Using PDF documents online is certainly easy using our PDF tool. You can fill out form 8898 form here and use many other options we provide. Our professional team is relentlessly endeavoring to expand the editor and insure that it is even faster for users with its cutting-edge functions. Take your experience to another level with continuously improving and amazing possibilities we offer! Getting underway is easy! All that you should do is follow these basic steps below:

Step 1: Press the "Get Form" button in the top part of this webpage to get into our PDF tool.

Step 2: With our online PDF editor, you may accomplish more than merely fill out blanks. Try all of the features and make your documents look professional with customized text added in, or tweak the original content to perfection - all that comes with the capability to incorporate your personal photos and sign it off.

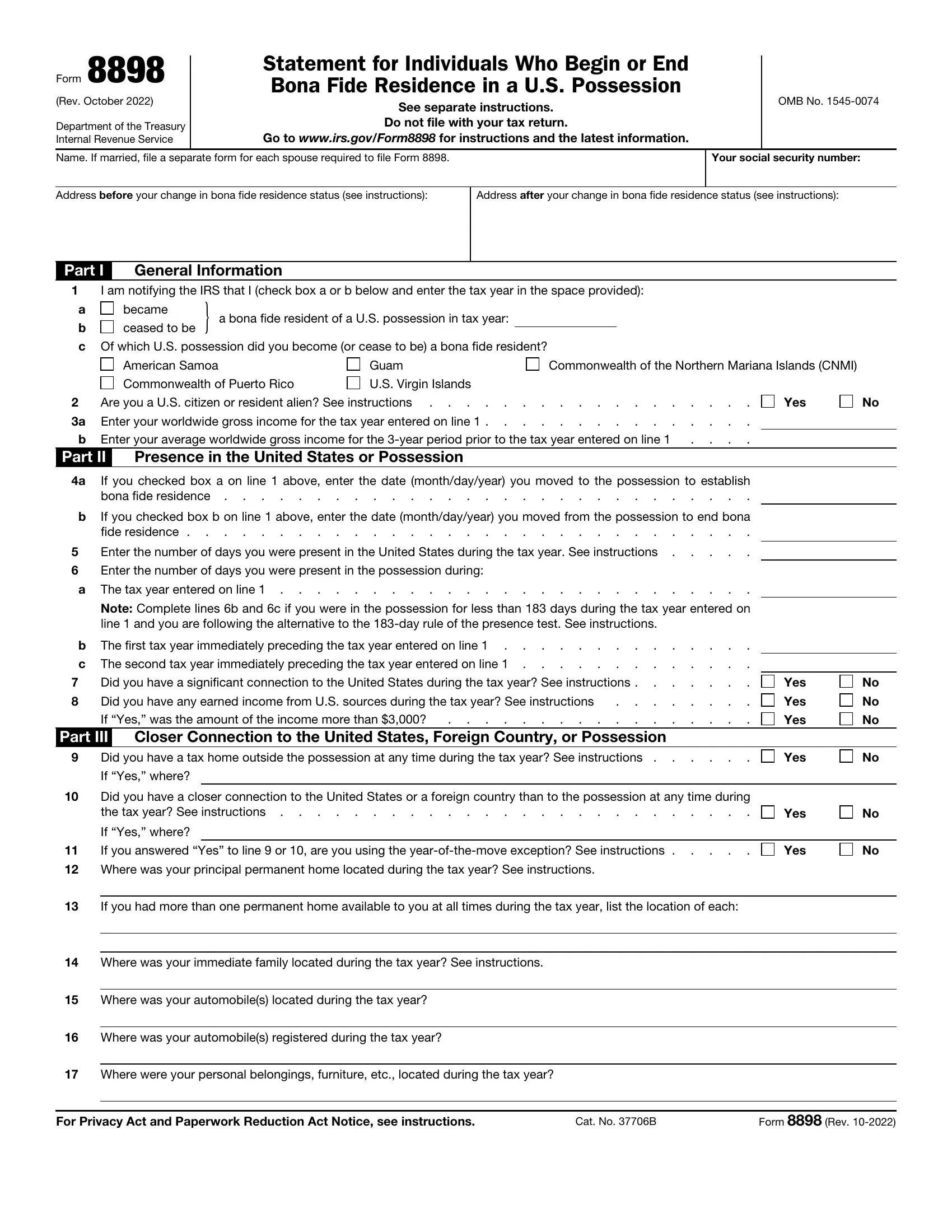

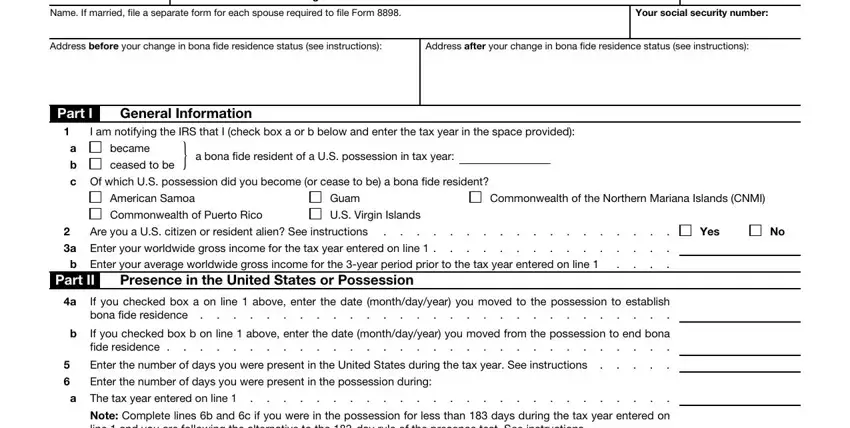

This PDF form will need particular details to be filled in, hence be sure to take whatever time to provide exactly what is required:

