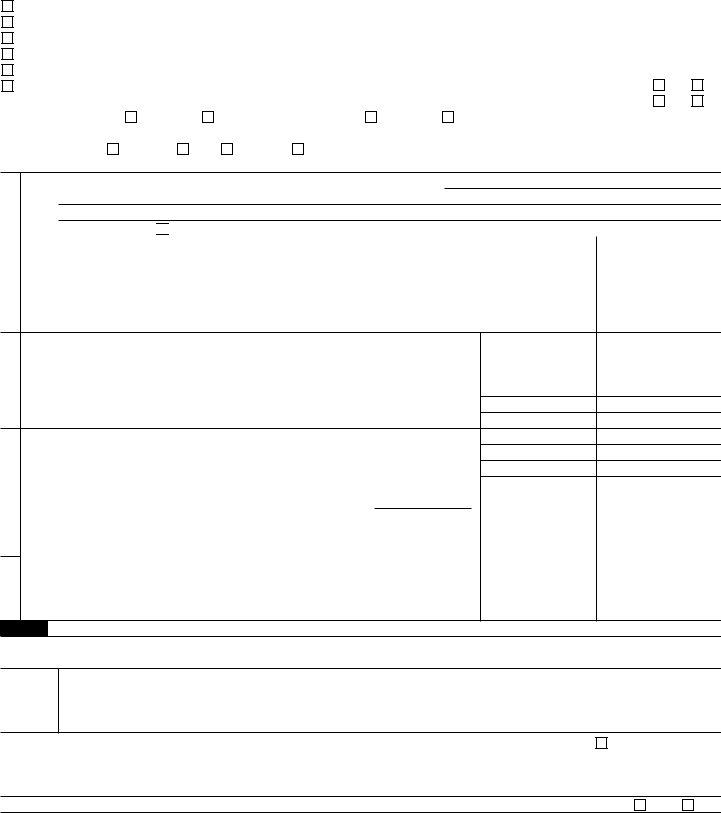

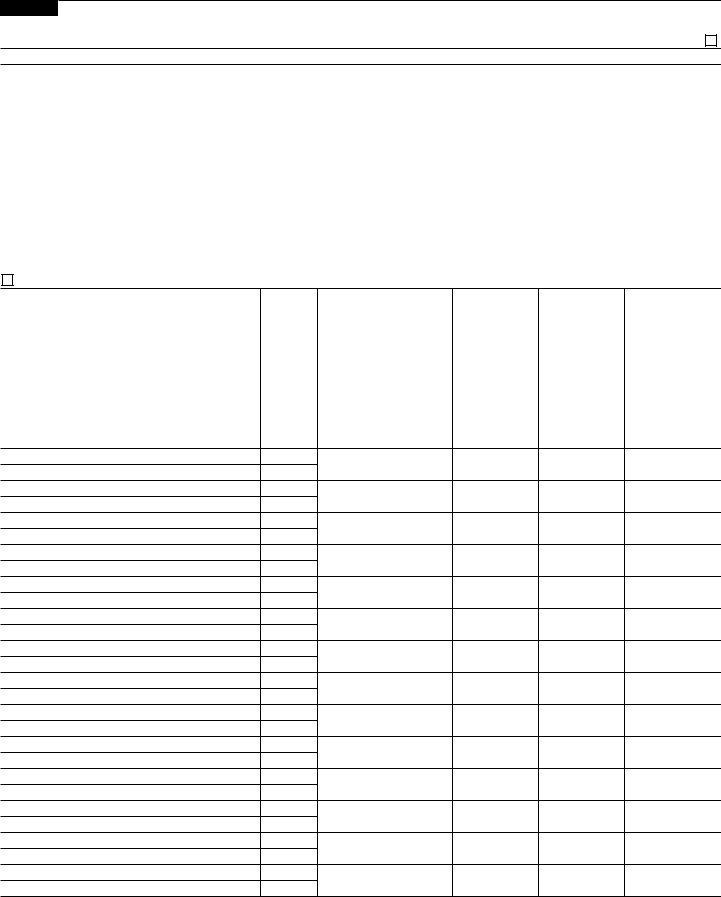

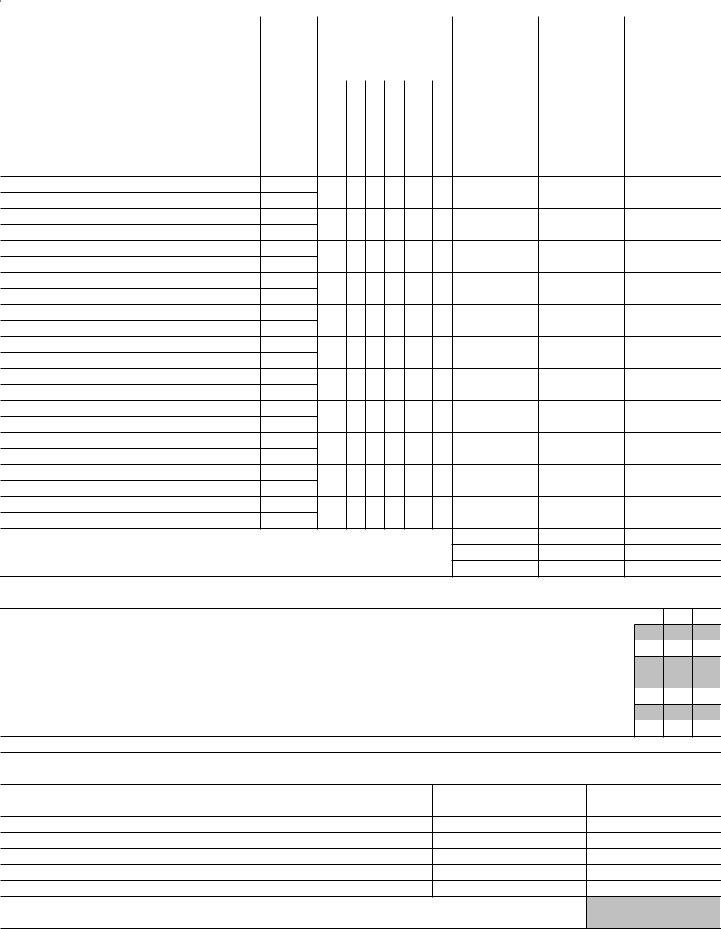

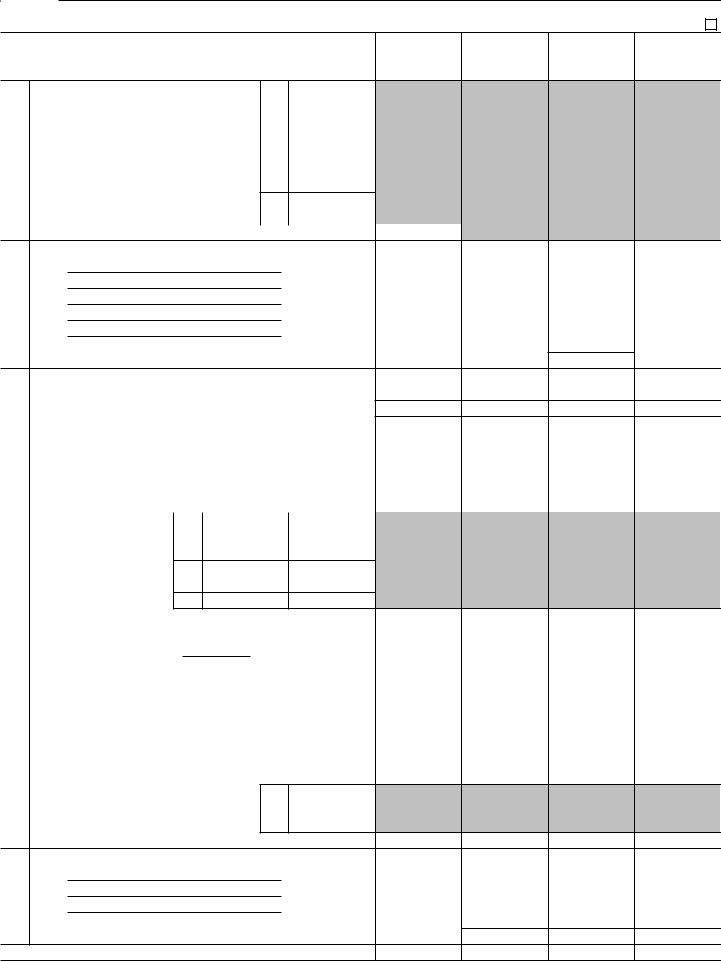

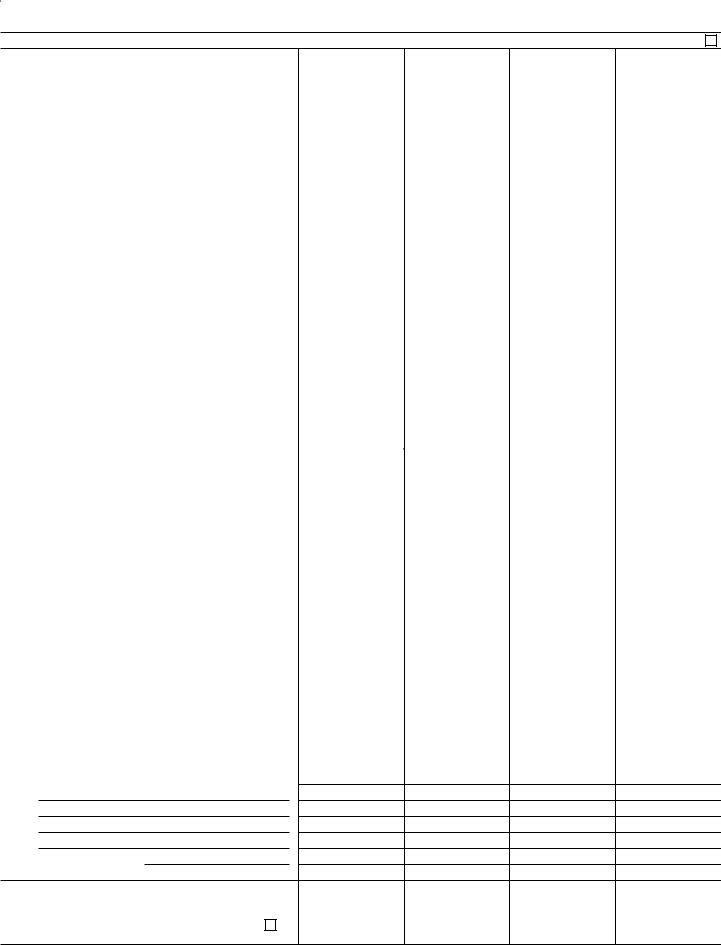

1Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? If “Yes,”

complete Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2Is the organization required to complete Schedule B, Schedule of Contributors? See instructions . . . .

3Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to

candidates for public office? If “Yes,” complete Schedule C, Part I . . . . . . . . . . . . . .

4Section 501(c)(3) organizations. Did the organization engage in lobbying activities, or have a section 501(h)

election in effect during the tax year? If “Yes,” complete Schedule C, Part II . . . . . . . . . . .

5Is the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues,

assessments, or similar amounts as defined in Rev. Proc. 98-19? If “Yes,” complete Schedule C, Part III . .

