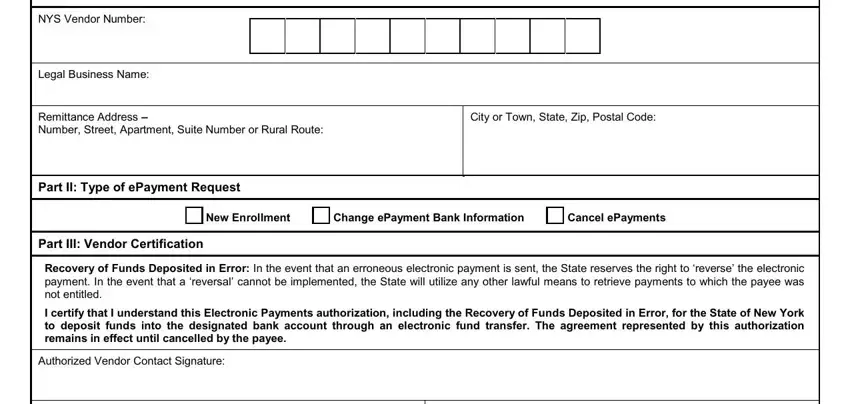

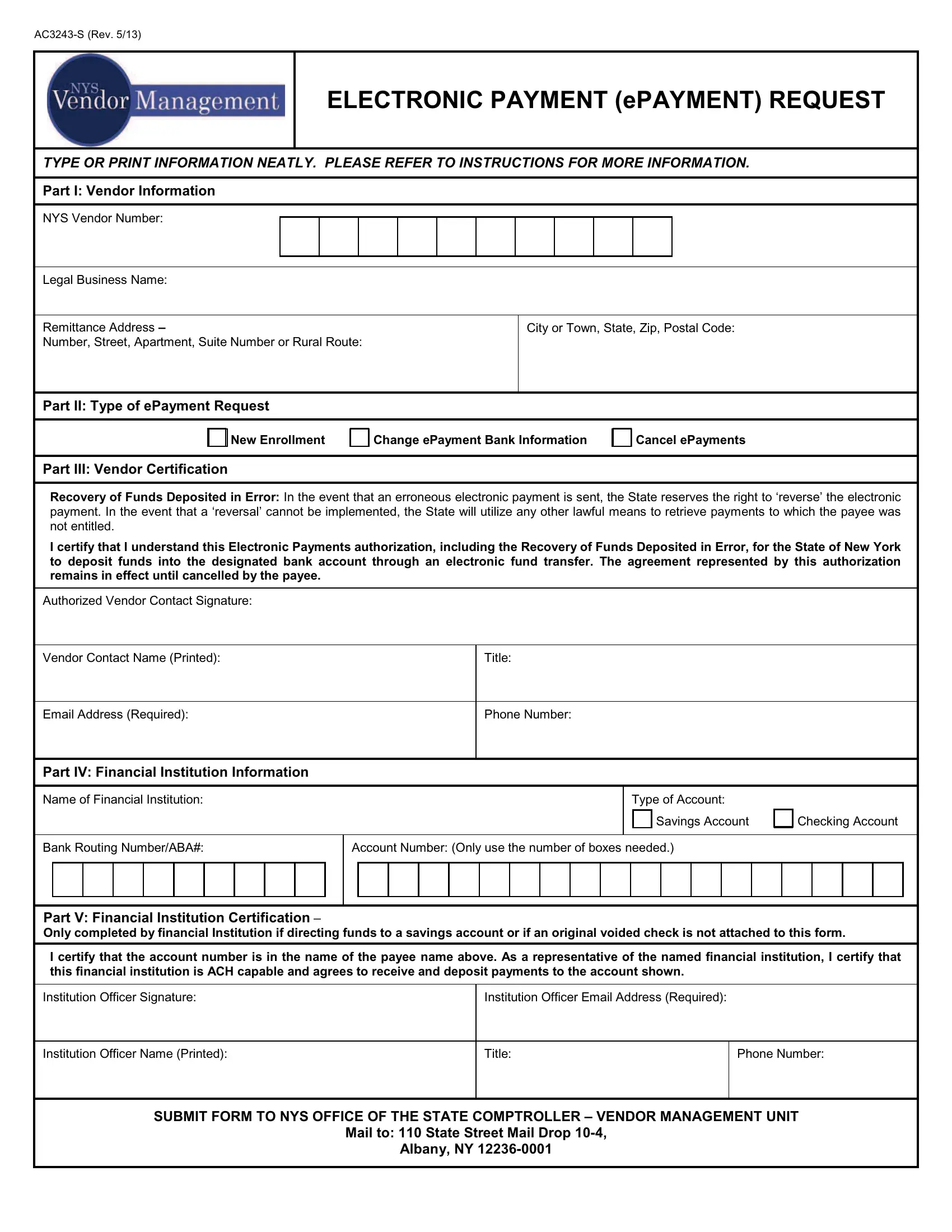

AC3243-S (Rev. 5/13)

ELECTRONIC PAYMENT (ePAYMENT) REQUEST

TYPE OR PRINT INFORMATION NEATLY. PLEASE REFER TO INSTRUCTIONS FOR MORE INFORMATION.

Part I: Vendor Information

NYS Vendor Number:

Legal Business Name:

Remittance Address –

Number, Street, Apartment, Suite Number or Rural Route:

City or Town, State, Zip, Postal Code:

Part II: Type of ePayment Request

Change ePayment Bank Information

Part III: Vendor Certification

Recovery of Funds Deposited in Error: In the event that an erroneous electronic payment is sent, the State reserves the right to ‘reverse’ the electronic payment. In the event that a ‘reversal’ cannot be implemented, the State will utilize any other lawful means to retrieve payments to which the payee was not entitled.

