State of New Jersey

Division of Taxation

Form 906

CLOSING AGREEMENT REQUEST

Enclosed packet includes:

1.A copy of the Closing Agreement statute.

2.A Closing Agreement Form 906 to complete.

3.Appointment of Taxpayer Representative, if applicable.

4.A Financial Statement of Debtor – Section I through Section V to be completed.

5.National Standard Expenses information to be used in the completion of Section II of Financial Statement of Debtor.

NOTE: Copies of the Taxpayer’s last two years Individual IRS returns, and Corporate returns, if applicable, are required to be submitted with Form 906.

Send completed required information to:

New Jersey Division of Taxation

Closing Agreements

PO Box 245

Trenton, NJ 08695-0245

Closing Agreements

Authority

Unless otherwise expressly noted, all provisions of this chapter were adopted pursuant to authority of N.J.S.A. 54:50-1 et seq. and were filed and became effective on January 27, 1978, as R. 1978 d. 29 Sec: 10 N.J.R. 41(a), N.J.R. 127(d).

Chapter Table of Contents

SUBCHAPTER 1 |

Closing Agreements |

18:33-1.1 General provisions

18:33-1.2 Taxable periods

18:33-1.3 Finality; determination of fraud

18:33-1.4 Procedure with respect to closing agreements

18:33-1.5 Applicability and coverage; policy

18:33-1.6 Procedures

18:33-1.1 General provisions

(a)The Director of the Division of Taxation or any of his delegated representatives may enter into a written agreement with any person relating to the liability of such person (or of the person or estate for whom he acts) in respect to any State tax administered by the Director of the Division of Taxation for any taxable period ending prior or subsequent to the date of such agreement. A closing agreement may be entered into in any case in which there appears to be an advantage in having the case permanently and conclusively closed, or if good and sufficient reasons are shown by the taxpayer for desiring a closing agreement and it is determined by the director that the State of New Jersey will sustain no disadvantage through consummation of such an agreement.

(b)A closing agreement may be executed even though under the agreement the taxpayer is not liable for any tax for the period to which the agreement relates. There may be a series of closing agreements relating to the tax liability for a single period.

18:33-1.2 Taxable periods

(a)Closing agreements with respect to taxable periods ended prior to the date of the agreement may relate to the total tax liability of the taxpayer or to any or more separate items affecting the tax liability of the taxpayer, as, for example, the amount of gross receipt, deduction items, other income items, statutory deductions or exclusions, statutory additions to income, the year in which an item of income is to be included in gross receipts or income, the year in which an item is to be deducted, or the value of property on a specific date.

(b)Closing agreements with respect to taxable periods ending subsequent to the date of the agreement may relate to one or more separate items affecting the tax liability of the taxpayer.

18:33-1.3 Finality; determination of fraud

(a)A closing agreement which is approved within such time as may be stated in such agreement, or later agreed to, shall be final an conclusive, and, expect upon a showing of fraud or malfeasance, or misrepresentation of a material fact.

1.The case shall not be reopened as to the matters agreed upon or the agreement modified by an officer, employee, or agent of the State of New Jersey; and

2.In any suit, action, or proceeding, such agreement, or any determination, assessment, collection, payment, abatement, refund, or credit made in accordance therewith, shall

not be annulled, modified, set aside, or disregarded. However, a closing agreement with respect to a taxable period ending subsequent to the date of the agreement is subject to any change in, or modification of, the law enacted subsequent to the date of the agreement and made applicable to such taxable period, and each closing agreement so recited.

(b)Execution and approval of closing agreement does not preclude an additional inspection of the taxpayer’s records to determine whether fraud, malfeasance, or misrepresentation of material fact exists as to execution of agreement.

18:33-1.4 Procedure with respect to closing agreements

(a)A request for a closing agreement which relates to a prior taxable period may be submitted at any time before a case with respect to the tax liability involved is filed in the Division of Tax Appeals. All closing agreements shall be executed on forms prescribed by the Director of the Division of Taxation.

(b)Any tax or deficiency in tax determined pursuant to a closing agreement shall be assessed and collected, and any overpayment determined pursuant thereto shall be credited or refunded, in accordance with the applicable provisions of law.

18:33-1.5 Applicability and coverage; policy

(a)The Director of the Division of Taxation or any Division of Taxation officer or employee authorized in writing by the Director, can enter and approve written closing agreements with any person. Such agreement can relate to the liability of such person (or the taxpayer represented by him), for any State tax administered by the Division of Taxation for any taxable period. The agreement can cover either the total liability of taxpayer or one or more of separate items affecting the liability, if it embraces a tax period ending before the date of the agreement; or one or more separate items affecting tax liability.

There can be a series of agreements covering a single tax period.

(b)A closing agreement may be entered into when it appears advantageous to have the case permanently closed; or where the taxpayer shows sufficient reason for desiring a closing agreement, and there would be no disadvantage to the State of New Jersey in entering into it. Closing agreements can be entered into, although under the agreement taxpayer is not liable for tax for the period covered.