6Did the organization maintain any donor advised funds or any similar funds or accounts for which donors have the right to provide advice on the distribution or investment of amounts in such funds or accounts? If

“Yes,” complete Schedule D, Part I . . . . . . . . . . . . . . . . . . . . . . . .

7Did the organization receive or hold a conservation easement, including easements to preserve open space,

the environment, historic land areas, or historic structures? If “Yes,” complete Schedule D, Part II |

. . . |

8Did the organization maintain collections of works of art, historical treasures, or other similar assets? If “Yes,”

complete Schedule D, Part III . . . . . . . . . . . . . . . . . . . . . . . . . .

9Did the organization report an amount in Part X, line 21, for escrow or custodial account liability, serve as a

custodian for amounts not listed in Part X; or provide credit counseling, debt management, credit repair, or debt negotiation services? If “Yes,” complete Schedule D, Part IV . . . . . . . . . . . . . .

10Did the organization, directly or through a related organization, hold assets in donor-restricted endowments

or in quasi endowments? If “Yes,” complete Schedule D, Part V . . . . . . . . . . . . . . .

11If the organization’s answer to any of the following questions is “Yes,” then complete Schedule D, Parts VI, VII, VIII, IX, or X, as applicable.

aDid the organization report an amount for land, buildings, and equipment in Part X, line 10? If “Yes,”

complete Schedule D, Part VI . . . . . . . . . . . . . . . . . . . . . . . . . .

bDid the organization report an amount for investments—other securities in Part X, line 12, that is 5% or more

of its total assets reported in Part X, line 16? If “Yes,” complete Schedule D, Part VII . . . . . . . .

cDid the organization report an amount for investments—program related in Part X, line 13, that is 5% or more

of its total assets reported in Part X, line 16? If “Yes,” complete Schedule D, Part VIII . . . . . . . .

dDid the organization report an amount for other assets in Part X, line 15, that is 5% or more of its total assets

reported in Part X, line 16? If “Yes,” complete Schedule D, Part IX . . . . . . . . . . . . . .

