941 v payment voucher can be filled in online easily. Simply use FormsPal PDF editor to get it done without delay. To have our editor on the leading edge of convenience, we aim to adopt user-oriented features and enhancements regularly. We are always happy to get feedback - join us in revampimg the way you work with PDF docs. This is what you'd want to do to start:

Step 1: Access the form in our editor by pressing the "Get Form Button" in the top part of this page.

Step 2: With the help of this advanced PDF tool, you're able to accomplish more than simply fill out forms. Edit away and make your forms appear professional with customized text added, or fine-tune the original input to excellence - all backed up by the capability to add just about any pictures and sign it off.

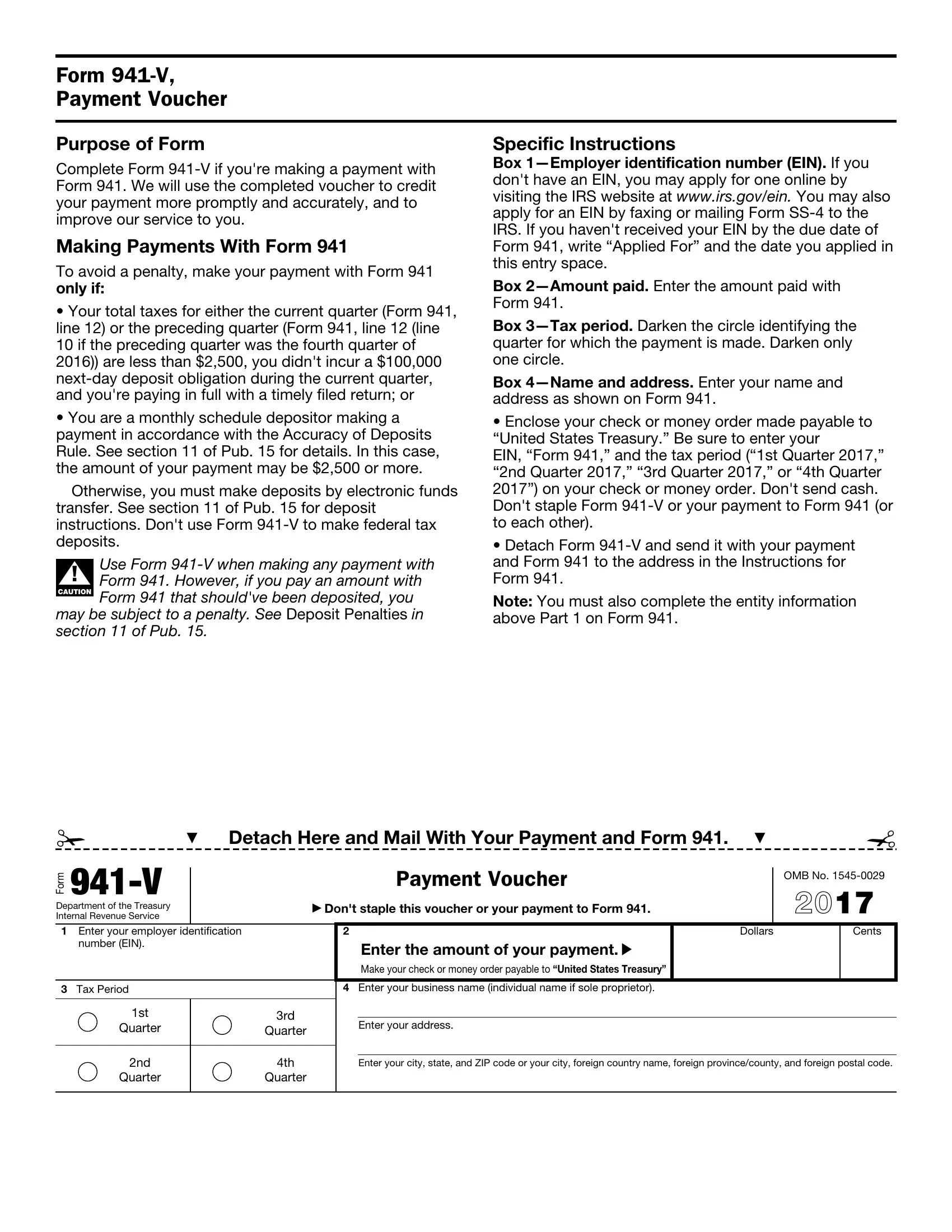

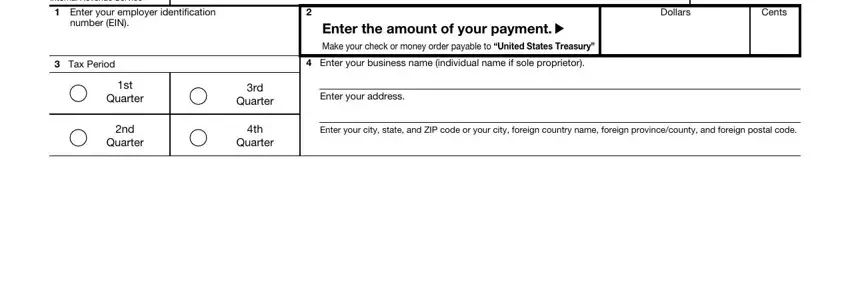

For you to fill out this PDF document, ensure that you type in the right details in every area:

1. It is recommended to fill out the 941 v payment voucher correctly, therefore be attentive when filling out the segments containing these fields:

Step 3: After looking through the filled out blanks, click "Done" and you are all set! Create a 7-day free trial subscription at FormsPal and acquire instant access to 941 v payment voucher - download or modify inside your FormsPal cabinet. FormsPal is invested in the personal privacy of our users; we make certain that all information going through our tool remains secure.