18:33-1.6 Procedures

(a)A request to enter into a closing agreement is executed on prescribed forms and submitted, processed and approved under prescribed procedure. If the proposed agreement relates to a prior taxable period, it must be submitted before a case with respect to the tax liability is filed in the Division of Tax Appeals or in any Division of the Superior Court of New Jersey or in any Federal Court.

(b)Where parties entered into a stipulation, on trial, or any matter regarding taxpayer’s liability, and the action is dismissed with prejudice, taxpayer shall not be permitted to repudiate the agreement because a closing agreement was not executed by the Director of the Division of Taxation.

(c)Taxpayer’s acceptance of a determination of additional tax under which an assessment of additional tax was made and paid, does not preclude the Director from determining an additional deficiency for the year.

(d)The Director of the Division of Taxation is not estopped from issuing a deficiency assessment. Acceptance of a sum submitted with an amended return does not discharge a taxpayer from further liability; a deficiency assessment is not a closing agreement.

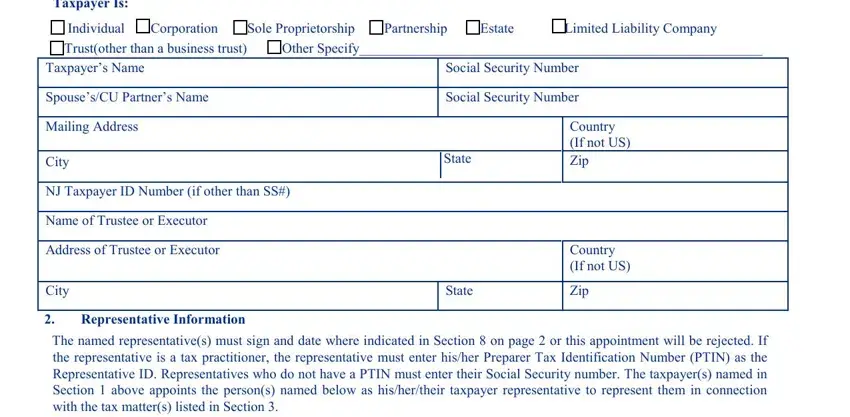

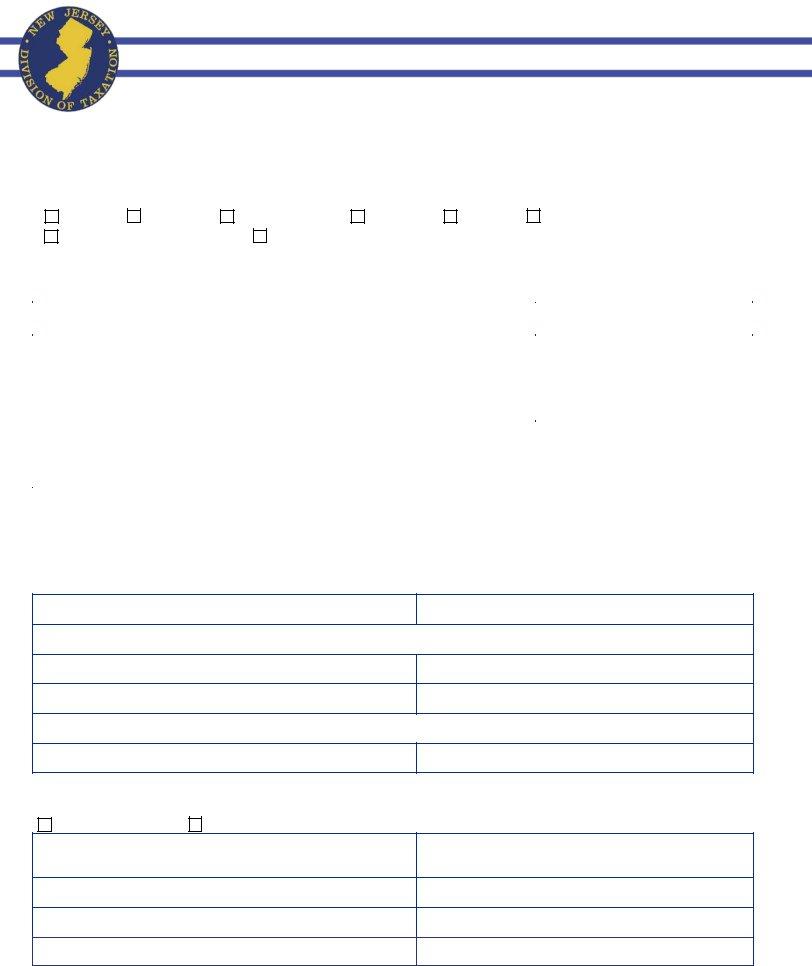

Appointment of Taxpayer Representative (Form M-5008-R)

1. Taxpayer Information

Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation. Section 3 of the form allows you to list which tax matters your representative is authorized to handle on your behalf.

