Working with PDF documents online is surprisingly easy using our PDF tool. Anyone can fill in alabama form a 3 tax here in a matter of minutes. FormsPal expert team is continuously endeavoring to develop the tool and help it become much faster for people with its multiple features. Take advantage of the current progressive prospects, and find a heap of new experiences! Here's what you'd have to do to get started:

Step 1: Hit the "Get Form" button at the top of this page to access our tool.

Step 2: This tool will allow you to work with PDF documents in a range of ways. Improve it by adding personalized text, adjust what's already in the file, and place in a signature - all within the reach of a couple of clicks!

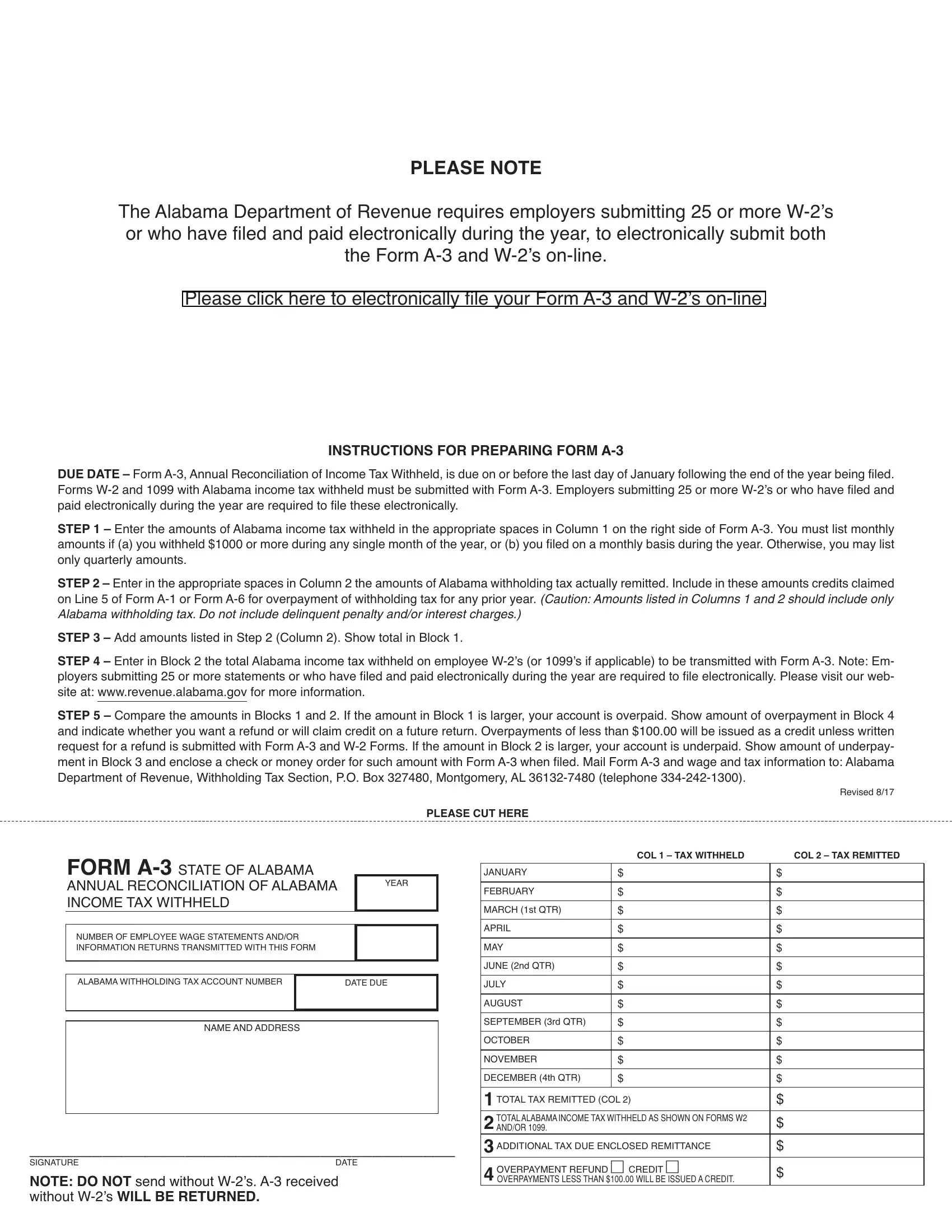

Filling out this form calls for attentiveness. Ensure all required blanks are completed accurately.

1. You'll want to complete the alabama form a 3 tax correctly, hence be attentive when filling in the parts including all of these blank fields:

Step 3: Right after looking through the filled out blanks, hit "Done" and you're good to go! Join us right now and easily access alabama form a 3 tax, ready for download. Each and every modification you make is handily kept , making it possible to customize the form further anytime. FormsPal guarantees your information privacy by using a secure system that in no way records or distributes any type of personal data involved. Be confident knowing your documents are kept protected each time you use our tools!