eDid the organization report an amount for other liabilities in Part X, line 25? If “Yes,” complete Schedule D, Part X

fDid the organization’s separate or consolidated financial statements for the tax year include a footnote that addresses the organization’s liability for uncertain tax positions under FIN 48 (ASC 740)? If “Yes,” complete Schedule D, Part X

12a Did the organization obtain separate, independent audited financial statements for the tax year? If “Yes,” complete Schedule D, Parts XI and XII . . . . . . . . . . . . . . . . . . . . . . . . . . .

bWas the organization included in consolidated, independent audited financial statements for the tax year? If “Yes,” and if the organization answered “No” to line 12a, then completing Schedule D, Parts XI and XII is optional

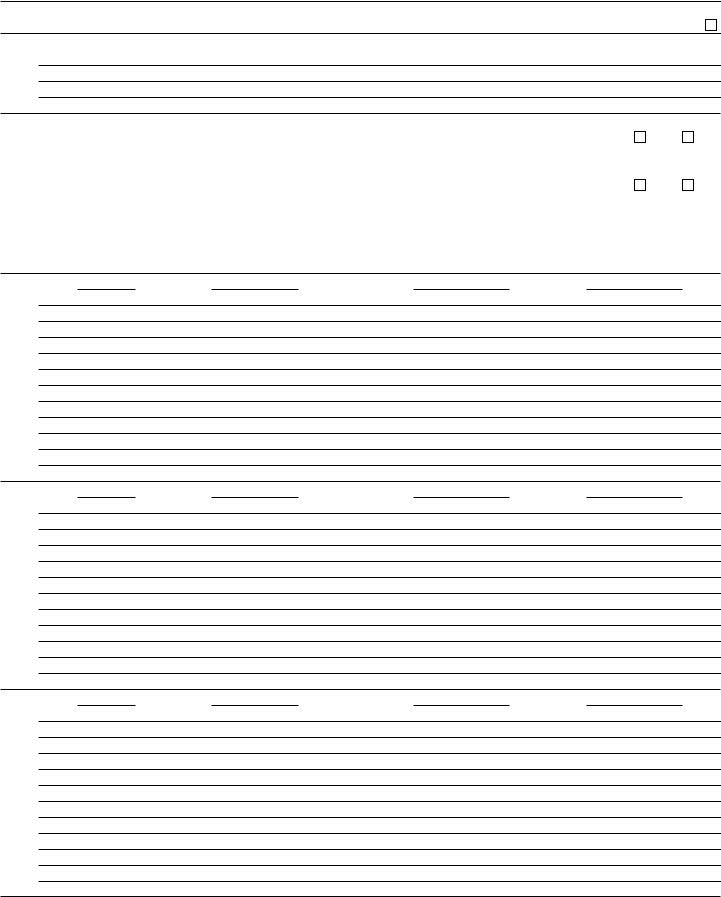

13 |

Is the organization a school described in section 170(b)(1)(A)(ii)? If “Yes,” complete Schedule E . . . . |

14a |

Did the organization maintain an office, employees, or agents outside of the United States? |

bDid the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising, business, investment, and program service activities outside the United States, or aggregate foreign investments valued at $100,000 or more? If “Yes,” complete Schedule F, Parts I and IV . . . . .

15Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or other assistance to or

for any foreign organization? If “Yes,” complete Schedule F, Parts II and IV . . . . . . . . . . .

16Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or other assistance to or for foreign individuals? If “Yes,” complete Schedule F, Parts III and IV. . . . . . . .

17Did the organization report a total of more than $15,000 of expenses for professional fundraising services on

Part IX, column (A), lines 6 and 11e? If “Yes,” complete Schedule G, Part I. See instructions . . . . .

18Did the organization report more than $15,000 total of fundraising event gross income and contributions on

Part VIII, lines 1c and 8a? If “Yes,” complete Schedule G, Part II . . . . . . . . . . . . . . .

19Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a?

If “Yes,” complete Schedule G, Part III . . . . . . . . . . . . . . . . . . . . . . .

20a Did the organization operate one or more hospital facilities? If “Yes,” complete Schedule H . . . . . .

b If “Yes” to line 20a, did the organization attach a copy of its audited financial statements to this return? |

. |

21Did the organization report more than $5,000 of grants or other assistance to any domestic organization or

domestic government on Part IX, column (A), line 1? If “Yes,” complete Schedule I, Parts I and II . . . .