Taxpayer Is: |

|

|

|

|

|

☐ Individual ☐Corporation ☐Sole Proprietorship |

☐Partnership ☐Estate |

☐Limited Liability Company |

☐Trust(other than a business trust) |

Other Specify__________________________________________________________ |

Taxpayer’s Name |

|

|

Social Security Number |

|

|

|

|

|

Spouse’s/CU Partner’s Name |

|

|

Social Security Number |

|

|

|

|

|

|

Mailing Address |

|

|

|

|

Country |

|

|

|

|

|

(If not US) |

City |

|

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

NJ Taxpayer ID Number (if other than SS#) |

|

|

|

|

|

|

|

|

|

|

Name of Trustee or Executor |

|

|

|

|

|

|

|

|

|

|

|

Address of Trustee or Executor |

|

|

|

|

Country |

|

|

|

|

|

(If not US) |

|

|

|

|

|

|

City |

|

|

State |

|

Zip |

|

|

|

|

|

|

2.Representative Information

The named representative(s) must sign and date where indicated in Section 8 on page 2 or this appointment will be rejected. If the representative is a tax practitioner, the representative must enter his/her Preparer Tax Identification Number (PTIN) as the Representative ID. Representatives who do not have a PTIN must enter their Social Security number. The taxpayer(s) named in Section 1 above appoints the person(s) named below as his/her/their taxpayer representative to represent them in connection with the tax matter(s) listed in Section 3.

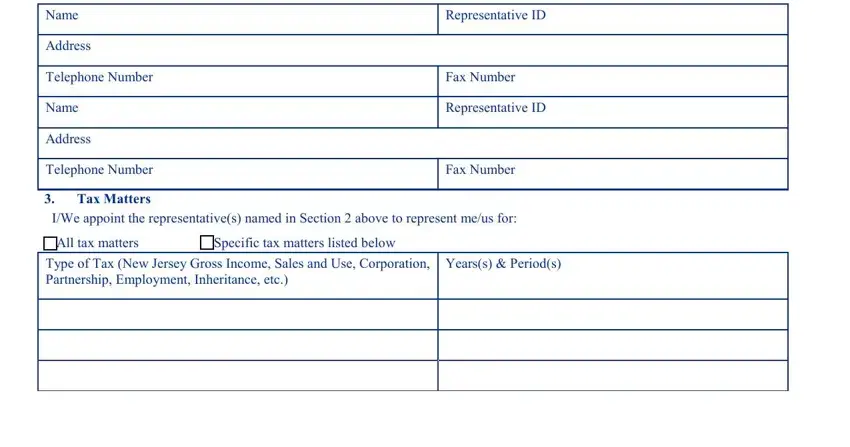

Name

Address

Telephone Number

Name

Address

Telephone Number

3.Tax Matters

Representative ID

Fax Number

Representative ID

Fax Number

I/We appoint the representative(s) named in Section 2 above to represent me/us for:

☐All tax matters |

☐Specific tax matters listed below |

Type of Tax (New Jersey Gross Income, Sales and Use, Corporation, Years(s) & Period(s) Partnership, Employment, Inheritance, etc.)

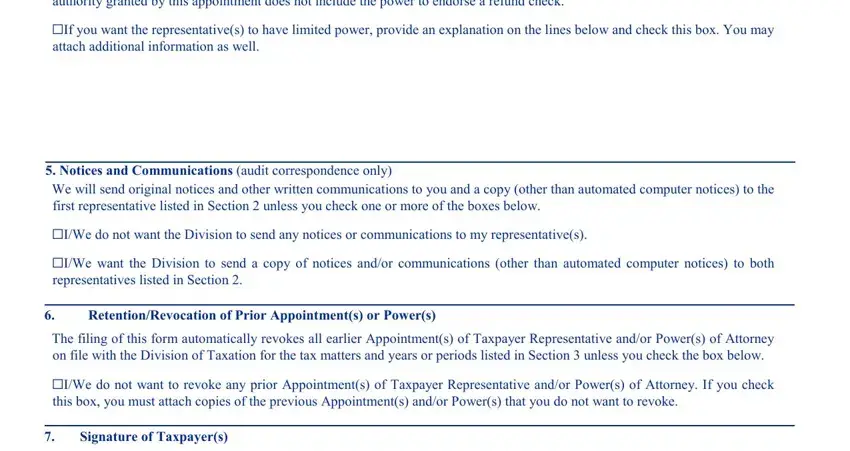

4.Acts Authorized

The representative(s) is/are authorized to receive and inspect confidential tax records and is/are granted full power to act with respect to the tax matters described in Section 3 above, and to do and perform all such acts as I/we could do or perform. The authority granted by this appointment does not include the power to endorse a refund check.

☐If you want the representative(s) to have limited power, provide an explanation on the lines below and check this box. You may attach additional information as well.

5.Notices and Communications (audit correspondence only)

We will send original notices and other written communications to you and a copy (other than automated computer notices) to the first representative listed in Section 2 unless you check one or more of the boxes below.

☐I/We do not want the Division to send any notices or communications to my representative(s).

☐I/We want the Division to send a copy of notices and/or communications (other than automated computer notices) to both representatives listed in Section 2.

6.Retention/Revocation of Prior Appointment(s) or Power(s)

The filing of this form automatically revokes all earlier Appointment(s) of Taxpayer Representative and/or Power(s) of Attorney on file with the Division of Taxation for the tax matters and years or periods listed in Section 3 unless you check the box below.

