When navigating the complexities of estate administration, the Kentucky Inheritance Tax Return (Short Form) 92A205 emerges as a pivotal document for specific, smaller estates in the Commonwealth of Kentucky. This particular form is tailored for estates that do not necessitate a federal estate tax return and comprise ten or fewer items, among other criteria including the absence of certain types of gifts, transfers, and property arrangements. It streamlines the process for estates that are straightforward and without the complications that would necessitate the long form. The form demands precision in declaring the assets and interests of the decedent, calculation of the net estate after deductions such as funeral expenses and debts, and determination of the inheritance tax due. It meticulously outlines the responsibilities of the personal representatives and provides a framework for calculating taxes, considering relationships to the decedent, and applying relevant deductions and penalties. The use of this form underlines the importance of compliance with state laws and the potential personal liability of beneficiaries and representatives for inaccuracies or failure to meet tax obligations. It embodies a simplified procedure for fulfilling one's duties to the estate and the state, making it a critical tool for specific estates navigating the inheritance tax terrain in Kentucky.

| Question | Answer |

|---|---|

| Form Name | Form 92A205 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | ky form short, ky inheritance, kentucky inheritance tax return short form, ky inheritance tax |

92A205

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Kentucky Inheritance

Tax Return

(Short Form)

FOR DEPARTMENT USE ONLY

|

4 |

6 |

|

|

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __ |

||||

Account Number |

Tax |

Mo |

Year |

|

This form is designed for small, uncomplicated estates. Requirements for use of this

(4)no real or personal property was transferred with a retained life interest, (5) the decedent did not possess any power to appoint any real or personal property or have the use of any qualified terminable interest property, and (6) the decedent had not received any real or personal property from another decedent within five years and paid inheritance tax on the property. Pursuant to KRS 140.190, the beneficiaries as well as the personal representative(s) may be held personally liable for the tax.

Return Status (check one):

Original Return

Amended

Amended

Decedent’s Name Last |

First |

|

|

|

|

Middle Initial |

Date of Death |

|

||

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

Occupation (If decedent was |

|

Age at |

|

Cause of Death |

HR Code Number (if known) |

||||

|

|

retired at death, state occu- |

|

Death |

|

|

|

|

|

|

|

|

pation prior to retirement.) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Residence (Domicile) at Time of Death |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Number and Street |

City |

|

|

State |

ZIP Code |

County |

|||

Name and Address of Executor/Administrator/Beneficiary |

|

Name and Address of Preparer |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Exec |

|

|

|

|

Atty |

|

|

|

||

Admr |

|

|

|

|

CPA |

|

|

|

||

_______ |

|

|

|

|

_______ |

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Did the decedent have a will? No Yes If Yes, attach a copy of the will. |

|

|

||||||||

Did the decedent have a trust agreement? No Yes |

If Yes, attach a copy of the trust agreement. |

|||||||||

Net Estate (from page 2) ......................................................................................................................

Inheritance tax due from Section III on reverse side .........................................................................

Discount of 5% from tax if paid within 9 months from death...........................................................

Total Tax Due ........................................................................................................................................

Interest and Penalty

Interest for late payment (see general information) ...............................................................................

Late filing penalty (see general information)...........................................................................................

Late payment penalty (see general information) ....................................................................................

Total due (tax plus interest and penalties, if applicable) .........................................................................

Total previously paid ..................................................................................................................................

Balance due/Refund ..................................................................................................................................

$

$

–

$

$

$

$

$

$

$

Attach check payable to “Kentucky State Treasurer” to this return and mail to

Kentucky Department of Revenue, Frankfort, KY 40620

Under criminal penalties, I declare that this return, including accompanying |

documents, has been examined by me, and |

|||||||||||||||

✍ is, to the best of my knowledge and belief, true, correct and complete. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Signature of Executor/Administrator/Beneficiary |

|

|

Social Security Number |

|

|

|

|

Date |

|

|

Telephone Number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Signature of Preparer |

