Dealing with PDF files online is very simple with our PDF tool. Anyone can fill out mi form 5081 here effortlessly. The editor is continually maintained by us, getting useful functions and growing to be better. To get the process started, consider these easy steps:

Step 1: Hit the "Get Form" button in the top area of this page to get into our PDF tool.

Step 2: As you start the PDF editor, there'll be the document made ready to be filled out. Apart from filling in various blank fields, you can also perform various other actions with the form, such as putting on custom textual content, modifying the initial textual content, inserting illustrations or photos, placing your signature to the PDF, and a lot more.

This document will require specific information; in order to ensure consistency, remember to adhere to the recommendations directly below:

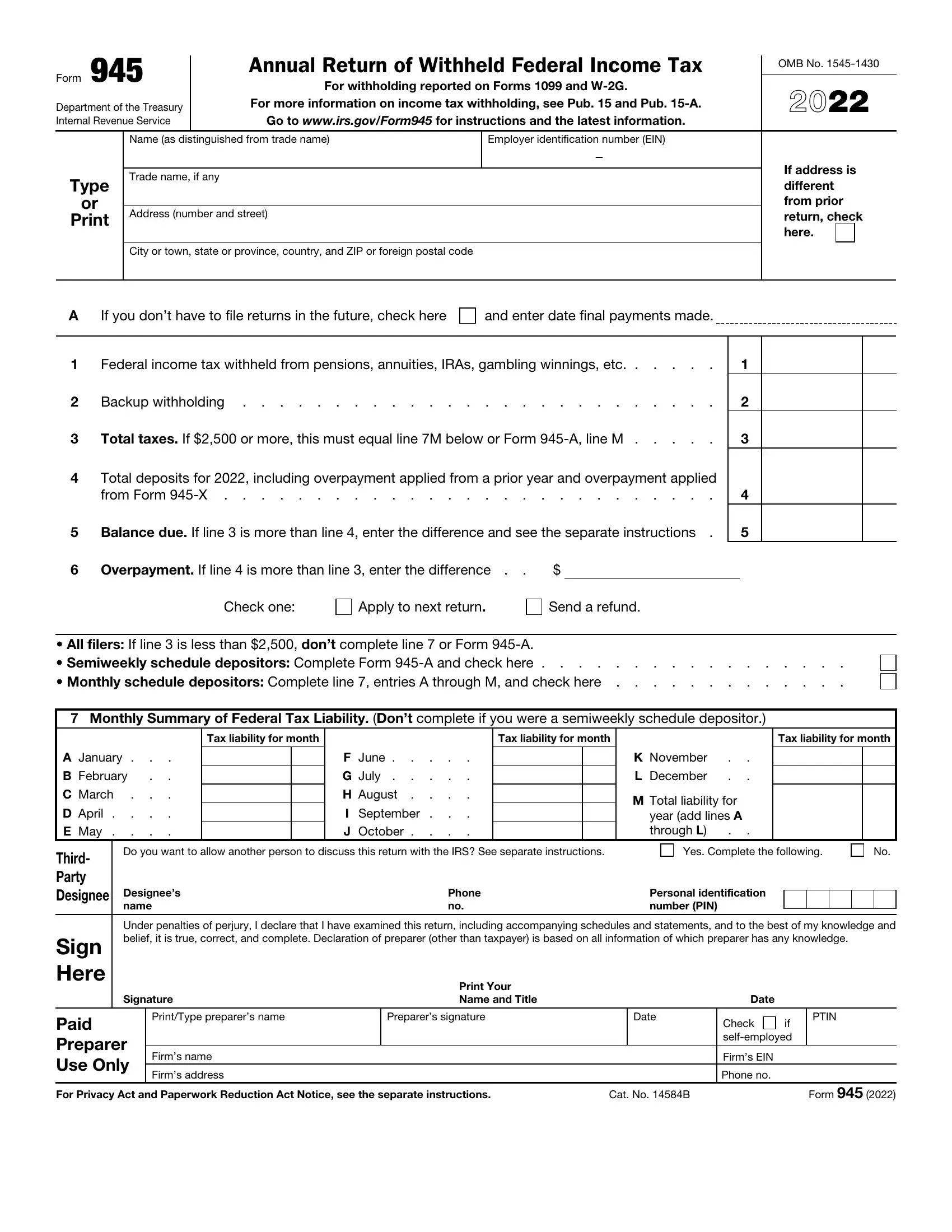

1. To begin with, when filling out the mi form 5081, begin with the section that includes the next blanks:

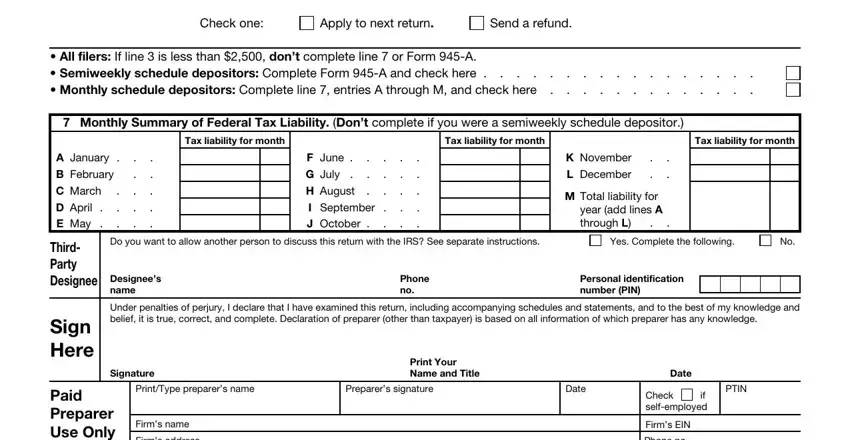

2. Once your current task is complete, take the next step – fill out all of these fields - Check one, Apply to next return, Send a refund, All filers If line is less than, Monthly Summary of Federal Tax, Tax liability for month, Tax