☐I/We do not want to revoke any prior Appointment(s) of Taxpayer Representative and/or Power(s) of Attorney. If you check this box, you must attach copies of the previous Appointment(s) and/or Power(s) that you do not want to revoke.

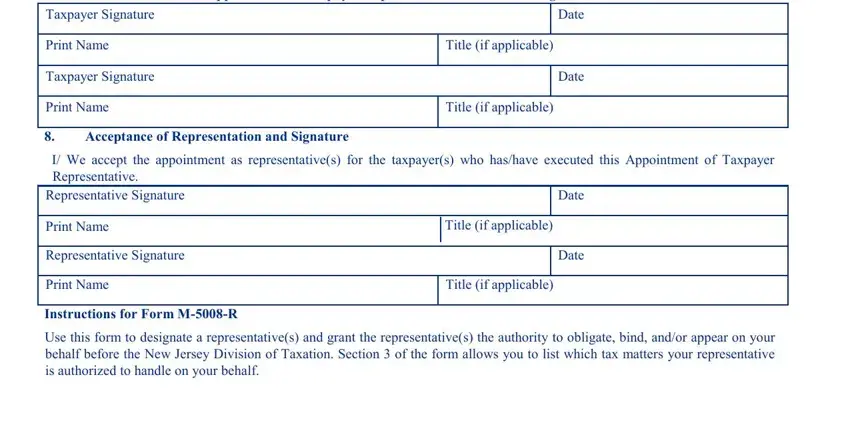

7.Signature of Taxpayer(s)

If the tax matters covered by this appointment concern a joint Gross Income Tax return and the representative(s) is/are being appointed to represent both spouses/CU partners, both must sign below.

If a corporate officer, partner, guardian, tax matter partner, executor, administrator, or trustee signs the appointment on behalf of the taxpayer, the signature below certifies that they have the authority to execute this form on behalf of the taxpayer(s).

This Appointment of Taxpayer Representative Is Void if not Signed and Dated

8.Acceptance of Representation and Signature

I/ We accept the appointment as representative(s) for the taxpayer(s) who has/have executed this Appointment of Taxpayer Representative.

Representative Signature |

|

|

Date |

|

|

|

|

Print Name |

|

Title (if applicable) |

|

|

|

|

|

|

|

|

Representative Signature |

|

|

Date |

|

|

|

|

Print Name |

|

Title (if applicable) |

|

|

|

|

Instructions for Form M-5008-R

Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation. Section 3 of the form allows you to list which tax matters your representative is authorized to handle on your behalf.

You may authorize the representative(s) to receive your confidential tax information. Unless otherwise indicated, the representative(s) may also perform any and all acts that you can perform regarding your taxes. This includes consenting to extend the time to assess tax or agreeing to a tax adjustment. Representatives may not sign returns or delegate authority unless specifically authorized to do so on this form.

Form M-5008-R Is not Required:

•When an individual appears with you or with a representative who is authorized to act on your behalf. For example, this form is not required if a representative appears on behalf of a corporate taxpayer with an authorized corporate officer;

•If a trustee, receiver, or attorney has been appointed by a court that has jurisdiction over a debtor;

•If an individual merely furnishes tax information or prepares a report or return for you;

•When a fiduciary stands in the position of, and acts as, the taxpayer. However, if a fiduciary wishes to authorize an individual to represent or act on behalf of the taxpayer, the fiduciary must sign and file Form M-5008-R.

Limitations

Appointing a representative does not relieve you of tax responsibilities or obligations. This form allows another person to represent you in most matters concerning tax administration, tax investigations, examinations/audits, and other meetings with the Division. Because you remain responsible for your tax obligations, a representative’s authority does not extend to some aspects of the collection process. Examples of the collection process are: judgments, levies, liens, and seizures. In these instances, we may require telephone communication, direct contact, and/or interaction with the taxpayer.

Who Can Execute the Appointment of Taxpayer Representative?

•An individual, if the request pertains to a personal Income or individual Use Tax return filed by that individual (or by an individual and his or her spouse/CU partner if the request pertains to a joint Income Tax return and joint representation is requested). If joint representation is not requested, each taxpayer must file his or her own form.

•If the taxpayer is a limited liability company (LLC), a manager of the LLC. If there is no manager, a member of the LLC authorized to act on tax matters on behalf of the entity.

•A sole proprietor.

•A general partner of a partnership or limited partnership.

•The administrator or executor of an estate.

•The trustee of a trust.

•If the taxpayer is a corporation, a principal officer or corporate officer who is authorized to act on tax matters and has legal authority to reach agreements on behalf of the corporation; any person who is designated by the board of directors or other governing body of the corporation; any officer or employee of the corporation upon written request signed by a principal officer of the corporation and attested by the secretary or other officer of the corporation; or any other person who is authorized to receive or inspect the corporation’s return or return information under I.R.C. §6103(e)(1)(D).

