Any time you wish to fill out indiana state income payment voucher form, you don't have to download and install any kind of programs - simply use our online PDF editor. Our tool is constantly evolving to give the best user experience attainable, and that's thanks to our resolve for constant improvement and listening closely to customer comments. By taking some simple steps, you'll be able to begin your PDF editing:

Step 1: Simply hit the "Get Form Button" at the top of this site to launch our form editing tool. This way, you'll find all that is necessary to fill out your file.

Step 2: Using our online PDF file editor, you'll be able to accomplish more than just fill out blank fields. Edit away and make your forms look sublime with customized text added in, or optimize the file's original input to perfection - all comes with the capability to insert your own graphics and sign the PDF off.

It is actually straightforward to finish the pdf with this practical tutorial! Here's what you have to do:

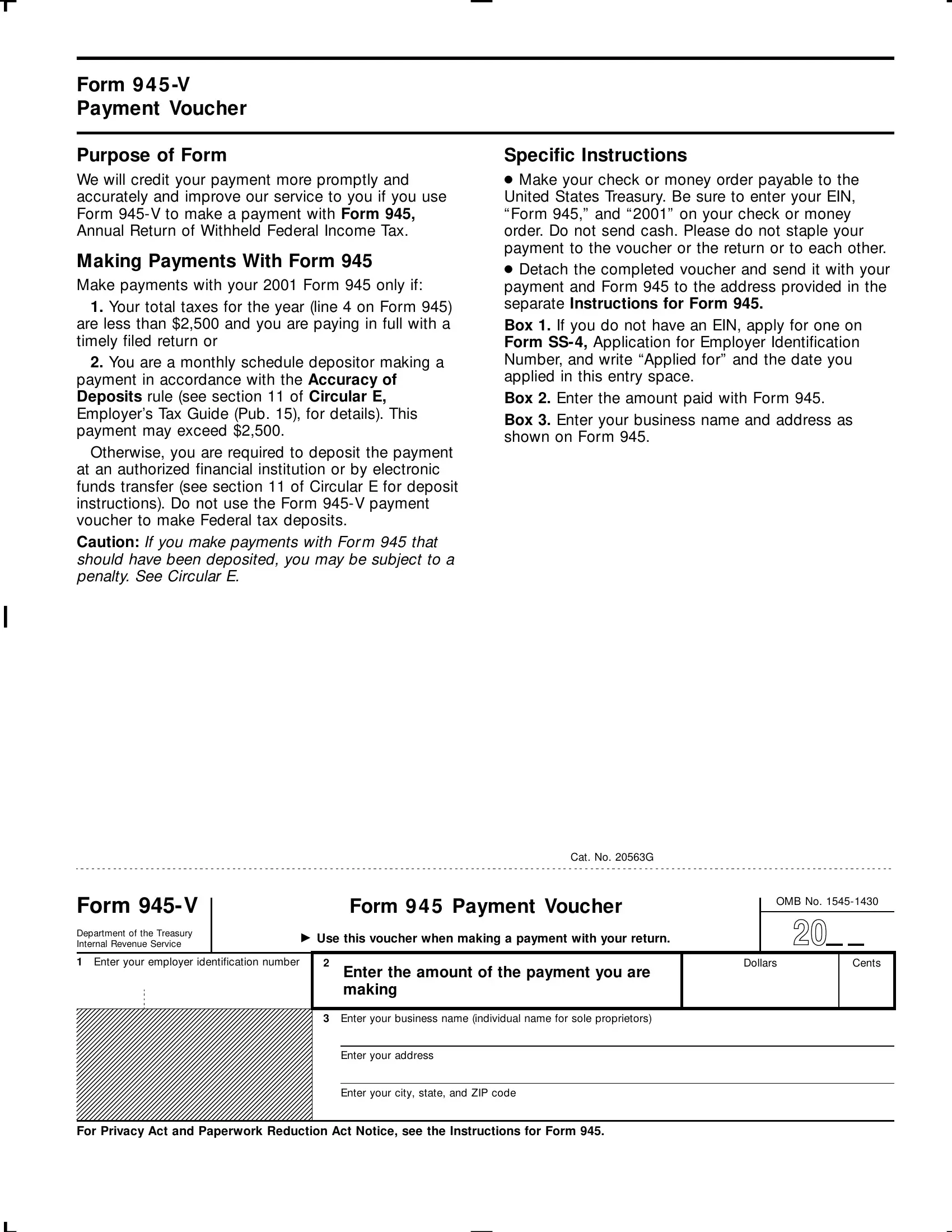

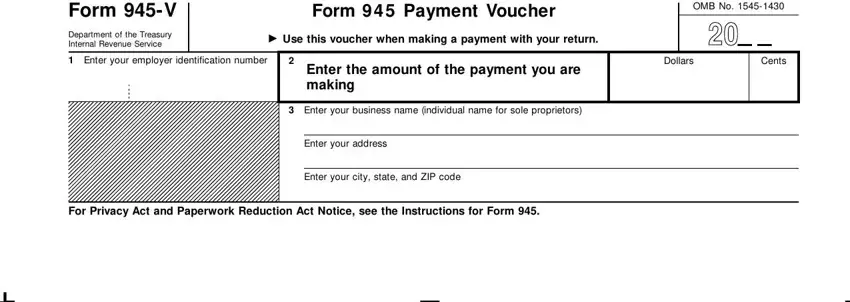

1. The indiana state income payment voucher form usually requires certain information to be inserted. Be sure the subsequent blank fields are finalized:

Step 3: Prior to moving forward, check that all blank fields have been filled out right. When you think it's all good, click “Done." Sign up with FormsPal right now and easily use indiana state income payment voucher form, all set for download. All alterations you make are preserved , helping you to customize the pdf later on if necessary. FormsPal ensures your information privacy by having a secure system that never records or shares any sort of private data involved in the process. Be confident knowing your documents are kept protected each time you work with our editor!