Making use of the online editor for PDFs by FormsPal, it is possible to fill in or edit Form 8854 right here and now. FormsPal team is aimed at making sure you have the perfect experience with our tool by continuously presenting new capabilities and upgrades. Our editor is now even more helpful with the most recent updates! Currently, editing PDF documents is simpler and faster than ever. Starting is effortless! All you need to do is adhere to the following easy steps directly below:

Step 1: Simply hit the "Get Form Button" above on this webpage to launch our pdf file editing tool. There you will find everything that is necessary to fill out your document.

Step 2: This editor will allow you to change most PDF forms in various ways. Enhance it by including customized text, correct original content, and include a signature - all at your fingertips!

This PDF doc will need you to type in some specific information; to ensure accuracy and reliability, remember to take heed of the guidelines down below:

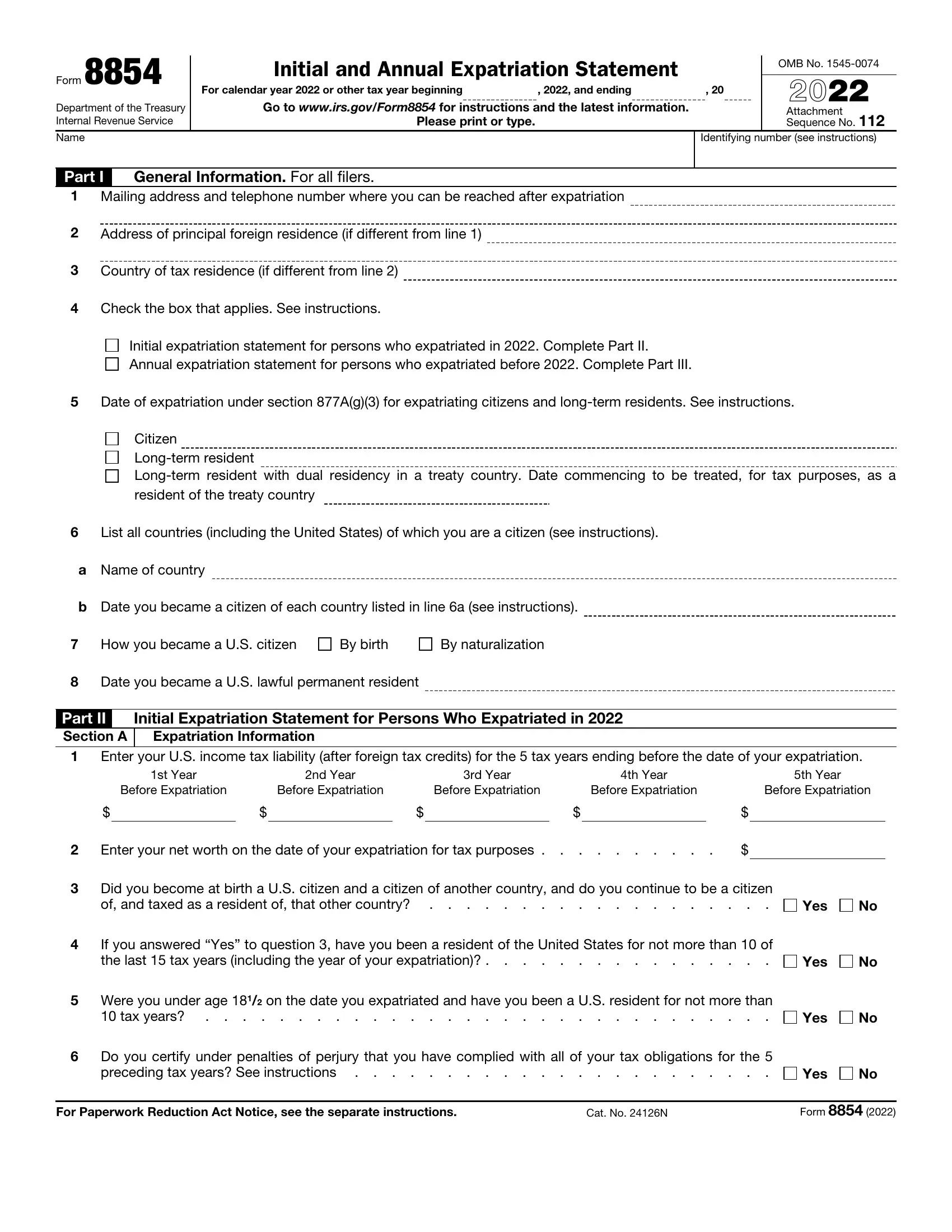

1. The Form 8854 requires specific information to be inserted. Make certain the following blanks are finalized:

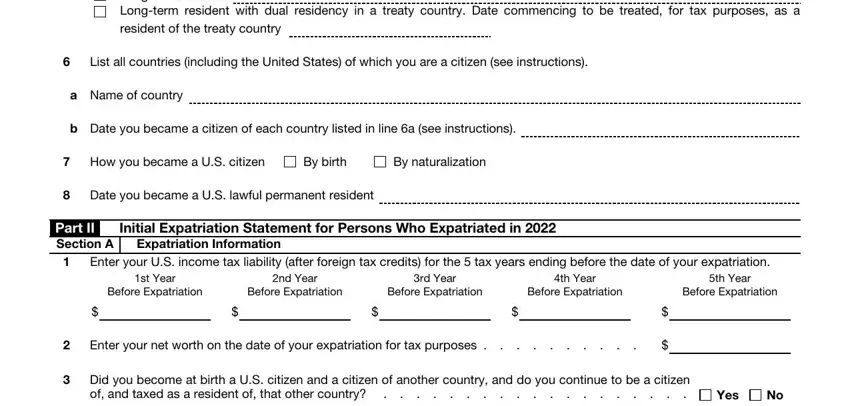

2. Just after filling in the previous section, head on to the subsequent part and fill out the necessary particulars in these fields - Citizen Longterm resident Longterm, List all countries including the, a Name of country, b Date you became a citizen of, How you became a US citizen, By birth, By naturalization, Date you became a US lawful, Part II Section A, Initial Expatriation Statement for, Expatriation Information, Enter your US income tax liability, st Year, nd Year, and rd Year.

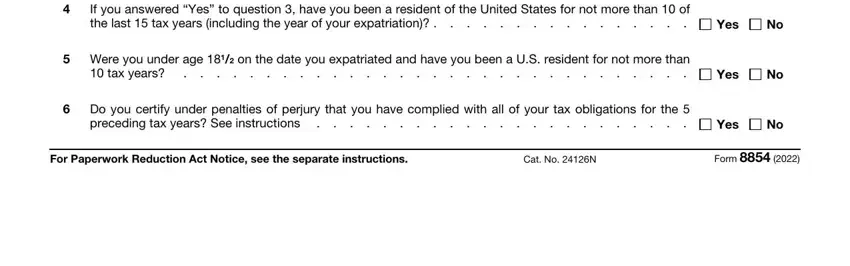

3. The following section will be focused on If you answered Yes to question, Yes, Were you under age on the date, tax years, Yes, Do you certify under penalties of, preceding tax years See, For Paperwork Reduction Act Notice, Cat No N, Yes, and Form - fill out these fields.