Tax Matters

You may enter more than one tax type and indicate the tax year(s) and/or tax period(s) applicable in Section 3. If you designate a specific tax but no tax year or period, the M-5008-R will apply to all tax years and periods. If you designate a specific tax year or period but not a specific tax type, this form will apply to all tax types for the designated tax year or period. If you do not designate either a tax type or a tax period, this form will apply to all taxes and all periods.

Retention/Revocation of Prior Powers of Attorney and/or Appointments of Taxpayer Representative

By executing and filing the M-5008-R with the Division of Taxation, you are revoking all M-5008-R previously executed and filed with this Division for the same tax matter(s), year(s), and period(s) covered by this form.

You may not partially revoke a previously filed Form M-5008-R. If a previously filed Form M-5008-R or Power of Attorney has more than one representative and you do not want to retain all the representatives on the previously filed form, you must execute a new form indicating the representative(s) retained.

Signature of Taxpayer(s)

You, or an individual you authorize to execute the Form M-5008-R on your behalf, must sign and date the form. You or the representative(s) may be required to provide identification and evidence of authority to sign this document.

Individuals. If the matter for which the appointment is prepared involves a joint Income Tax return and the same individual(s) will represent both spouses/CU partners, both must sign Form M-5008-R, unless one spouse/CU partner authorizes the other, in writing, to sign for both. In that case, you must attach a copy of the authorization to the appointment. If the matter for which the

appointment is prepared involves a joint return and different individuals will represent the spouses/CU partners, each must execute his or her own Appointment of Taxpayer Representative.

Corporations. The president, vice-president, treasurer, assistant treasurer, or any other officer of the corporation having authority to bind the corporation must sign Form M-5008-R.

Partnerships. All partners must sign Form M-5008-R, or if the form is executed on behalf of the partnership only, a partner duly authorized to act for the partnership must sign it. A partner is authorized to act for the partnership if, under state law, the partner has authority to bind the partnership.

Limited Liability Companies (LLC). A member or manager must sign Form M-5008-R, or, if the form is executed on behalf of the LLC only, a member or manager duly authorized to act for the LLC must sign it, and the signor must certify that he/she has such authority.

Fiduciaries. In matters involving fiduciaries under agreements, declarations, or appointments, Form M-5008-R must be signed by all of the fiduciaries, unless proof is furnished that fewer than all fiduciaries have the authority to act in the matter under consideration. Evidence of the authority of the fiduciaries to act must be included when filing Form M-5008-R.

Estates. The administrator or executor of an estate may execute Form M-5008-R.

Trusts. The trustee of a trust may execute Form M-5008-R.

Others. Form M-5008-R must be signed by the taxpayer or by an individual having the authority to act on behalf of the taxpayer.

Instructions for Submission

Completion and submission of this form is only required when you are communicating – either in person or in writing – with the

Division on behalf of another person.

In Person

If you are planning to visit a Regional Information Center on behalf of another individual, you must bring:

•The completed form, signed by both the representative and the taxpayer; and

•One form of government-issued photo identification (such as a driver’s license) or two forms of non-picture government- issued identification (such as a birth certificate).

In Writing

If you are responding to a notice sent by the Division, submit your documentation to the PO Box on the notice.

You must include with your correspondence:

•The completed form, signed by both the representative and the taxpayer;

•A copy of the notice; and

•Any corresponding documentation.

