Future Developments

For the latest information about developments related to Form 8879-EMP and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8879emp.

Purpose of Form

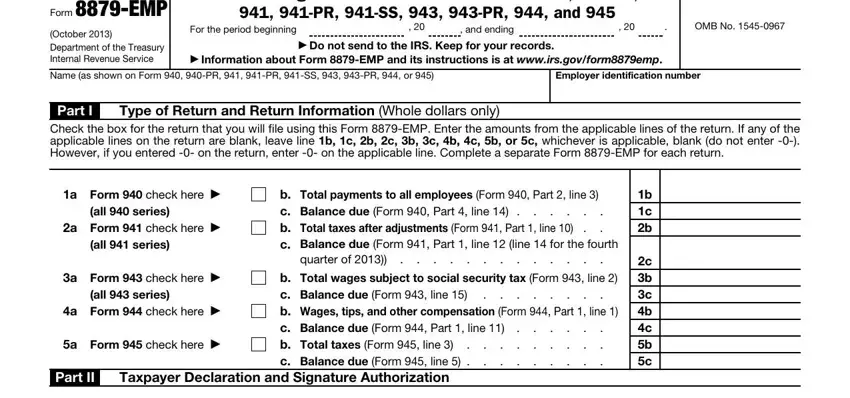

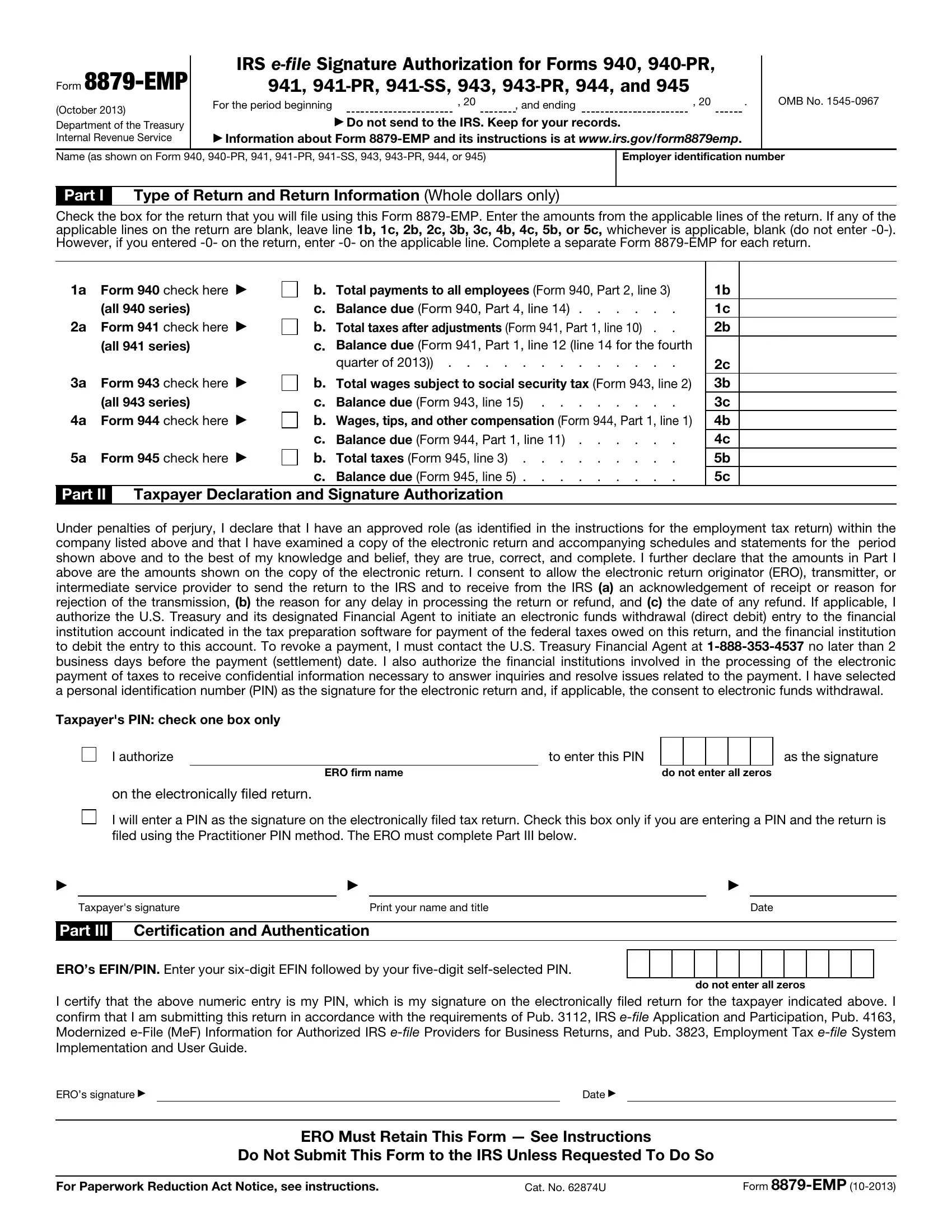

Use Form 8879-EMP if you and the electronic return originator (ERO) want to use a personal identification number (PIN) to electronically sign an electronic employment tax return.

