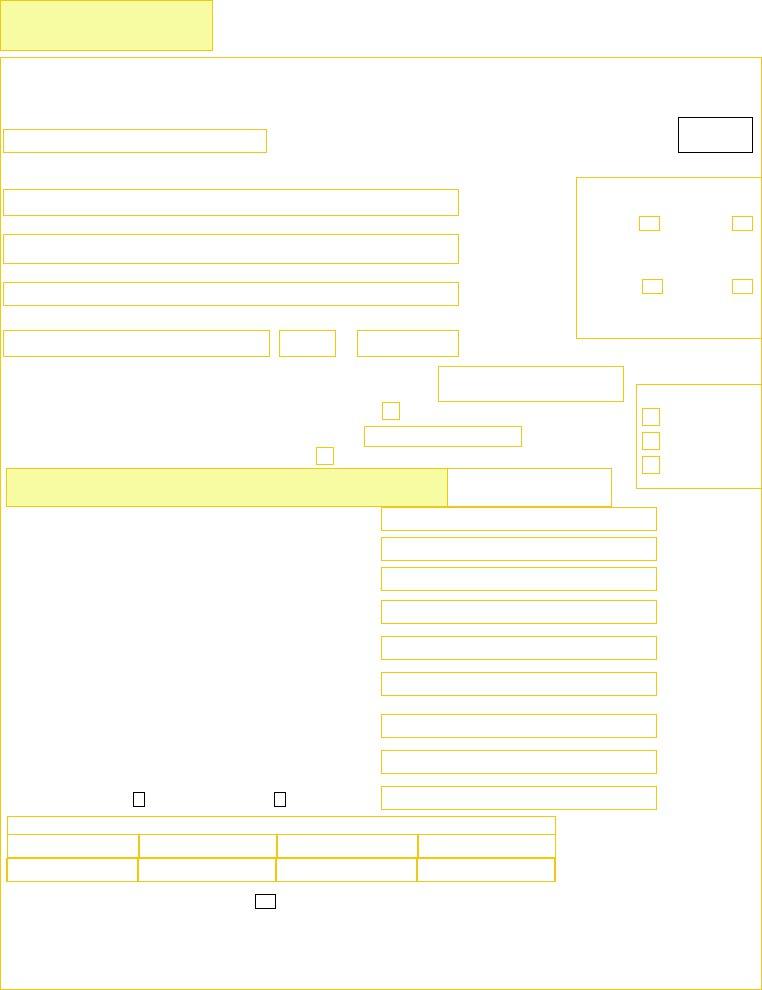

The Form 941 V.I., revised in May 2012, serves as a crucial document for employers in the U.S. Virgin Islands, detailing their quarterly tax obligations to the Bureau of Internal Revenue. This form is tailored for reporting income taxes, social security tax, or Medicare tax withheld from employees' paychecks, along with the employer's portion of social security or Medicare tax. Employers are required to meticulously fill in their Employer Identification Number (EIN), along with their name, business address, and other pertinent details. The form encompasses various sections asking for the number of employees, total wages paid, the total income tax withheld, and adjustments for any income tax over or underwithheld in previous quarters. Employers making payments under the Advanced Earned Income Credit (EIC) are also required to report these amounts. The instructions at the back provide detailed guidance on how to accurately complete each line, ensuring employers can comply with their tax responsibilities effectively. Additionally, employers who foresee no future need for filing or who operate on a seasonal basis have the option to indicate such situations. The document also delineates the procedure for employers who deposit taxes on a semiweekly schedule, requiring the attachment of Schedule B (Form 941VI) to accommodate this reporting frequency. Designed to aid in the organized reporting of tax liabilities and contributions, the Form 941 V.I. embodies an essential tool for maintaining compliance with local tax laws, encapsulating the need for accuracy and timeliness in reporting tax information relevant to both the employer and their employees in the U.S. Virgin Islands.

| Question | Answer |

|---|---|

| Form Name | Form 941 Vi |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | what form 941 virgin islands, schedule b 941 vi, 941vi, form 941 vi |

FORM 941 V.I.

(REV. 05/2012)

Government of the U. S. Virgin Islands |

Employer’s Quarterly Virgin Islands Tax Return |

|||

BUREAU OF INTERNAL REVENUE |

(Refer to Publication 15 or the Circular E for filing Requirements - see reverse for instructions) |

|||

|

|

|

|

|

Employer Identification Number (EIN) |

|

|

|

|

|

20 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (as distinguished from tradename) |

|

|

|

|

|

|

|

|

D/B/A |

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|||||

|

|

|

|

|

|

|||

A. Indicate your principal business activity code (SEE REVERSE): |

|

|

||||||

B. If you do not have to file returns in the future, check here |

|

|

|

|||||

|

|

|

||||||

and enter date final wages were paid (mm dd yy) |

|

- |

|

- |

||||

|

|

|||||||

C. If you are a seasonal employer, check here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.) Number of Employees (except household) employed during the quarter.