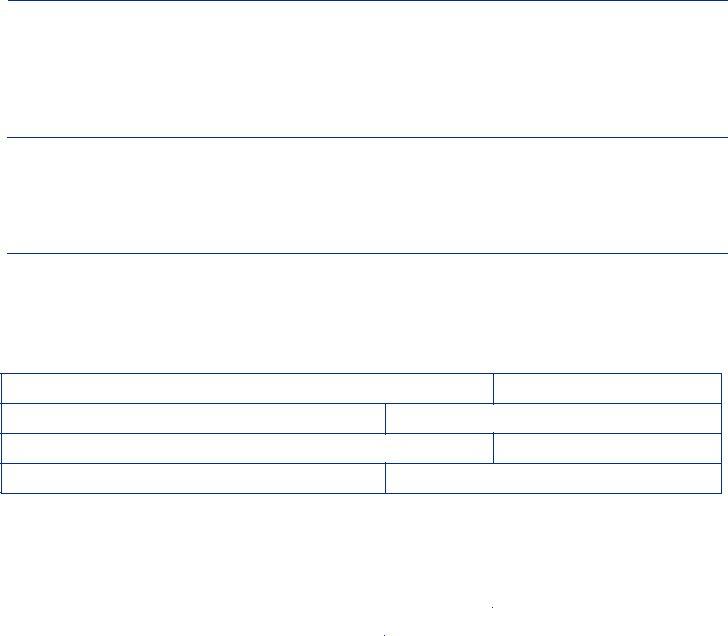

New Jersey Treasury Department – Division of Taxation

CLOSING AGREEMENT AS TO FINAL DETERMINATION

COVERING SPECIFIC TAX MATTERS

NJ Form 906

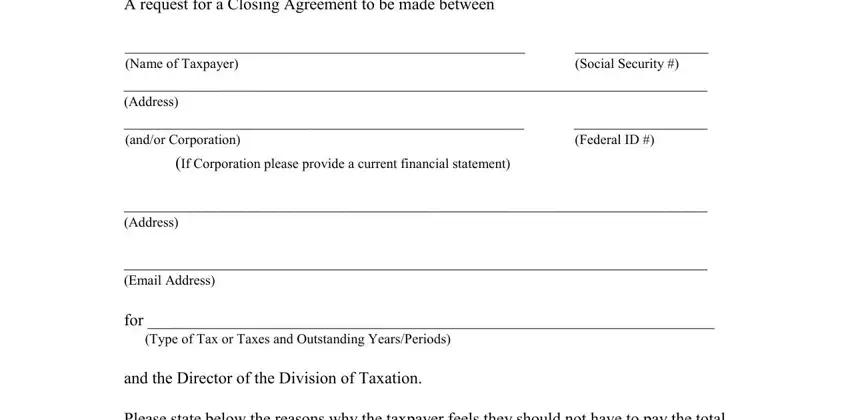

A request for a Closing Agreement to be made between |

|

________________________________________________ |

________________ |

(Name of Taxpayer) |

(Social Security #) |

______________________________________________________________________

(Address)

________________________________________________ |

________________ |

(and/or Corporation) |

(Federal ID #) |

(If Corporation please provide a current financial statement) |

|

______________________________________________________________________

(Address)

______________________________________________________________________

(Email Address)

for ____________________________________________________________________

(Type of Tax or Taxes and Outstanding Years/Periods)

and the Director of the Division of Taxation.

Please state below the reasons why the taxpayer feels they should not have to pay the total outstanding tax liabilities due the Division of Taxation.

(If additional space is required you may attach an additional sheet)

Amount Offered as Payment in Full: $_________________

How will payment be made? ________________________

Source of Funds for Offer: __________________________

______________________________________ |

_______________ |

Signature of Taxpayer/Officer |

Date |

State of New Jersey Division of Taxation

Financial Statement of Debtor

Section I – Employment Data

1. __________________________________________ |

2. ______________ |

3. _________________ |

|

Name (Debtor) |

Birth Date |

Social Security # |

4. |

______________________________________________________________ ___________________ |

|

Home Address |

|

Phone Number |

5. |

__________________________________________ |

6. ______________ |

7. |

|

_________________ |

|

|

|

Name (Spouse) |

Birth Date |

Social Security # |

|

(Provide address if different from yours) |

|

|

DEBTOR EMPLOYMENT DATA

8. Occupation: ________________________ 9. How Long in Present Employment? ___________

10.Present Employer’s Name: _______________________________________________________

Address: ________________________________________ Phone Number________________

11.Present Monthly Income Total: $_______________ (Provide breakdown on line below) Salary or Wages $__________ Commissions $_________ Other (State Source) $_________

12.Other Employment – Within the last three years:

Employer’s Name |

Address |

Phone Number Employment Dates |

________________ |

_____________________________ |

_____________ ________________ |

________________ |

_____________________________ |

_____________ |

________________ |

________________ |

_____________________________ |

_____________ |

________________ |

SPOUSE’S EMPLOYMENT DATA

13. Occupation: ________________________ 14. How Long in Present Employment? ___________

15.Present Employer’s Name: _______________________________________________________

Address: ________________________________________ Phone Number________________

16.Present Monthly Income Total: $_______________ (Provide breakdown on line below) Salary or Wages $__________ Commissions $_________ Other (State Source) $_________

17.Other Employment – Within the last three years:

Employer’s Name |

Address |

Phone Number |

Employment Dates |

________________ |

_____________________________ |

_____________ |

_______________ |

________________ |

_____________________________ |

_____________ |

_______________ |

________________ |

_____________________________ |

_____________ |

_______________ |

|

|

|

|

DEPENDENTS

18. Total Number: _______

Relationship __________ Age ___ Relationship __________ Age ___ Relationship _________ Age ___

19.Total Monthly Income of Dependents (except spouse): $_______________

Section II – Financial Data

20.For what period did you last file a Federal tax return? _________________________

21.For what period did you last file a New Jersey Income tax return? _______________

22.Amount of Gross Income reported on last Federal tax return filed? $_____________

Monthly Income and Expense Analysis

|

Total Income |

Gross |

Necessary Living Expenses |

Claimed |

|

|

|

|

|

23. |

Wages/Salaries (Taxpayer) |

$ |

34. National Standard Expenses (1) |

$ |

|

|

|

|

|

|

24. |

Wages/Salaries (Spouse) |

|

35. |

Rent/ Mortgage |

|

|

|

|

|

|

25. Interest / Dividends |

|

36. |

Utilities |

|

|

|

|

|

|

|

26. |

Net Business Income |

|

37. |

Health Care |

|

|

|

|

|

|

|

27. |

Rental Income |

|

38. |

Taxes (Income) - Federal |

|

|

|

|

|

|

|

28. |

Pension (Taxpayer) |

|

39. |

Taxes (Income) – State |

|

|

|

|

|

|

|

29. |

Pension (Spouse) |

|

40. |

Property Taxes |

|

|

|

(If not included with mortgage) |

|

|

|

|

|

|

|

|

|

|

|

|

30. |

Child Support |

|

41. |

Court Ordered Payments |

|

|

|

|

|

|

|

31. |

Alimony |

|

42. |

Child/Dependent Care |

|

|

|

|

|

|

|

32. |

Other Income (Specify) |

|

43. |

Other Expenses (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33. |

Total Income |

$ |

44. Total Expenses |

$ |

|

|

|

|

|

|

(1)Select value from National Standard Expenses Table on last page of this application