liability for month, Tax liability for month, A January B February C March D, F June G July H August I, K November L December, Total liability for year add lines, Do you want to allow another, Yes Complete the following, and Designees name with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

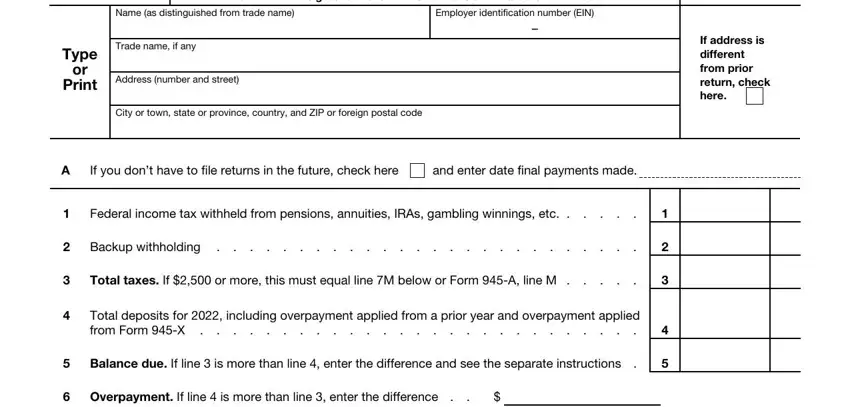

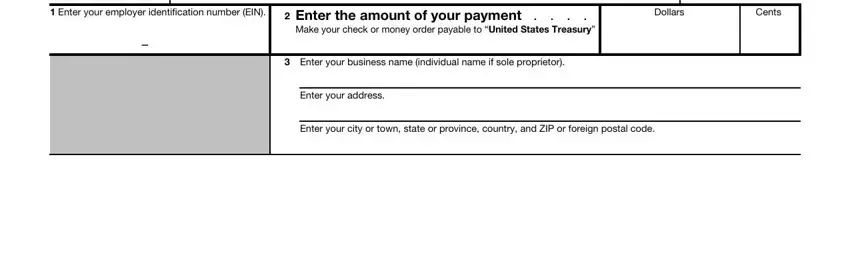

3. This next step is related to Department of the Treasury, Enter your employer, Enter the amount of your payment, Make your check or money order, Dollars, Cents, Enter your business name, Enter your address, and Enter your city or town state or - fill out all of these empty form fields.

It's very easy to make a mistake while filling out the Enter your business name, thus ensure that you look again before you decide to send it in.

Step 3: Prior to finalizing your document, make certain that form fields were filled out the correct way. Once you establish that it's fine, click “Done." Make a free trial option with us and obtain direct access to mi form 5081 - which you are able to then make use of as you wish inside your FormsPal account. FormsPal guarantees safe form tools with no personal information recording or any type of sharing. Feel safe knowing that your information is safe here!