1. When submitting the form 8898 form, be sure to complete all of the necessary blank fields within the associated part. It will help to speed up the work, making it possible for your information to be handled promptly and appropriately.

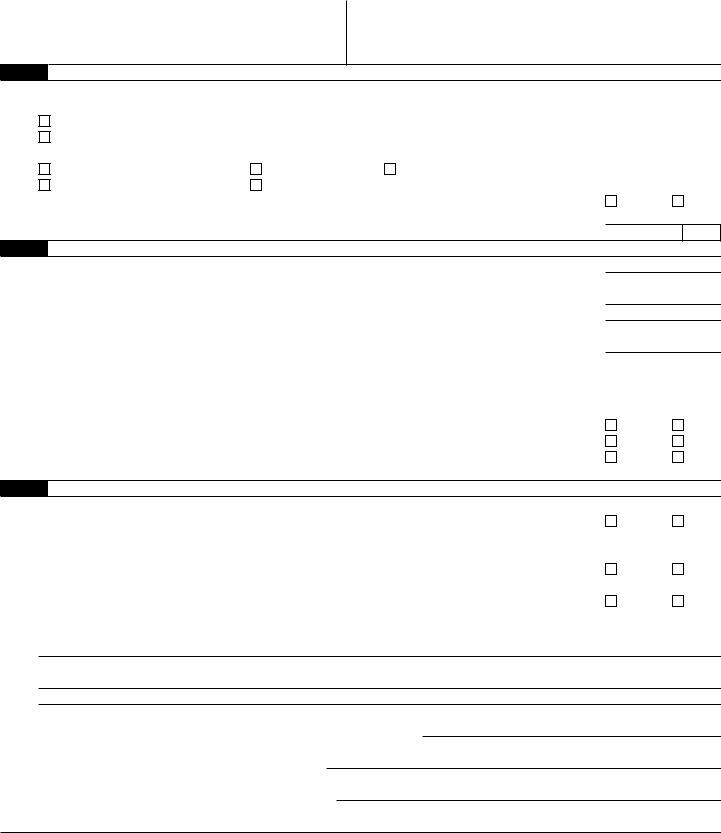

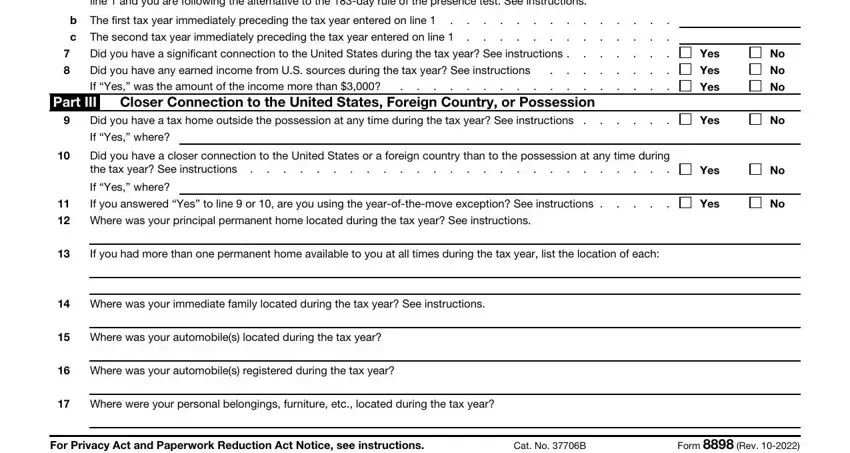

2. After filling out the last step, go on to the subsequent stage and fill out all required details in all these blanks - Note Complete lines b and c if you, b The first tax year immediately, Did you have a significant, Part III Closer Connection to the, Did you have a tax home outside, Did you have a closer connection, Yes, Yes, Yes, Yes, Yes, If Yes where If you answered Yes, Yes, Where was your principal, and If you had more than one permanent.

It is possible to get it wrong when filling out the Did you have a significant, for that reason you'll want to take another look before you'll send it in.

