You can work with tax clearance certificate irs get without difficulty in our PDF editor online. To retain our tool on the cutting edge of convenience, we work to put into practice user-oriented features and enhancements on a regular basis. We're always grateful for any feedback - join us in revolutionizing the way you work with PDF docs. It just takes a couple of easy steps:

Step 1: First, access the tool by clicking the "Get Form Button" in the top section of this site.

Step 2: As soon as you launch the online editor, you'll see the document prepared to be filled in. Aside from filling out different fields, you might also do many other things with the PDF, specifically writing any textual content, editing the initial text, adding illustrations or photos, putting your signature on the PDF, and much more.

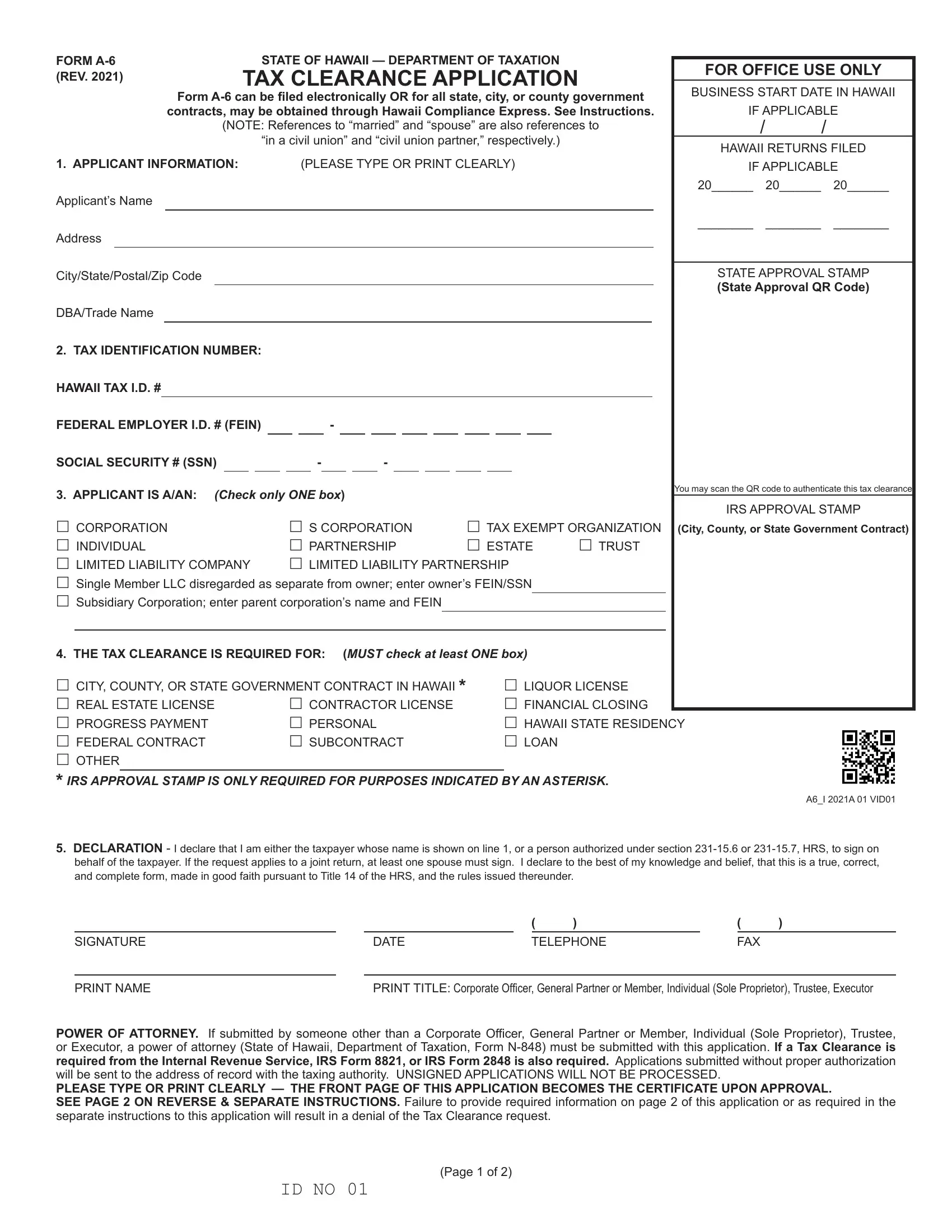

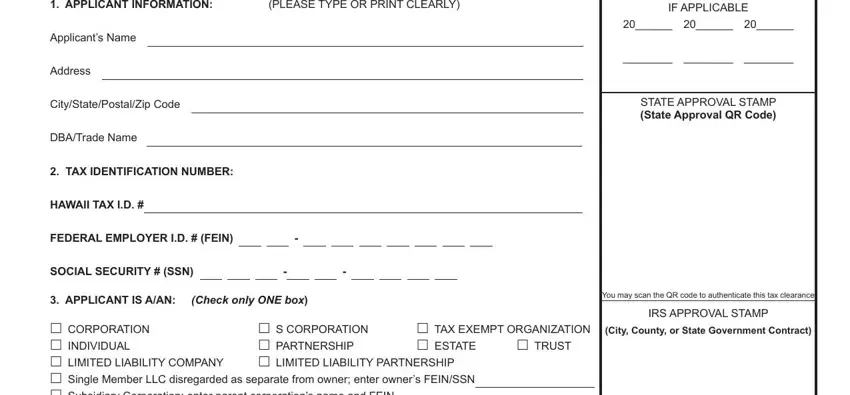

This document requires some specific information; to ensure accuracy, take the time to adhere to the subsequent tips:

1. When filling in the tax clearance certificate irs get, ensure to complete all of the needed blanks within the associated area. It will help to facilitate the process, allowing your details to be processed without delay and accurately.