Section III – Assets and Liabilities

45. |

Cash |

$ _____________ |

46. |

Checking Account |

_____________ |

47. |

Savings Account |

_____________ |

48. |

Stocks, Bonds & Other Securities |

_____________ |

49. |

Cash or Loan Value of Insurance |

_____________ |

50.Motor Vehicles (Model and Year) a. Owned Vehicles

1.____________________________ _____________

2.____________________________ _____________

3.____________________________ _____________

b. Leased Vehicles

1.____________________________ _____________

2.____________________________ _____________

3.____________________________ _____________

51. |

Debts Owed to You |

_____________ |

52. |

Household Furniture and Goods |

_____________ |

53. |

Items Used in Trade or Business |

_____________ |

54.Real Estate

1. |

__________________________________ |

_____________ |

2. |

__________________________________ |

_____________ |

3. |

__________________________________ |

_____________ |

4. |

__________________________________ |

_____________ |

55.Any Other Assets - Specify

1.__________________________________ _____________

2.__________________________________ _____________

3.__________________________________ _____________

4.__________________________________ _____________

Total Assets |

$ _____________ |

Section III – Assets and Liabilities Continued

|

Liabilities |

|

56. |

Bills Owed (Doctors, Lawyers, etc.) |

|

|

1. __________________________________ |

$_____________ |

|

2. __________________________________ |

_____________ |

3.__________________________________ _____________

57.Installment Debt (Car, Credit Card, etc.)

1.__________________________________ _____________

2.__________________________________ _____________

3.__________________________________ _____________

4.__________________________________ _____________

5.__________________________________ _____________

58. |

Federal Taxes Owed |

_____________ |

|

Has Federal lien been filed? _________ |

|

|

(If yes please supply copy) |

|

59. |

State Taxes Owed |

_____________ |

60.Real Estate Mortgages (2)

1.__________________________________ _____________

2.__________________________________ _____________

3.__________________________________ _____________

61.Loans Payable (To Banks, Finance Co., etc.) (2)

1.__________________________________ _____________

2.__________________________________ _____________

3.__________________________________ _____________

62.Judgments Owed (Other Than Federal or State)

(Please supply copy)

1.__________________________________ _____________

2.__________________________________ _____________

3.__________________________________ _____________

63.Other Debts (Itemize)

1.__________________________________ _____________

2.__________________________________ _____________

3.__________________________________ _____________

Total Liabilities |

$ _____________ |

(2)Note: Please include your current statement from lender with monthly payment amount and current balance due.

Section IV – General Financial Information

64.Real Property (Brief description and type of ownership)

Physical Address |

|

Date Acquired |

|

Cost |

______________________________________ |

_______________ |

___________ |

______________________________________ |

_______________ |

___________ |

______________________________________ |

_______________ |

___________ |

______________________________________ |

_______________ |

___________ |

65.Bank Accounts (Include Savings and Loans, Credit Unions, IRAs & Retirement Plans, Certificate of Deposit, etc.)

Name of Institution |

Address |

Type |

Acct # |

Balance |

________________ |

_________________ ___________ ___________ ___________ |

________________ |

_________________ ___________ ___________ ___________ |

________________ |

_________________ ___________ ___________ ___________ |

|

|

|

|

Total $ ___________ |

66.Securities (Stocks, bonds, mutual funds, money market funds, government securities, etc.)

Kind |

Quantity |

Owner of Record |

Current Value |

_______________________ ___________ ________________ |

________________ |

_______________________ ___________ ________________ |

________________ |

_______________________ ___________ ________________ |

________________ |

_______________________ ___________ ________________ |

________________ |

Total $________________

67.Charge Cards and lines of credit from banks, credit unions and savings and loans

|

|

|

Financial |

|

Credit |

Amount |

Monthly |

|

Type of Account or Card |

Institution |

|

Limit |

Owed |

Payment |

|

______________________ |

________________ |

______ |

__________ __________ |

|

______________________ |

________________ |

______ |

__________ __________ |

|

______________________ |

________________ |

______ |

__________ __________ |

|

______________________ |

________________ |

______ |

__________ __________ |

|

______________________ |

________________ |

______ |

__________ __________ |

|

|

|

|

|

|

Total $__________ |

68. |

Life Insurance |

|

|

|

|

|

|

|

|

|

|

Type |

|

Face |

Available |

|

Name of Company |

Policy Number |

Whole/Term Amount |

Loan Value |

|

________________ |

________________ |

__________ |

___________ ____________ |

|

________________ |

________________ |

__________ |

___________ ____________ |

|

________________ |

________________ |

__________ |

___________ ____________ |

Total $____________

Section V – General Information

69.Are you a party in any lawsuit now pending? ____ Yes ____No If yes please explain:

