You could complete 8879 s without difficulty using our online editor for PDFs. Our editor is consistently evolving to give the best user experience possible, and that is due to our commitment to continual development and listening closely to comments from users. It merely requires a few basic steps:

Step 1: Simply click on the "Get Form Button" above on this page to start up our pdf form editor. There you'll find all that is needed to fill out your file.

Step 2: With the help of our state-of-the-art PDF tool, you may accomplish more than merely fill out blank form fields. Express yourself and make your forms look high-quality with custom text incorporated, or adjust the original input to perfection - all that comes along with an ability to insert stunning images and sign the document off.

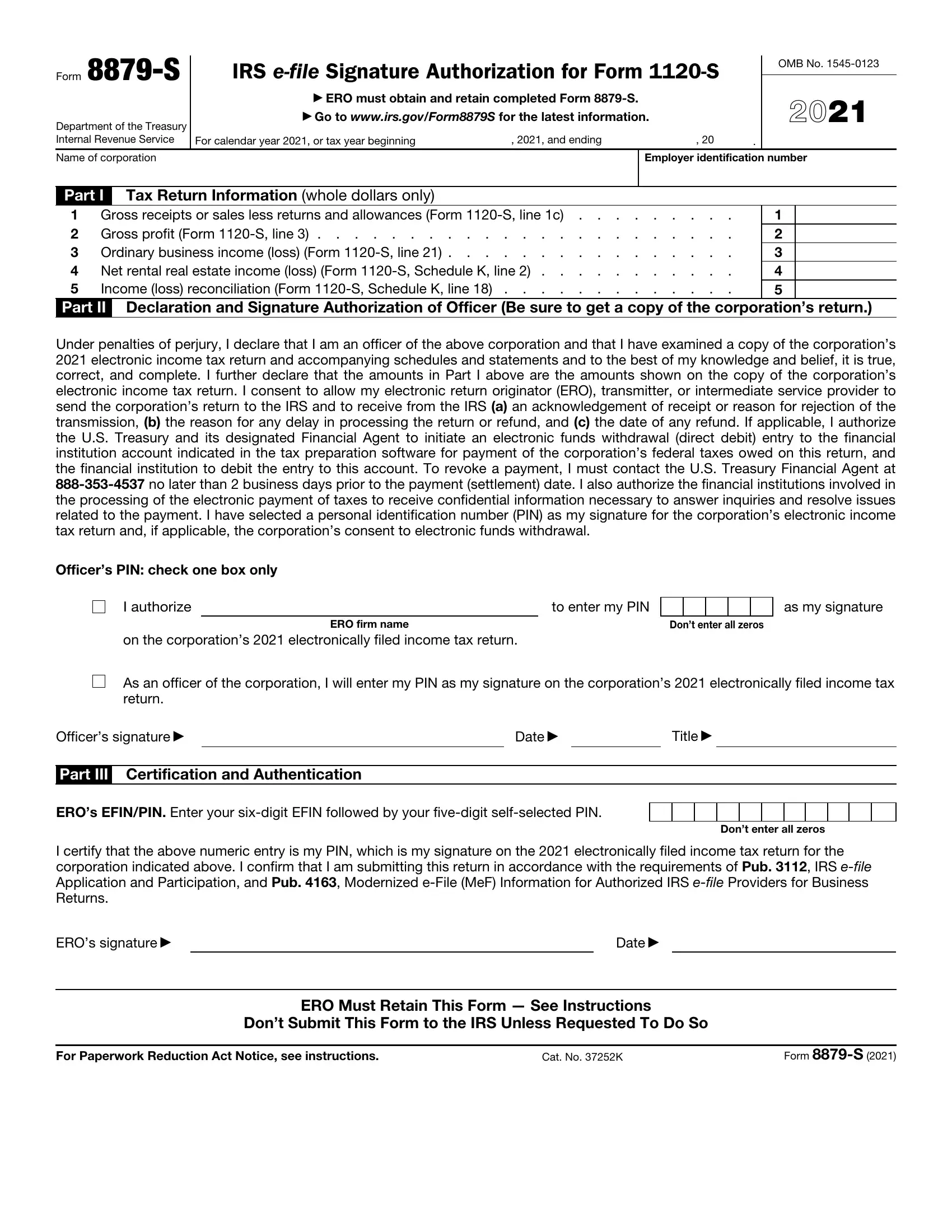

This document requires specific details; in order to ensure correctness, be sure to consider the following guidelines:

1. Fill out the 8879 s with a selection of necessary fields. Get all of the required information and ensure nothing is left out!

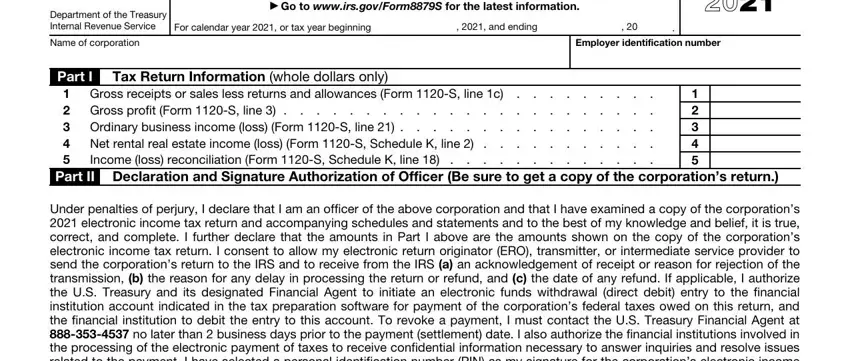

2. Once your current task is complete, take the next step – fill out all of these fields - Officers PIN check one box only, I authorize, to enter my PIN, as my signature, ERO firm name, Dont enter all zeros, on the corporations, As an officer of the corporation I, Officers signature, Date, Title, Part III Certification and, EROs EFINPIN Enter your sixdigit, Dont enter all zeros, and I certify that the above numeric with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Regarding Officers PIN check one box only and to enter my PIN, make certain you take a second look in this section. Both of these could be the key fields in the PDF.

Step 3: Before submitting this file, ensure that blank fields have been filled in the proper way. Once you think it is all good, click on “Done." Get the 8879 s the instant you sign up for a free trial. Easily access the pdf from your personal account page, with any edits and changes being automatically kept! FormsPal offers safe document tools without data record-keeping or sharing. Be assured that your information is in good hands here!