2.) |

Total Wages, Tips, plus other compensation………... …....……… |

2 |

|||||

3.) |

Total income tax withheld from wages, tips, & sick pay…...…….. |

3 |

|||||

…. |

|

|

|

|

|

|

|

4.) |

Adjustment of withheld income tax for preceding quarters of |

|

|||||

|

calendar year………………………………………….………….. |

4 |

|||||

5.) |

Adjusted total of income tax withheld (line 3 adjusted by line 4)... |

5 |

|||||

6.) |

Advanced earned income credit (EIC) payments made to |

|

|||||

|

employees, if any |

………………...…………………..……..… |

6 |

||||

7.) |

NET TAXES (subtract line 6 from line 5) THIS SHOULD |

|

|||||

|

EQUAL LINE 11 COLUMN(D) BELOW……........…..…….. |

7 |

|||||

8.) |

Total deposits for the quarter, including overpayment applied |

|

|||||

|

from prior quarter…………………………………………...… … |

8 |

|||||

9.) Balance Due to be paid with this return (7 - 8)………....…… |

9 |

||||||

10.) Overpayment, if line 8 is more than line 7, enter excess $ here ... |

|

||||||

|

And check if to be: |

|

|

Applied to next return or |

|

Refunded. |

10 |

11.) |

MONTHLY SUMMARY OF TAX LIABILITY |

|

||

(a) 1st month liability |

(b) 2nd month liability |

(c) 3rd month liability |

(d) Total Liability for |

|

Quarter |

||||

|

|

|

||

TAX PERIOD

Check only one quarter

1st QTR. |

|

3RD QTR. |

|

|

|

|

|

Ends: MAR. 31 |

Ends: SEPT. 30 |

||

Due: APR. 30 |

Due: OCT. 31 |

||

2ND QTR. |

|

4TH QTR. |

|

|

|

||

JUN) |

DEC) |

||

Ends: JUN. 30 |

Ends: DEC. 31 |

||

Due: JUL. 31 |

Due: JAN 31 |

||

Indicate Firm Type:

Sole Proprietor

Partnership

Corporation

SEE BACK OF FORM FOR SPECIAL INSTRUCTIONS REGARDING LINES 11 & 12

$ |

$ |

$ |

$ |

|

|

|

|

|

|

12.) Check if you are a semiweekly depositor. |

|

|

Complete and attach Schedule B (Form 941VI). |

|

|

|

|

|

|

I declare under penalties of perjury that I have examined this return (including the accompanying schedules and statements) and to the best of my knowledge and belief is true, correct, and complete.

NAME:___________________________________________________________________________ TITLE: _______________________________________________

|

(PRESIDENT, OWNER, ETC.) |

SIGNATURE: _______________________________________________________ DATE: __________________ |

Telephone: ________________________ |

FORM 941VI (05/2012)

|

I N STRUCTI ON S FOR TAX PAYERS- FORM 9 4 1 V . I . |

LI N E 1 . |

En t e r t h e n u m be r of e m ploy e e s on y ou r pa y r oll du r in g t h e qu a r t e r . D o n ot in clu de h ou se h old e m ploy e e s a n d pe r son s n ot com pe n sa t e d du r in g t h e |

|

Qu a r t e r . |

LI N E 2 . |

En t e r t h e t ot a l of a ll w a ge s pa id, t ips r e por t e d, t a x a ble fr in ge be n e fit s pr ov ide d a n d ot h e r com pe n sa t ion pa id t o e m ploy e e s, e ve n if y ou do n ot h a v e t o |

|

w it h h old in com e t a x e s on it . |

LI N E 3 . |

En t e r t h e in com e t a x y ou w it h h e ld on w a ge s, t ips, a n d t a x a ble fr in ge be n e fit s. |

