Should you would like to fill out 941c 2020, you don't need to download and install any sort of software - simply give a try to our online PDF editor. In order to make our tool better and simpler to utilize, we continuously come up with new features, with our users' suggestions in mind. With some basic steps, it is possible to start your PDF editing:

Step 1: Open the PDF file in our tool by clicking on the "Get Form Button" in the top part of this webpage.

Step 2: This editor allows you to change your PDF form in various ways. Enhance it by adding customized text, correct existing content, and put in a signature - all readily available!

Concentrate while filling out this pdf. Make sure all required fields are done correctly.

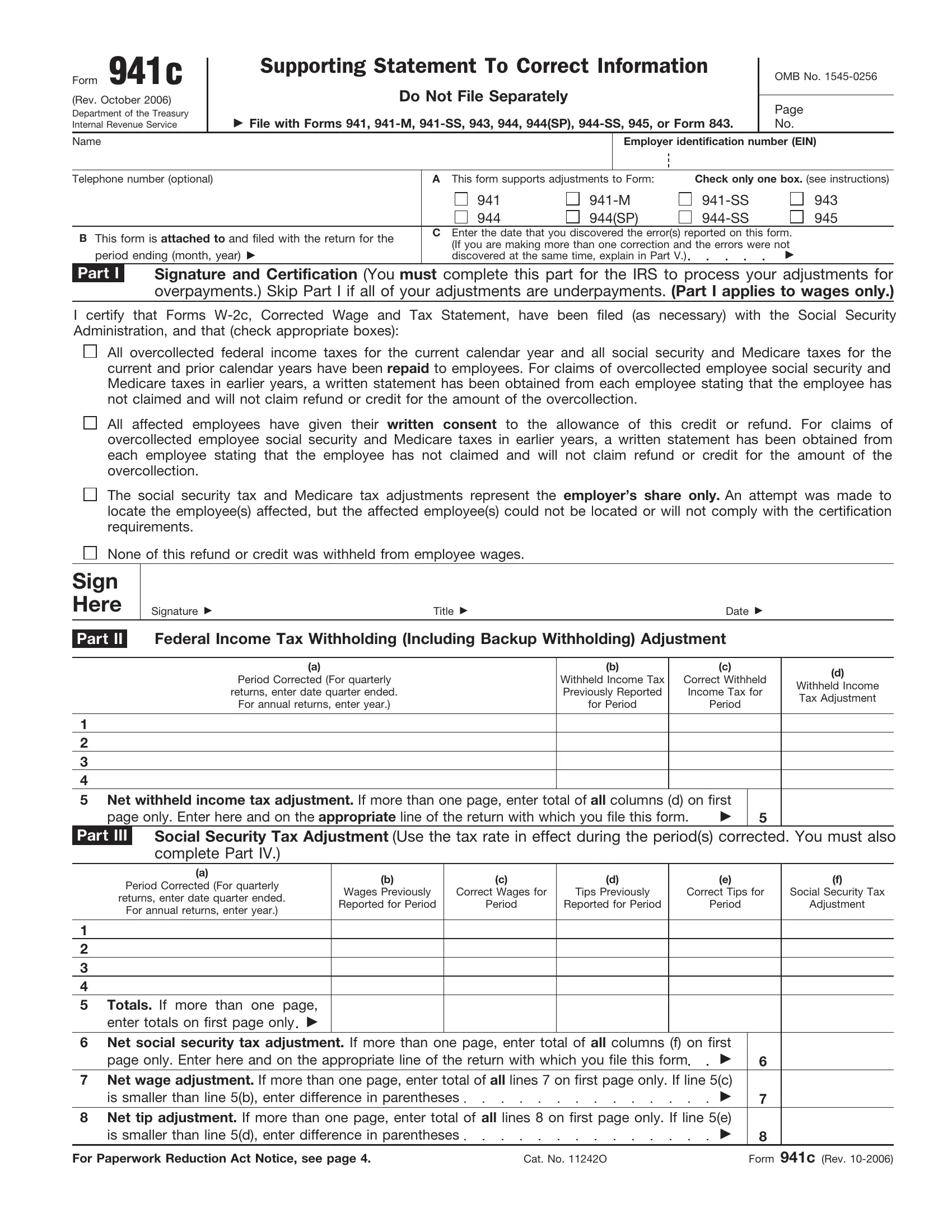

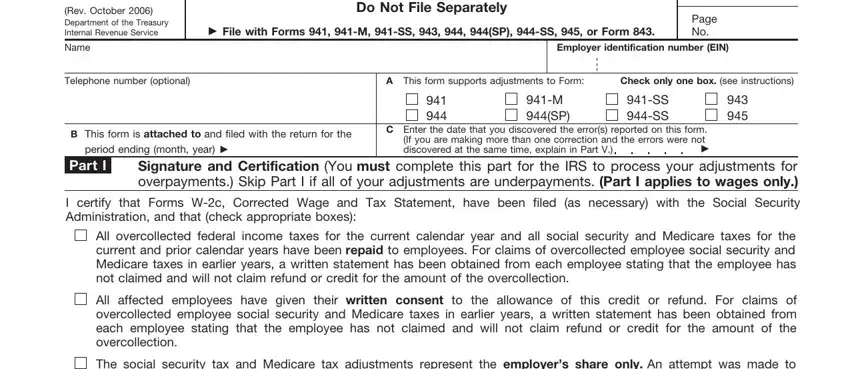

1. The 941c 2020 involves specific details to be entered. Be sure that the following blank fields are completed:

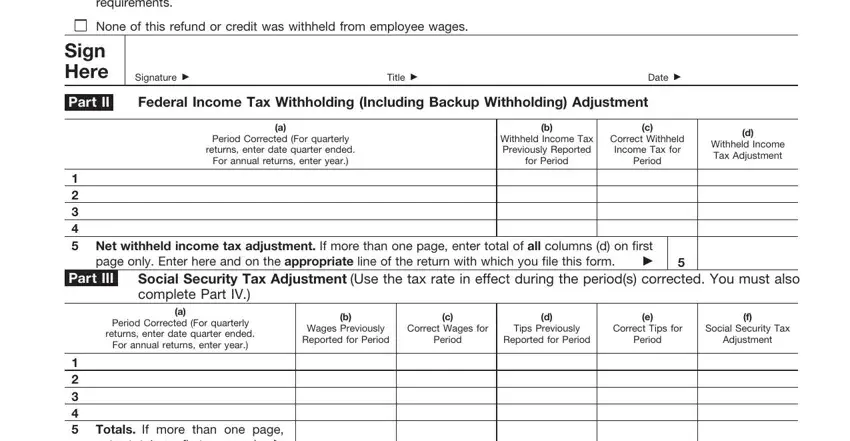

2. Once your current task is complete, take the next step – fill out all of these fields - All overcollected federal income, Federal Income Tax Withholding, Signature , Date , Title , Period Corrected For quarterly, returns enter date quarter ended, For annual returns enter year, Withheld Income Tax Previously, Correct Withheld Income Tax for, for Period, Period, Withheld Income Tax Adjustment, Net withheld income tax adjustment, and Social Security Tax Adjustment Use with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

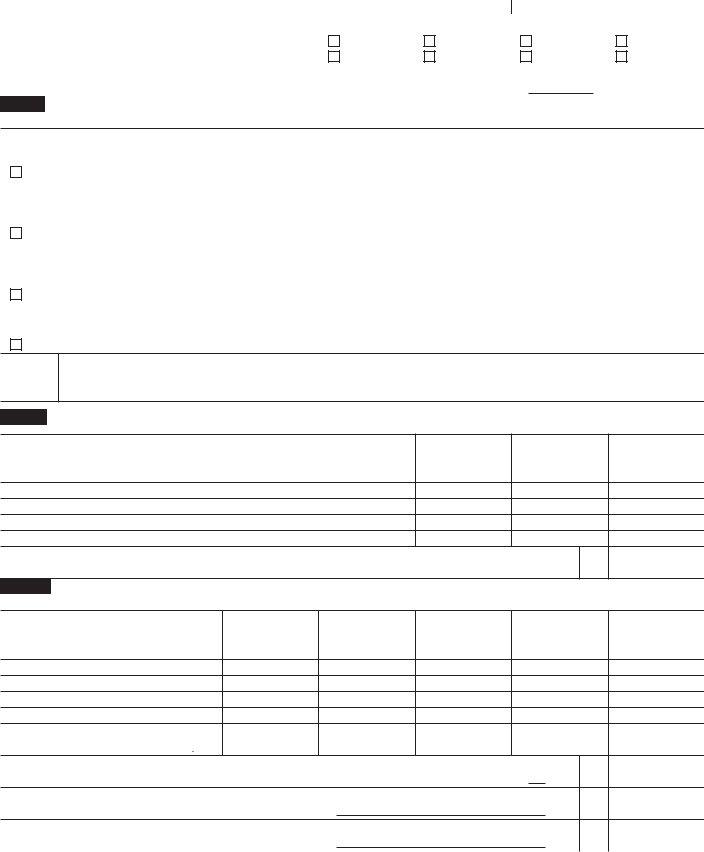

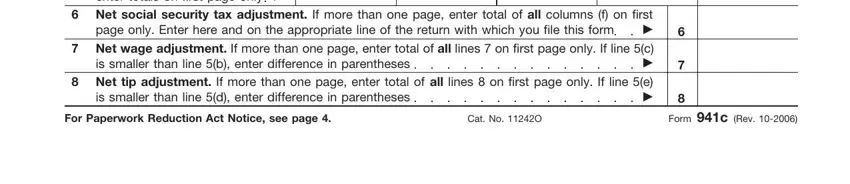

3. Through this stage, check out Totals If more than one page enter, Net social security tax adjustment, Net wage adjustment If more than, Net tip adjustment If more than, For Paperwork Reduction Act Notice, Cat No O, and Form c Rev . Each one of these are required to be filled out with utmost awareness of detail.