Date |

Telephone Number |

SECTION |

92A205 |

|

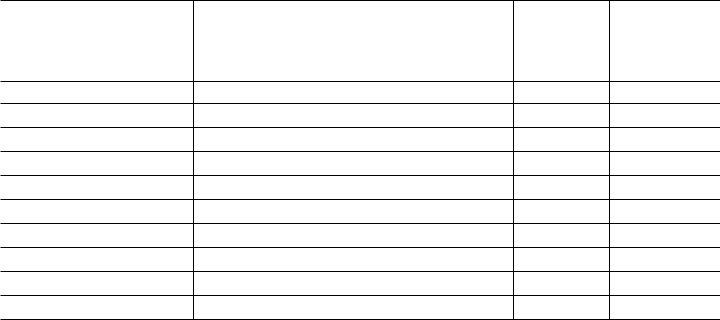

List all items which decedent owned or in which the decedent had an interest. Complete Form 92A204, Real Estate Valuation Information Form, for each parcel of real estate. For stocks and bonds, a balance sheet, at a date nearest the decedent’s death, together with a statement of net earnings and dividends paid for the

Description and Location

of Real or Personal Property

Ownership (Check or fill in applicable blocks)

Indi- |

|

|

Joint |

|

|

Survivorship |

Date |

Name of |

|||

vidual |

|||||

REQUIRED |

Placed in |

||||

|

|||||

|

Joint Names |

||||

|

|

|

|||

|

With |

Without |

REQUIRED |

|

|

|

|

|

|

|

|

Fair Cash

Value of 100%

Interest at

Date of Death

Decedent’s

Interest

TOTAL GROSS ESTATE |

$ _________________________ |

|

|

|

|

|

SECTION |

|

Funeral expenses |

$ ______________________________ |

|

Monument |

$ ______________________________ |

|

Cemetery lot and maintenance of lot |

$ ______________________________ |

|

Subtotal (not to exceed $5,000) |

$ _________________________ |

|

Personal representatives’ commissions |

$ _________________________ |

|

Attorneys’ fees |

$ _________________________ |

|

Appraisers’ fees and court costs |

$ _________________________ |

|

Mortgages and liens (decedent’s share) |

$ _________________________ |

|

Other debts of decedent (itemize only if total debts exceed $500): |

|

|

__________________________________________________________________________________________ |

$ _________________________ |

|

__________________________________________________________________________________________ |

$ _________________________ |

|

__________________________________________________________________________________________ |

$ _________________________ |

|

__________________________________________________________________________________________ |

$ _________________________ |

|

TOTAL DEDUCTIONS |

$ _________________________ |

|

NET ESTATE (Total Gross Estate Less Total Deductions) (enter on page 1) |

$ _________________________ |

|

|

|

|

92A205

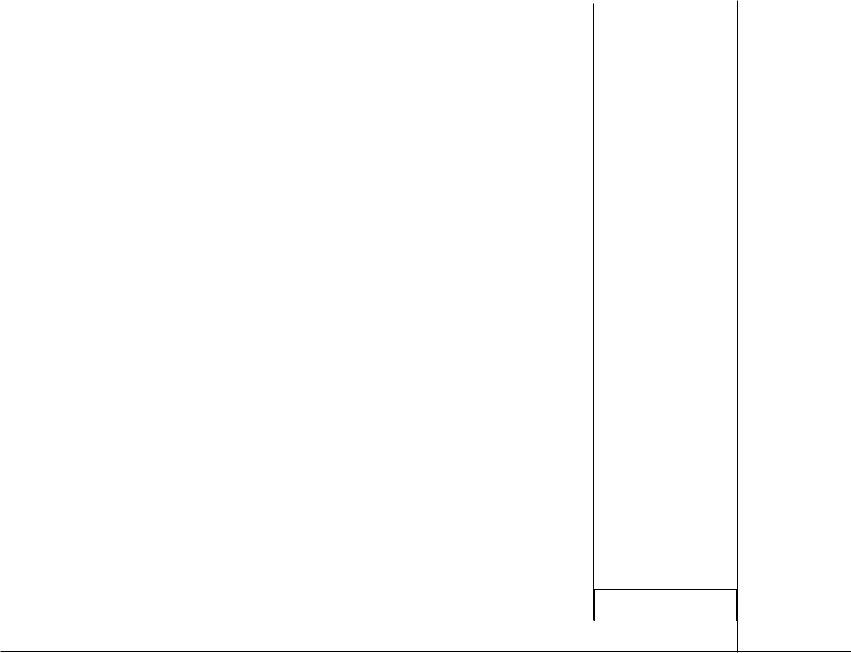

SECTION

List Names of Heirs and Beneficiaries or Exempt |

Social Security |

Relationship |

|

|

|

|

Organizations. Itemize shares of property received. |

Age |

Distributive Share |

Tax |

|||

Number |

(If Any) |

|||||

(See General Information) |

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total distributive shares (must equal net estate) |

$ |

Total Inheritance Tax Due (enter on page 1) |

|

|

$