LI N E 4 . |

Use t h is lin e t o cor r e ct e r r or s in in com e t a x w it h h e ld fr om w a ge s pa id in e a r lie r qu a r t e r s for t h e sa m e ca le n da r y e a r . D o n ot u se t h is lin e t o a dj u st or t o |

|

cla im a r e fu n d or cr e dit for a n y ov e r pa y m e n t of in com e t a x t h a t y ou w it h h e ld or de du ct e d fr om a n e m ploy e e in a pr ior y e a r . Be ca u se a n y a m ou n t sh ow n |

|

on t h is lin e in cr e a se s or de cr e a se s y ou r t a x lia bilit y , t h e a dj u st m e n t m u st be t a k e n in t o a ccou n t on lin e 1 1 M on t h ly Su m m a r y of Ta x Lia bilit y . You a r e |

|

r e qu ir e d t o pr ov ide ba ck gr ou n d in for m a t ion a n d docu m e n t a t ion su ppor t in g pr ior qu a r t e r a dj u st m e n t s or a t t a ch a st a t e m e n t t h a t sh ow s: ( 1 ) W h a t t h e |

|

e r r or w a s, ( 2 ) Qu a r t e r in w h ich t h e e r r or w a s m a de , ( 3 ) Th e a m ou n t of t h e e r r or e a ch qu a r t e r a n d ( 4 ) D a t e in w h ich y ou fou n d t h e e r r or . |

LI N E 5 . |

Add lin e 4 t o lin e 3 if y ou a r e r e por t in g a ddit ion a l in com e t a x w it h h e ld for a n e a r lie r qu a r t e r . Su bt r a ct lin e 4 fr om lin e 3 if y ou a r e r e du cin g t h e a m ou n t of |

|

in com e t a x w it h h e ld . I f t h e r e is n o e n t r y on lin e 4 , e n t e r a m ou n t fr om lin e 3 . |

LI N E 6 . |

En t e r a dv a n ce EI C pa y m e n t s m a de t o e m ploy e e s. Eligible e m ploy e e s m a y e le ct t o r e ce iv e pa r t of t h e EI C a s a n a dv a n ce pa y m e n t . |

LI N E 7 . |

Su bt r a ct lin e 6 fr om lin e 5 . |

LI N E 8 . |

En t e r t h e t ot a l de posit s m a de du r in g t h e qu a r t e r a n d a n y ov e r pa y m e n t s fr om pr e ce din g qu a r t e r s. |

LI N E 9 . |

You sh ou ld h a v e a ba la n ce du e on ly if y ou r n e t t a x lia bilit y for t h e qu a r t e r ( lin e 7 ) is le ss t h a n $ 2 ,5 0 0 . ( H ow e v e r , se e Pu blica t ion 1 5 or t h e Cir cu la r E |

|

r e ga r din g pa y m e n t s m a de u n de r t h e a ccu r a cy of de posit s r u le ) I f lin e 7 is $ 2 ,5 0 0 or m or e a n d y ou h a v e de posit e d a ll t a x e s w h e n du e , t h e a m ou n t on lin e |

|

9 ( ba la n ce du e ) sh ou ld be z e r o . |

LI N E 1 0 . |

I f y ou de posit e d m or e t h a n t h e cor r e ct a m ou n t for t h e qu a r t e r , in dica t e t h a t a m ou n t in t h e spa ce pr ov ide d . Th is ov e r pa y m e n t ca n be r e fu n de d or a pplie d |

|

t o y ou r n e x t r e t u r n by ch e ck in g t h e a ppr opr ia t e box . I f y ou do n ot ch e ck e it h e r box , y ou r ov e r pa y m e n t w ill be a pplie d t o y ou r n e x t r e t u r n . Th e V I BI R |

|

m a y a pply y ou r ov e r pa y m e n t s t o a n y pa st du e t a x a ccou n t s. |

LI N E 1 1 . |

Th is sh ou ld be a su m m a r y of y ou r t a x lia bilit y , n ot a su m m a r y of de posit s m a de . I f lin e 7 is le ss t h a n $ 2 ,5 0 0 , do n ot com ple t e lin e 1 1 . Com ple t e lin e 1 1 if |

|

y ou a r e a m on t h ly sch e du le de posit or ( se e Cir cu la r E for de t a ils on de posit r u le s) . Sk ip lin e 1 2 a n d com ple t e lin e 1 3 . |

LI N E 1 2 . |

Com ple t e lin e 1 2 if y ou a r e a Se m i- W e e k ly Sch e du le D e posit or . ( Se e Cir cu la r E for de t a ils on de posit r u le s) . I n dica t e t h e da y w a ge s w e r e pa id du r in g t h e |

|

w e e k of t h e qu a r t e r by pla cin g a ch e ck m a r k in t h e a ppr opr ia t e box . |

V . I . Bu r e a u of I n t e r n a l Re v e n u e Code s for Pr in cipa l Bu sin e ss Act iv it y a n d Pr in cipa l Pr odu ct s or Se r v ice s

( se le ct on ly on e a n d e n t e r on f r on t of f or m ) .