As to Net tip adjustment If more than and Net social security tax adjustment, be certain that you review things here. These two are considered the most important fields in this form.

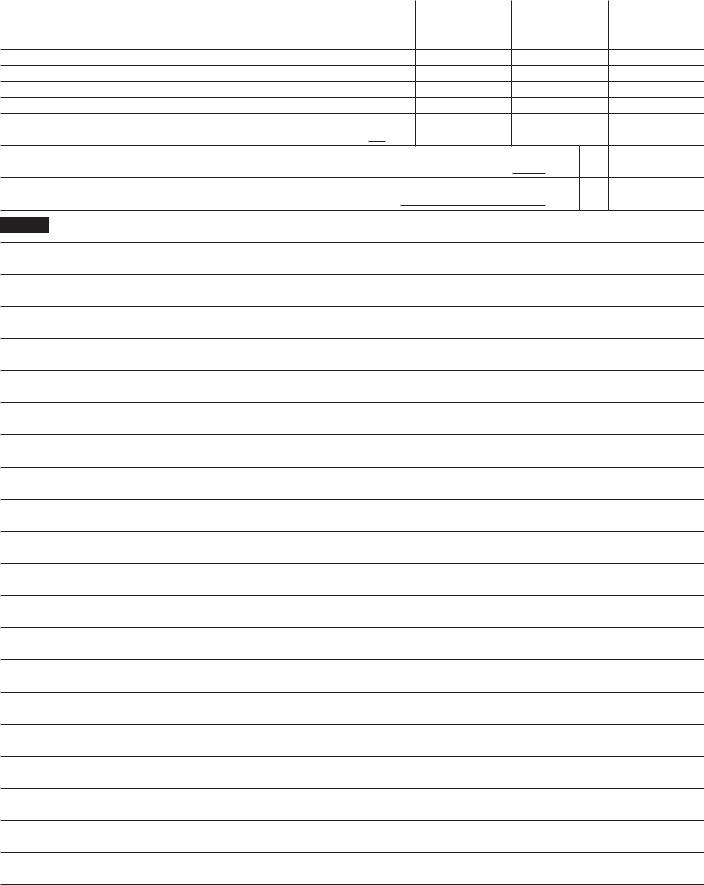

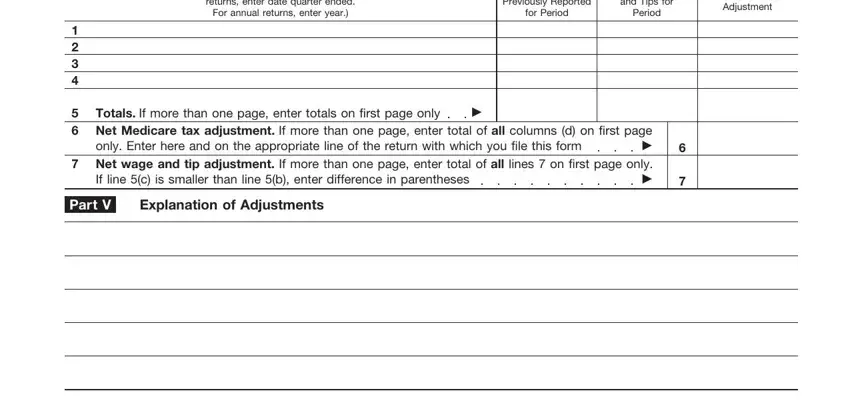

4. Completing Totals If more than one page enter, Net Medicare tax adjustment If, Net wage and tip adjustment If, Part V, Explanation of Adjustments, returns enter date quarter ended, For annual returns enter year, Previously Reported, and Tips for, for Period, Period, Medicare Tax, and Adjustment is crucial in this stage - be certain to don't hurry and be mindful with each and every empty field!

5. Lastly, the following final section is precisely what you'll want to wrap up before submitting the form. The blank fields here include the next: .

Step 3: Just after proofreading your fields and details, hit "Done" and you're all set! Get hold of your 941c 2020 after you sign up at FormsPal for a 7-day free trial. Easily access the form inside your personal account, together with any modifications and adjustments being all preserved! Here at FormsPal, we endeavor to be sure that all your information is stored private.