800-998-9999.

•Desert Communities, CA (part of Riverside County)

•Southwest Georgia United, GA (part of Crisp County and all of Dooly County)

•Southernmost Illinois Delta, IL (parts of Alexander and Johnson Counties and all of Pulaski County)

•Kentucky Highlands, KY (part of Wayne County and all of Clinton and Jackson Counties)

•Aroostook County, ME (part of Aroostook County)

•Mid-Delta, MS (parts of Bolivar, Holmes, Humphreys, Leflore, Sunflower, and Washington Counties)

•Griggs-Steele, ND (part of Griggs County and all of Steele County)

•Oglala Sioux Tribe, SD (parts of Jackson and Bennett Counties and all of Shannon County)

•Middle Rio Grande FUTURO Communities, TX (parts of Dimmit, Maverick, Uvalde, and Zavala Counties)

•Rio Grande Valley, TX (parts of Cameron, Hidalgo, Starr, and Willacy Counties)

Qualified empowerment zone employee. A qualified empowerment zone employee is any employee (full-time or part-time) of the employer who:

•Performs substantially all of the services for that employer within an empowerment zone in the employer’s trade or business and

•Has his or her principal residence within that empowerment zone while performing those services (employees who work in the Washington, DC, empowerment zone may live anywhere in the District of Columbia).

See Qualified Employees below for a list of persons who are not qualified employees.

Qualified Employees

Any person may be a qualified employee except the following.

•Any relative of the employer described in sections 152(d)(2)(A) through 152(d)(2)(G).

•A dependent of the employer described in section 152(d)(2)(H).

•If the employer is a corporation, any individual who bears any of the relationships described in sections 152(d)(2)(A) through 152(d)(2)(G), or is a dependent, as described in section 152(d)(2)(H), of an individual who owns (or is considered to own under section 267(c)) more than 50% in value of the outstanding stock of the corporation.

•If the employer is an entity other than a corporation, any individual who owns directly or indirectly more than 50% of the capital and profits interest, including constructive ownership, in the entity.

•If the employer is an estate or trust, any individual who is a grantor, beneficiary, or fiduciary of the estate or trust (or a dependent, as described in section 152(d)(2)(H), of such an individual), or any individual who is a relative, as described in sections 152(d)(2)(A) through 152(d)(2)(G), of the grantor, beneficiary, or fiduciary of the estate or trust.

•Any person who owns (or is considered to own under section 318) more than 5% of the outstanding or voting stock of the employer, or if not a corporate employer, more than 5% of the capital or profits interest in the employer.

•Any individual employed by the employer for less than 90 days. For exceptions, see Early termination of employee, later.

•Any individual employed by the employer at any private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.

•Any individual employed by the employer in a trade or business of which the principal activity is farming (see Note below), but only if at the close of the tax year the sum of the following amounts exceeds $500,000.

1.The larger of the unadjusted bases or fair market value of the farm assets owned by the employer.

2.The value of the farm assets leased by the employer.