Agr icu lt u r e , For e st r y , a n d Fish in g Code s |

Tr a n spor t a t ion , Com m u n ica t ion , Ele ct r ic, |

Fin a n ce , I n su r a n ce , a n d Re a l Est a t e Code s con t . |

|||

1 1 1 0 0 0 |

Cr ops ( in clu din g v e ge t a ble s |

Ga s, a n d Sa n it a r y Se r v ice s Code s |

5 2 3 9 0 0 |

Other Financial I nvestment Activities |

|

|

& fr u it s) |

2 2 1 1 0 0 |

Ut ilit ie s |

5 2 4 2 0 0 |

Age n cie s, Br ok e r a ge s, & Ot h e r I n su r a n ce |

1 1 2 0 0 0 |

An im a l |

4 8 1 0 0 0 |

Air Tr a n spor t a t ion |

|

Related Activities |

1 1 1 9 9 8 |

Ot h e r Agr icu lt u r a l Se r v ice s |

4 8 3 0 0 0 |

W a t e r Tr a n spor t a t ion |

5 2 4 2 1 0 |

I n su r a n ce Age n t s, Br ok e r s & |

1 1 2 9 0 0 |

An im a l Pr odu ct ion |

4 8 3 1 1 1 |

D e e p Se a Fr e igh t Tr a n spor t a t ion |

|

Se r v ice s |

1 1 4 0 0 0 |

Fish in g, H u n t in g a n d Tr a ppin g |

4 8 4 1 1 0 |

Tr u ck in g |

5 3 1 1 1 0 |

Le ssor s of Re side n t ia l Bu ildin gs |

5 4 1 9 4 0 |

V e t e r in a r y Se r v ice s |

4 8 5 1 1 1 |

Pa sse n ge r Tr a n sit |

5 3 1 1 2 0 |

Le ssor s of N on - Re side n t ia l Bu ildin gs |

5 6 1 7 3 0 |

La n dsca pin g & H or t icu lt u r a l |

4 8 5 3 1 0 |

Ta x i Se r v ice s |

5 3 1 2 1 0 |

Re a l Est a t e Age n t s, Br ok e r s & |

|

Se r v ice s |

4 8 8 9 9 9 |

Ot h e r Tr a n spor t a t ion Se r v ice s |

|

M a n a ge r s |

Con st r u ct ion Code s |

4 8 8 9 9 9 |

Pa sse n ge r Tr a n spor t a t ion |

5 3 1 3 9 0 |

Ot h e r Act iv it ie s Re la t e d t o Re a l Est a t e |

|

2 3 6 1 0 0 |

Re side n t ia l Bu ildin g Con st r u ct ion |

|

Ar r a n ge m e n t s |

|

|

2 3 6 2 0 0 |

N on r e side n t ia l Bu ildin g Con st r u ct ion |

4 9 3 1 0 0 |

W a r e h ou sin g & St or a ge |

|

|

2 3 7 0 0 0 |

H e a v y a n d Civ il En gin e e r in g Con st r u ct ion |

5 1 1 1 0 0 |

N e w spa pe r , Pe r iodica l, Book , & |

Se r v ice Code s |

|

|

|

|

D ir e ct or y Pu blish e r s |

5 1 2 1 3 1 |

M ot ion Pict u r e Th e a t e r s |

Sp e cia l t r a d e con t r a ct or s: |

5 1 7 9 1 9 |

Com m u n ica t ion |

5 3 2 1 1 1 |

Pa sse n ge r Ca r Re n t a l |

|

2 3 8 1 1 0 |

Con cr e t e w or k |

5 6 2 0 0 0 |

W a st e M a n a ge m e n t Se r v ice s |

5 3 2 2 3 0 |

V ide o Ta pe & D isc Re n t a l |

2 3 8 1 4 0 |

M a son r y |

|

|

5 4 1 1 0 0 |

Le ga l se r v ice s |

2 3 8 1 6 0 |

Roofin g Con t r a ct or s |

Tr a de Code s |

5 4 1 2 0 0 |

Accou n t in g, Ta x Pr e p, Book k e e pin g & |

|

2 3 8 1 7 0 |

Sidin g Con t r a ct or s |

4 2 5 1 0 0 |

W h ole sa le Tr a de Age n t s & Br ok e r s |

|

Payroll Services |

2 3 8 2 1 0 |

Ele ct r ica l & Ot h e r W ir in g Con t r a ct or s |

|

|

5 4 1 2 1 1 |

Ce r t ifie d Pu blic Accou n t a n t s |

2 3 8 2 2 0 |

Pa in t in g, Pa pe r h a n gin g, a n d |