70.Are you a trustee, executor or administrator? ____ Yes ____No If yes please explain:

71.Is anyone holding any monies on your behalf? ____ Yes ____No If yes please explain:

72.Is there any likelihood you would receive an inheritance? ____ Yes ____No If yes please explain:

73.Do you receive or under any circumstances expect to receive benefits from an established trust from a claim for compensation or damages from a contingent or future interest in property of any kind? ____ Yes ____No

If yes please explain:

With knowledge of the penalties for false statements provided by 2C:21-4(b) ($7,500 fine and /or 3- 5 years imprisonment) and with the knowledge that this financial statement is submitted by me to affect action by the Division of Taxation, I certify that I believe the above statements are true and that it is a complete statement of all my income and assets, real and personal, whether held in my name or by any other.

___________________ _____________________________________

DateSignature Revised 08/2004

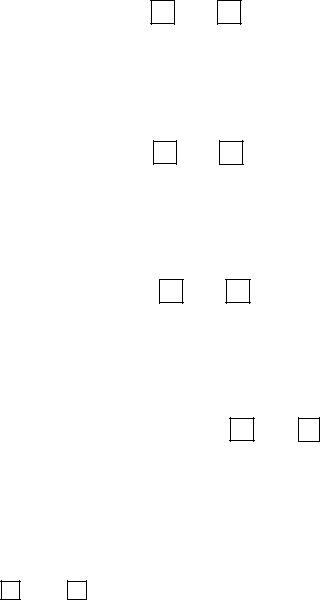

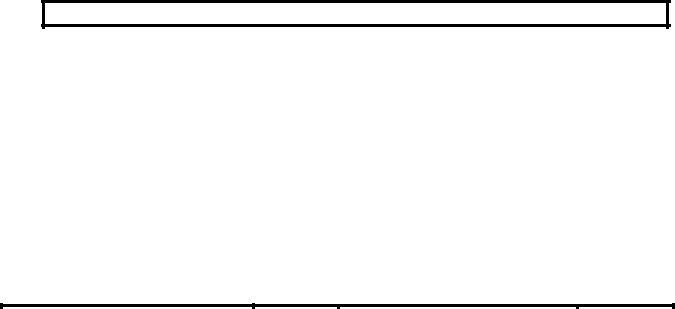

National Standards: Food, Clothing and Other Items

DISCLAIMER: IRS Collection Financial Standards are intended for use in calculating repayment of delinquent taxes. These Standards are effective on March 25, 2019 for purposes of federal tax administration only. Expense information for use in bankruptcy calculations can be found on the website for the U.S. Trustee Program.

Download the national standards for food, clothing and other items in PDF format for printing. Please note that the standard amounts change, so if you elect to print them, check back periodically to assure you have the latest version.

National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous.

The standards are derived from the Bureau of Labor Statistics (BLS) Consumer Expenditure Survey (CES) and defined as follows:

Food includes food at home and food away from home. Food at home refers to the total expenditures for food from grocery stores or other food stores. It excludes the purchase of nonfood items. Food away from home includes all meals and snacks, including tips, at fast-food, take-out, delivery and full-service restaurants, etc.

Housekeeping supplies includes laundry and cleaning supplies, stationery supplies, postage, delivery services, miscellaneous household products, and lawn and garden supplies.

Apparel and services includes clothing, footwear, material, patterns and notions for making clothes, alterations and repairs, clothing rental, clothing storage, dry cleaning and sent-out laundry, watches, jewelry and repairs to watches and jewelry.

Personal care products and services includes products for the hair, oral hygiene products, shaving needs, cosmetics and bath products, electric personal care appliances, and other personal care products.

The miscellaneous allowance is for expenses taxpayers may incur that are not included in any other allowable living expense items, or for any portion of expenses that exceed the Collection Financial Standards and are not allowed under a deviation. Taxpayers can use the miscellaneous allowance to pay for expenses that exceed the standards, or for other expenses such as credit card payments, bank fees and charges, reading material and school supplies.

Taxpayers are allowed the total National Standards amount monthly for their family size, without questioning the amounts they actually spend. If the amount claimed is more than the total allowed by the National Standards for food, housekeeping supplies, apparel and services, and personal care products and services, the taxpayer must provide documentation to substantiate those expenses are necessary living expenses. Deviations from the standard amount are not allowed for miscellaneous expenses. Generally, the total number of persons allowed for National Standards should be the same as those allowed as dependents on the taxpayer’s most recent year income tax return.

|

|

|

|

|

Housekeeping |

$40 |

$72 |

$76 |

$76 |

supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apparel & services |

$88 |

$159 |

$169 |

$243 |

|

|

|

|

|

|

|

|

|

|

Personal care |

$43 |

$70 |

$76 |

$91 |

products & services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous |

$170 |

$302 |

$339 |

$418 |

|

|

|

|

|

|

|

|

|

|

Additional Persons Amount

For each additional person, add to four- person total allowance: