You'll be able to prepare form 8855 effortlessly in our online editor for PDFs. Our editor is consistently developing to grant the best user experience attainable, and that's due to our dedication to continual enhancement and listening closely to testimonials. Here is what you would have to do to get started:

Step 1: Click the orange "Get Form" button above. It'll open our pdf tool so you could begin filling in your form.

Step 2: This editor offers you the opportunity to modify nearly all PDF documents in a variety of ways. Transform it with your own text, correct original content, and place in a signature - all readily available!

This PDF form requires specific details; in order to ensure accuracy, be sure to heed the tips further on:

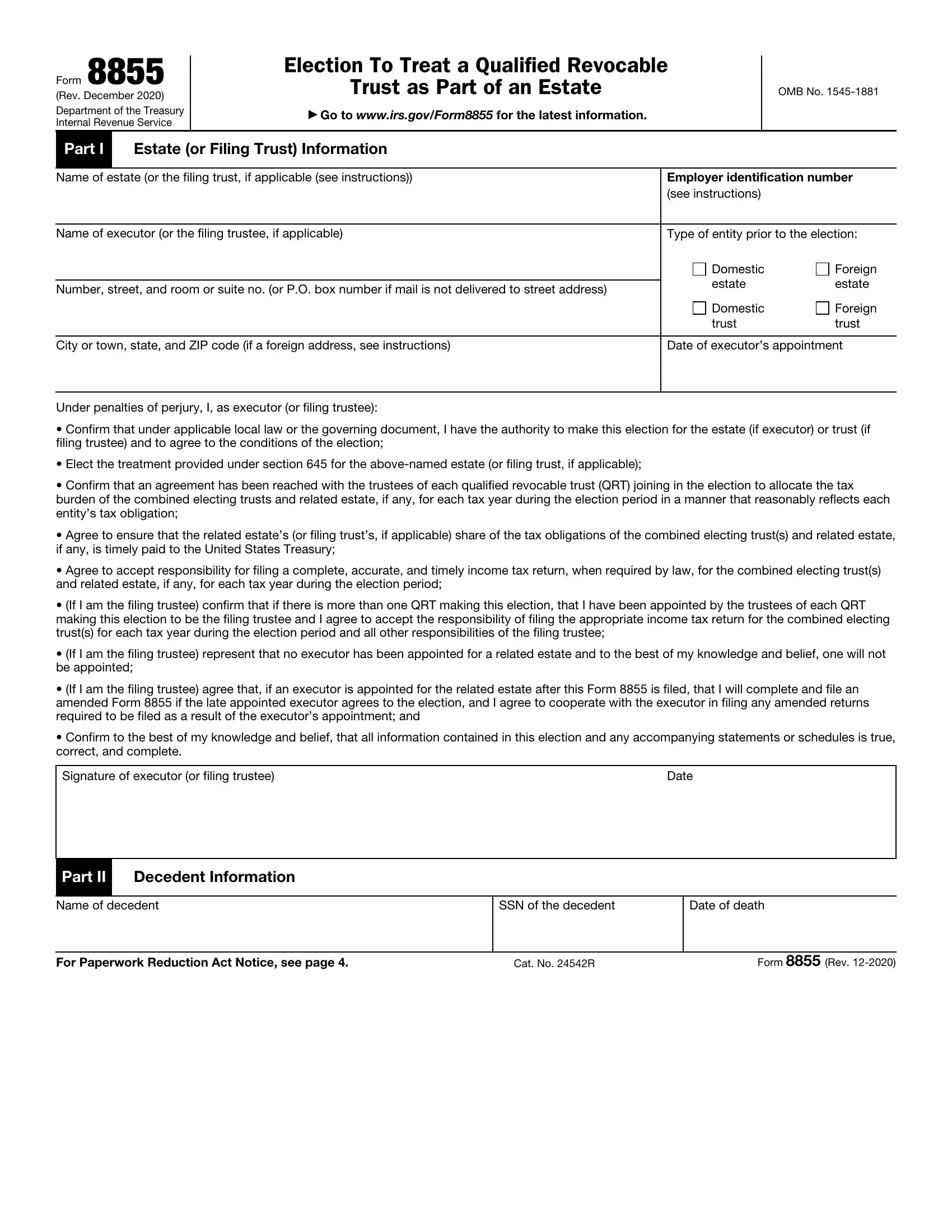

1. While filling in the form 8855, make certain to incorporate all of the important blank fields in the associated part. It will help hasten the work, allowing for your details to be handled fast and accurately.

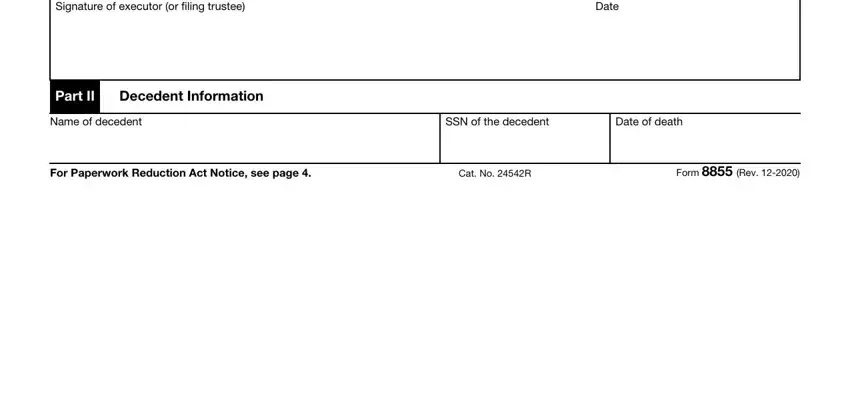

2. Once your current task is complete, take the next step – fill out all of these fields - Signature of executor or filing, Date, Part II, Decedent Information, Name of decedent, SSN of the decedent, Date of death, For Paperwork Reduction Act Notice, Cat No R, and Form Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

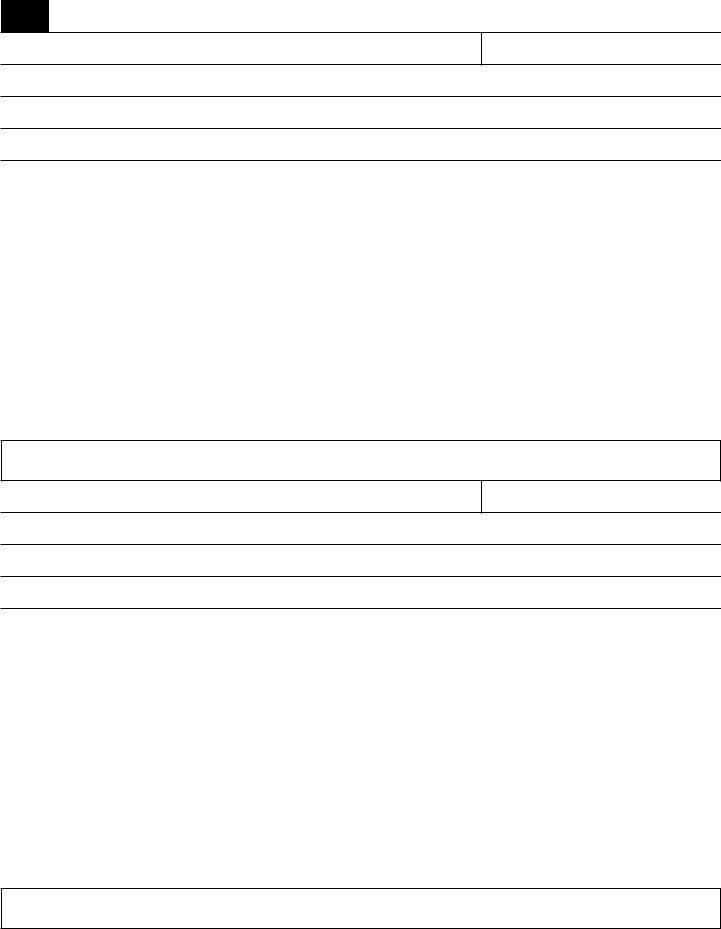

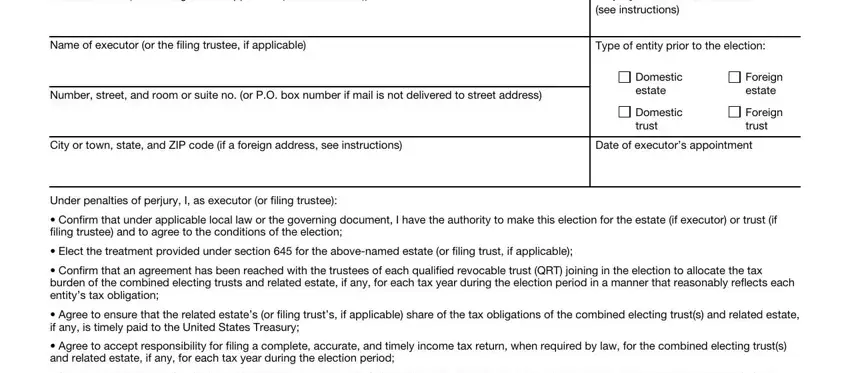

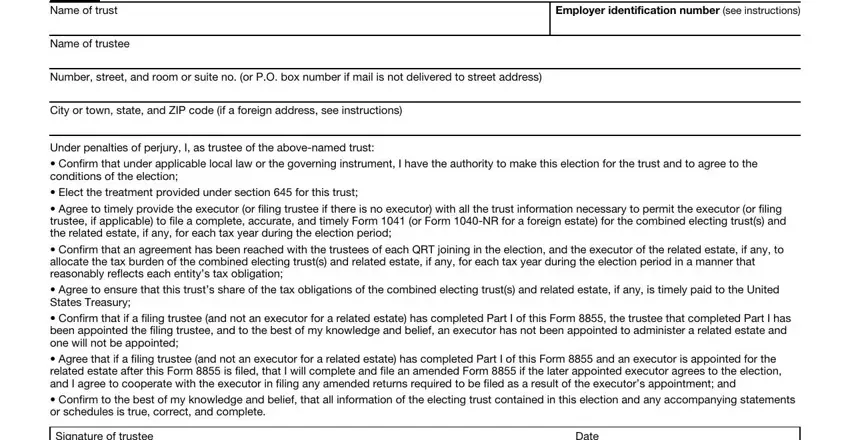

3. This next step is focused on Name of trust, Name of trustee, Employer identification number see, Number street and room or suite no, City or town state and ZIP code if, Under penalties of perjury I as, Confirm that under applicable, Elect the treatment provided, Agree to timely provide the, Confirm that an agreement has, Agree to ensure that this trusts, Confirm that if a filing trustee, Agree that if a filing trustee, Confirm to the best of my, and Signature of trustee - fill in all these fields.

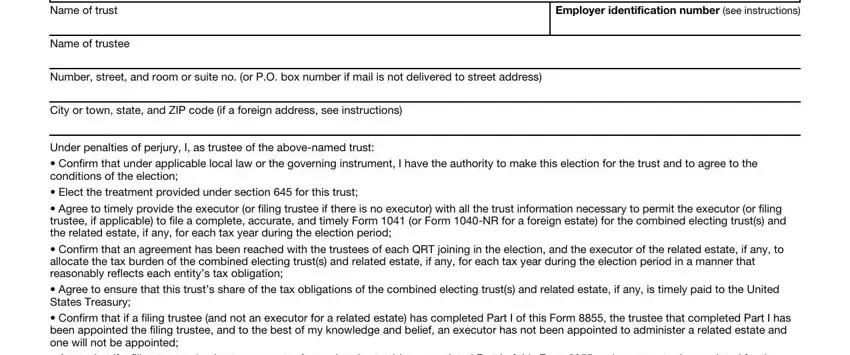

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name of trust, Name of trustee, Employer identification number see, Number street and room or suite no, City or town state and ZIP code if, Under penalties of perjury I as, Confirm that under applicable, Elect the treatment provided, Agree to timely provide the, Confirm that an agreement has, Agree to ensure that this trusts, Confirm that if a filing trustee, and Agree that if a filing trustee - to proceed further in your process!

Always be very attentive while completing Name of trustee and City or town state and ZIP code if, since this is the section where many people make errors.

Step 3: Be certain that your details are accurate and then just click "Done" to continue further. Download your form 8855 when you sign up for a 7-day free trial. Readily get access to the pdf file inside your personal cabinet, along with any modifications and adjustments all saved! FormsPal guarantees your information confidentiality by using a protected system that never records or distributes any sort of personal information involved in the process. Be assured knowing your docs are kept confidential whenever you work with our tools!