Re t a il t r a d e : |

5 4 1 6 1 0 |

M a n a ge m e n t Con su lt in g Se r v ice s |

|

|

D e cor a t in g |

4 4 1 1 0 0 |

Au t om ot iv e D e a le r s |

5 6 1 4 1 0 |

Pe r son a l Se r v ice s |

2 3 8 3 2 0 |

Pa in t in g & W a ll Cov e r in g Con t r a ct or s |

4 4 2 0 0 0 |

Fu r n it u r e St or e s |

5 6 1 5 0 0 |

Tr a v e l Ar r a n ge m e n t & Re se r v a t ion Se r v ice s |

2 3 8 3 1 0 |

D r y w a ll & I n su la t ion Con st r u ct ion |

4 4 3 0 0 0 |

Ele ct r on ics & Applia n ce St or e s |

6 1 1 0 0 0 |

Edu ca t ion a l Se r v ice s |

2 3 8 3 3 0 |

Ca r pe n t e r in g a n d Floor in g |

4 4 4 0 0 0 |

Bu ildin g M a t e r ia ls, H a r dw a r e , |

6 1 1 6 9 0 |

All Sch ools a n d I n st r u ct ion s |

2 3 8 3 3 0 |

Floor in g Con t r a ct or s |

|

Ga r de n Su pplie s |

6 2 1 0 0 0 |

Am bu la t or y H e a lt h Ca r e Se r v ice s |

2 3 8 3 4 0 |

Tile & Te r r a z z o Con st r u ct ion |

4 4 5 0 0 0 |

Food & Be v e r a ge St or e s |

6 2 1 1 1 2 |

M e dica l & H e a lt h Se r v ice s |

2 3 8 3 5 0 |

Fin ish Ca r pe n t r y Con t r a ct or s |

4 4 5 1 0 0 |

Gr oce r y St or e s |

6 2 4 4 1 0 |

Ch ild D a y Ca r e |

2 3 8 9 9 0 |

All Ot h e r Spe cia lt y Tr a de Con t r a ct or s |

4 4 7 0 0 0 |

Ga solin e Se r v ice St a t ion |

7 1 3 2 0 0 |

Ga m blin g I n du st r ie s |

4 2 3 7 2 0 |

Plu m bin g a n d Air Con dit ion in g |

4 4 8 0 0 0 |

Appa r e l & Acce ssor y St or e s |

7 1 3 9 9 0 |

Am u se m e n t a n d Re cr e a t ion a l |

|

|

4 5 2 0 0 0 |

Ge n e r a l M e r ch a n dise |

|

Se r v ice s |

M a n u fa ct u r in g Code s |

4 5 3 0 0 0 |

M isce lla n e ou s Re t a il st or e s |

7 2 1 1 1 0 |

H ot e l & Ot h e r Lodgin g Pla ce s |

|

3 1 1 0 0 0 |

Food |

|

|

7 2 2 0 0 0 |

Food Se r v ice s & D r in k in g Pla ce s |

3 1 5 0 0 0 |

Appa r e l |

Fin a n ce , I n su r a n ce , a n d Re a l Est a t e Code s |

8 1 1 0 0 0 |

Re pa ir & M a in t e n a n ce |

|

3 1 6 0 0 0 |

Le a t h e r & Le a t h e r Pr odu ct s |

5 2 2 1 1 0 |

Com m e r cia l Ba n k in g |

8 1 1 1 0 0 |

Au t om ot iv e Re pa ir & M a in t e n a n ce |

3 2 3 1 0 0 |

Pr in t in g & Re la t e d Su ppor t Act iv it ie s |

5 2 2 1 3 0 |

Cr e dit Un ion s |

8 1 1 2 1 9 |

Ele ct r on ic Re pa ir & M a in t e n a n ce |

3 2 3 1 1 9 |

Pr in t in g & Pu blish in g |

5 2 2 3 1 0 |

M or t ga ge & N on - m or t ga ge Loa n Br ok e r s |

8 1 2 0 0 0 |

Pe r son a l & La u n dr y Se r v ice s |

3 2 5 0 0 0 |

Ch e m ica ls M a n u fa ct u r in g |

5 2 3 1 1 0 |

I n v e st m e n t Ba n k in g & Se cu r it ie s D e a lin g |

8 1 3 9 0 0 |

Bu sin e ss, Pr ofe ssion a l, |

3 3 7 0 0 0 |

Fu r n it u r e & Fix t u r e s |

5 2 3 1 2 0 |

Se cu r it y a n d Com m odit y Br ok e r s, |

|

|

3 3 9 9 9 9 |

Ot h e r |

|

D e a le r s Ex ch a n ge a n d Se r v ice s |

|

|