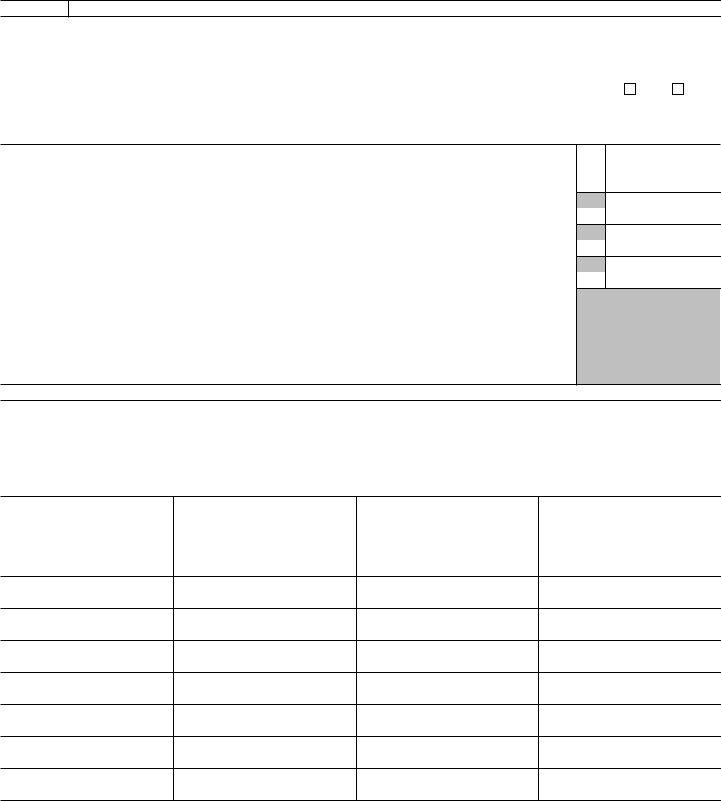

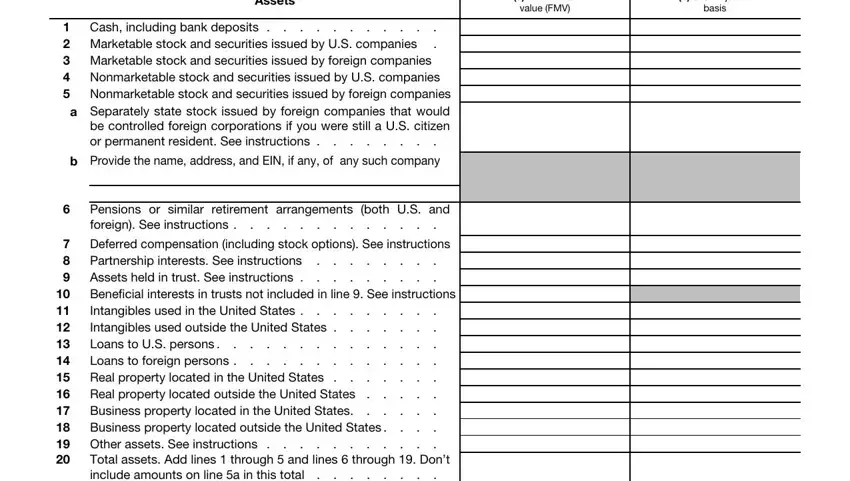

4. Now complete this next section! Here you have all these Assets, a Fair market, value FMV, b US adjusted, basis, Cash including bank deposits, Marketable stock and securities, Nonmarketable stock and securities, Provide the name address and EIN, Pensions or similar retirement, and Deferred compensation including form blanks to fill in.

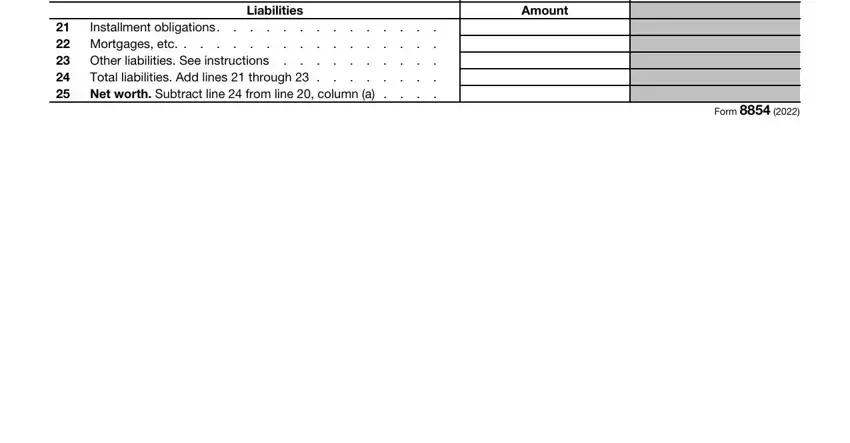

5. This pdf should be finalized by going through this area. Below one can find a full list of form fields that require accurate information to allow your form usage to be complete: Installment obligations, Mortgages etc, Other liabilities See, Liabilities, Amount, and Form.

It is easy to make errors while completing the Other liabilities See, and so be sure to look again prior to when you submit it.

Step 3: Prior to moving on, check that form fields were filled in the right way. When you think it is all good, press “Done." Join us now and immediately obtain Form 8854, all set for downloading. All alterations you make are saved , meaning you can edit the file at a later time as required. With FormsPal, it is simple to fill out documents without stressing about personal information incidents or data entries being distributed. Our protected system ensures that your personal data is kept safe.