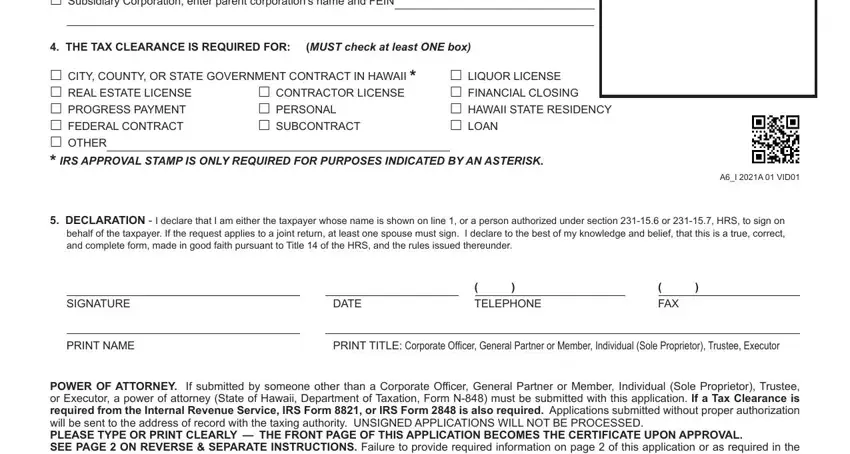

2. Once your current task is complete, take the next step – fill out all of these fields - CORPORATION INDIVIDUAL LIMITED, THE TAX CLEARANCE IS REQUIRED FOR, CITY COUNTY OR STATE GOVERNMENT, CONTRACTOR LICENSE PERSONAL, LIQUOR LICENSE FINANCIAL CLOSING, AI A VID, DECLARATION I declare that I am, SIGNATURE, PRINT NAME, DATE, TELEPHONE, FAX, PRINT TITLE Corporate Officer, and POWER OF ATTORNEY If submitted by with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

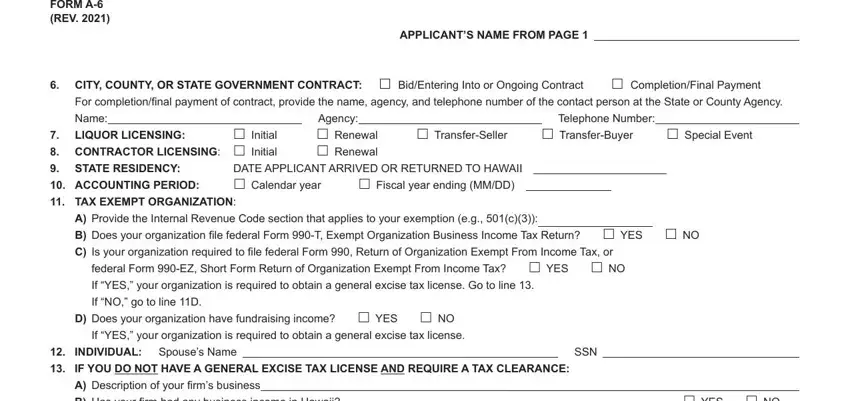

3. Your next step is usually straightforward - fill out all of the blanks in FORM A REV, APPLICANTS NAME FROM PAGE, CITY COUNTY OR STATE GOVERNMENT, For completionfinal payment of, Initial LIQUOR LICENSING, Renewal Renewal, TransferSeller, TransferBuyer, Special Event, DATE APPLICANT ARRIVED OR RETURNED, Fiscal year ending MMDD, TAX EXEMPT ORGANIZATION, A Provide the Internal Revenue, federal Form EZ Short Form Return, and NO If YES your organization is to conclude this process.

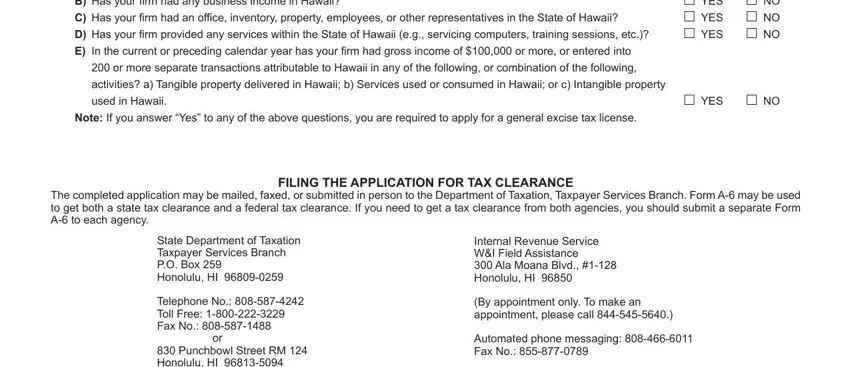

4. Filling out A Description of your firms, YES YES YES, NO NO NO, YES, The completed application may be, FILING THE APPLICATION FOR TAX, State Department of Taxation, and Internal Revenue Service WI Field is essential in the next form section - make sure you don't rush and fill in every empty field!

Be very careful when filling in State Department of Taxation and Internal Revenue Service WI Field, because this is the section where many people make some mistakes.

Step 3: Right after rereading the entries, click "Done" and you are good to go! Create a 7-day free trial option at FormsPal and obtain immediate access to tax clearance certificate irs get - downloadable, emailable, and editable in your FormsPal account page. FormsPal is invested in the confidentiality of all our users; we make sure all information going through our tool stays secure.