I certify that I understand this Electronic Payments authorization, including the Recovery of Funds Deposited in Error, for the State of New York to deposit funds into the designated bank account through an electronic fund transfer. The agreement represented by this authorization remains in effect until cancelled by the payee.

Authorized Vendor Contact Signature:

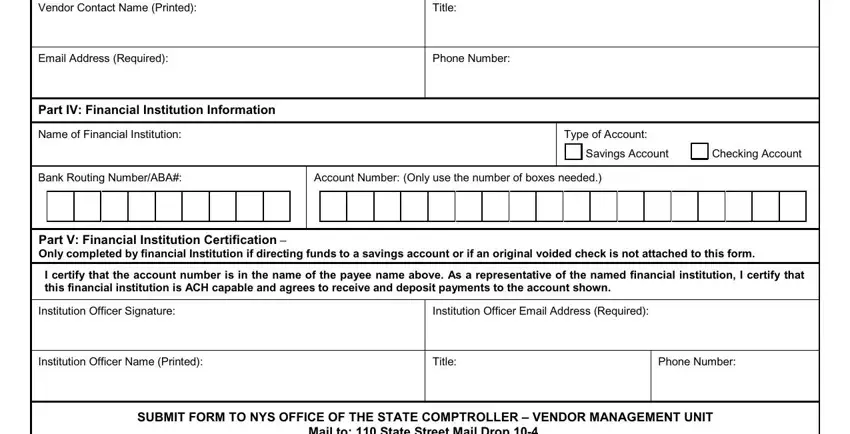

Vendor Contact Name (Printed):

Email Address (Required):

Part IV: Financial Institution Information

Name of Financial Institution:

Type of Account: Savings Account

Bank Routing Number/ABA#:

Account Number: (Only use the number of boxes needed.)

Part V: Financial Institution Certification –

Only completed by financial Institution if directing funds to a savings account or if an original voided check is not attached to this form.

I certify that the account number is in the name of the payee name above. As a representative of the named financial institution, I certify that this financial institution is ACH capable and agrees to receive and deposit payments to the account shown.

Institution Officer Signature:

Institution Officer Email Address (Required):

Institution Officer Name (Printed):

SUBMIT FORM TO NYS OFFICE OF THE STATE COMPTROLLER – VENDOR MANAGEMENT UNIT

Mail to: 110 State Street Mail Drop 10-4,

Albany, NY 12236-0001

AC3243-S (Rev. 5/13) Page 2

NYS Office of the State Comptroller

Instructions for Electronic Payment (ePayment) Request

Please Note: For your protection, we will not accept email or fax to enroll or change electronic payment information. Failure to provide the requested information may delay or prevent the receipt of payments through the Electronic Payment (ePayment) Program.

Notification Required under Personal Privacy Protection Law: The information provided on this form is required under Section 109 of the New York State Finance Law, as well as the New York State and Federal tax laws (See New York State Tax Law § 674, 26 USC §6041). This information will be provided only to the designated financial institution(s) and/or their agent(s) for the purpose of processing payments, and for other official business of the Office of the State Comptroller. No further disclosure of this information will be made unless such disclosure is authorized or required by law. The information provided is maintained in New York State’s Statewide Financial System by the Vendor Management Unit within the Bureau of State Expenditures, Office of the State Comptroller, 110 State Street, Albany, New York 12236.

Part I: NYS Vendor Information

Vendor ID (Required): The NYS Vendor ID is a ten-character identifier issued by the Vendor Management Unit when the vendor is registered in the Vendor File.

Legal Business Name (Required): The name of the person or business as it appears on the Social Security card or other required Federal tax documents. Do not abbreviate names.

Remittance Address: The Remittance Address is the default address where payments will be delivered if the payment fails to process electronically.

Part II: Type of ePayment Request

Select one of the following options (Required):

New Enrollment – Please complete all information in Part III and IV and attach an original voided check. If you do not attach an original voided check the financial institution must complete Part IV and V.

Change ePayment Bank Information – Please complete all information in Part III and IV and attach an original voided check. If you do not attach an original voided check the financial institution must complete Part IV and V.

Cancel ePayments – Please complete all information in Part III. To cancel, the payee's authorized vendor contact must provide this form or signed written notification (including all information in Part III) to the address provided on the front of this form. Notification may be submitted via mail, fax (518-402-4212) or email (epayments@osc.state.ny.us).

Part III: Vendor Certification

Authorized Vendor Contact Signature (Required): The signature of the contact person at the vendor submitting the request. This should be someone who can make financial and/or legal decisions for the entity or the Vendor’s Primary Contact on their NYS Vendor Record.

Vendor Contact Name (Required): Print the name of the contact person at the vendor. This should be someone who can make financial and/or legal decisions for the entity or the Vendor’s Primary Contact on their Vendor Record.

Title (Required): Contact’s title

Email Address (Required): Contact’s email address

Phone Number (Required): Contact’s phone number

Part IV: Financial Institution Information

Name of Financial Institution (Required): Name of the bank that the account is with.

Type of Account: Savings or Checking Account

Bank Routing Number/ABA# (Required): Nine-digit number identifying the financial institution the account belongs to.

Account Number (Required): Vendor’s Bank Account Number

Part V: Financial Institution Certification

Institution Officer Signature (Required): Signature of the Institution Officer at the bank certifying the banking information provided on this form.

Institution Officer Name (Required): Name of the Institution Officer at the bank completing this section of the form.

Title (Required): Institution Officer’s title

Phone Number (Required): Institution Officer’s phone number

Email Address (Required): Institution Officer’s email address