If applicable, Form 8879-EMP is also used to authorize an electronic funds withdrawal. If you do not use Form 8879-EMP to sign the return, you must use Form 8453-EMP, Employment Tax Declaration for an IRS e-file Return. For more information, see the Form 8453-EMP instructions.

Do not send this form to the IRS. The ERO must retain Form 8879-EMP.

ERO Responsibilities

The ERO will:

• Enter the name and employer identification number as shown on Form 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, or 945.

• Complete Part I by checking the box for the type of return being filed and entering the amounts from the return being filed. Zeros should only be entered if the return contains zeros. Otherwise, if the line on the return is blank, leave the corresponding line in Part I blank.

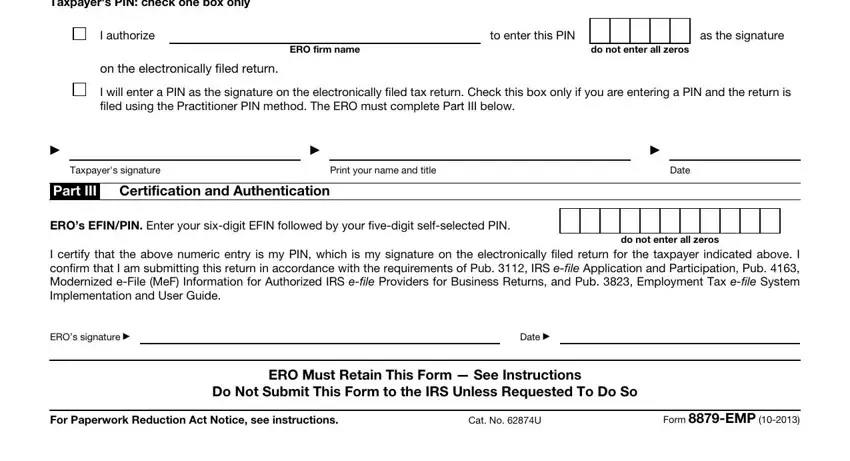

• Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the taxpayer’s PIN.

• Give the taxpayer Form 8879-EMP for completion and review. This can be done by hand delivery, U.S. mail, private delivery service, email, or Internet website.

• Complete Part III, including a signature and date.

Form 8879-EMP must be completed and signed

! |

before the electronic return is transmitted (or |

▲ released for transmission). |

CAUTION |

|

Taxpayer’s Responsibilities

The taxpayer filing Form 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, or 945 has the following responsibilities.

•Verify the type of return being filed in Part I.

•Verify the accuracy of the return.

•Check the appropriate box in Part II to either authorize the ERO to enter your PIN or to choose to enter it in person.

•Indicate or verify the PIN when authorizing the ERO to enter it (the PIN must be five numbers other than all zeros).

•Sign, date, and print your name and title in Part II.

•Return the completed Form 8879-EMP to the ERO by hand delivery, U.S. mail, private delivery service, or fax.

Note. The return will not be transmitted to the IRS until the ERO receives the signed Form 8879-EMP.

Important Notes for EROs

•Do not send Form 8879-EMP to the IRS unless requested to do so. Retain the completed Form 8879-EMP for 4 years from the return due date or IRS received date, whichever is later.

•Enter the taxpayer’s PIN on the input screen only if the taxpayer has authorized you to do so.

•Provide the taxpayer with a copy of the signed Form 8879- EMP upon request.

•Provide the taxpayer with a corrected copy of Form 8879-EMP if changes are made to the return (for example, based on the taxpayer’s review).

•See Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file Providers for Business Returns.

Paperwork Reduction Act Notice. We ask for the information on Form 8879-EMP to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . . . 2 hr., 37 min.

Learning about the law

or the form . . . . . . . . . . . . . . . 6 min.

Preparing the form . . . . . . . . . . . . 9 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 8879-EMP simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/formspubs. Click on More Information and then click on Comment on Tax Forms and Publications. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send Form 8879-EMP to this address. Instead, keep it for your records.