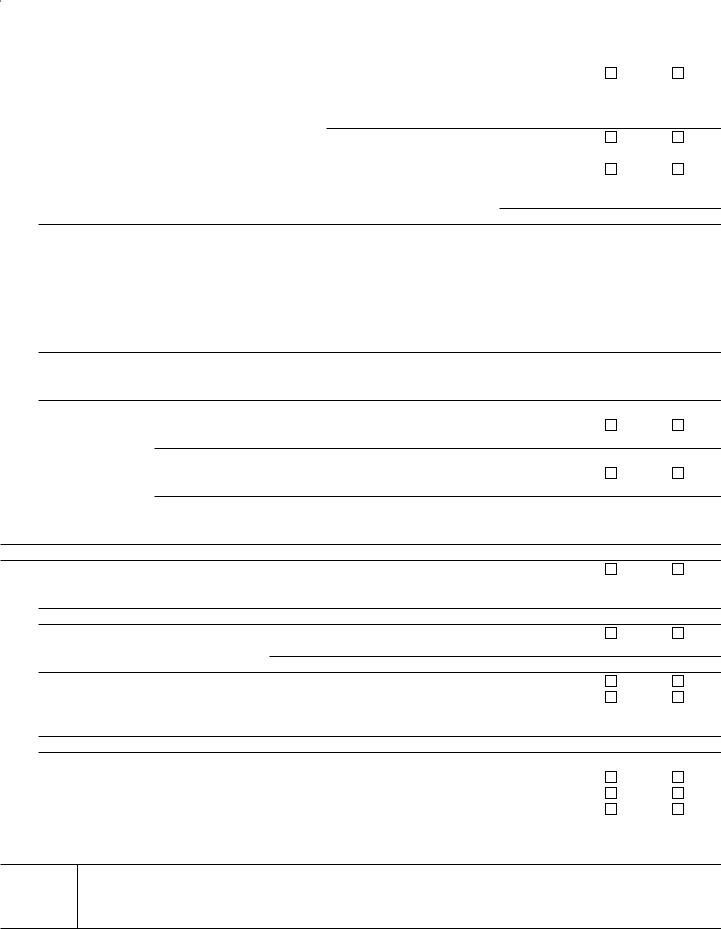

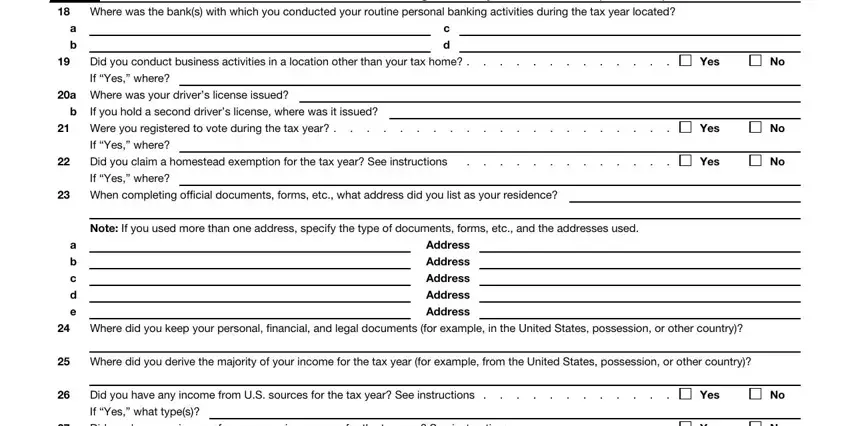

3. In this specific stage, have a look at Part III Closer Connection to the, Did you conduct business, Yes, a Where was your drivers license, If you hold a second drivers, Were you registered to vote, If Yes where Did you claim a, Yes, Yes, When completing official, Note If you used more than one, Address, Address, Address, and Address. Each of these are required to be filled out with greatest awareness of detail.

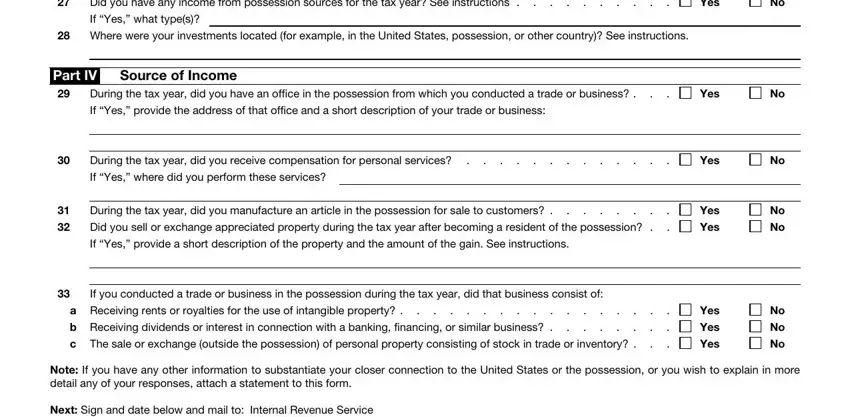

4. All set to begin working on the next segment! In this case you'll get all these Did you have any income from US, Yes, Where were your investments, Part IV, Source of Income, During the tax year did you have, Yes, During the tax year did you, Yes, During the tax year did you, Yes, Yes, Yes, Yes, and Yes fields to complete.

Step 3: Confirm that your information is correct and just click "Done" to conclude the process. After starting a7-day free trial account with us, you will be able to download form 8898 form or email it directly. The PDF file will also be readily accessible through your personal account menu with your each modification. Here at FormsPal.com, we endeavor to make sure that all your details are stored private.