You may prepare what is an 8893 instantly with our PDFinity® online PDF tool. Our expert team is continuously endeavoring to develop the editor and insure that it is even better for users with its extensive functions. Bring your experience to another level with constantly growing and fantastic possibilities available today! This is what you will want to do to get started:

Step 1: Click the "Get Form" button in the top part of this page to get into our editor.

Step 2: With the help of this advanced PDF tool, you could accomplish more than merely complete forms. Express yourself and make your docs seem sublime with customized text put in, or adjust the original input to excellence - all that accompanied by the capability to insert just about any photos and sign the PDF off.

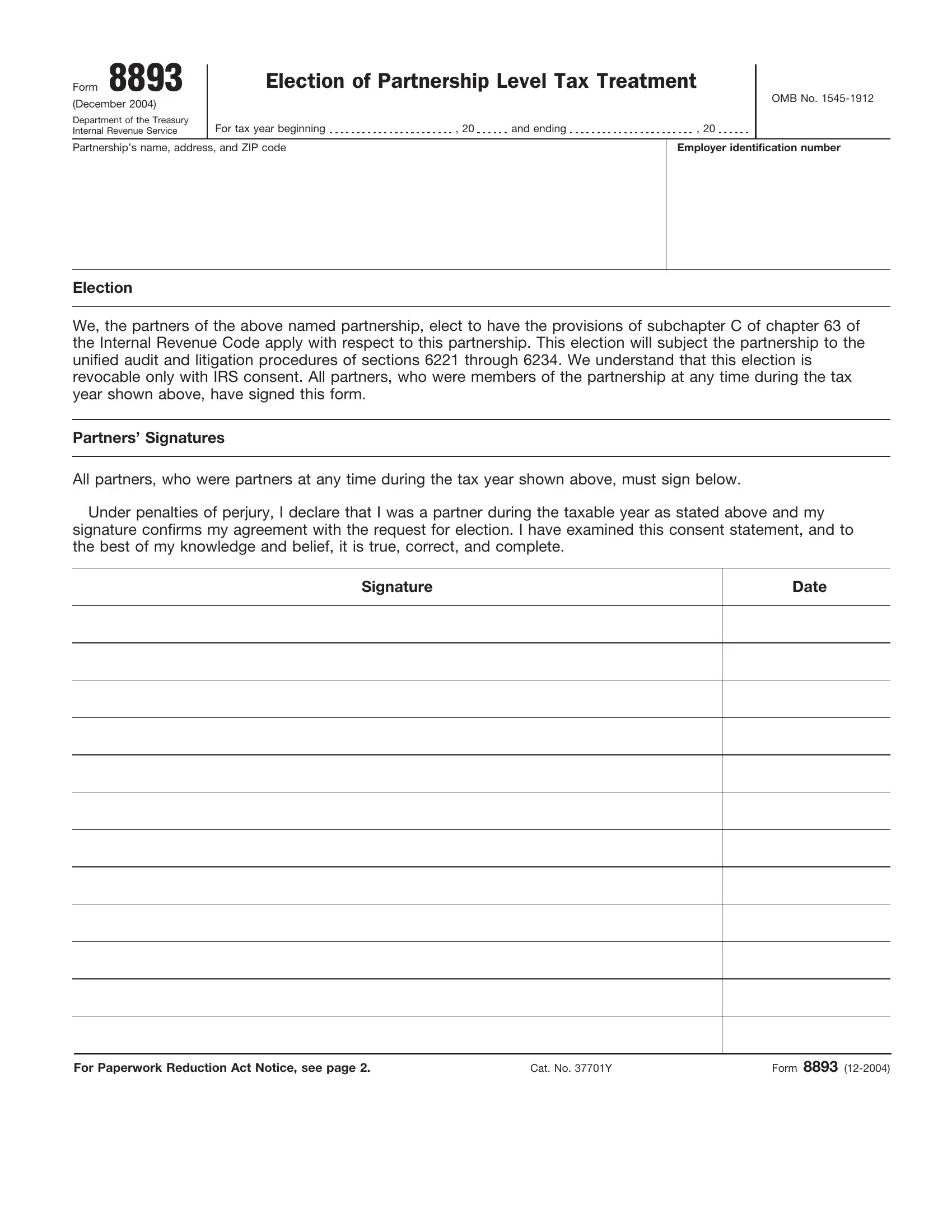

When it comes to blanks of this specific form, here's what you should do:

1. While filling out the what is an 8893, make certain to complete all necessary blank fields in the relevant area. This will help facilitate the work, enabling your details to be processed swiftly and correctly.

Step 3: Check the information you've inserted in the blanks and then click the "Done" button. Sign up with us right now and immediately access what is an 8893, ready for download. Every single change you make is handily preserved , helping you to modify the pdf later on when necessary. FormsPal provides risk-free document tools with no data record-keeping or any type of sharing. Be assured that your data is secure with us!